- 4 -

Enlarge image

|

Frequently Asked Questions

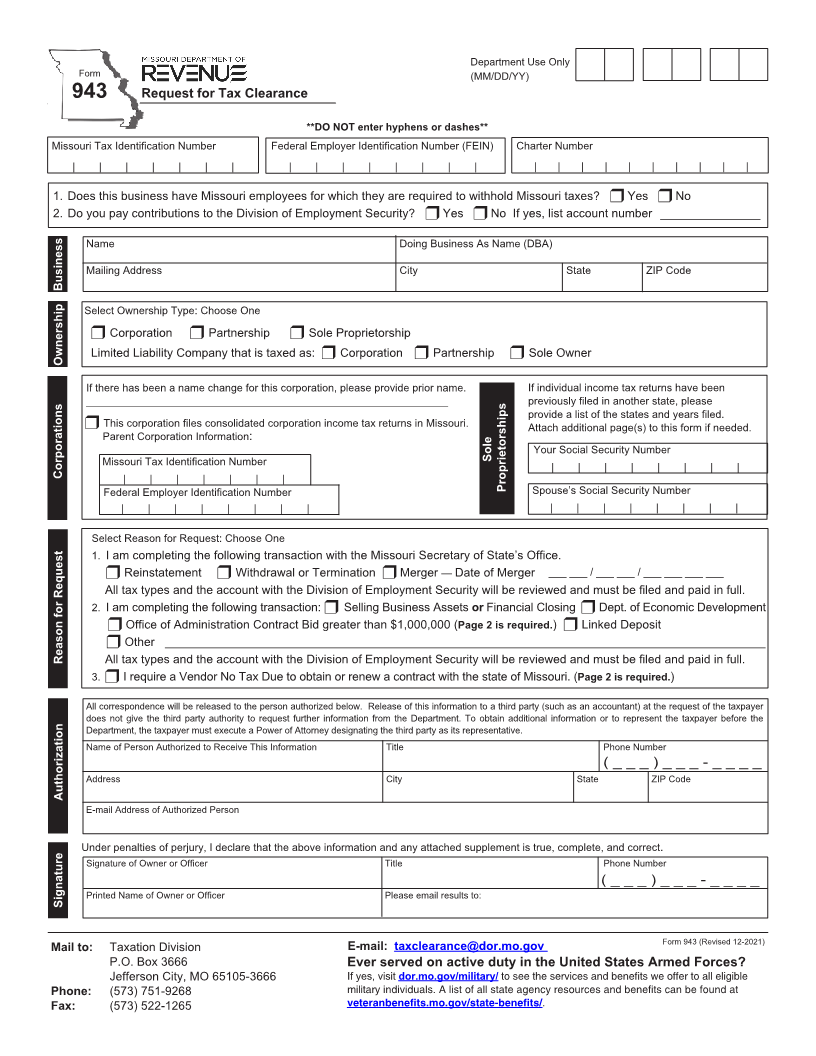

1. What if I don’t know my Missouri tax identification number? 6. What are the consequences of being administratively dissolved

The Missouri tax identification number is assigned by the Missouri versus voluntarily dissolved?

Department of Revenue at the time you register for the reporting If the corporation voluntarily dissolves, it indicates the corporation

of sales, use, withholding, corporation income, or corporation requested the dissolution. If it is administratively dissolved, the

franchise tax. If you have not registered your business or need to Secretary of State’s Office has dissolved the corporation. If the

check on the status of a registration, please contact Business Tax corporation is administratively dissolved, it could have difficulty

Registration at (573) 751-5860. If you do not have a Missouri Tax when bidding a job in the state, trying to obtain a loan, or when

Idenification number leave blank. completing a financial closing through a bank. The Secretary of

State’s website is: www.sos.mo.gov, and may be viewed for additional

2. What is my federal employer identification number? information, forms, and the current status of the corporation.

The Internal Revenue Service issues your federal em ployer

identification number when you register to file federal taxes. If you 7. Does this request have to be signed by the owner or corporate

do not have this number, we will review the account based on the officer?

information provided. Yes, an officer or the owner must sign the request.

3. What is my corporation charter number or certificate of authority 8. Is there a fee to request a tax clearance?

number?

Your corporate charter number is issued to a Missouri corporation, No. There is no fee to submit a Request for Tax Clearance.

limited liability company or limited partnership, by the Missouri

9. Can I send my Secretary of State application with my tax

Secretary of State’s Office, authorizing your company to transact clearance request form?

business in the State of Missouri. The certificate of authority

number is issued by the Missouri Secretary of State’s Office to No, once you receive the clearance letter it is sent with all required

foreign entities. Questions concerning these numbers should information to the Secretary of State’s Office.

be directed to the Missouri Secretary of State’s Office at (573)

10. Will the Secretary of State’s Office accept a faxed copy of the tax

751-4153. clearance?

4. I am a foreign corporation. Am I required to register with the Yes, as long as it is within the allotted 60 day timeframe indicated

Missouri Secretary of State’s Office? on the clearance letter. Because the letter is only valid for 60 days,

you may need to take this into consideration when completing the

If you are a corporation, you must be authorized to transact business request for tax clearance and not request it too soon.

in the State of Missouri with the Missouri Secretary of State’s Office.

Some foreign corporations may not be required to obtain a certificate

of authority number in Missouri. If your corporation is not required, If you are requesting a No Tax Due use No Tax Due Request (Form 5522).

indicate so and the reason why. You may review Section 351.572.2,

RSMo, for possible reasons a corporation may not be required to If you have questions concerning the tax clearance, please contact the

register. Missouri Department of Revenue, Tax Clearance Unit at (573) 751-9268.

The fax number is (573) 522-1265.

5. What are the reasons a corporation is dissolved?

If you have questions concerning reinstatements, please contact the

A corporation can be dissolved for failure to file the Annual Report, Missouri Secretary of State’s Office at (573) 751-4153 or toll free at

failure to file and or pay required taxes, failure to maintain a (866) 223-6535.

registered agent, and practicing fraud against the state.

Federal Privacy Notice

The Federal Privacy Act requires the Missouri Department of Revenue states, and the Multistate Tax Commission(Chapter 32and 143, RSMo). In

(Department) to inform taxpayers of the Department’s legal authority for addition, statutorily provided non-tax uses are: (1) to provide information to

requesting identifying information, including social security numbers, and to the Department of Higher Education with respect to applicants for financial

explain why the information is needed and how the information will be used. assistance under Chapter 173, RSMo and (2) to offset refunds against

amounts due to a state agency by a person or entity (Chapter 143, RSMo).

Chapter 143 of the Missouri Revised Statutes authorizes the Department Information furnished to other agencies or persons shall be used solely for

to request information necessary to carry out the tax laws of the state of the purpose of administering tax laws or the specific laws administered by

Missouri. Federal law 42 U.S.C. Section 405 (c)(2)(C) authorizes the states the person having the statutory right to obtain it as indicated above. (For the

to require taxpayers to provide social security numbers. Department’s authority to prescribe forms and to require furnishing of social

The Department uses your social security number to identify you and security numbers, see Chapters 135, 143, and 144, RSMo.)

process your tax returns and other documents, to determine and collect You are required to provide your social security number on your tax return.

the correct amount of tax, to ensure you are complying with the tax laws, Failure to provide your social security number or providing a false social

and to exchange tax information with the Internal Revenue Service, other security number may result in criminal action against you.

Form 943 (Revised 12-2021)

|