Enlarge image

Form Reset Form Print Form

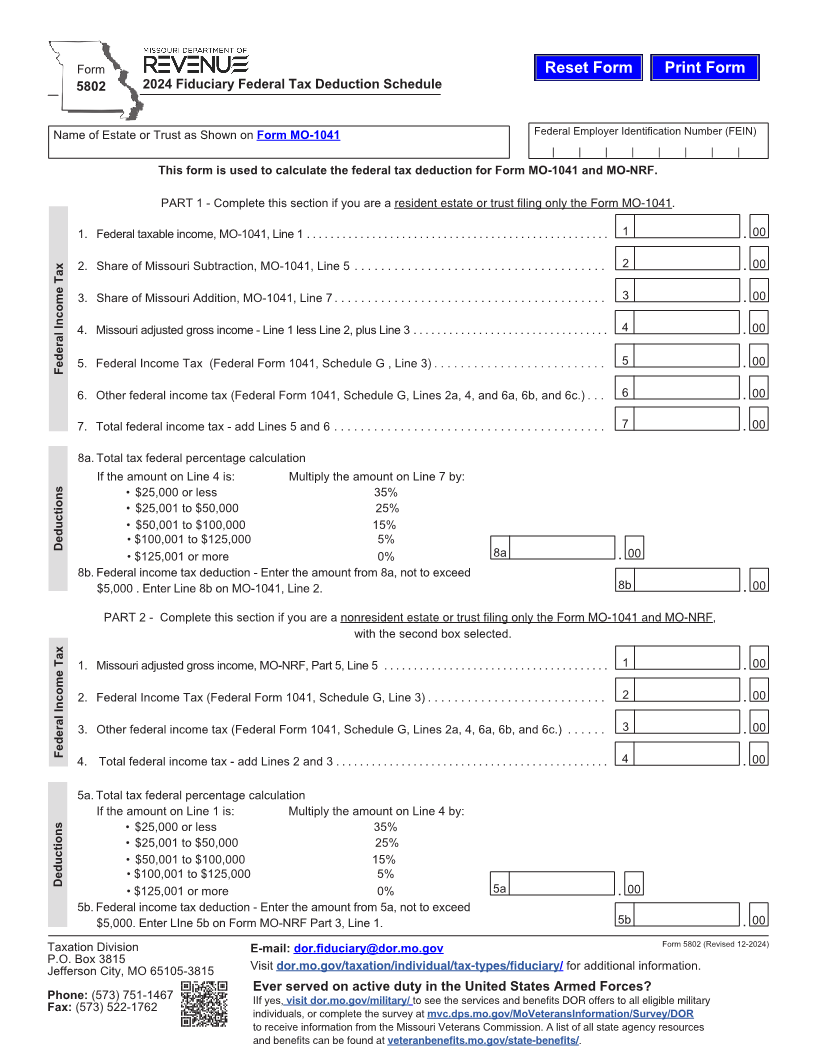

5802 2024 Fiduciary Federal Tax Deduction Schedule

Name of Estate or Trust as Shown on Form MO‑1041 Federal Employer Identification Number (FEIN)

| | | | | | | |

This form is used to calculate the federal tax deduction for Form MO‑1041 and MO‑NRF.

PART 1 - Complete this section if you are a resident estate or trust filing only the Form MO-1041.

1. Federal taxable income, MO-1041, Line 1 ................................................... 1 . 00

2. Share of Missouri Subtraction, MO-1041, Line 5 ...................................... 2 . 00

3. Share of Missouri Addition, MO-1041, Line 7 ......................................... 3 . 00

4. Missouri adjusted gross income - Line 1 less Line 2, plus Line 3 ................................. 4 . 00

Federal Income Tax 5. Federal Income Tax (Federal Form 1041, Schedule G , Line 3) .......................... 5 . 00

6. Other federal income tax (Federal Form 1041, Schedule G, Lines 2a, 4, and 6a, 6b, and 6c.) ... 6 . 00

7. Total federal income tax - add Lines 5 and 6 ......................................... 7 . 00

8a. Total tax federal percentage calculation

If the amount on Line 4 is: Multiply the amount on Line 7 by:

• $25,000 or less 35%

• $25,001 to $50,000 25%

• $50,001 to $100,000 15%

Deductions • $100,001 to $125,000 5%

• $125,001 or more 0% 8a . 00

8b. Federal income tax deduction - Enter the amount from 8a, not to exceed

$5,000 . Enter Line 8b on MO-1041, Line 2. 8b . 00

PART 2 - Complete this section if you are a nonresident estate or trust filing only the Form MO-1041 and MO-NRF,

with the second box selected.

1. Missouri adjusted gross income, MO-NRF, Part 5, Line 5 ...................................... 1 . 00

2. Federal Income Tax (Federal Form 1041, Schedule G, Line 3) ........................... 2 . 00

3. Other federal income tax (Federal Form 1041, Schedule G, Lines 2a, 4, 6a, 6b, and 6c.) ...... 3 . 00

Federal Income Tax

4. Total federal income tax - add Lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 . 00

5a. Total tax federal percentage calculation

If the amount on Line 1 is: Multiply the amount on Line 4 by:

• $25,000 or less 35%

• $25,001 to $50,000 25%

• $50,001 to $100,000 15%

Deductions • $100,001 to $125,000 5%

• $125,001 or more 0% 5a . 00

5b. Federal income tax deduction - Enter the amount from 5a, not to exceed

$5,000. Enter LIne 5b on Form MO-NRF Part 3, Line 1. 5b . 00

Taxation Division E‑mail: dor.fiduciary@dor.mo.gov Form 5802 (Revised 12-2024)

P.O. Box 3815 Visit dor.mo.gov/taxation/individual/tax-types/fiduciary/ for additional information.

Jefferson City, MO 65105-3815

Ever served on active duty in the United States Armed Forces?

Phone: (573) 751-1467 IIf yes, visit dor.mo.gov/military/ to see the services and benefits DOR offers to all eligible military

Fax: (573) 522-1762 individuals, or complete the survey at mvc.dps.mo.gov/MoVeteransInformation/Survey/DOR

to receive information from the Missouri Veterans Commission. A list of all state agency resources

and benefits can be found at veteranbenefits.mo.gov/state-benefits/.