Enlarge image

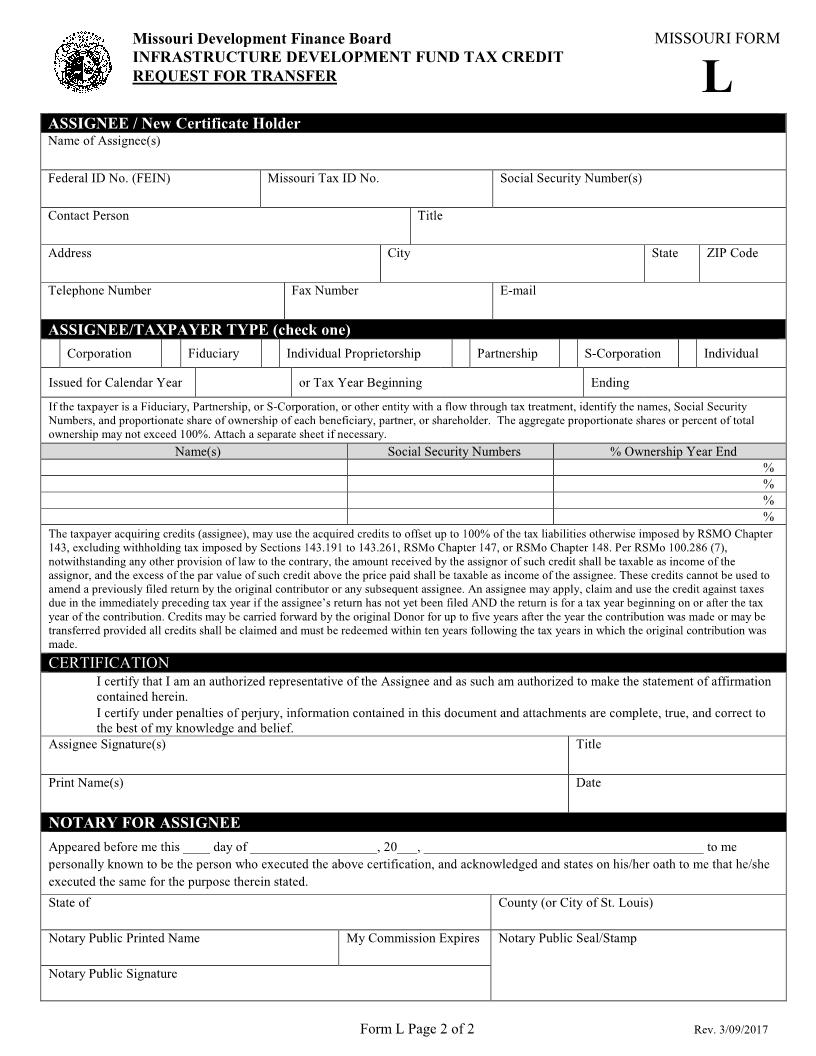

Missouri Development Finance Board MISSOURI FORM

INFRASTRUCTURE DEVELOPMENT FUND TAX CREDIT

REQUEST FOR TRANSFER

L

The Missouri Form L must be used when transferring Infrastructure Development Fund Tax Credits. A separate Form L must be

submitted for each tax credit voucher being requested. If more than one individual is listed as the Assignor/Assignee, the Social Security

Number and signature of all individuals must be included.

ASSIGNOR / Current Certificate Holder

Date Name of Assignor(s)

Federal ID No. (FEIN) Missouri Tax ID No. Social Security Number(s)

Contact Person Title

Address City State ZIP Code

Telephone Number Fax Number E-mail

TRANSFER

Amount of Approved Tax Credit Approved Tax Credit Number Date of Contribution Date of Transfer

$

Per RSMo Section 100.286 (7), credits may be sold for no less than seventy-five percent (75%) of the par value of such credits or an

amount not to exceed 100% of annual earned credits.

Amount of Tax Credits Sold Transfer Rate Sale Price

$ % $

Total Amount of Credit to be Transferred $

CERTIFICATION

· I certify that I am an authorized representative of the Assignor and as such am authorized to make the statement of affirmation

contained herein.

· I certify under penalties of perjury, information contained in this document and attachments are complete, true, and correct to

the best of my knowledge and belief.

Assignor Signature(s) Title

Print Name(s) Date

NOTARY FOR ASSIGNOR

Appeared before me this ____ day of ___________________, 20___, __________________________________________ to me

personally known to be the person who executed the above certification, and acknowledged and states on his/her oath to me that he/she

executed the same for the purpose therein stated.

State of County (or City of St. Louis)

Notary Public Printed Name My Commission Expires Notary Public Seal/Stamp

Notary Public Signature

RETURN Mailing Address UPS or Fed-Ex Overnight Address

COMPLETED Missouri Development Finance Board Missouri Development Finance Board

FORM TO: P.O. Box 567 221 Bolivar Street, Suite 300

Jefferson City, Missouri 65102 Jefferson City, Missouri 65101

Form L Page 1 of 2 Rev. 3/09/2017