Enlarge image

Reset Form Print Form

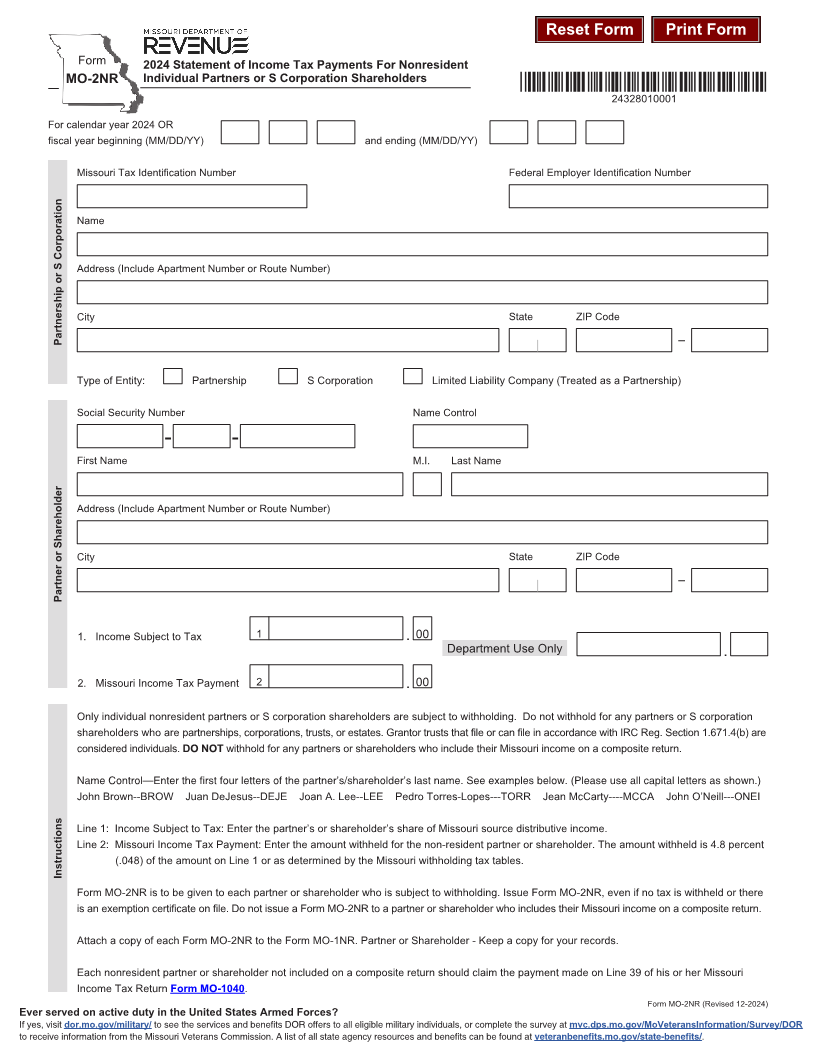

Form 2024 Statement of Income Tax Payments For Nonresident

MO-2NR Individual Partners or S Corporation Shareholders *24328010001*

24328010001

For calendar year 2024 OR

fiscal year beginning (MM/DD/YY) and ending (MM/DD/YY)

Missouri Tax Identification Number Federal Employer Identification Number

Name

Address (Include Apartment Number or Route Number)

City State ZIP Code

Partnership or S Corporation _

Type of Entity: Partnership S Corporation Limited Liability Company (Treated as a Partnership)

Social Security Number Name Control

- -

First Name M.I. Last Name

Address (Include Apartment Number or Route Number)

City State ZIP Code

_

Partner or Shareholder

1. Income Subject to Tax 1 . 00

Department Use Only .

2. Missouri Income Tax Payment 2 . 00

Only individual nonresident partners or S corporation shareholders are subject to withholding. Do not withhold for any partners or S corporation

shareholders who are partnerships, corporations, trusts, or estates. Grantor trusts that file or can file in accordance with IRC Reg. Section 1.671.4(b) are

considered individuals. DO NOT withhold for any partners or shareholders who include their Missouri income on a composite return.

Name Control—Enter the first four letters of the partner’s/shareholder’s last name. See examples below. (Please use all capital letters as shown.)

John Brown--BROW Juan DeJesus--DEJE Joan A. Lee--LEE Pedro Torres-Lopes---TORR Jean McCarty----MCCA John O’Neill---ONEI

Line 1: Income Subject to Tax: Enter the partner’s or shareholder’s share of Missouri source distributive income.

Line 2: Missouri Income Tax Payment: Enter the amount withheld for the non-resident partner or shareholder. The amount withheld is 4.8 percent

(.048) of the amount on Line 1 or as determined by the Missouri withholding tax tables.

Instructions

Form MO-2NR is to be given to each partner or shareholder who is subject to withholding. Issue Form MO-2NR, even if no tax is withheld or there

is an exemption certificate on file. Do not issue a Form MO-2NR to a partner or shareholder who includes their Missouri income on a composite return.

Attach a copy of each Form MO-2NR to the Form MO-1NR. Partner or Shareholder - Keep a copy for your records.

Each nonresident partner or shareholder not included on a composite return should claim the payment made on Line 39 of his or her Missouri

Income Tax Return Form MO-1040.

Form MO-2NR (Revised 12-2024)

Ever served on active duty in the United States Armed Forces?

If yes, visit dor.mo.gov/military/ to see the services and benefits DOR offers to all eligible military individuals, or complete the survey at mvc.dps.mo.gov/MoVeteransInformation/Survey/DOR

to receive information from the Missouri Veterans Commission. A list of all state agency resources and benefits can be found at veteranbenefits.mo.gov/state-benefits/.