Enlarge image

Form

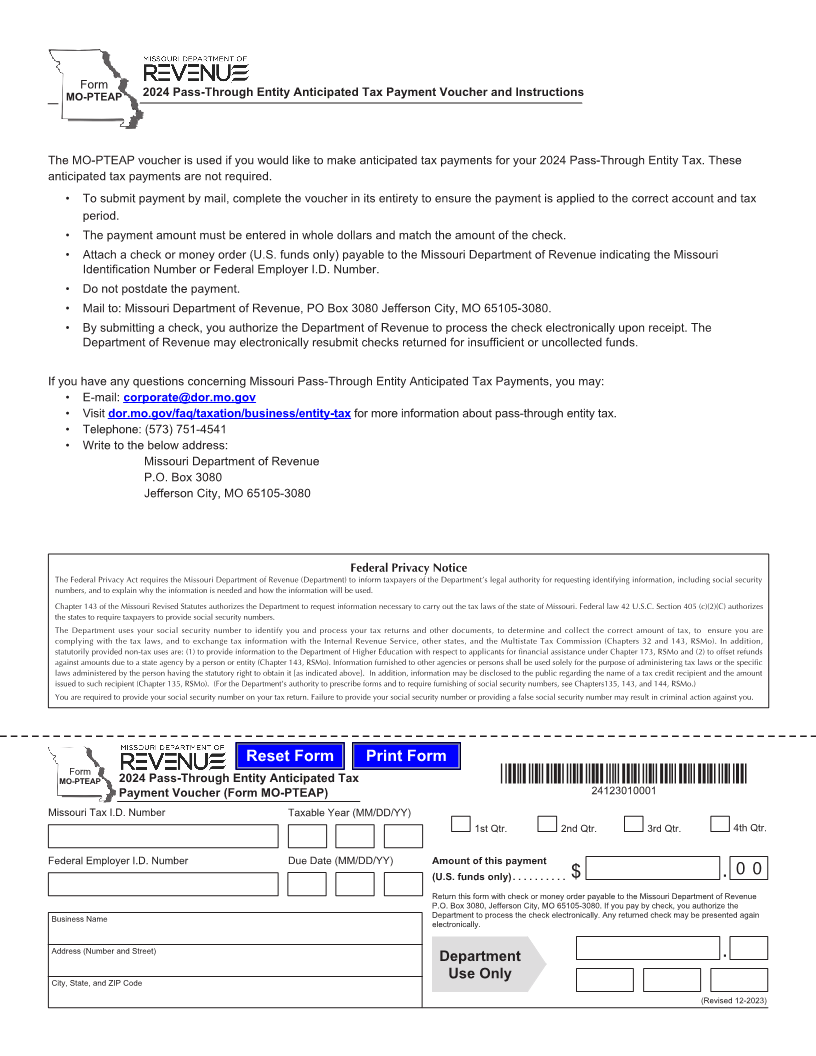

MO-PTEAP 2024 Pass-Through Entity Anticipated Tax Payment Voucher and Instructions

The MO-PTEAP voucher is used if you would like to make anticipated tax payments for your 2024 Pass-Through Entity Tax. These

anticipated tax payments are not required.

• To submit payment by mail, complete the voucher in its entirety to ensure the payment is applied to the correct account and tax

period.

• The payment amount must be entered in whole dollars and match the amount of the check.

• Attach a check or money order (U.S. funds only) payable to the Missouri Department of Revenue indicating the Missouri

Identification Number or Federal Employer I.D. Number.

• Do not postdate the payment.

• Mail to: Missouri Department of Revenue, PO Box 3080 Jefferson City, MO 65105-3080.

• By submitting a check, you authorize the Department of Revenue to process the check electronically upon receipt. The

Department of Revenue may electronically resubmit checks returned for insufficient or uncollected funds.

If you have any questions concerning Missouri Pass-Through Entity Anticipated Tax Payments, you may:

• E-mail: corporate@dor.mo.gov

• Visit dor.mo.gov/faq/taxation/business/entity-tax for more information about pass-through entity tax.

• Telephone: (573) 751-4541

• Write to the below address:

Missouri Department of Revenue

P.O. Box 3080

Jefferson City, MO 65105-3080

Federal Privacy Notice

The Federal Privacy Act requires the Missouri Department of Revenue (Department) to inform taxpayers of the Department’s legal authority for requesting identifying information, including social security

numbers, and to explain why the information is needed and how the information will be used.

Chapter 143 of the Missouri Revised Statutes authorizes the Department to request information necessary to carry out the tax laws of the state of Missouri. Federal law 42 U.S.C. Section 405 (c)(2)(C) authorizes

the states to require taxpayers to provide social security numbers.

The Department uses your social security number to identify you and process your tax returns and other documents, to determine and collect the correct amount of tax, to ensure you are

complying with the tax laws, and to exchange tax information with the Internal Revenue Service, other states, and the Multistate Tax Commission (Chapters 32 and 143, RSMo). In addition,

statutorily provided non-tax uses are: (1) to provide information to the Department of Higher Education with respect to applicants for financial assistance under Chapter 173, RSMo and (2) to offset refunds

against amounts due to a state agency by a person or entity (Chapter 143, RSMo). Information furnished to other agencies or persons shall be used solely for the purpose of administering tax laws or the specific

laws administered by the person having the statutory right to obtain it [as indicated above]. In addition, information may be disclosed to the public regarding the name of a tax credit recipient and the amount

issued to such recipient (Chapter 135, RSMo). (For the Department’s authority to prescribe forms and to require furnishing of social security numbers, see Chapters135, 143, and 144, RSMo.)

You are required to provide your social security number on your tax return. Failure to provide your social security number or providing a false social security number may result in criminal action against you.

Reset Form Print Form

Form

MO-PTEAP 2024 Pass-Through Entity Anticipated Tax *24123010001*

Payment Voucher (Form MO-PTEAP) 24123010001

Missouri Tax I.D. Number Taxable Year (MM/DD/YY)

1st Qtr. 2nd Qtr. 3rd Qtr. 4th Qtr.

Federal Employer I.D. Number Due Date (MM/DD/YY) Amount of this payment

(U.S. funds only).......... $ . 00

Return this form with check or money order payable to the Missouri Department of Revenue

P.O. Box 3080, Jefferson City, MO 65105-3080. If you pay by check, you authorize the

Business Name Department to process the check electronically. Any returned check may be presented again

electronically.

Address (Number and Street)

Department .

City, State, and ZIP Code Use Only

(Revised 12-2023)