Enlarge image

Reset Form Print Form

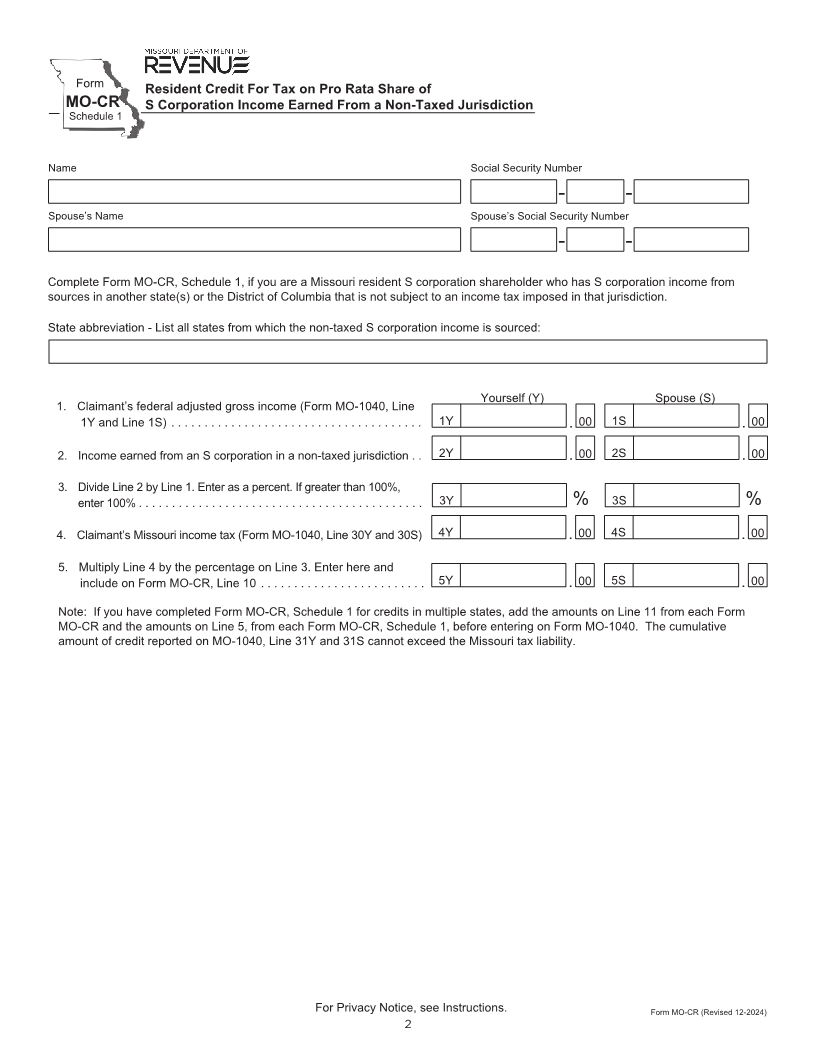

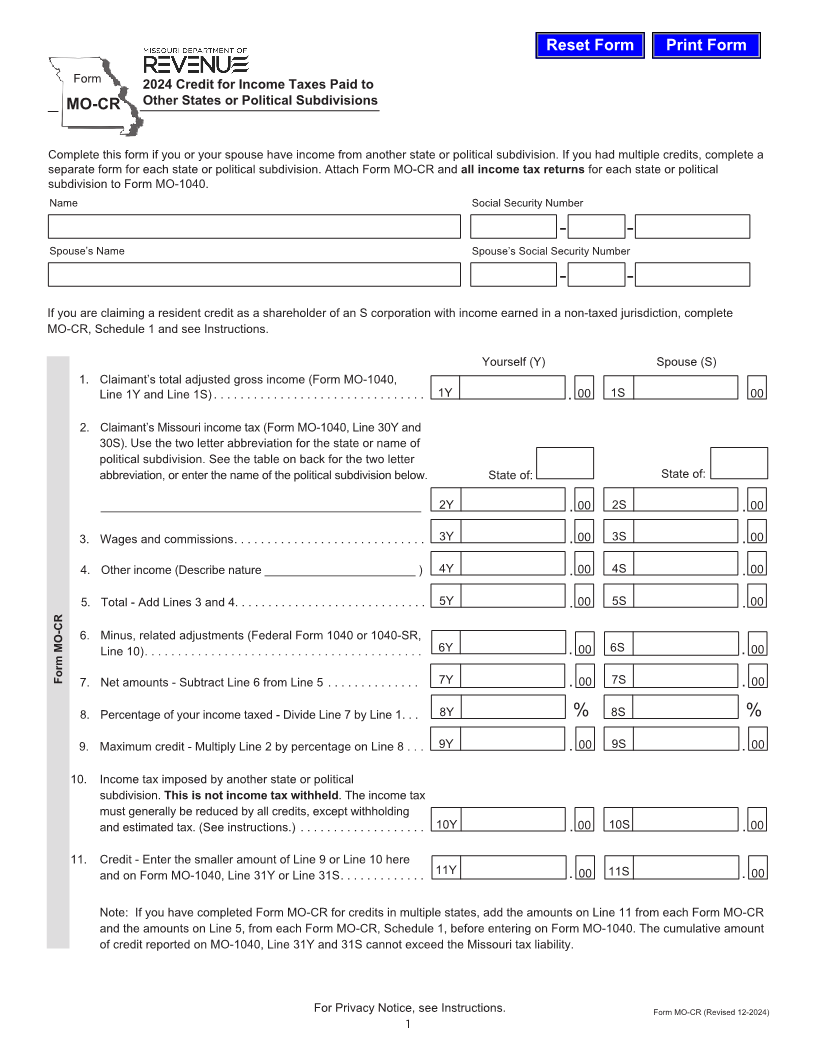

Form

2024 Credit for Income Taxes Paid to

MO-CR Other States or Political Subdivisions

Complete this form if you or your spouse have income from another state or political subdivision. If you had multiple credits, complete a

separate form for each state or political subdivision. Attach Form MO-CR and all income tax returns for each state or political

subdivision to Form MO-1040.

Name Social Security Number

- -

Spouse’s Name Spouse’s Social Security Number

- -

If you are claiming a resident credit as a shareholder of an S corporation with income earned in a non-taxed jurisdiction, complete

MO-CR, Schedule 1 and see Instructions.

Yourself (Y) Spouse (S)

1. Claimant’s total adjusted gross income (Form MO-1040,

Line 1Y and Line 1S) ................................ 1Y . 00 1S 00

2. Claimant’s Missouri income tax (Form MO-1040, Line 30Y and

30S). Use the two letter abbreviation for the state or name of

political subdivision. See the table on back for the two letter

abbreviation, or enter the name of the political subdivision below. State of: State of:

________________________________________________ 2Y . 00 2S . 00

3. Wages and commissions............................. 3Y . 00 3S . 00

4. Other income (Describe nature _______________________ ) 4Y . 00 4S . 00

5. Total - Add Lines 3 and 4............................. 5Y . 00 5S . 00

6. Minus, related adjustments (Federal Form 1040 or 1040-SR,

Line 10) .......................................... 6Y . 00 6S . 00

Form MO-CR 7. Net amounts - Subtract Line 6 from Line 5 .............. 7Y . 00 7S . 00

8. Percentage of your income taxed - Divide Line 7 by Line 1... 8Y % 8S %

9. Maximum credit - Multiply Line 2 by percentage on Line 8 . . . 9Y . 00 9S . 00

10. Income tax imposed by another state or political

subdivision. This is not income tax withheld. The income tax

must generally be reduced by all credits, except withholding

and estimated tax. (See instructions.) ................... 10Y . 00 10S . 00

11. Credit - Enter the smaller amount of Line 9 or Line 10 here

and on Form MO-1040, Line 31Y or Line 31S............. 11Y . 00 11S . 00

Note: If you have completed Form MO-CR for credits in multiple states, add the amounts on Line 11 from each Form MO-CR

and the amounts on Line 5, from each Form MO-CR, Schedule 1, before entering on Form MO-1040. The cumulative amount

of credit reported on MO-1040, Line 31Y and 31S cannot exceed the Missouri tax liability.

For Privacy Notice, see Instructions. Form MO-CR (Revised 12-2024)

1