Enlarge image

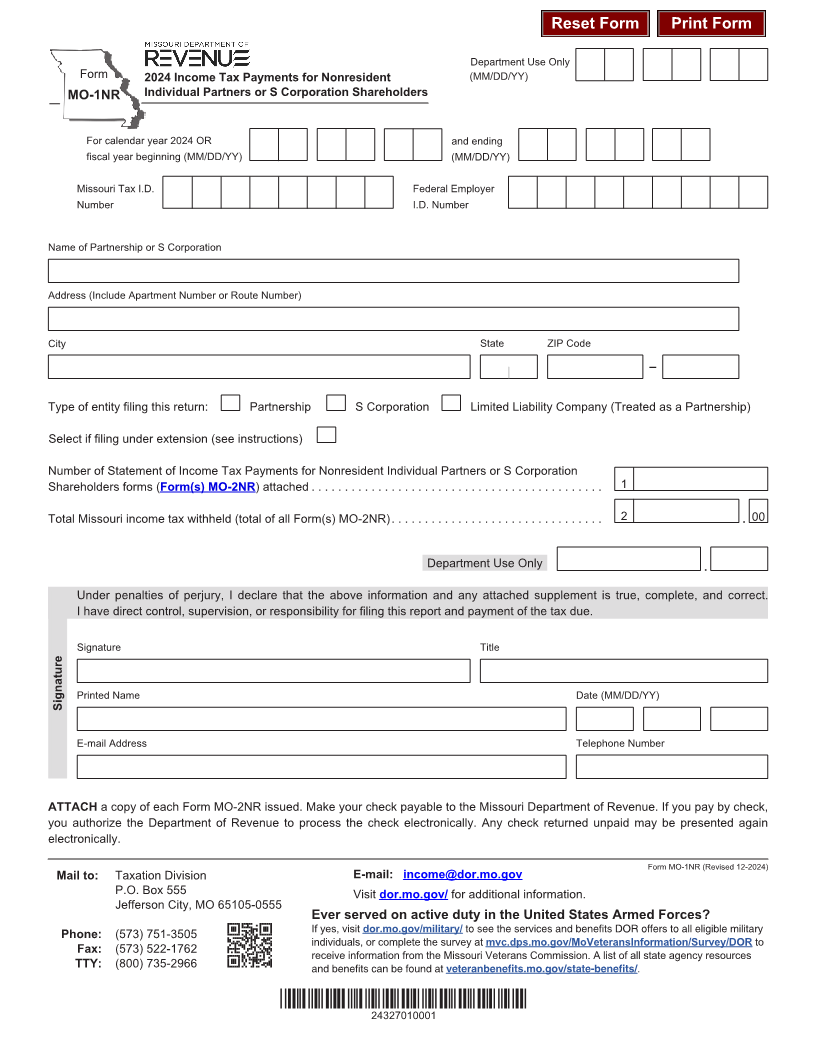

Reset Form Print Form

Department Use Only

Form 2024 Income Tax Payments for Nonresident (MM/DD/YY)

MO-1NR Individual Partners or S Corporation Shareholders

For calendar year 2024 OR and ending

fiscal year beginning (MM/DD/YY) (MM/DD/YY)

Missouri Tax I.D. Federal Employer

Number I.D. Number

Name of Partnership or S Corporation

Address (Include Apartment Number or Route Number)

City State ZIP Code

_

Type of entity filing this return: Partnership S Corporation Limited Liability Company (Treated as a Partnership)

Select if filing under extension (see instructions)

Number of Statement of Income Tax Payments for Nonresident Individual Partners or S Corporation

Shareholders forms (Form(s) MO-2NR) attached ............................................ 1

Total Missouri income tax withheld (total of all Form(s) MO-2NR)................................ 2 . 00

Department Use Only .

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

I have direct control, supervision, or responsibility for filing this report and payment of the tax due.

Signature Title

Printed Name Date (MM/DD/YY)

Signature

E-mail Address Telephone Number

ATTACH a copy of each Form MO-2NR issued. Make your check payable to the Missouri Department of Revenue. If you pay by check,

you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again

electronically.

Form MO-1NR (Revised 12-2024)

Mail to: Taxation Division E-mail: income@dor.mo.gov

P.O. Box 555 Visit dor.mo.gov/ for additional information.

Jefferson City, MO 65105-0555

Ever served on active duty in the United States Armed Forces?

Phone: (573) 751-3505 If yes, visit dor.mo.gov/military/ to see the services and benefits DOR offers to all eligible military

individuals, or complete the survey at mvc.dps.mo.gov/MoVeteransInformation/Survey/DOR to

Fax: (573) 522-1762 receive information from the Missouri Veterans Commission. A list of all state agency resources

TTY: (800) 735-2966 and benefits can be found at veteranbenefits.mo.gov/state-benefits/.

*24327010001*

24327010001