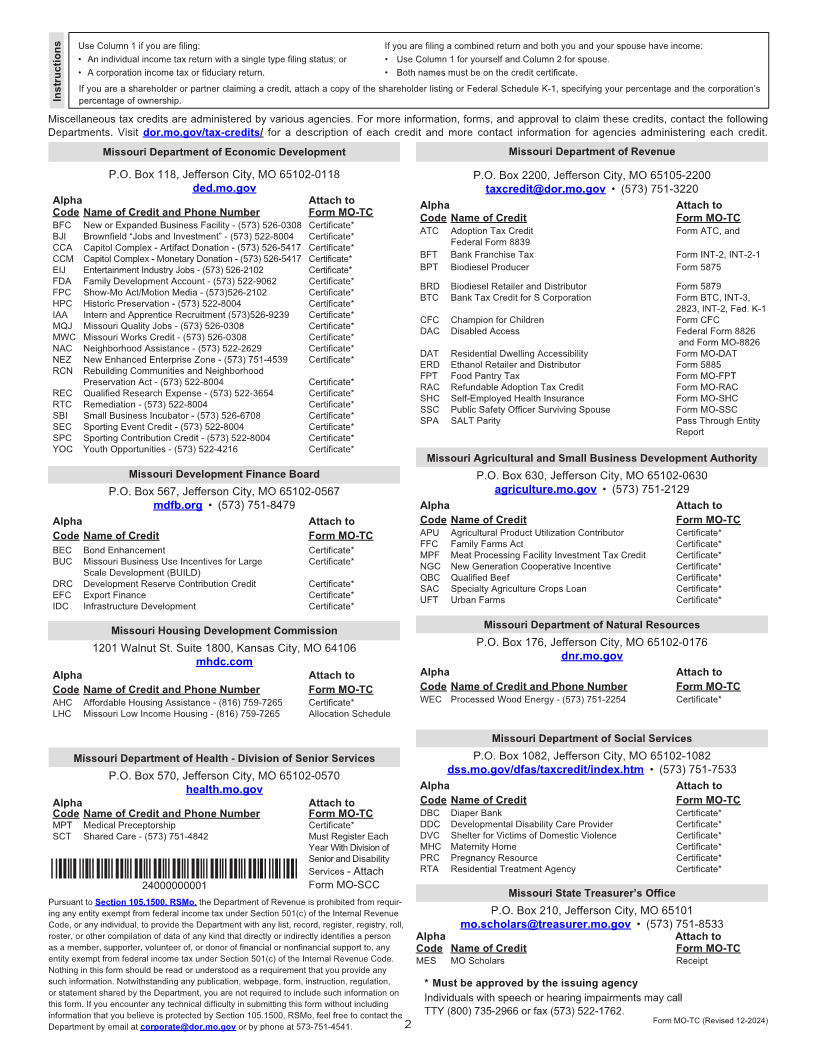

Enlarge image

Reset Form Print Form

Department Use Only

Form (MM/DD/YY)

MO-TC 2024 Miscellaneous Income Tax Credits

Name Social Security

(Last, First) Number

Spouse’s Name Spouse’s Social

(Last, First) Security Number

Corporation Charter

Name Number

Missouri Tax Federal Employer

I.D. Number I.D. Number

• Benefit Number - The number is the last six (6) digits of the number of this form. Each credit is assigned an alpha code to ensure proper

located on your Certificate of Eligibility. processing of the credit claimed.

Example: For benefit, ABC-2018-12345-123456, enter 123456, on • If you are claiming more than 10 credits, attach additional MO-TC(s)

Form MO-TC. • The sum of the tax credits claimed in Column 1 or Column 2 cannot

• Alpha code - The three (3) character code located on the next page exceed the applicable tax liability, unless the credit is refundable.

Alpha Code Credit Name • Yourself • Spouse

Benefit Number (3 characters) Each credit will apply against your tax • Corporation Income (on a combined return)

(See example above) from the next liability in the order they appear below. • Fiduciary

page Column 1 Column 2

1. 1. 00 00

2. 2. 00 00

3. 3. 00 00

4. 4. 00 00

5. 5. 00 00

6. 6. 00 00

7. 7. 00 00

8. 8. 00 00

9. 9. 00 00

10. 10. 00 00

11. Subtotals - add Lines 1 through 10. ......................................................... 11. 00 00

12. Enter the amount of the tax liability from Form MO-1040, Line 35Y for yourself and Line 35S for your spouse, or

Form MO-1120, Line 16, Form MO-1041, Line 15 or Form MO-PTE, Line 10 ........................... 12. 00 00

13. Total Credits - add amounts from Line 11, Columns 1 and 2. (Enter here and on Form MO-1120, Line 17; Form MO-1040,

Line 42; or Form MO-1041, Line 16; or Form MO-PTE, Line 11.) Line 13 cannot exceed the amount on Line 12, unless the

credit is refundable. .................................................................................... 13. 00

I declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax

exemption, credit or abatement if I employ such aliens. I also declare that if I am a business entity, I participate in a federal work authorization program

with respect to the employees working in connection with any contracted services and I do not knowingly employ any person who is an unauthorized

alien in connection with any contracted services. I am aware of any applicable reporting requirements of Section 135.805 RSMo and the penalty

provisions of Section 135.810 RSMo.

Signature Taxpayer’s Signature Printed Name Date (MM/DD/YYYY)

__ __ / __ __ / __ __ __ __

Spouse’s Signature Printed Name Date (MM/DD/YYYY)

__ __ / __ __ / __ __ __ __

Use this form to claim income tax credits on Form MO-1040, MO-1120, or MO-1041. Attach to Form MO-1040, MO-1120, or MO-1041.

Ever served on active duty in the United States Armed Forces? *24306010001*

If yes, visit dor.mo.gov/military/ to see the services and benefits DOR offers to all eligible military

individuals, or complete the survey at mvc.dps.mo.gov/MoVeteransInformation/Survey/DOR to 24306010001

receive information from the Missouri Veterans Commission. A list of all state agency resources For Privacy Notice, see instructions.

and benefits can be found at veteranbenefits.mo.gov/state-benefits/. Form MO-TC (Revised 12-2024)

1