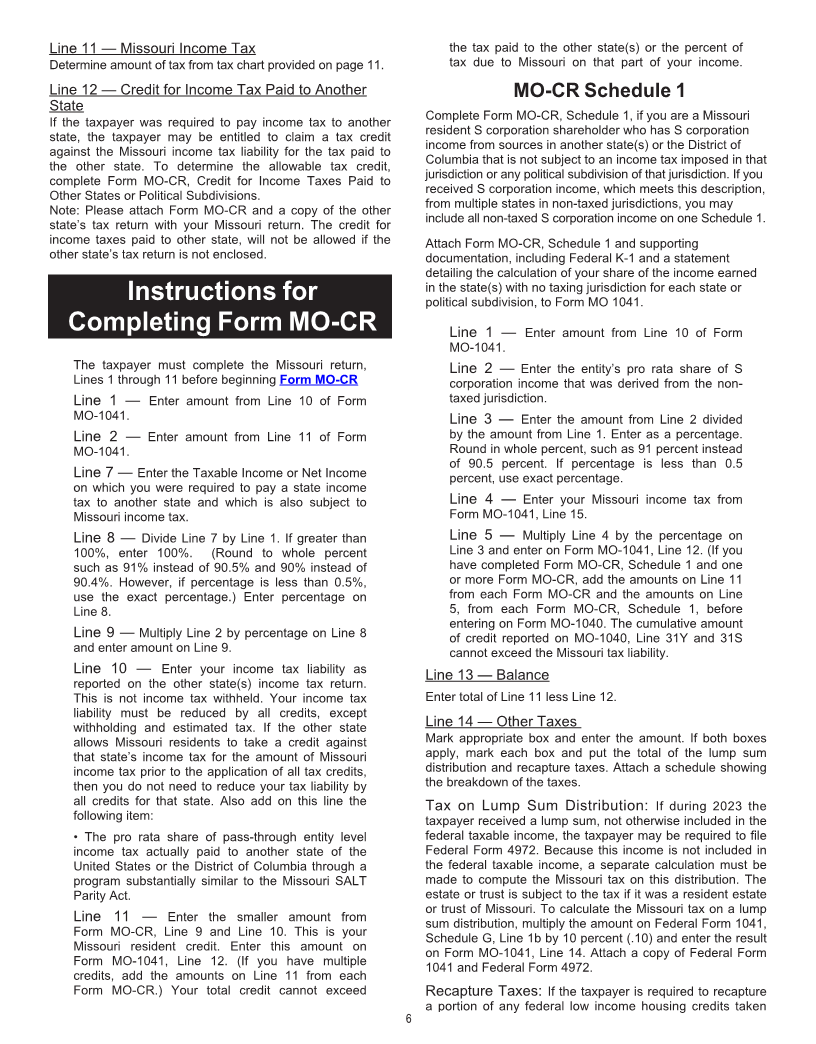

Enlarge image

Reset Form Print Form

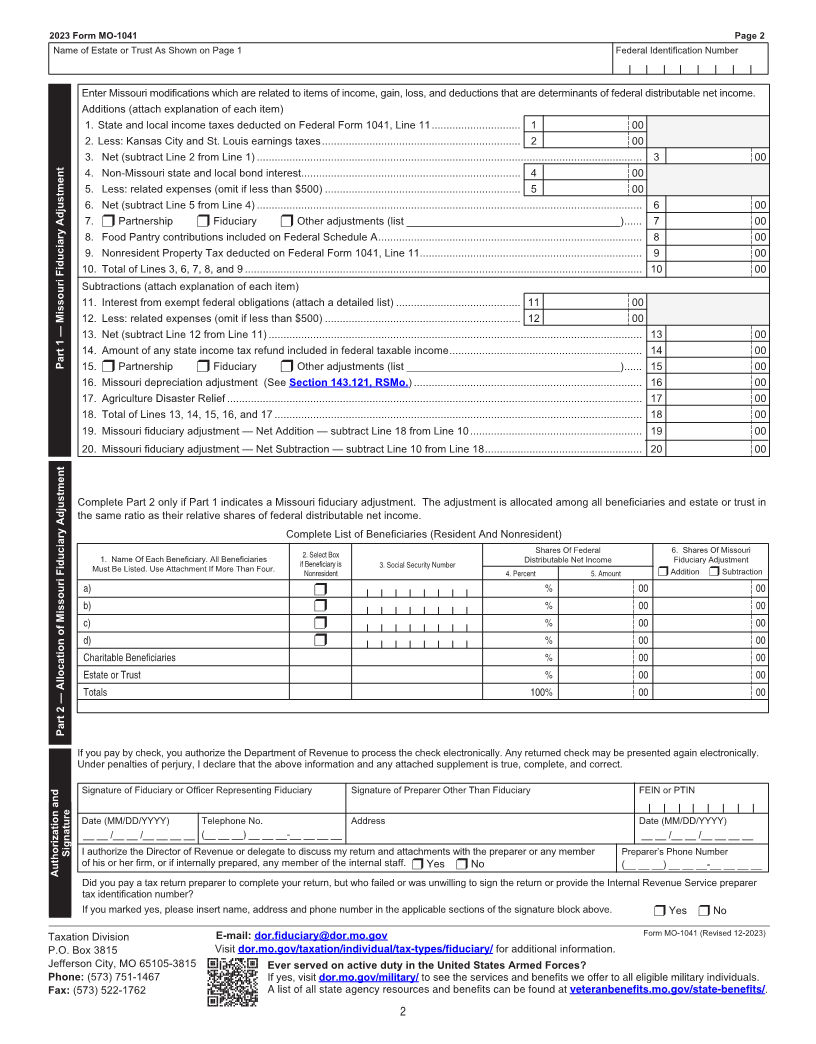

Form

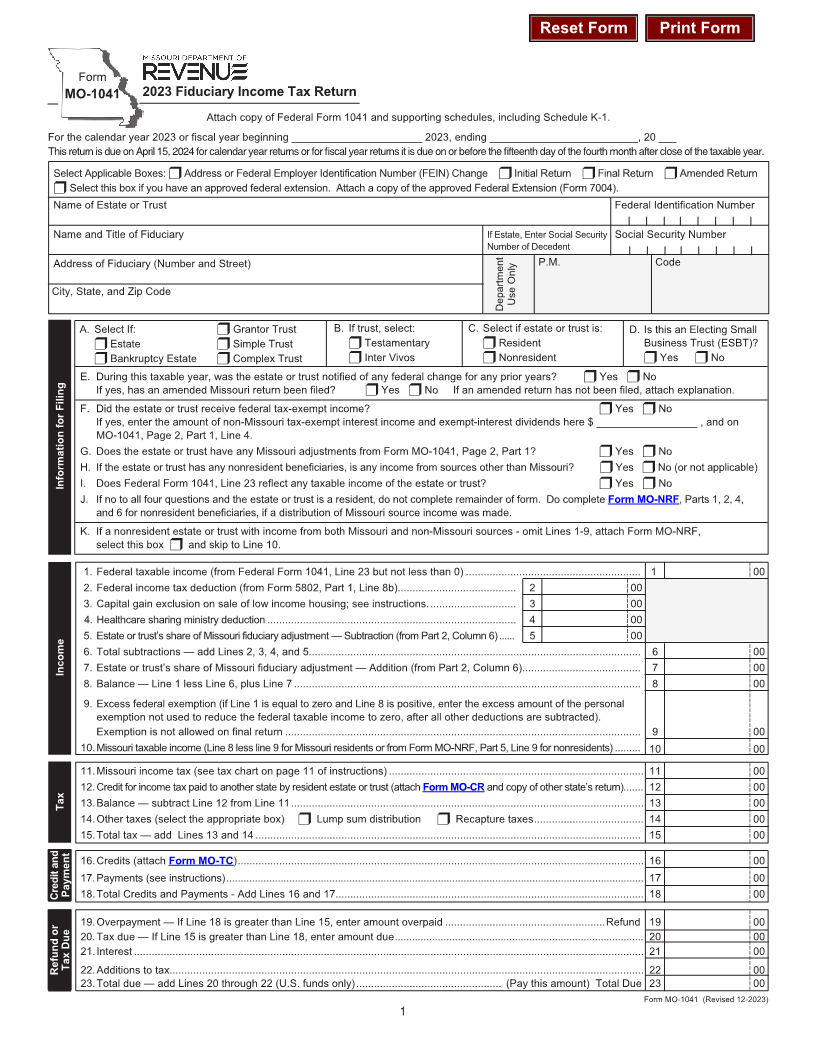

MO-1041 2023 Fiduciary Income Tax Return

Attach copy of Federal Form 1041 and supporting schedules, including Schedule K‑1.

For the calendar year 2023 or fiscal year beginning ______________________ 2023, ending _________________________, 20 ___

This return is due on April 15, 2024 for calendar year returns or for fiscal year returns it is due on or before the fifteenth day of the fourth month after close of the taxable year.

Select Applicable Boxes: r Address or Federal Employer Identification Number (FEIN) Change r Initial Return r Final Return r Amended Return

r Select this box if you have an approved federal extension. Attach a copy of the approved Federal Extension (Form 7004).

Name of Estate or Trust Federal Identification Number

Name and Title of Fiduciary If Estate, Enter Social Security Social Security Number

Number of Decedent

Address of Fiduciary (Number and Street) P.M. Code

City, State, and Zip Code

Department Use Only

A. Select If: r Grantor Trust B. If trust, select: C. Select if estate or trust is: D. Is this an Electing Small

r Estate r Simple Trust r Testamentary r Resident Business Trust (ESBT)?

r Bankruptcy Estate r Complex Trust r Inter Vivos r Nonresident r Yes r No

E. During this taxable year, was the estate or trust notified of any federal change for any prior years? r Yes r No

If yes, has an amended Missouri return been filed? r Yes r No If an amended return has not been filed, attach explanation.

F. Did the estate or trust receive federal tax‑exempt income? r Yes r No

If yes, enter the amount of non‑Missouri tax‑exempt interest income and exempt‑interest dividends here $ _________________ , and on

MO‑1041, Page 2, Part 1, Line 4.

G. Does the estate or trust have any Missouri adjustments from Form MO‑1041, Page 2, Part 1? r Yes r No

H. If the estate or trust has any nonresident beneficiaries, is any income from sources other than Missouri? r Yes r No (or not applicable)

Information for Filing I. Does Federal Form 1041, Line 23 reflect any taxable income of the estate or trust? r Yes r No

J. If no to all four questions and the estate or trust is a resident, do not complete remainder of form. Do complete Form MO-NRF, Parts 1, 2, 4,

and 6 for nonresident beneficiaries, if a distribution of Missouri source income was made.

K. If a nonresident estate or trust with income from both Missouri and non‑Missouri sources ‑ omit Lines 1‑9, attach Form MO‑NRF,

select this box r and skip to Line 10.

1. Federal taxable income (from Federal Form 1041, Line 23 but not less than 0) ........................................................... 1 00

2. Federal income tax deduction (from Form 5802, Part 1, Line 8b)........................................ 2 00

3. Capital gain exclusion on sale of low income housing; see instructions. ............................. 3 00

4. Healthcare sharing ministry deduction .................................................................................... 4 00

5. Estate or trust’s share of Missouri fiduciary adjustment — Subtraction (from Part 2, Column 6) ...... 5 00

6. Total subtractions — add Lines 2, 3, 4, and 5................................................................................................................ 6 00

Income 7. Estate or trust’s share of Missouri fiduciary adjustment — Addition (from Part 2, Column 6)........................................ 7 00

8. Balance — Line 1 less Line 6, plus Line 7 ..................................................................................................................... 8 00

9. Excess federal exemption (if Line 1 is equal to zero and Line 8 is positive, enter the excess amount of the personal

exemption not used to reduce the federal taxable income to zero, after all other deductions are subtracted).

Exemption is not allowed on final return ........................................................................................................................ 9 00

10. Missouri taxable income (Line 8 less line 9 for Missouri residents or from Form MO‑NRF, Part 5, Line 9 for nonresidents) ......... 10 00

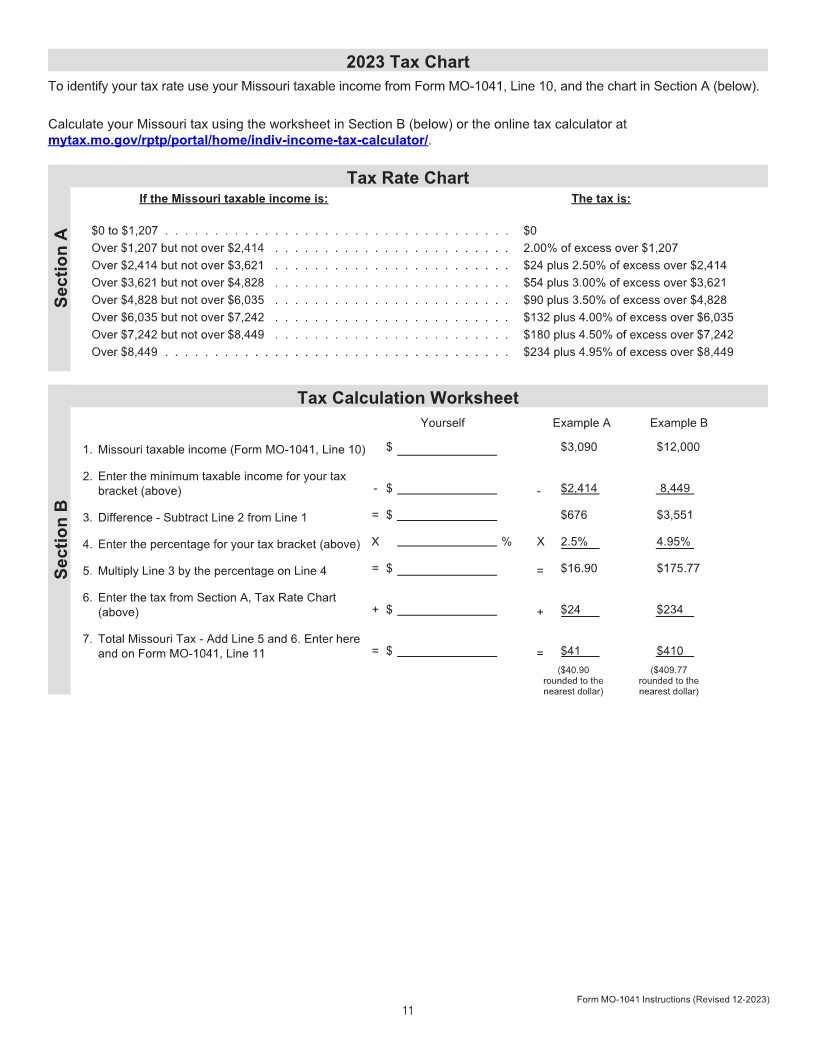

11. Missouri income tax (see tax chart on page 11 of instructions) ...................................................................................... 11 00

12. Credit for income tax paid to another state by resident estate or trust (attach Form MO-CR and copy of other state’s return)....... 12 00

Tax 13. Balance — subtract Line 12 from Line 11 ....................................................................................................................... 13 00

14. Other taxes (select the appropriate box) r Lump sum distribution r Recapture taxes ..................................... 14 00

15. Total tax — add Lines 13 and 14 .................................................................................................................................. 15 00

16. Credits (attach Form MO-TC) ......................................................................................................................................... 16 00

17. Payments (see instructions) .................................................................................................................................................. 17 00

Credit and Payment 18. Total Credits and Payments ‑ Add Lines 16 and 17........................................................................................................ 18 00

19. Overpayment — If Line 18 is greater than Line 15, enter amount overpaid ......................................................Refund 19 00

20. Tax due — If Line 15 is greater than Line 18, enter amount due ....................................................................................... 20 00

21. Interest ............................................................................................................................................................................ 21 00

Refund or Tax Due 22. Additions to tax................................................................................................................................................................ 22 00

23. Total due — add Lines 20 through 22 (U.S. funds only) ................................................. (Pay this amount) Total Due 23 00

Form MO‑1041 (Revised 12‑2023)

1