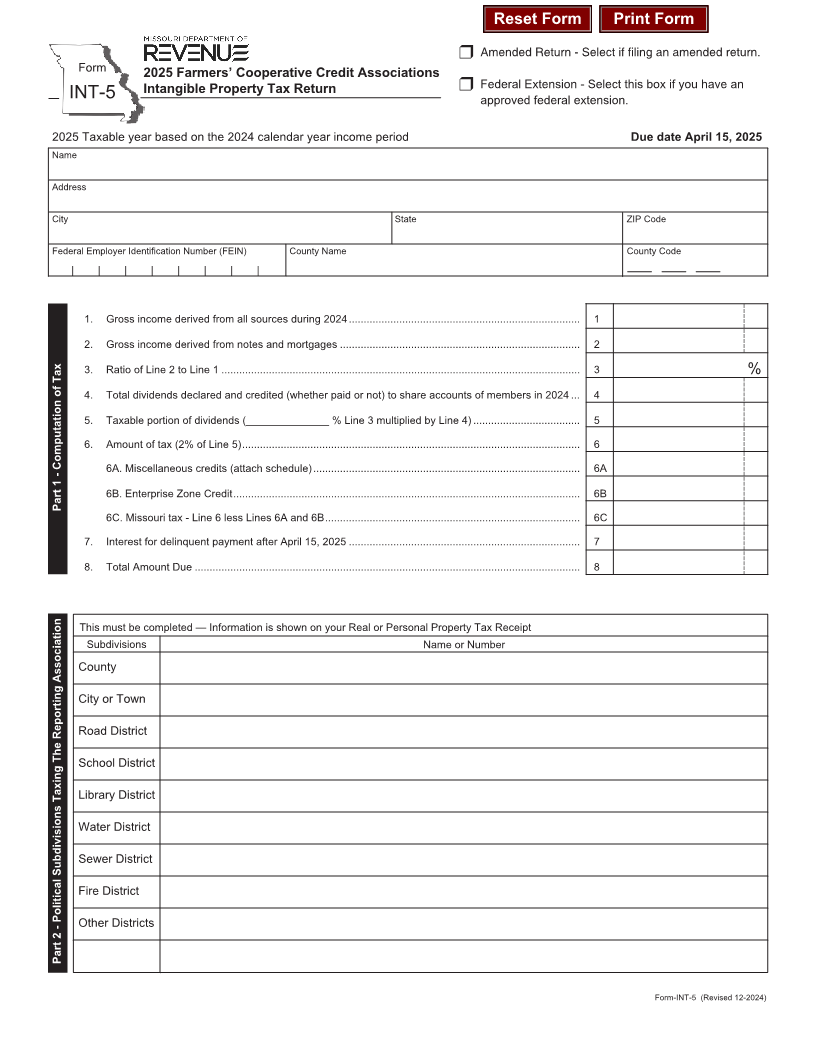

Enlarge image

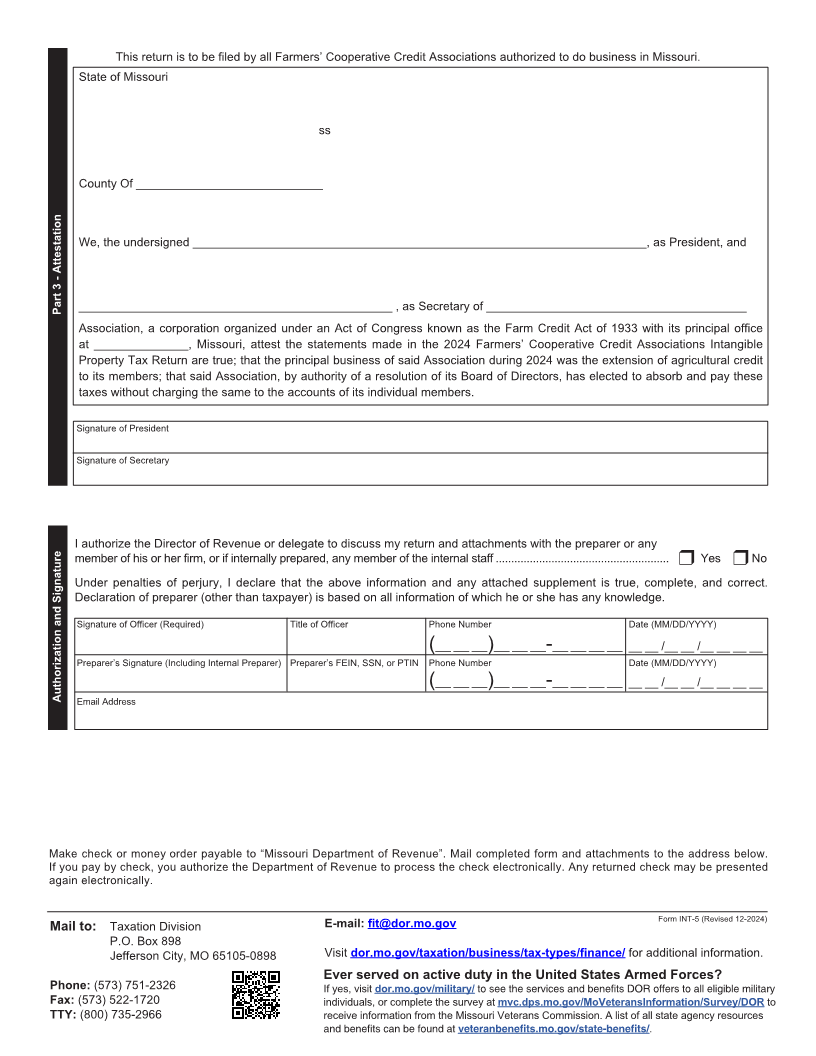

Reset Form Print Form

r Amended Return - Select if filing an amended return.

Form 2025 Farmers’ Cooperative Credit Associations

INT-5 Intangible Property Tax Return r Federal Extension - Select this box if you have an

approved federal extension.

2025 Taxable year based on the 2024 calendar year income period Due date April 15, 2025

Name

Address

City State ZIP Code

Federal Employer Identification Number (FEIN) County Name County Code

| | | | | | | |

1. Gross income derived from all sources during 2024 .............................................................................. 1

2. Gross income derived from notes and mortgages ................................................................................. 2

3. Ratio of Line 2 to Line 1 ......................................................................................................................... 3 %

4. Total dividends declared and credited (whether paid or not) to share accounts of members in 2024 ... 4

5. Taxable portion of dividends (______________ % Line 3 multiplied by Line 4) .................................... 5

6. Amount of tax (2% of Line 5) .................................................................................................................. 6

6A. Miscellaneous credits (attach schedule) .......................................................................................... 6A

6B. Enterprise Zone Credit ..................................................................................................................... 6B

Part 1 - Computation of Tax

6C. Missouri tax - Line 6 less Lines 6A and 6B ...................................................................................... 6C

7. Interest for delinquent payment after April 15, 2025 .............................................................................. 7

8. Total Amount Due .................................................................................................................................. 8

This must be completed — Information is shown on your Real or Personal Property Tax Receipt

Subdivisions Name or Number

County

City or Town

Road District

School District

Library District

Water District

Sewer District

Fire District

Other Districts

Part 2 - Political Subdivisions Taxing The Reporting Association

Form-INT-5 (Revised 12-2024)