Enlarge image

Department Use Only

Form (MM/DD/YY)

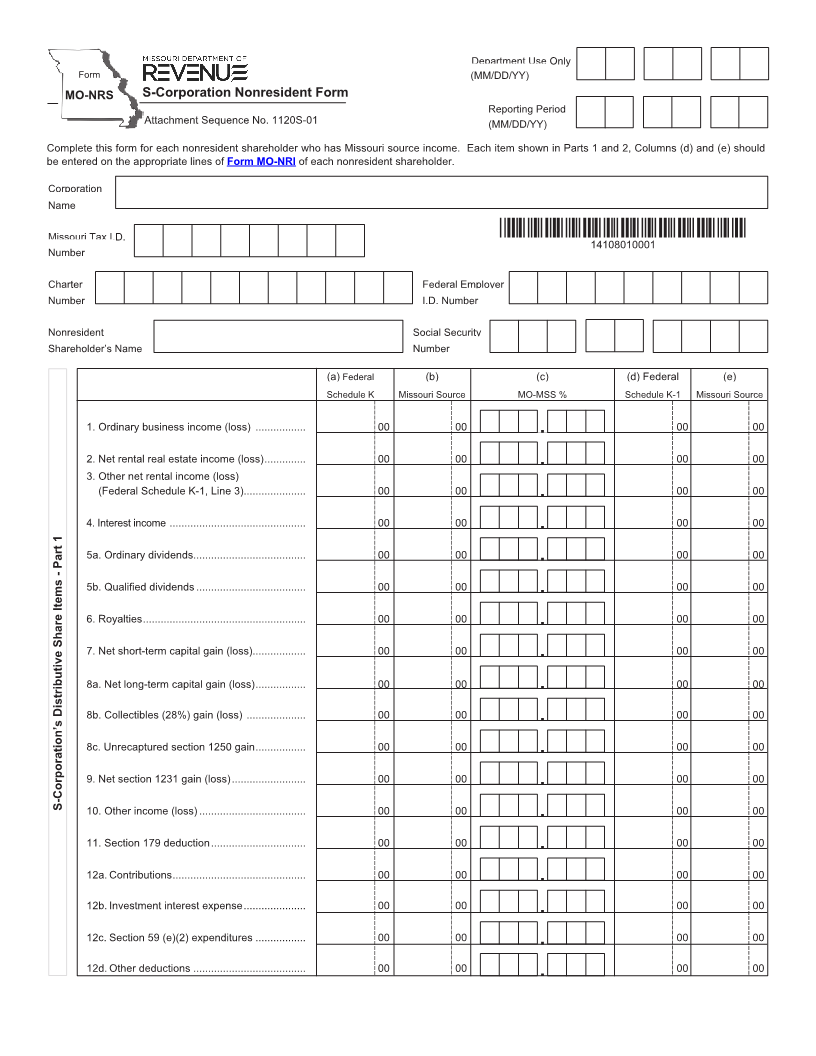

MO-NRS S-Corporation Nonresident Form

Reporting Period

Attachment Sequence No. 1120S-01 (MM/DD/YY)

Complete this form for each nonresident shareholder who has Missouri source income. Each item shown in Parts 1 and 2, Columns (d) and (e) should

be entered on the appropriate lines of Form MO-NRI of each nonresident shareholder.

Corporation

Name

Missouri Tax I.D. *14108010001*

14108010001

Number

Charter Federal Employer

Number I.D. Number

Nonresident Social Security

Shareholder’s Name Number

(a) Federal (b) (c) (d) Federal (e)

Schedule K Missouri Source MO-MSS % Schedule K-1 Missouri Source

1. Ordinary business income (loss) ................. 00 00 00 00

.

2. Net rental real estate income (loss) .............. 00 00 00 00

.

3. Other net rental income (loss)

(Federal Schedule K-1, Line 3)..................... 00 00 00 00

.

4. Interest income .............................................. 00 00 00 00

.

5a. Ordinary dividends...................................... 00 00 00 00

.

5b. Qualified dividends ..................................... 00 00 00 00

.

6. Royalties ....................................................... 00 00 00 00

.

7. Net short-term capital gain (loss).................. 00 00 00 00

.

8a. Net long-term capital gain (loss) ................. 00 00 . 00 00

8b. Collectibles (28%) gain (loss) .................... 00 00 00 00

.

8c. Unrecaptured section 1250 gain ................. 00 00 00 00

.

9. Net section 1231 gain (loss) ......................... 00 00 00 00

.

S-Corporation’s Distributive Share Items - Part 1

10. Other income (loss) .................................... 00 00 00 00

.

11. Section 179 deduction ................................ 00 00 00 00

.

12a. Contributions ............................................. 00 00 00 00

.

12b. Investment interest expense ..................... 00 00 00 00

.

12c. Section 59 (e)(2) expenditures ................. 00 00 00 00

.

12d. Other deductions ...................................... 00 00 00 00

.