Enlarge image

Reset Form Print Form

Form

Department Use Only

MO-WFTC 2024 Missouri Working Family Tax Credit

(MM/DD/YY)

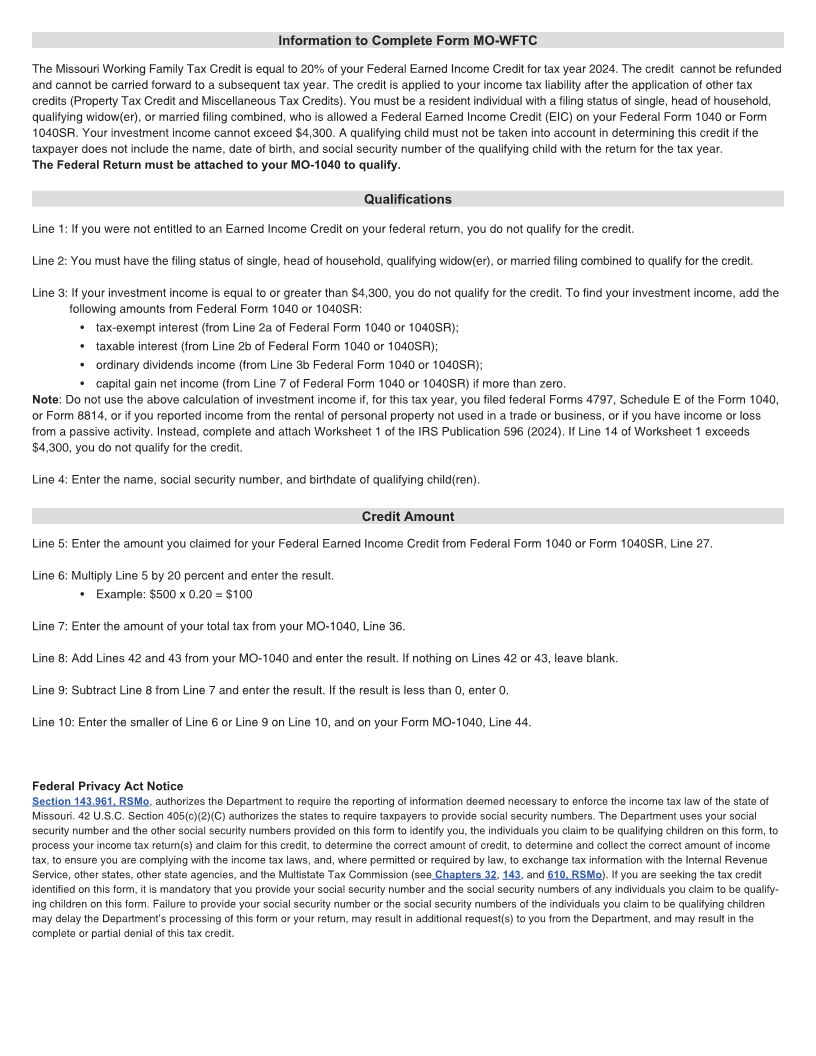

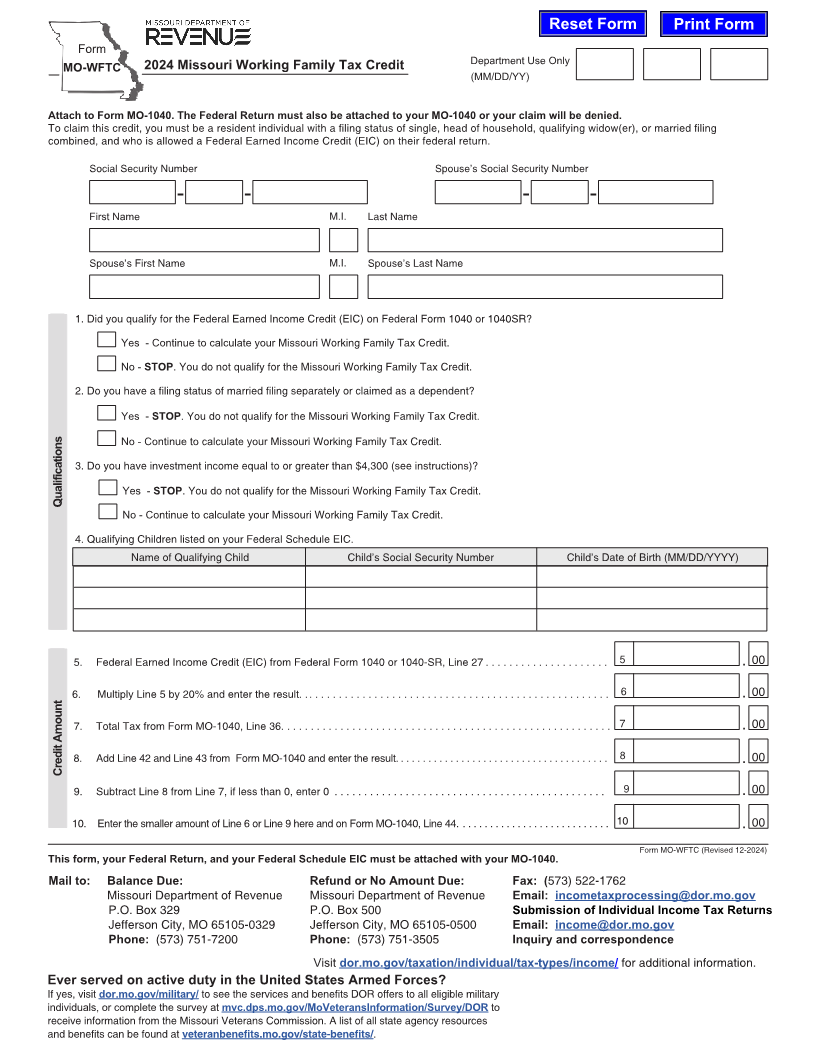

Attach to Form MO-1040. The Federal Return must also be attached to your MO-1040 or your claim will be denied.

To claim this credit, you must be a resident individual with a filing status of single, head of household, qualifying widow(er), or married filing

combined, and who is allowed a Federal Earned Income Credit (EIC) on their federal return.

Social Security Number Spouse’s Social Security Number

- - - -

First Name M.I. Last Name

Spouse’s First Name M.I. Spouse’s Last Name

1. Did you qualify for the Federal Earned Income Credit (EIC) on Federal Form 1040 or 1040SR?

Yes - Continue to calculate your Missouri Working Family Tax Credit.

No - STOP. You do not qualify for the Missouri Working Family Tax Credit.

2. Do you have a filing status of married filing separately or claimed as a dependent?

Yes - STOP. You do not qualify for the Missouri Working Family Tax Credit.

No - Continue to calculate your Missouri Working Family Tax Credit.

3. Do you have investment income equal to or greater than $4,300 (see instructions)?

Yes - STOP. You do not qualify for the Missouri Working Family Tax Credit.

Qualifications

No - Continue to calculate your Missouri Working Family Tax Credit.

4. Qualifying Children listed on your Federal Schedule EIC.

Name of Qualifying Child Child’s Social Security Number Child’s Date of Birth (MM/DD/YYYY)

5. Federal Earned Income Credit (EIC) from Federal Form 1040 or 1040-SR, Line 27 ..................... 5 . 00

6. Multiply Line 5 by 20% and enter the result. . ................................................... 6 . 00

7. Total Tax from Form MO-1040, Line 36. ....................................................... 7 . 00

8. Add Line 42 and Line 43 from Form MO-1040 and enter the result. ...................................... 8 . 00

Credit Amount

9. Subtract Line 8 from Line 7, if less than 0, enter 0 .............................................. 9 . 00

10. Enter the smaller amount of Line 6 or Line 9 here and on Form MO-1040, Line 44. ........................... 10 . 00

Form MO-WFTC (Revised 12-2024)

This form, your Federal Return, and your Federal Schedule EIC must be attached with your MO-1040.

Mail to: Balance Due: Refund or No Amount Due: Fax: (573) 522-1762

Missouri Department of Revenue Missouri Department of Revenue Email: incometaxprocessing@dor.mo.gov

P.O. Box 329 P.O. Box 500 Submission of Individual Income Tax Returns

Jefferson City, MO 65105-0329 Jefferson City, MO 65105-0500 Email: income@dor.mo.gov

Phone: (573) 751-7200 Phone: (573) 751-3505 Inquiry and correspondence

Visit dor.mo.gov/taxation/individual/tax-types/income/ for additional information.

Ever served on active duty in the United States Armed Forces?

If yes, visit dor.mo.gov/military/ to see the services and benefits DOR offers to all eligible military

individuals, or complete the survey at mvc.dps.mo.gov/MoVeteransInformation/Survey/DOR to

receive information from the Missouri Veterans Commission. A list of all state agency resources

and benefits can be found at veteranbenefits.mo.gov/state-benefits/.