Enlarge image

Reset Form Print Form

Attach Federal Return. See instructions

Form and diagram on page 3 of Form MO-NRI.

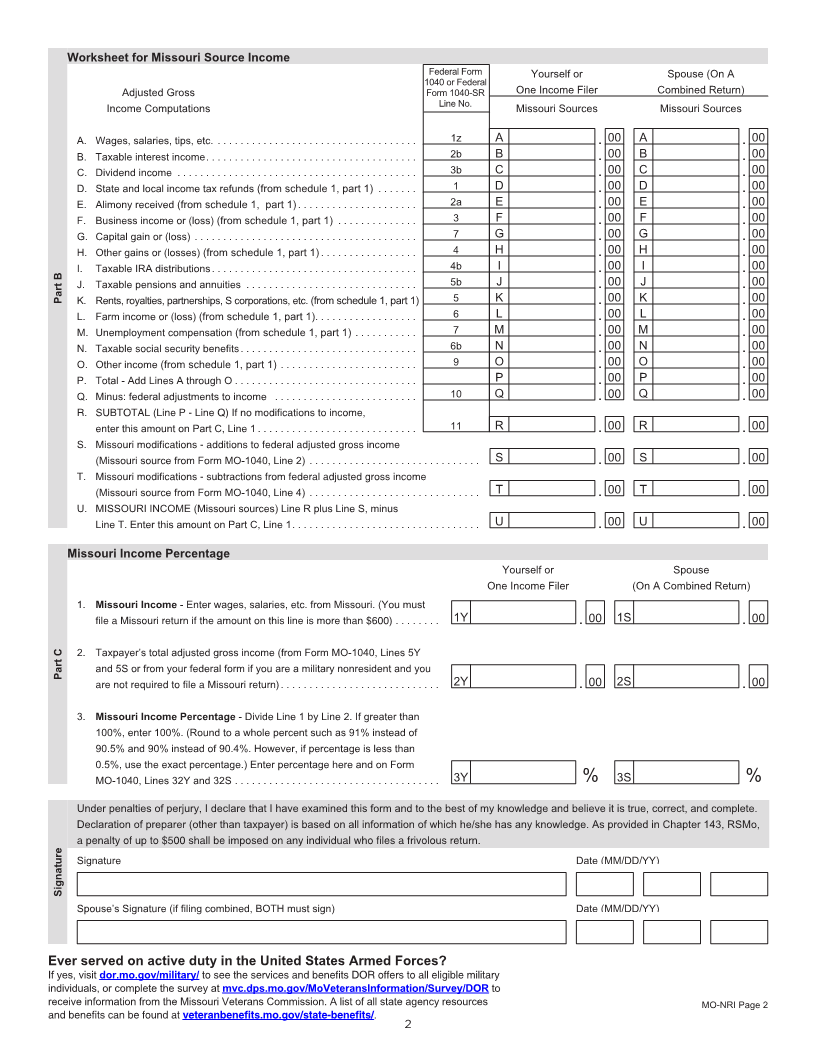

MO-NRI 2024 Missouri Income Percentage

Resident/Nonresident Status - Select your status in the appropriate box below.

Social Security Number Spouse’s Social Security Number

- - - -

Name Spouse’s Name

Address Address

City, State, ZIP Code City, State, ZIP Code

1. Nonresident of Missouri 1. Nonresident of Missouri

State of residence during 2024 _____________________ State of residence during 2024 _____________________

Remote Work (See instructions on Form MO-NRI, page 3) Remote Work (See instructions on Form MO-NRI, page 3)

2. Part-Year Missouri Resident 2. Part-Year Missouri Resident

Remote Work (See instructions on Form MO-NRI, page 3) Remote Work (See instructions on Form MO-NRI, page 3)

Indicate the dates you were a Missouri Resident in 2024. Indicate the dates you were a Missouri Resident in 2024.

A. Date From: _______________ Date To: _____________ A. Date From: _______________ Date To: _____________

Part A B. Indicate the other state of residence B. Indicate the other state of residence

and dates you resided there __________________________ and dates you resided there __________________________

Date From: _______________ Date To: _____________ Date From: _______________ Date To: _____________

Based on the Military Spouse’s Residency Relief Act, if you are the spouse of a military servicemember residing outside of Missouri solely

because your spouse is there on military orders, and Missouri is your state of residence, any income you earn is taxable to Missouri. Do not

complete Form MO-NRI. You must report 100% on Line 32 of Form MO-1040.

3. Military/Nonresident Tax Status - Indicate your tax status 3. Military/Nonresident Tax Status - Indicate your tax status

below and complete Part C - Missouri Income Percentage. below and complete Part C - Missouri Income Percentage.

Missouri Home of Record Missouri Home of Record

I did not at any time during the tax year 2024 maintain a I did not at any time during the tax year 2024 maintain a

permanent place of abode in Missouri, nor did I spend more permanent place of abode in Missouri, nor did I spend more

than 30 days in Missouri during the year. I did maintain a than 30 days in Missouri during the year. I did maintain a

permanent place of abode in the state of _____________ . permanent place of abode in the state of _____________ .

Non-Missouri Home of Record Non-Missouri Home of Record

I resided in Missouri during 2024 solely because my spouse I resided in Missouri during 2024 solely because my spouse

or I was stationed at _____________________________ or I was stationed at _____________________________

on military orders. My home of record is in the state of on military orders. My home of record is in the state of

______________ . ______________ .

For Privacy Notice, see Instructions. MO-NRI Page 1

1