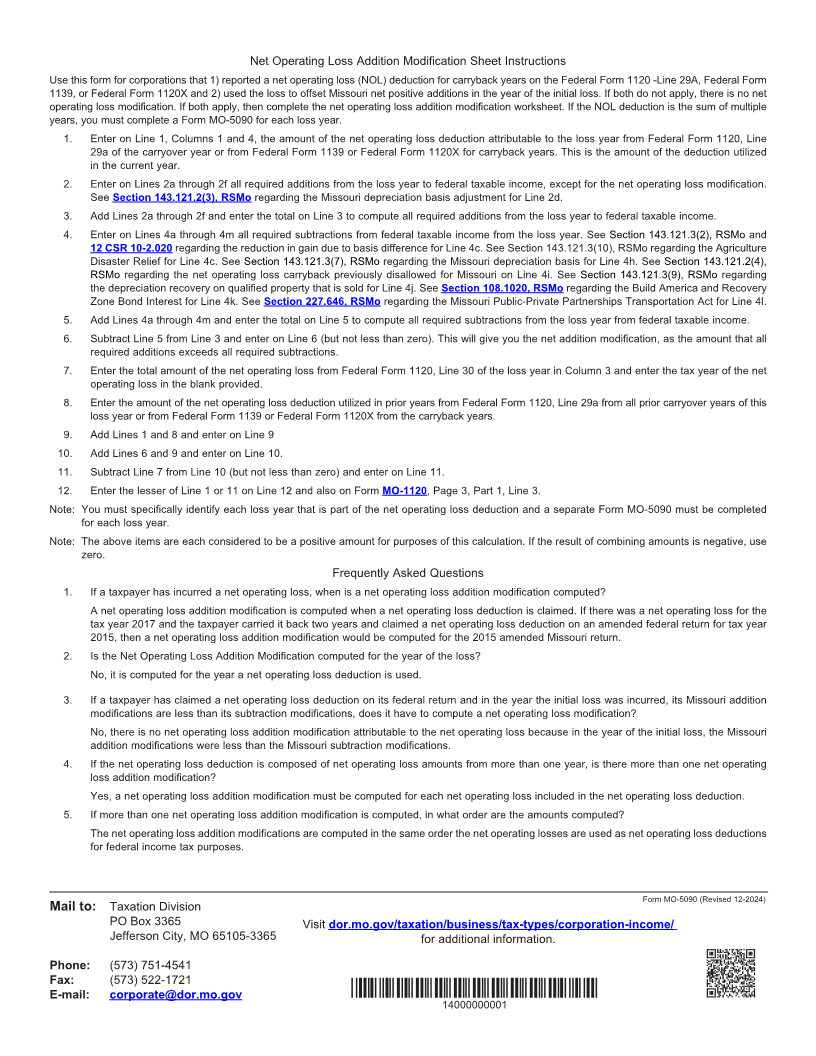

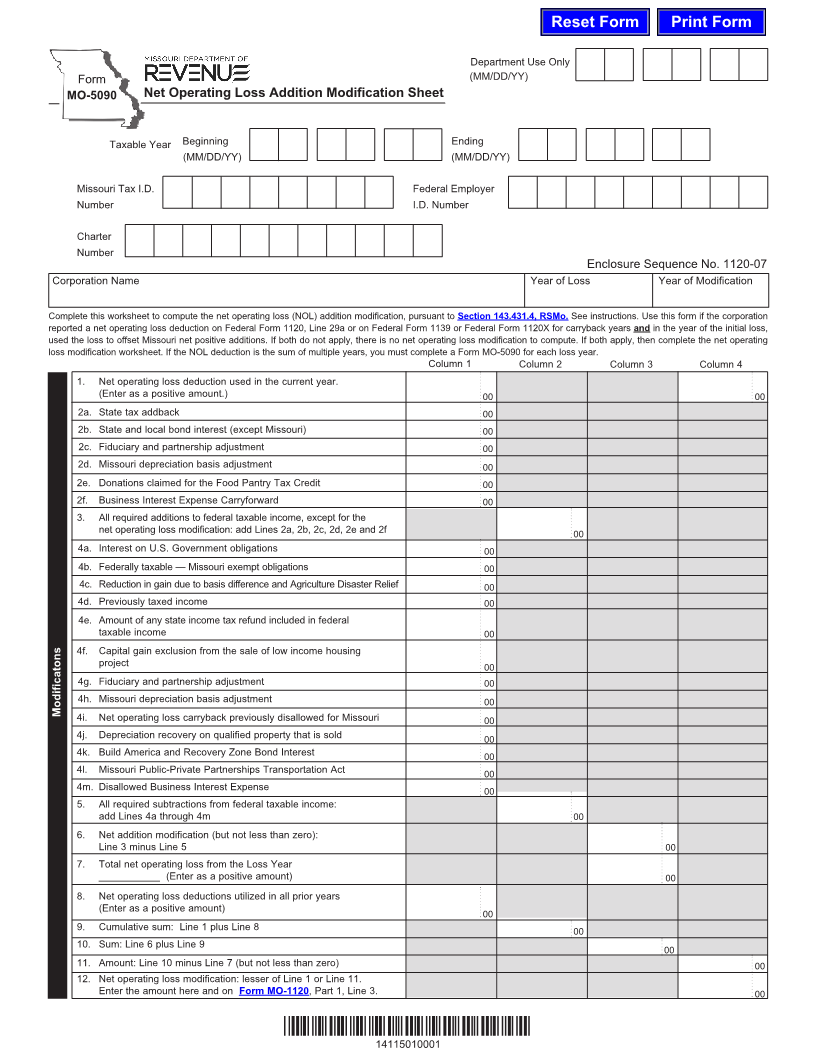

Enlarge image

Reset Form Print Form

Department Use Only

Form (MM/DD/YY)

MO-5090 Net Operating Loss Addition Modification Sheet

Taxable Year Beginning Ending

(MM/DD/YY) (MM/DD/YY)

Missouri Tax I.D. Federal Employer

Number I.D. Number

Charter

Number

Enclosure Sequence No. 1120-07

Corporation Name Year of Loss Year of Modification

Complete this worksheet to compute the net operating loss (NOL) addition modification, pursuant to Section 143.431.4, RSMo. See instructions. Use this form if the corporation

reported a net operating loss deduction on Federal Form 1120, Line 29a or on Federal Form 1139 or Federal Form 1120X for carryback years and in the year of the initial loss,

used the loss to offset Missouri net positive additions. If both do not apply, there is no net operating loss modification to compute. If both apply, then complete the net operating

loss modification worksheet. If the NOL deduction is the sum of multiple years, you must complete a Form MO-5090 for each loss year.

Column 1 Column 2 Column 3 Column 4

1. Net operating loss deduction used in the current year.

(Enter as a positive amount.) 00 00

2a. State tax addback 00

2b. State and local bond interest (except Missouri) 00

2c. Fiduciary and partnership adjustment 00

2d. Missouri depreciation basis adjustment 00

2e. Donations claimed for the Food Pantry Tax Credit 00

2f. Business Interest Expense Carryforward 00

3. All required additions to federal taxable income, except for the

net operating loss modification: add Lines 2a, 2b, 2c, 2d, 2e and 2f 00

4a. Interest on U.S. Government obligations 00

4b. Federally taxable — Missouri exempt obligations 00

4c. Reduction in gain due to basis difference and Agriculture Disaster Relief 00

4d. Previously taxed income 00

4e. Amount of any state income tax refund included in federal

taxable income 00

4f. Capital gain exclusion from the sale of low income housing

project 00

4g. Fiduciary and partnership adjustment 00

4h. Missouri depreciation basis adjustment 00

Modificatons

4i. Net operating loss carryback previously disallowed for Missouri 00

4j. Depreciation recovery on qualified property that is sold 00

4k. Build America and Recovery Zone Bond Interest 00

4l. Missouri Public-Private Partnerships Transportation Act 00

4m. Disallowed Business Interest Expense 00

5. All required subtractions from federal taxable income:

add Lines 4a through 4m 00

6. Net addition modification (but not less than zero):

Line 3 minus Line 5 00

7. Total net operating loss from the Loss Year

___________ (Enter as a positive amount) 00

8. Net operating loss deductions utilized in all prior years

(Enter as a positive amount) 00

9. Cumulative sum: Line 1 plus Line 8 00

10. Sum: Line 6 plus Line 9 00

11. Amount: Line 10 minus Line 7 (but not less than zero) 00

12. Net operating loss modification: lesser of Line 1 or Line 11.

Enter the amount here and on Form MO-1120, Part 1, Line 3. 00

*14115010001*

14115010001