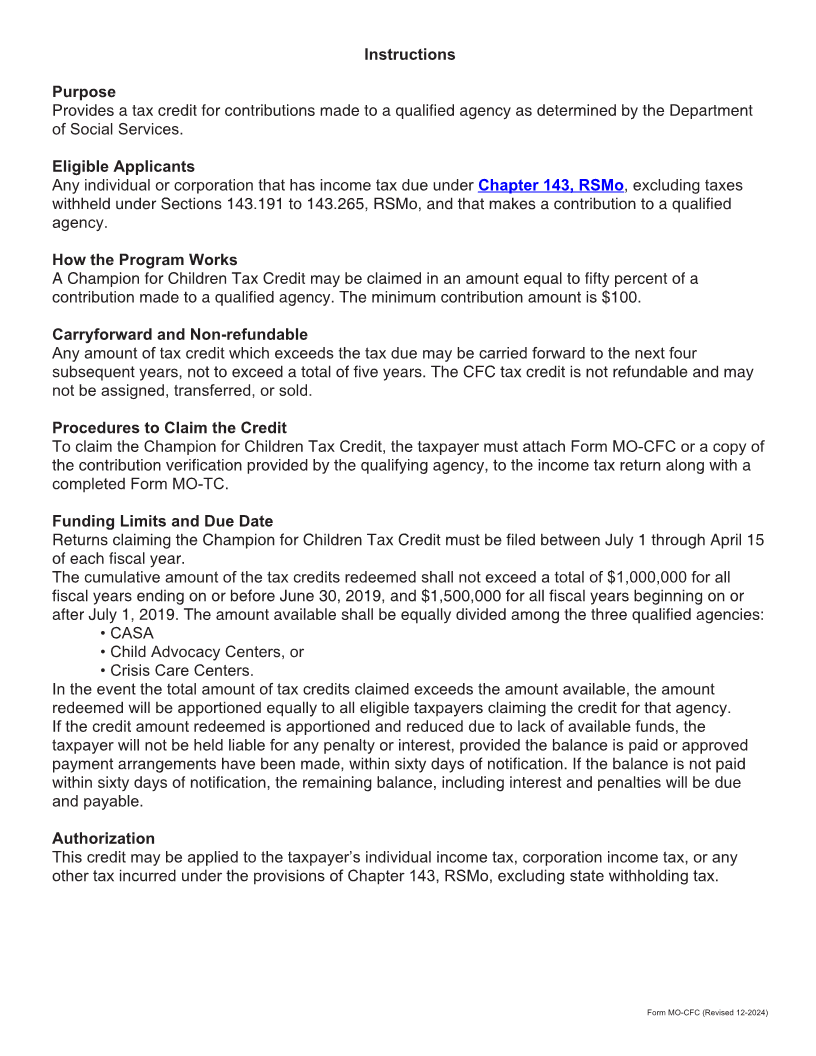

Enlarge image

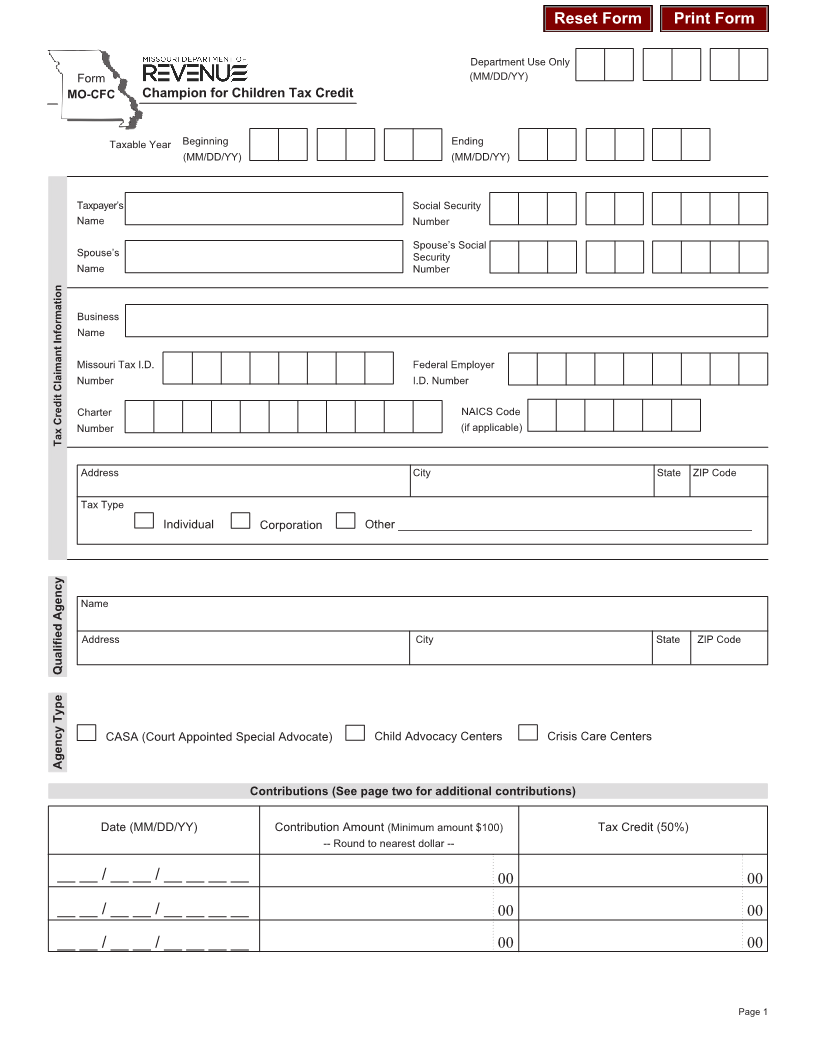

Reset Form Print Form

Department Use Only

Form (MM/DD/YY)

MO-CFC Champion for Children Tax Credit

Taxable Year Beginning Ending

(MM/DD/YY) (MM/DD/YY)

Taxpayer’s Social Security

Name Number

Spouse’s Social

Spouse’s Security

Name Number

Business

Name

Missouri Tax I.D. Federal Employer

Number I.D. Number

Charter NAICS Code

Number (if applicable)

Tax Credit Claimant Information

Address City State ZIP Code

Tax Type

Individual Corporation Other _____________________________________________________

Name

Address City State ZIP Code

Qualified Agency

CASA (Court Appointed Special Advocate) Child Advocacy Centers Crisis Care Centers

Agency Type

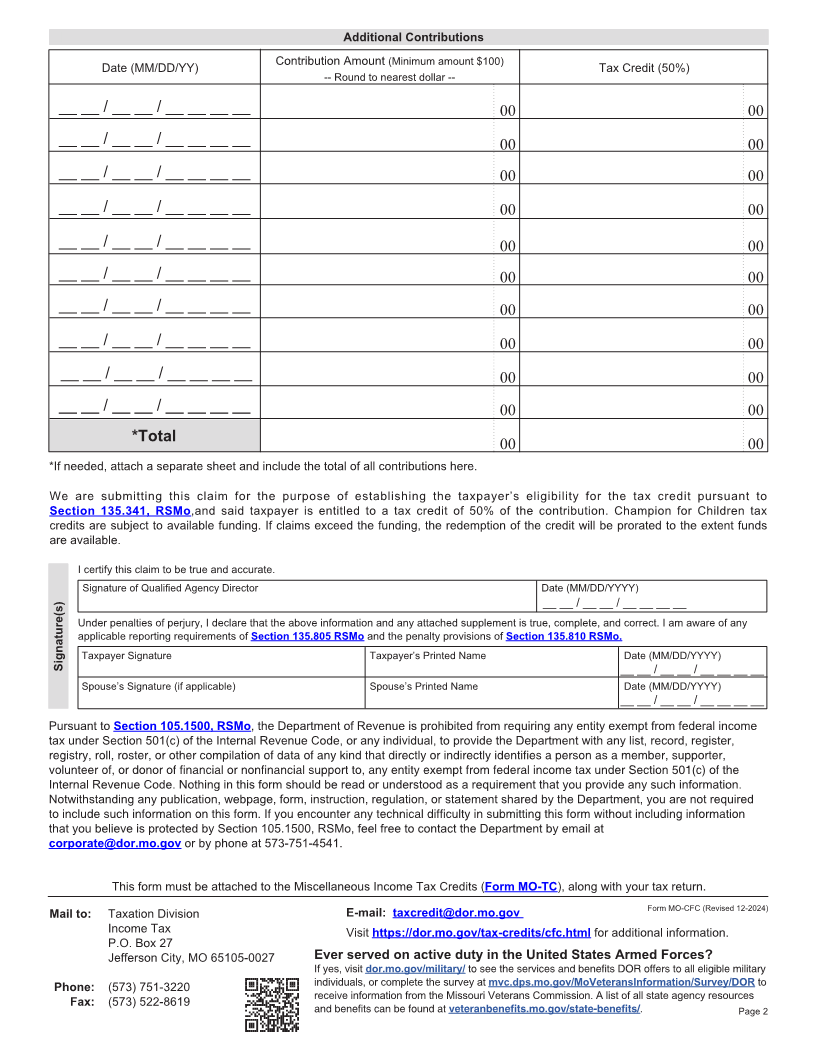

Contributions (See page two for additional contributions)

Date (MM/DD/YY) Contribution Amount (Minimum amount $100) Tax Credit (50%)

-- Round to nearest dollar --

__ __ / __ __ / __ __ __ __ 00 00

__ __ / __ __ / __ __ __ __ 00 00

__ __ / __ __ / __ __ __ __ 00 00

Page 1