Enlarge image

Reset Form Print Form

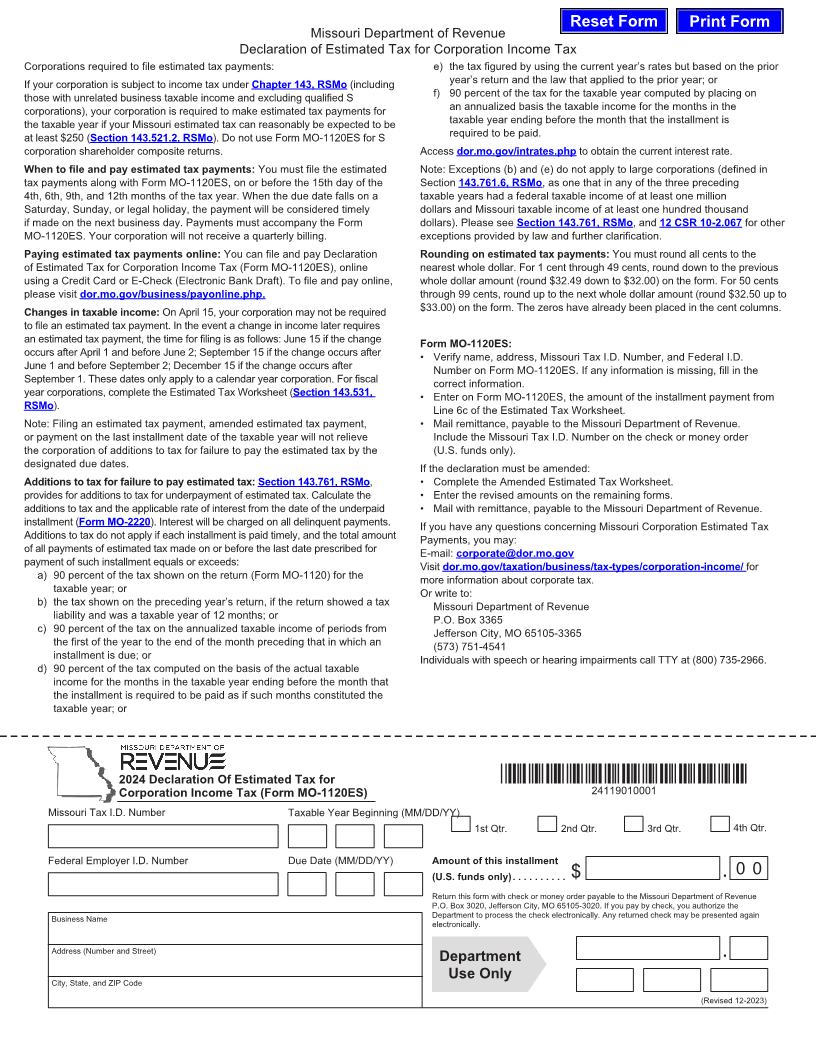

Missouri Department of Revenue

Declaration of Estimated Tax for Corporation Income Tax

Corporations required to file estimated tax payments: e) the tax figured by using the current year’s rates but based on the prior

If your corporation is subject to income tax under Chapter 143, RSMo (including year’s return and the law that applied to the prior year; or

those with unrelated business taxable income and excluding qualified S f) 90 percent of the tax for the taxable year computed by placing on

corporations), your corporation is required to make estimated tax payments for an annualized basis the taxable income for the months in the

the taxable year if your Missouri estimated tax can reasonably be expected to be taxable year ending before the month that the installment is

at least $250 (Section 143.521.2, RSMo). Do not use Form MO-1120ES for S required to be paid.

corporation shareholder composite returns. Access dor.mo.gov/intrates.php to obtain the current interest rate.

When to file and pay estimated tax payments: You must file the estimated Note: Exceptions (b) and (e) do not apply to large corporations (defined in

tax payments along with Form MO-1120ES, on or before the 15th day of the Section 143.761.6, RSMo, as one that in any of the three preceding

4th, 6th, 9th, and 12th months of the tax year. When the due date falls on a taxable years had a federal taxable income of at least one million

Saturday, Sunday, or legal holiday, the payment will be considered timely dollars and Missouri taxable income of at least one hundred thousand

if made on the next business day. Payments must accompany the Form dollars). Please see Section 143.761, RSMo, and 12 CSR 10-2.067 for other

MO-1120ES. Your corporation will not receive a quarterly billing. exceptions provided by law and further clarification.

Paying estimated tax payments online: You can file and pay Declaration Rounding on estimated tax payments: You must round all cents to the

of Estimated Tax for Corporation Income Tax (Form MO-1120ES), online nearest whole dollar. For 1 cent through 49 cents, round down to the previous

using a Credit Card or E-Check (Electronic Bank Draft). To file and pay online, whole dollar amount (round $32.49 down to $32.00) on the form. For 50 cents

please visit dor.mo.gov/business/payonline.php. through 99 cents, round up to the next whole dollar amount (round $32.50 up to

Changes in taxable income: On April 15, your corporation may not be required $33.00) on the form. The zeros have already been placed in the cent columns.

to file an estimated tax payment. In the event a change in income later requires

an estimated tax payment, the time for filing is as follows: June 15 if the change Form MO-1120ES:

occurs after April 1 and before June 2; September 15 if the change occurs after • Verify name, address, Missouri Tax I.D. Number, and Federal I.D.

June 1 and before September 2; December 15 if the change occurs after Number on Form MO-1120ES. If any information is missing, fill in the

Sep tem ber 1. These dates only apply to a calendar year corporation. For fiscal correct information.

year corporations, complete the Estimated Tax Worksheet (Section 143.531, • Enter on Form MO-1120ES, the amount of the installment payment from

RSMo). Line 6c of the Estimated Tax Worksheet.

Note: Filing an estimated tax payment, amended estimated tax payment, • Mail remittance, payable to the Missouri Department of Revenue.

or payment on the last installment date of the taxable year will not relieve Include the Missouri Tax I.D. Number on the check or money order

the corporation of additions to tax for failure to pay the estimated tax by the (U.S. funds only).

designated due dates. If the declaration must be amended:

Additions to tax for failure to pay estimated tax: Section 143.761, RSMo, • Complete the Amended Estimated Tax Worksheet.

provides for additions to tax for underpayment of estimated tax. Calculate the • Enter the revised amounts on the remaining forms.

additions to tax and the applicable rate of interest from the date of the underpaid • Mail with remittance, payable to the Missouri Department of Revenue.

installment (Form MO-2220). Interest will be charged on all delinquent payments. If you have any questions concerning Missouri Corporation Estimated Tax

Additions to tax do not apply if each installment is paid timely, and the total amount Payments, you may:

of all payments of estimated tax made on or before the last date prescribed for E-mail: corporate@dor.mo.gov

payment of such installment equals or exceeds: Visit dor.mo.gov/taxation/business/tax-types/corporation-income/ for

a) 90 percent of the tax shown on the return (Form MO-1120) for the more information about corporate tax.

taxable year; or Or write to:

b) the tax shown on the preceding year’s return, if the return showed a tax Missouri Department of Revenue

liability and was a taxable year of 12 months; or P.O. Box 3365

c) 90 percent of the tax on the annualized taxable income of periods from Jefferson City, MO 65105-3365

the first of the year to the end of the month preceding that in which an (573) 751-4541

installment is due; or Individuals with speech or hearing impairments call TTY at (800) 735-2966.

d) 90 percent of the tax computed on the basis of the actual taxable

income for the months in the taxable year ending before the month that

the installment is required to be paid as if such months constituted the

taxable year; or

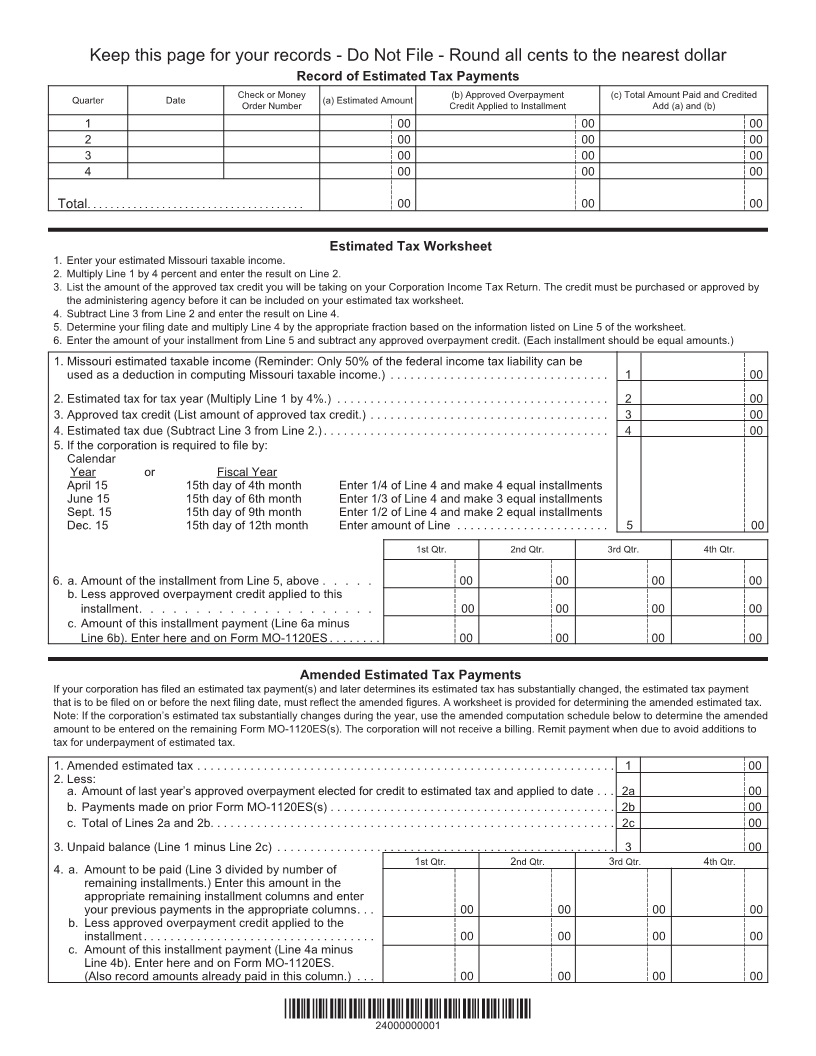

2024 Declaration Of Estimated Tax for *24119010001*

Corporation Income Tax (Form MO-1120ES) 24119010001

Missouri Tax I.D. Number Taxable Year Beginning (MM/DD/YY)

1st Qtr. 2nd Qtr. 3rd Qtr. 4th Qtr.

Federal Employer I.D. Number Due Date (MM/DD/YY) Amount of this installment

(U.S. funds only).......... $ . 00

Return this form with check or money order payable to the Missouri Department of Revenue

P.O. Box 3020, Jefferson City, MO 65105-3020. If you pay by check, you authorize the

Business Name Department to process the check electronically. Any returned check may be presented again

electronically.

Address (Number and Street)

Department .

City, State, and ZIP Code Use Only

(Revised 12-2023)