Enlarge image

Form 2024 Instructions for Composite Individual

Return for Nonresident Partners or Shareholders

5677

A composite return is allowed by the Missouri Department of Revenue for any partnership, S corporation, limited liability partnership, or

limited liability company (treated as a partnership for tax purposes) with nonresident partners or S corporation shareholders not otherwise

required to file a Missouri individual income tax return. Please refer to Missouri Regulation 12 CSR 10-2.190 for the specific requirements

and procedures for filing a composite return.

Nonresident individuals, partnerships, S corporations, regular corporations, estates (filing a Federal Form 1041), and trusts can be included

on the composite income tax form. Composite returns must be filed on the individual income tax long form MO-1040. Prior year

forms can be obtained at dor.mo.gov/forms/.

The following is a summary of the procedures to use when completing a composite return:

1. Select the composite return box at the top of the Form MO-1040.

2. Fill in the federal identification number of the corporation or partnership in the “Social Security Number” field.

3. Fill in the name of the corporation or partnership in the “Name (First)” field.

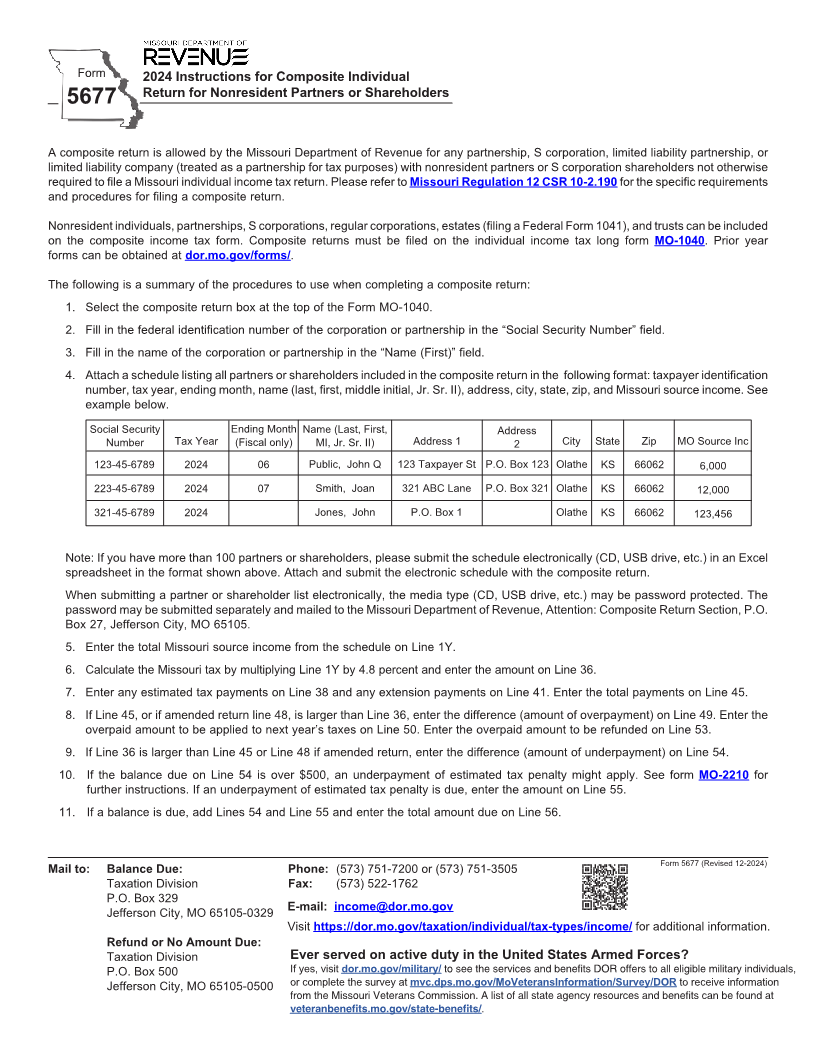

4. Attach a schedule listing all partners or shareholders included in the composite return in the following format: taxpayer identification

number, tax year, ending month, name (last, first, middle initial, Jr. Sr. II), address, city, state, zip, and Missouri source income. See

example below.

Social Security Ending Month Name (Last, First, Address

Number Tax Year (Fiscal only) MI, Jr. Sr. II) Address 1 2 City State Zip MO Source Inc

123-45-6789 2024 06 Public, John Q 123 Taxpayer St P.O. Box 123 Olathe KS 66062 6,000

223-45-6789 2024 07 Smith, Joan 321 ABC Lane P.O. Box 321 Olathe KS 66062 12,000

321-45-6789 2024 Jones, John P.O. Box 1 Olathe KS 66062 123,456

Note: If you have more than 100 partners or shareholders, please submit the schedule electronically (CD, USB drive, etc.) in an Excel

spreadsheet in the format shown above. Attach and submit the electronic schedule with the composite return.

When submitting a partner or shareholder list electronically, the media type (CD, USB drive, etc.) may be password protected. The

password may be submitted separately and mailed to the Missouri Department of Revenue, Attention: Composite Return Section, P.O.

Box 27, Jefferson City, MO 65105.

5. Enter the total Missouri source income from the schedule on Line 1Y.

6. Calculate the Missouri tax by multiplying Line 1Y by 4.8 percent and enter the amount on Line 36.

7. Enter any estimated tax payments on Line 38 and any extension payments on Line 41. Enter the total payments on Line 45.

8. If Line 45, or if amended return line 48, is larger than Line 36, enter the difference (amount of overpayment) on Line 49. Enter the

overpaid amount to be applied to next year’s taxes on Line 50. Enter the overpaid amount to be refunded on Line 53.

9. If Line 36 is larger than Line 45 or Line 48 if amended return, enter the difference (amount of underpayment) on Line 54.

10. If the balance due on Line 54 is over $500, an underpayment of estimated tax penalty might apply. See form MO-2210 for

further instructions. If an underpayment of estimated tax penalty is due, enter the amount on Line 55.

11. If a balance is due, add Lines 54 and Line 55 and enter the total amount due on Line 56.

Form 5677 (Revised 12-2024)

Mail to: Balance Due: Phone: (573) 751-7200 or (573) 751-3505

Taxation Division Fax: (573) 522-1762

P.O. Box 329

Jefferson City, MO 65105-0329 E-mail: income@dor.mo.gov

Visit https://dor.mo.gov/taxation/individual/tax-types/income/ for additional information.

Refund or No Amount Due:

Taxation Division Ever served on active duty in the United States Armed Forces?

P.O. Box 500 If yes, visit dor.mo.gov/military/ to see the services and benefits DOR offers to all eligible military individuals,

Jefferson City, MO 65105-0500 or complete the survey at mvc.dps.mo.gov/MoVeteransInformation/Survey/DOR to receive information

from the Missouri Veterans Commission. A list of all state agency resources and benefits can be found at

.

veteranbenefits.mo.gov/state-benefits/