Enlarge image

Form

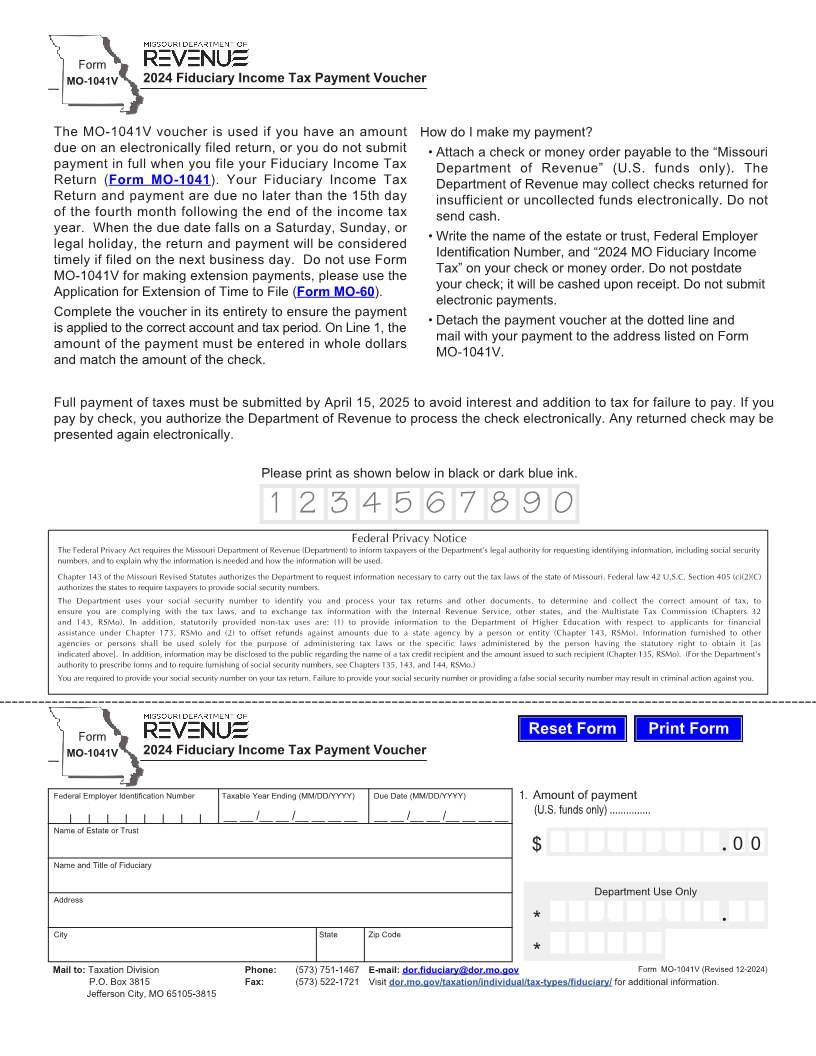

MO-1041V 2024 Fiduciary Income Tax Payment Voucher

The MO-1041V voucher is used if you have an amount How do I make my payment?

due on an electronically filed return, or you do not submit • Attach a check or money order payable to the “Missouri

payment in full when you file your Fiduciary Income Tax Department of Reve nue” (U.S. funds only). The

Return (Form MO-1041). Your Fiduciary Income Tax Department of Revenue may collect checks returned for

Return and payment are due no later than the 15th day insufficient or uncollected funds electronically. Do not

of the fourth month following the end of the income tax send cash.

year. When the due date falls on a Saturday, Sunday, or

• Write the name of the estate or trust, Federal Employer

legal holiday, the return and payment will be considered

Identification Number, and “2024 MO Fiduciary Income

timely if filed on the next business day. Do not use Form

Tax” on your check or money order. Do not postdate

MO-1041V for making extension payments, please use the

your check; it will be cashed upon receipt. Do not submit

Application for Extension of Time to File (Form MO-60).

electronic payments.

Complete the voucher in its entirety to ensure the payment

• Detach the payment voucher at the dotted line and

is applied to the correct account and tax period. On Line 1, the

mail with your payment to the address listed on Form

amount of the payment must be entered in whole dollars

MO-1041V.

and match the amount of the check.

Full payment of taxes must be submitted by April 15, 2025 to avoid interest and addition to tax for failure to pay. If you

pay by check, you authorize the Department of Revenue to process the check electronically. Any returned check may be

presented again electronically.

Please print as shown below in black or dark blue ink.

1 2 3 4 5 6 7 8 9 0

Federal Privacy Notice

The Federal Privacy Act requires the Missouri Department of Revenue (Department) to inform taxpayers of the Department’s legal authority for requesting identifying information, including social security

numbers, and to explain why the information is needed and how the information will be used.

Chapter 143 of the Missouri Revised Statutes authorizes the Department to request information necessary to carry out the tax laws of the state of Missouri. Federal law 42 U.S.C. Section 405 (c)(2)(C)

authorizes the states to require taxpayers to provide social security numbers.

The Department uses your social security number to identify you and process your tax returns and other documents, to determine and collect the correct amount of tax, to

ensure you are complying with the tax laws, and to exchange tax information with the Internal Revenue Service, other states, and the Multistate Tax Commission (Chapters 32

and 143, RSMo). In addition, statutorily provided non-tax uses are: (1) to provide information to the Department of Higher Education with respect to applicants for financial

assistance under Chapter 173, RSMo and (2) to offset refunds against amounts due to a state agency by a person or entity (Chapter 143, RSMo). Information furnished to other

agencies or persons shall be used solely for the purpose of administering tax laws or the specific laws administered by the person having the statutory right to obtain it [as

indicated above]. In addition, information may be disclosed to the public regarding the name of a tax credit recipient and the amount issued to such recipient (Chapter 135, RSMo). (For the Department’s

authority to prescribe forms and to require furnishing of social security numbers, see Chapters 135, 143, and 144, RSMo.)

You are required to provide your social security number on your tax return. Failure to provide your social security number or providing a false social security number may result in criminal action against you.

Form Reset Form Print Form

MO-1041V 2024 Fiduciary Income Tax Payment Voucher

Federal Employer Identification Number Taxable Year Ending (MM/DD/YYYY) Due Date (MM/DD/YYYY) 1. Amount of payment

__ __ /__ __ /__ __ __ __ __ __ /__ __ /__ __ __ __ (U.S. funds only) ...............

Name of Estate or Trust

$ • 00

Name and Title of Fiduciary

Address Department Use Only

* •

City State Zip Code

*

Mail to: Taxation Division Phone: (573) 751-1467 E-mail: dor.fiduciary@dor.mo.gov Form MO-1041V (Revised 12-2024)

P.O. Box 3815 Fax: (573) 522-1721 Visit dor.mo.gov/taxation/individual/tax-types/fiduciary/ for additional information.

Jefferson City, MO 65105-3815