Enlarge image

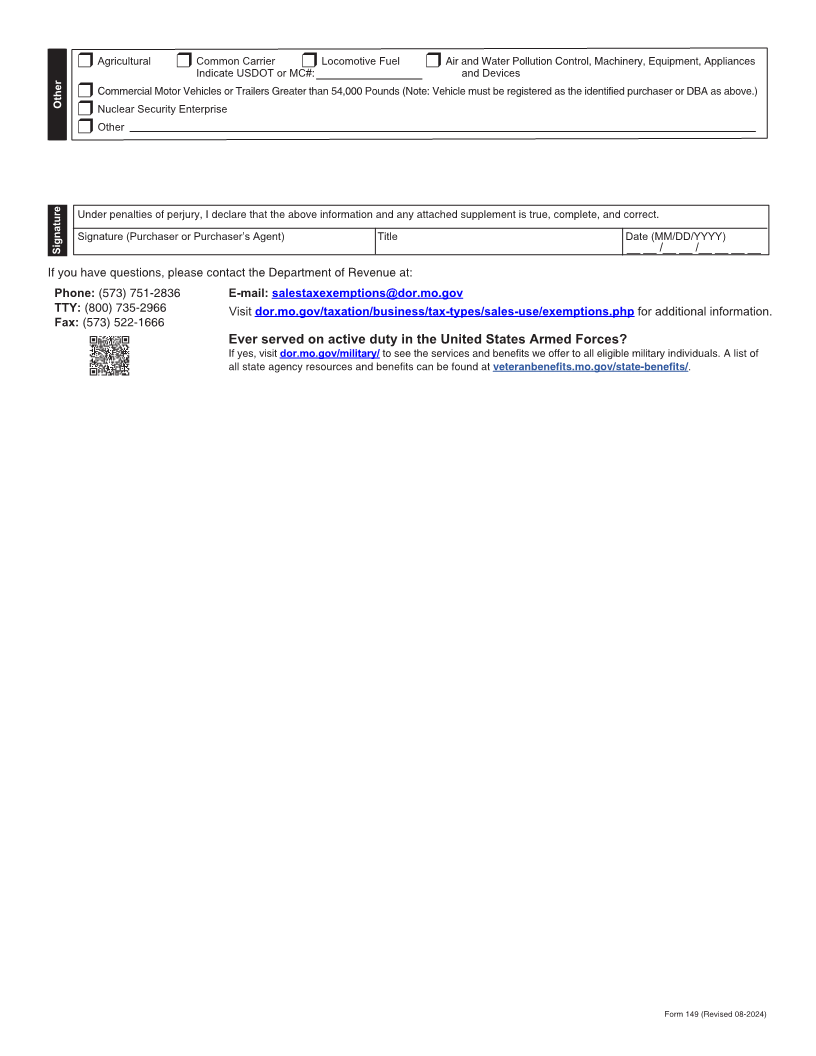

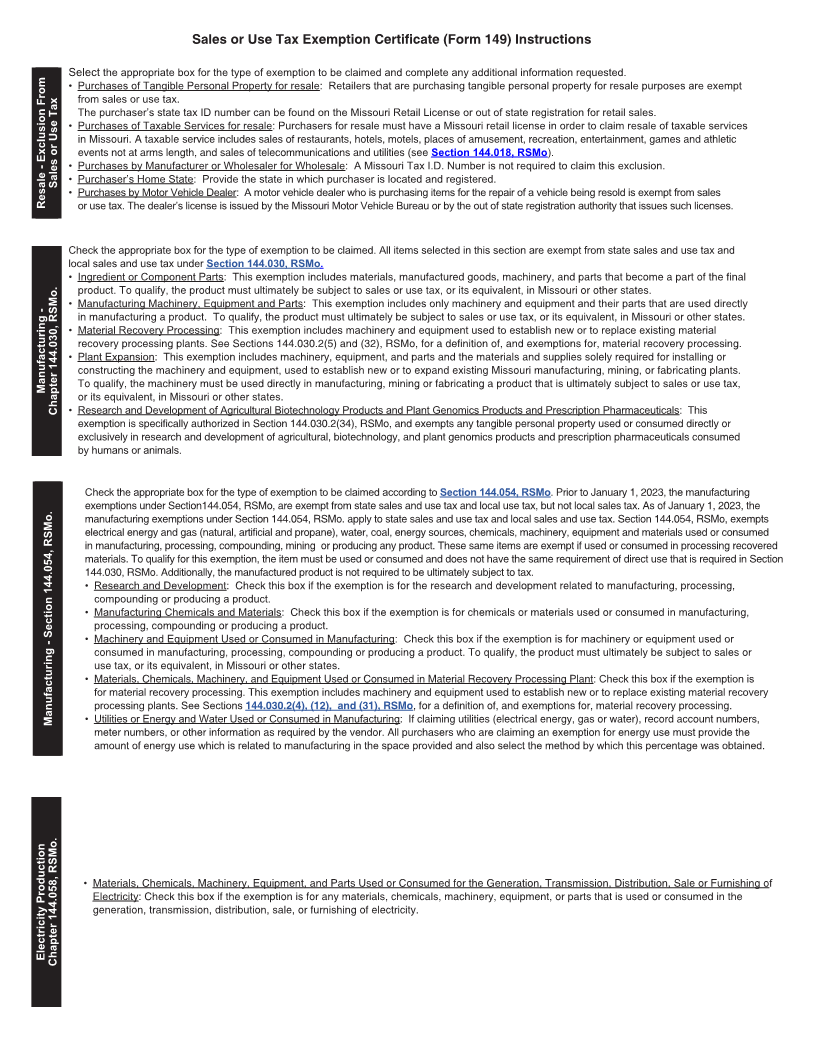

Form Reset Form Print Form

Sales and Use Tax Exemption Certificate

149

Caution to seller: In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the property being sold is exempt.

Name Missouri Tax I.D. Number

| | | | | | |

Contact Person Doing Business As Name (DBA) SSN/FEIN

| | | | | | | |

Address City State ZIP Code

Purchaser Describe product or services purchased exempt from tax Telephone Number

(___ ___ ___) ___ ___ ___-___ ___ ___ ___

Type of business

Name Telephone Number

(___ ___ ___) ___ ___ ___-___ ___ ___ ___

Contact Person Doing Business As Name (DBA)

Seller

Address City State ZIP Code

r Purchases of Tangible Personal Property for resale: Retailer’s State Tax ID Number ______________________ Home State ___________

(Missouri Retailers must have a Missouri Tax I.D. Number)

r Purchases of Taxable Services for resale (see list of taxable services in instructions) Retailer’s Missouri Tax I.D. Number _____________.

(Resale certificate cannot be taken by seller in good faith unless the purchaser is registered in Missouri)

r Purchases by Manufacturer or Wholesaler for Wholesale: Home State: ___________ (Missouri Tax I.D. Number may not be required)

Sales or Use Tax r Purchases by Motor Vehicle Dealer: Missouri Dealer License Number ____________________________ (Only for items that will be used

on vehicles being resold) (An Exemption Certificate for Tire and Lead-Acid Battery Fee (Form 149T) is required for tire and battery fees)

Resale - Exclusion From

These are exempt from state and local sales and use tax.

r Ingredient or Component Part r Manufacturing Machinery, Equipment, and Parts r Material Recovery Processing

r Plant Expansion r Research and Development of Agricultural Biotechnology Products and Plant Genomics Products

Manufacturing and Prescription Pharmaceuticals

Section 144.030, RSMo.

Prior to January 1, 2023, the manufacturing exemptions under Section 144.054, RSMo are exempt from state sales and use tax and

local use tax, but not local sales tax. The seller must collect and report local sales taxes imposed by political subdivisions. As of January

1, 2023, the manufacturing exemptions under Section 144.054, RSMo. apply to state sales and use tax and local sales and use tax.

r Manufacturing Chemicals and Materials r Machinery and Equipment Used or Consumed in Manufacturing

r Materials, Chemicals, Machinery, and Equipment Used or Consumed in Material Recovery Processing Plant r Research and Development

Manufacturing r Utilities or Energy and Water Used or Consumed in Manufacturing (Must complete below)

Section 144.054, RSMo. Purchaser’s Manufacturing Percentage __________ % Purchaser’s Square Footage ______________

These are exempt from state and local sales and use tax.

r Materials, Chemicals, Machinery, Equipment, and Parts Used or Consumed For The Generation, Transmission, Distribution, Sale or Furnishing Of

Electricity

Electricity Production Section 144.058, RSMo.