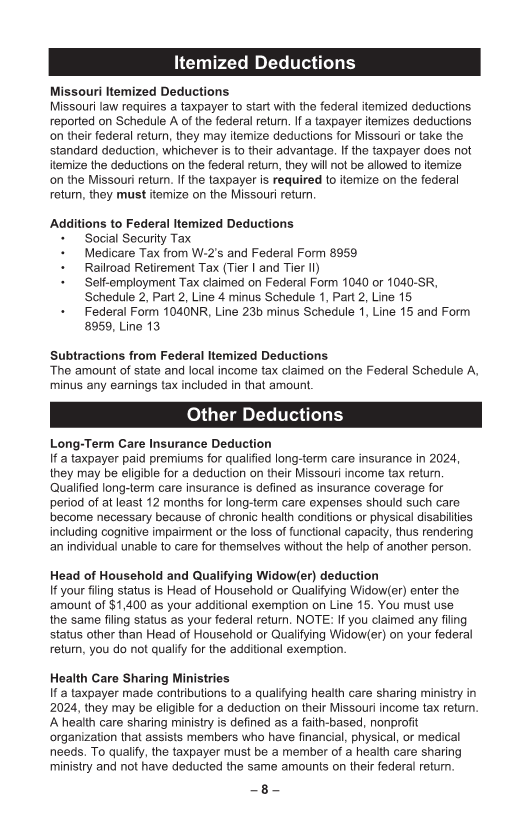

Enlarge image

2024

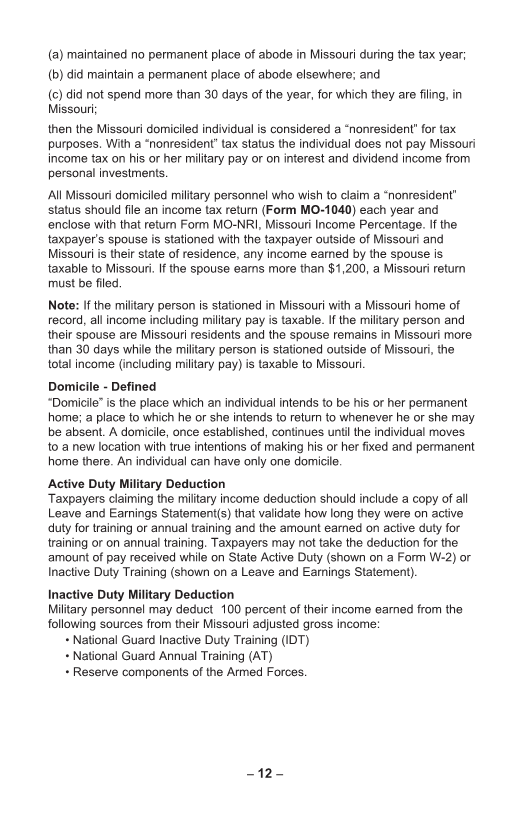

Missouri

Income Tax

Reference Guide

2024 Individual Income

MO-1040Form Tax Return - Long FormFor Calendar Year January 1 - December 31, 2024

Print inAmendedBLACK ink only Returnand DO NOT STAPLE. Return(For use by S corporations or Partnerships)

DepartmentFederal Extensionof Social- SelectServicesthisApplicationbox if youCompositehaveofanEligibilityapprovedformfederalattached.extension. Attach a copy Federal ExtensionFederal(Form return4868). attached.

IfFiscalfilingYeara fiscalBeginningyear(MM/DD/YY)return enter the beginningFiscaland endingYear Endingdates(MM/DD/YY)here. Vendor Code Department Use Only

0 0 1

Filing StatusSingle DependentClaimed as a MarriedCombinedFiling SeparatelyMarried Filing HouseholdHead of QualifyingWidow(er)

in 2024

YourselfAge 62 throughSpouse64 YourselfAge 65 or OlderSpouse YourselfDeceasedBlindSpouse Yourself-100% DisabledSpouse- YourselfNon-ObligatedSpouseSpouseDeceasedin 2024

FirstSocialNameSecurity Number- - M.I. Last Name Spouse’s Social Security Number Suffix

NameName Spouse’s First Name M.I. Spouse’s Last Name Suffix

In Care Of Name (Attorney, Executor, Personal Representative, etc.)

Present Address (Include Apartment Number or Rural Route)

City, Town, or Post Office State ZIP Code

Address County of Residence _

LEAD General KansasCity

You may contribute to any one or all of the trust funds on Line 51. See pages 11-12MemorialWorkers’WorkersofFundthe instructions LeadChildhoodFundTestingfor moreMissouritrustFamilyFundMilitaryRelieffund information. RevenueGeneral RFundevenue ProgramOrgan DonorFund Regional MilitaryMemorial SoldiersMuseum

TrustChildren’sFund TrustVeteransFund DeliveredElderlyTrust FundMealsHome NationalTrustMissouriFundGuard

Missouriof HonorMedalFund *24322010001* FoundationEnforcementMemorialLawFund in St. Louis Fund

2432201000121

Have a question about taxes?

Look inside for the answers . . .

Form 4711 (Revised 12-2024)