Enlarge image

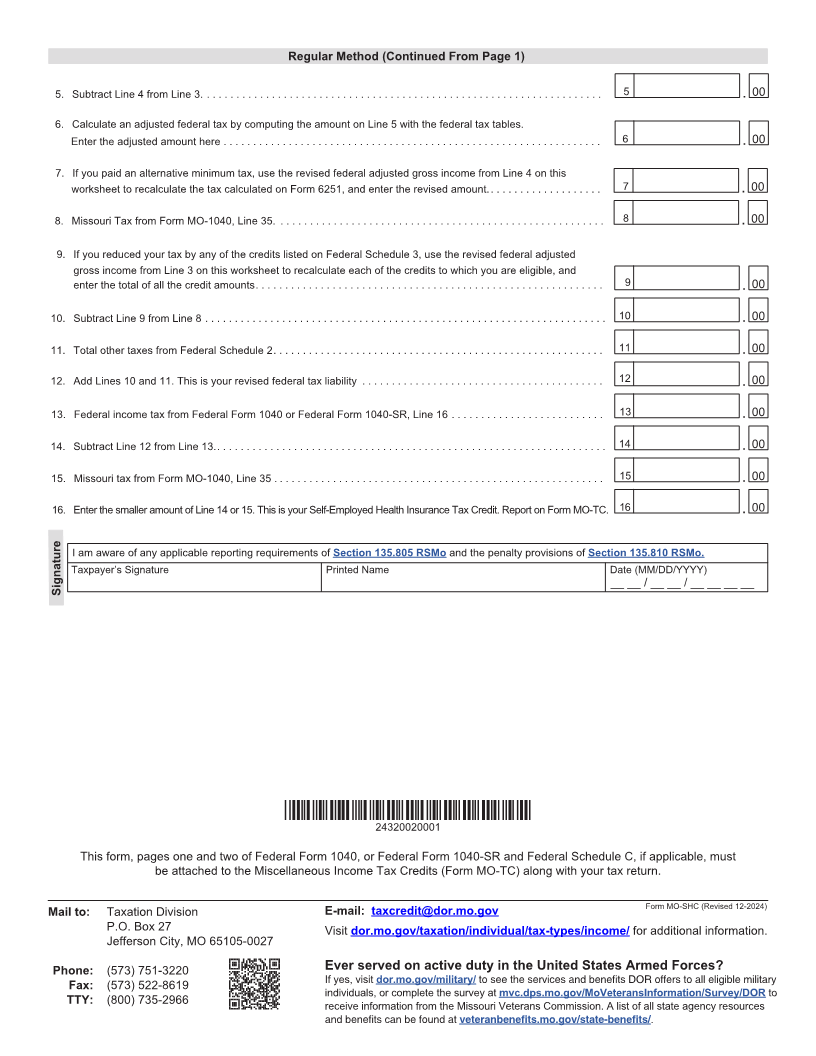

Reset Form

Department Use Only

Form (MM/DD/YY)

MO-SHC 2024 Self-Employed Health Insurance Tax Credit

*24320010001*

24320010001

Social Security Number

- -

Taxpayer Name

Qualifications and Instructions

If you are a self-employed individual and were not able to deduct all of your health care premiums from your federal adjusted gross income,

you may be eligible for a tax credit equal to the portion of your federal tax liability incurred due to the inclusion of your health care premiums in

your federal adjusted gross income. To qualify for this credit your tax liability must be less that $3,000.00 before other credits.

Tax Liability Limitation - Do I qualify?

Add the amount from Form MO-1040, Lines 33 plus 31 and any lump sum distribution on Line 34 and enter here. . 00

Is this amount equal to or greater than $3,000.00?

No - Continue to short or regular method to calculate your Self-employed Health Insurance Tax Credit.

Yes - STOP. You do not qualify for the Self-employed Health Insurance Tax Credit.

Calculate your tax credit by using either method below and enter the total on the Miscellaneous Income Tax Credits (Form MO-TC).

Self-employed individuals with itemized deductions are limited on their federal return because their federal adjusted gross income exceeded the limits

established by the Internal Revenue Service should use the Regular Method. If you are filing a combined return, and both spouses were self-employed

and paid health insurance premiums, each spouse must file a separate Form MO-SHC and only include their portion of the amounts from each of the

federal and Missouri return lines referenced below.

Short Method

1. Federal taxable income from Federal Form 1040 or Federal Form 1040-SR, Line 15 ...................... 1 . 00

2. Amount you paid for health insurance premiums which were included in federal adjusted gross income ........ 2 . 00

(Do not include health insurance premiums paid by your spouse.)

3. Subtract Line 2 from Line 1 ................................................................ 3 . 00

4. Calculate an adjusted federal tax by comparing the amount on Line 3 with the federal tax tables ............. 4 . 00

5. Federal income tax from your Federal Form 1040 or Federal Form 1040-SR, Line 16. ...................... 5 . 00

6. Subtract Line 4 from Line 5. ................................................................... 6 . 00

7. Missouri Tax from Form MO-1040, Line 35. ....................................................... 7 . 00

8. Enter the smaller amount of Lines 6 or 7. This is your Self-Employed Health Insurance Tax Credit. Report on Form MO-TC. 8 . 00

Regular Method

1. Federal adjusted gross income from Federal Form 1040 or Federal Form 1040-SR, Line 11 ................. 1 . 00

2. The amount you paid for health insurance premiums which were included in your federal adjusted gross income 2 . 00

(Do not include health insurance premiums paid by your spouse.)

3. Subtract Line 2 from Line 1. This is your revised federal adjusted gross income .......................... 3 . 00

4. Enter your standard or itemized deductions. ...................................................... 4 . 00