- 23 -

Enlarge image

|

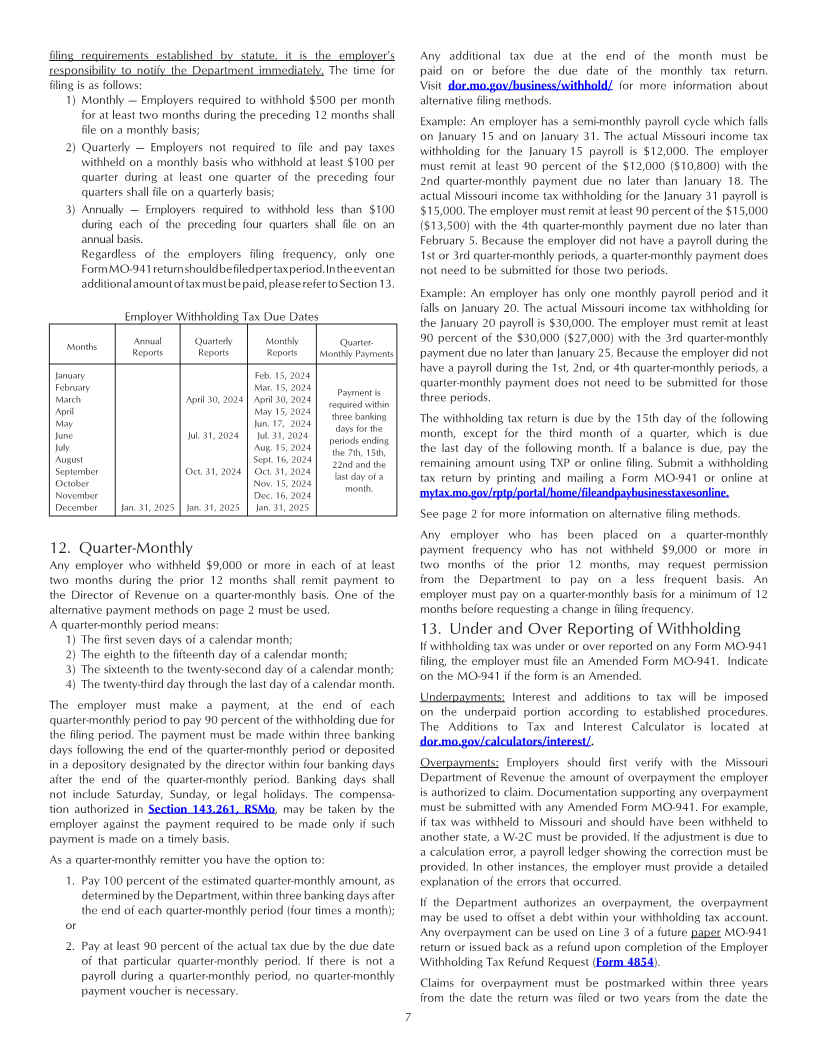

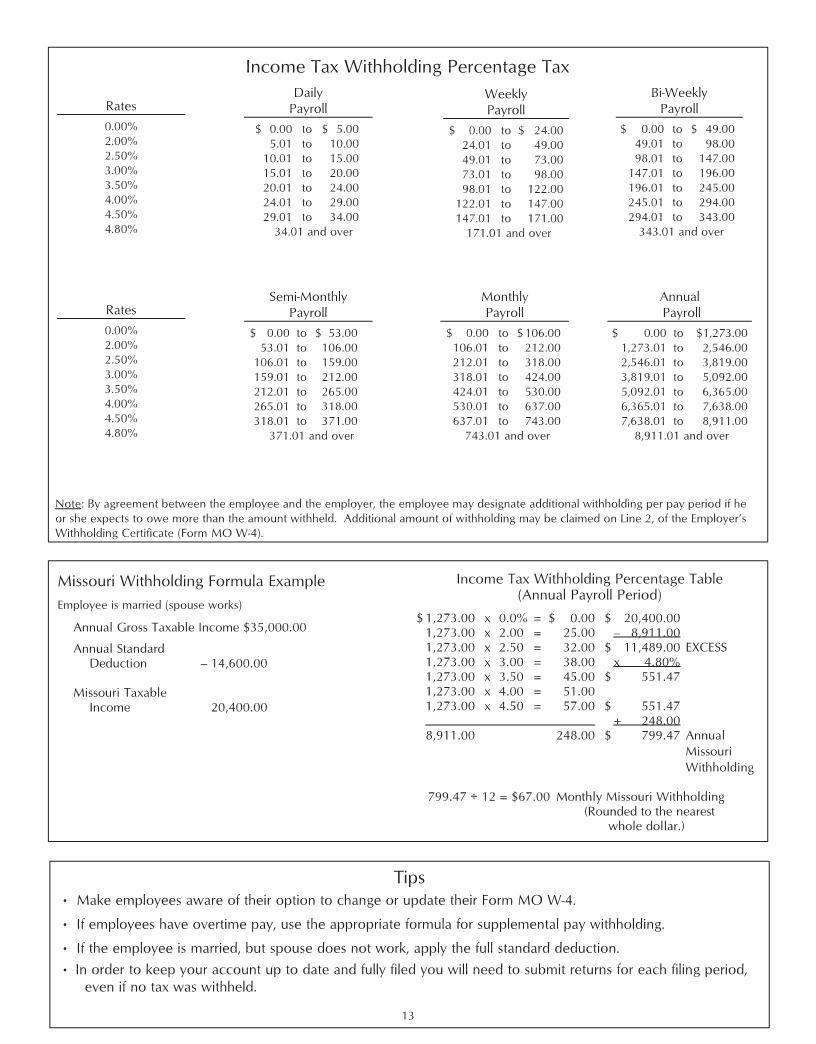

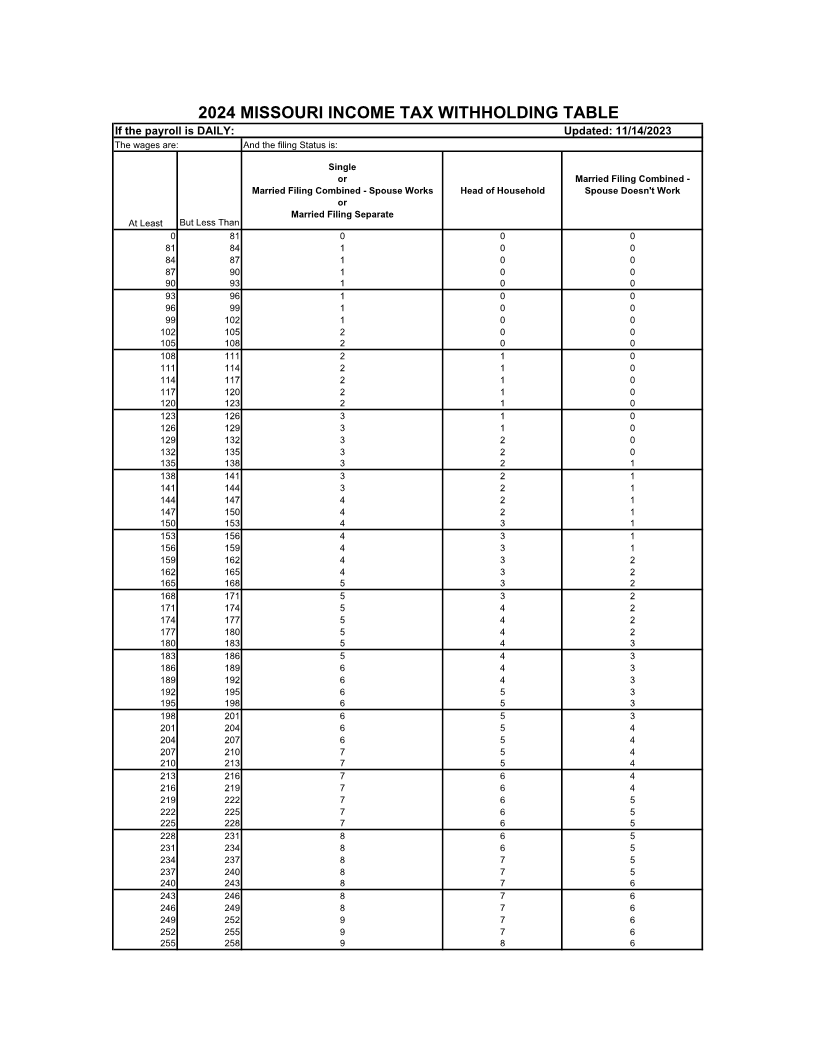

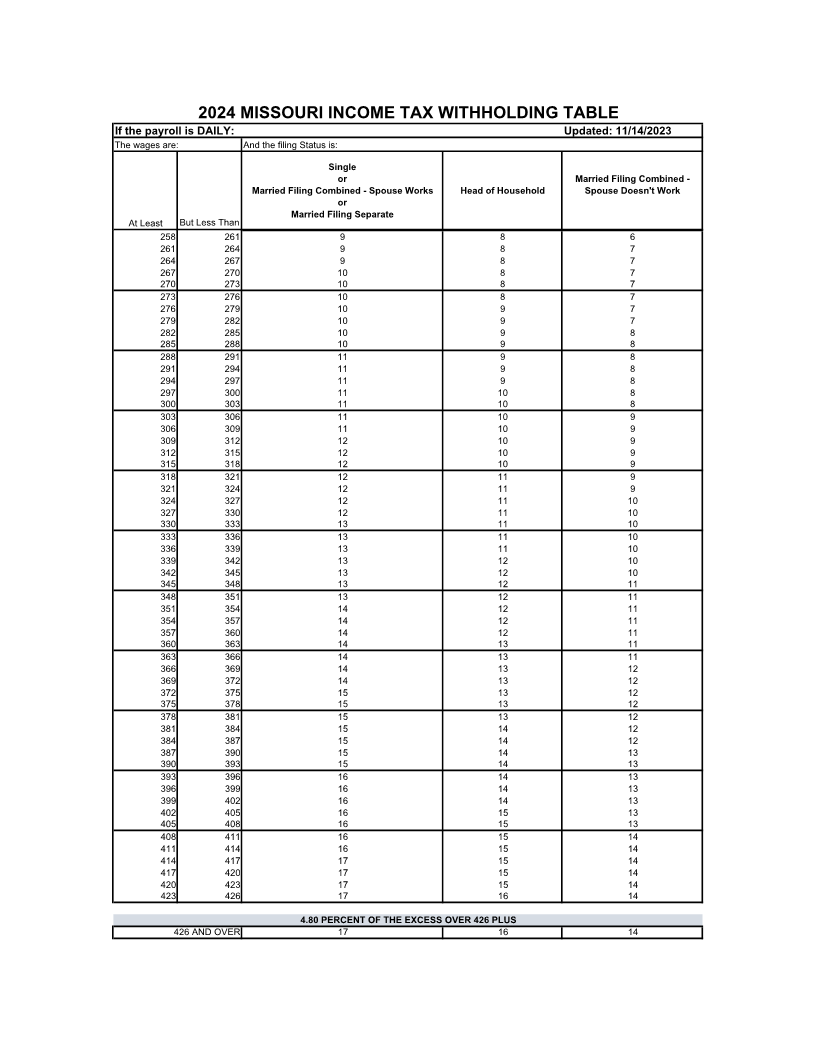

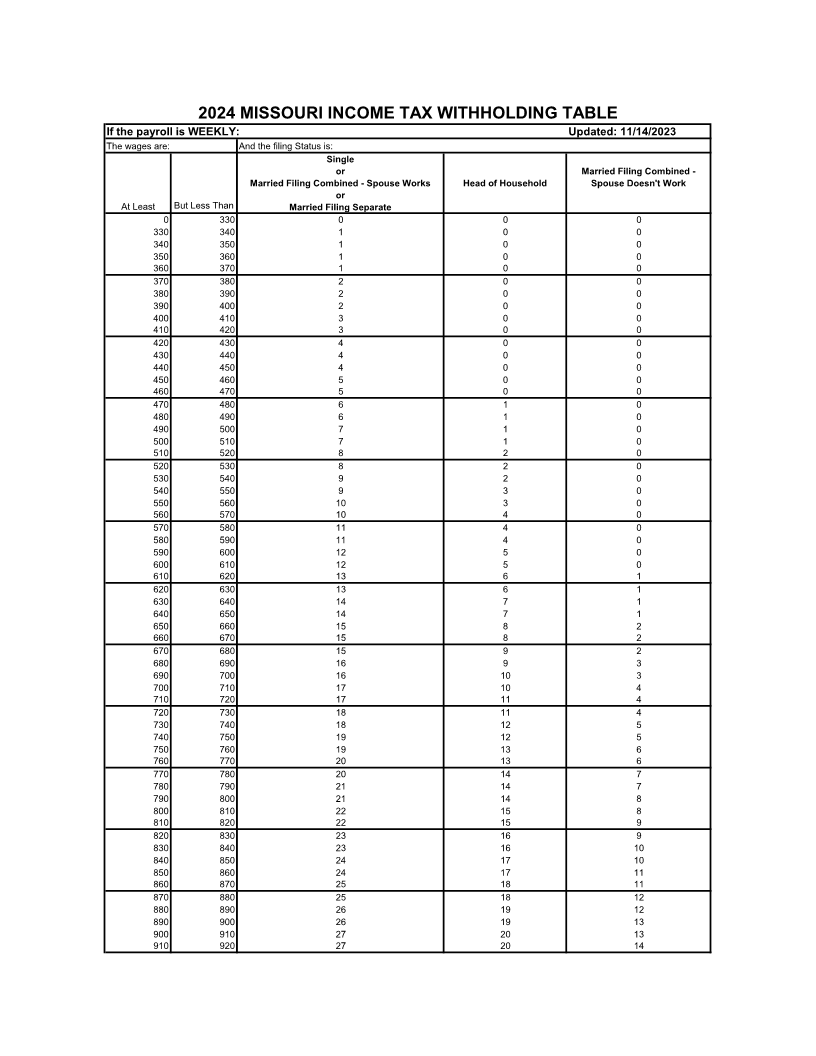

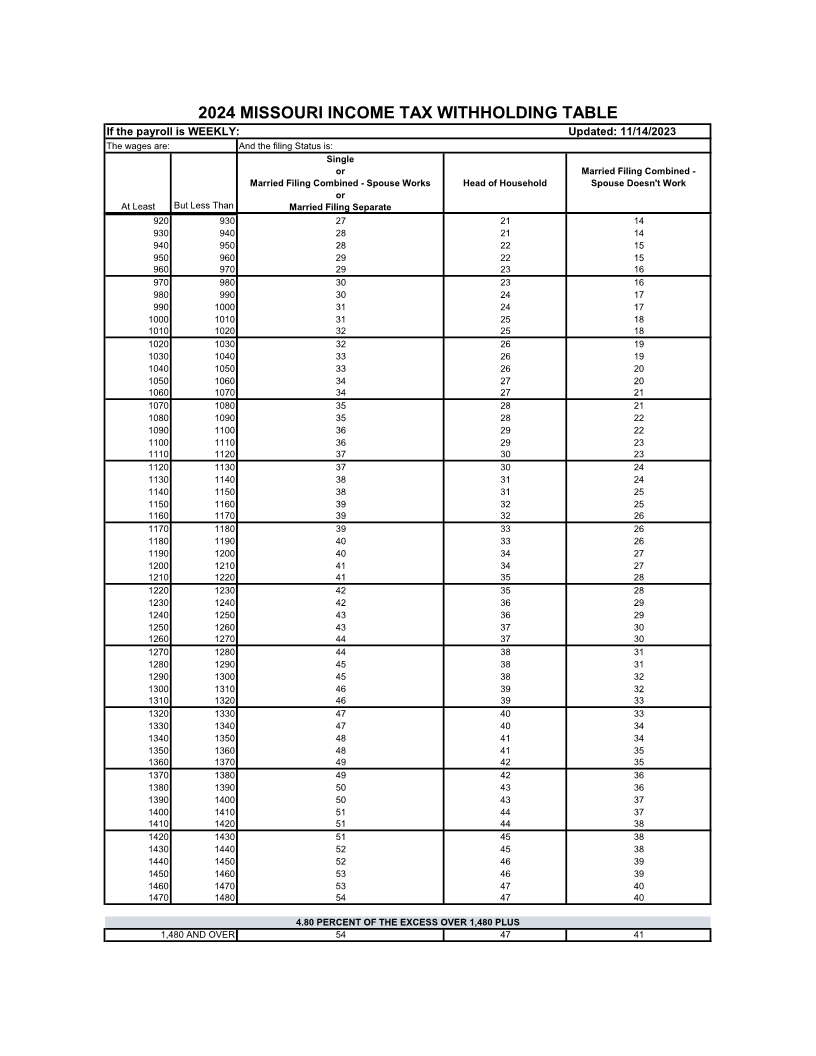

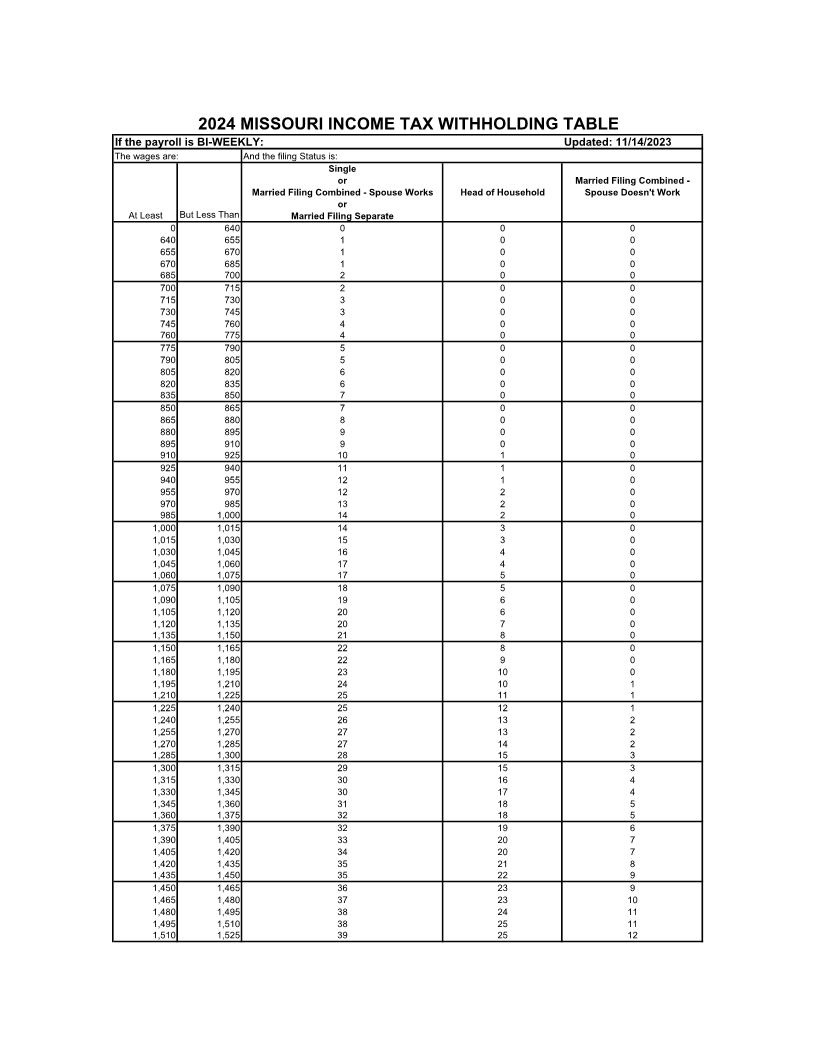

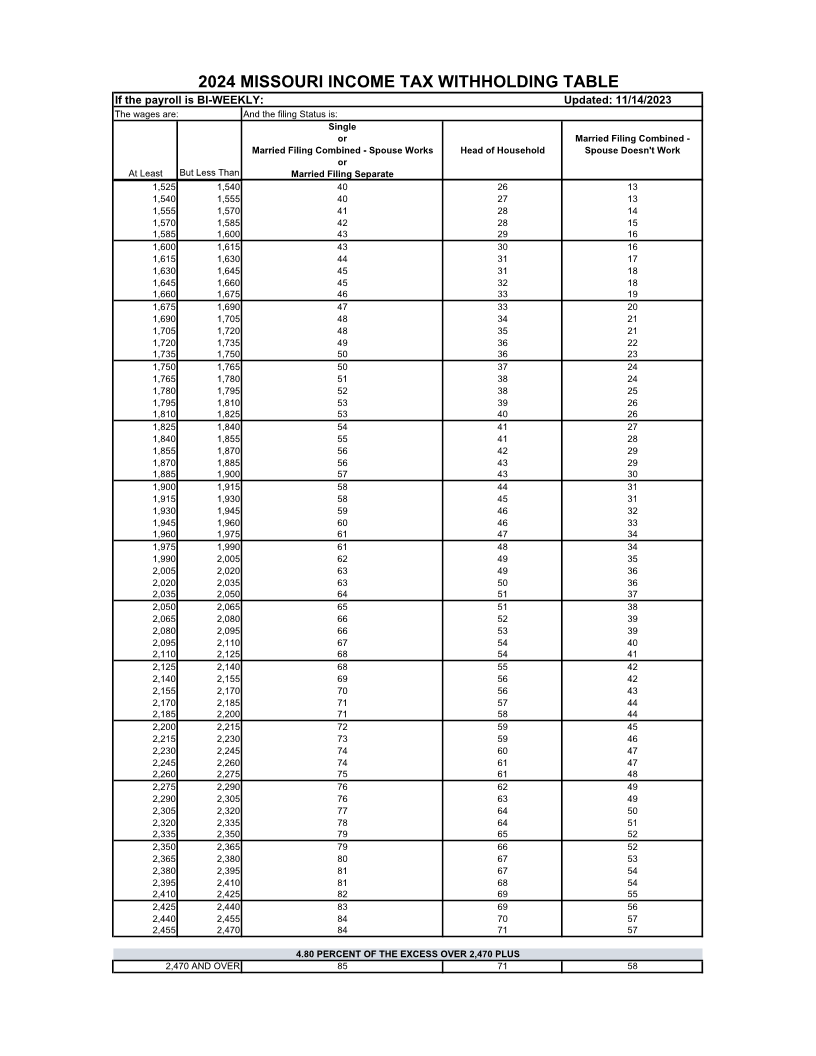

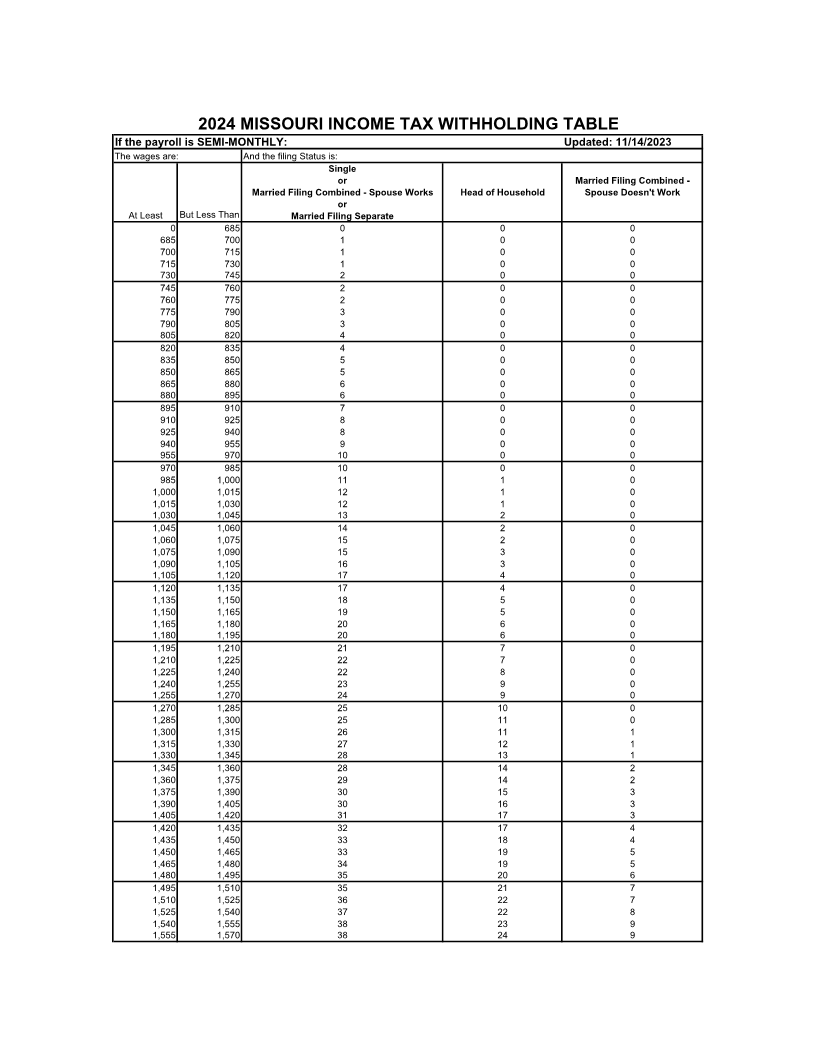

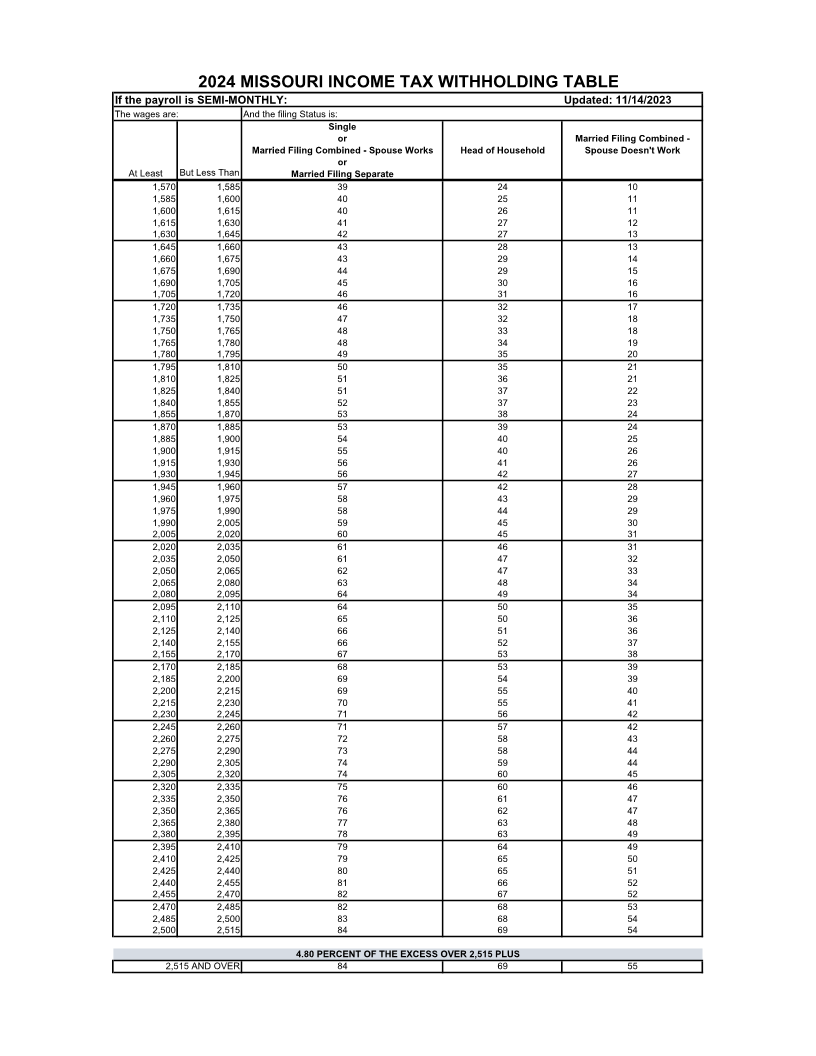

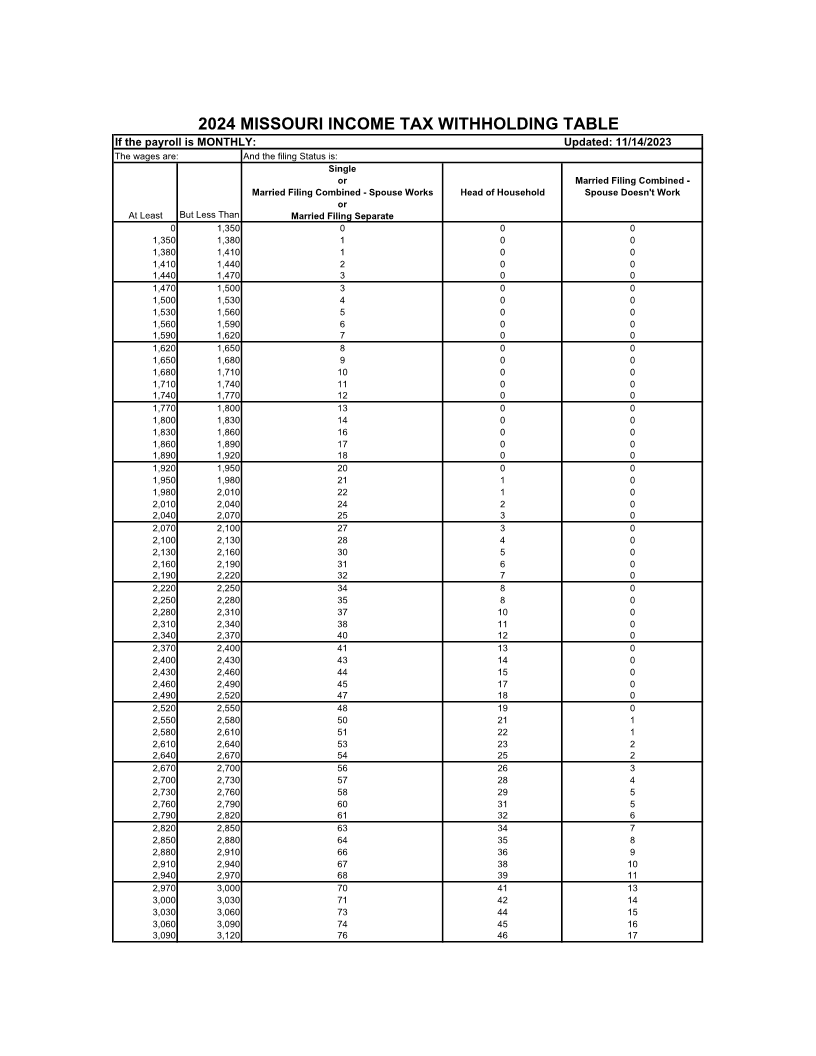

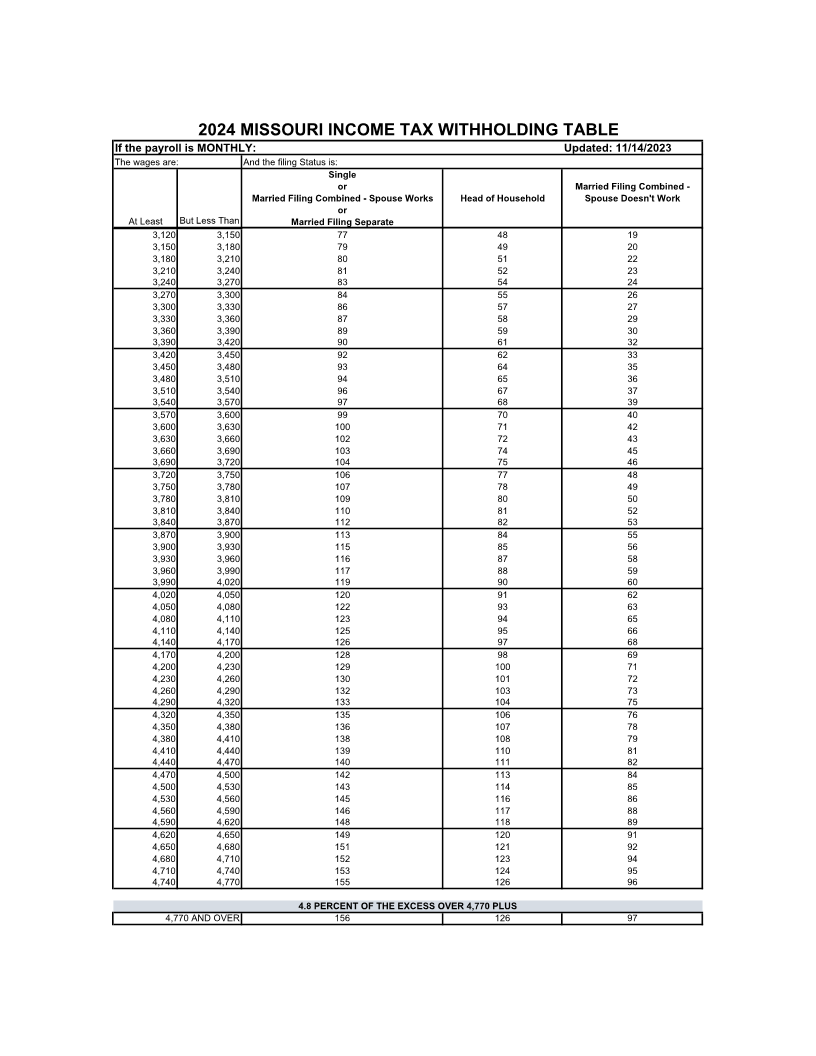

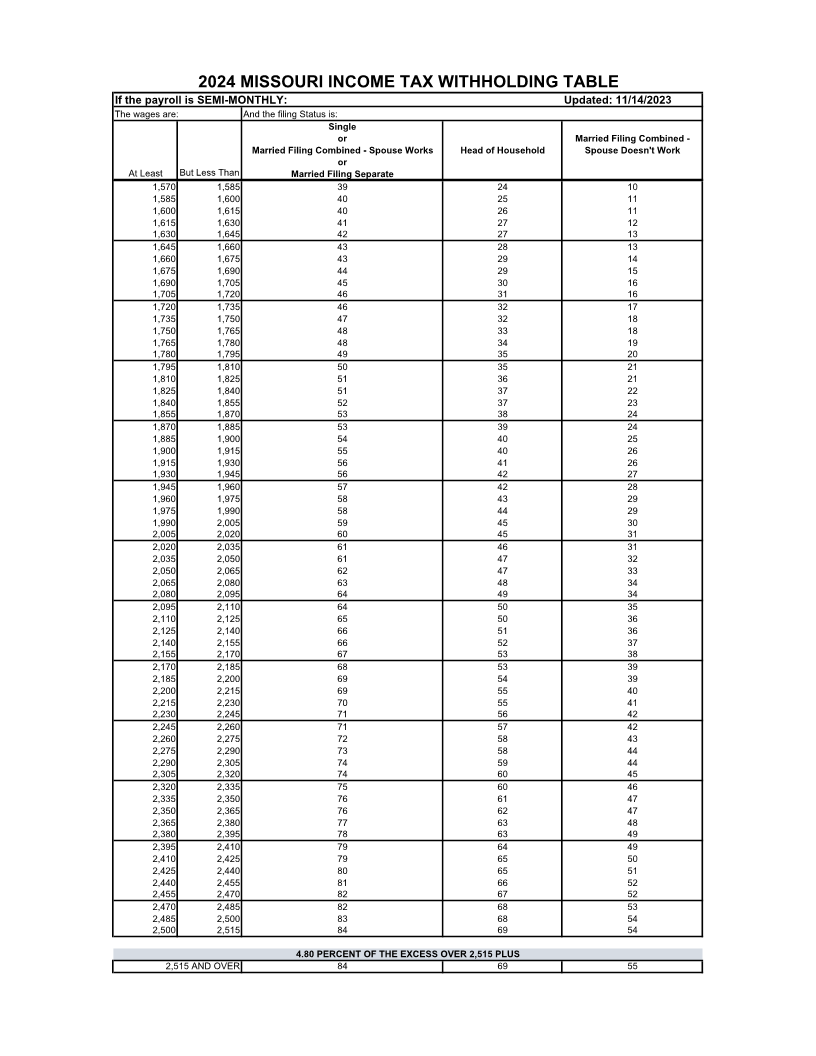

2024 MISSOURI INCOME TAX WITHHOLDING TABLE

If the payroll is SEMI-MONTHLY: Updated: 11/14/2023

The wages are: And the filing Status is:

Single

or Married Filing Combined -

Married Filing Combined - Spouse Works Head of Household Spouse Doesn't Work

or

At Least But Less Than Married Filing Separate

1,570 1,585 39 24 10

1,585 1,600 40 25 11

1,600 1,615 40 26 11

1,615 1,630 41 27 12

1,630 1,645 42 27 13

1,645 1,660 43 28 13

1,660 1,675 43 29 14

1,675 1,690 44 29 15

1,690 1,705 45 30 16

1,705 1,720 46 31 16

1,720 1,735 46 32 17

1,735 1,750 47 32 18

1,750 1,765 48 33 18

1,765 1,780 48 34 19

1,780 1,795 49 35 20

1,795 1,810 50 35 21

1,810 1,825 51 36 21

1,825 1,840 51 37 22

1,840 1,855 52 37 23

1,855 1,870 53 38 24

1,870 1,885 53 39 24

1,885 1,900 54 40 25

1,900 1,915 55 40 26

1,915 1,930 56 41 26

1,930 1,945 56 42 27

1,945 1,960 57 42 28

1,960 1,975 58 43 29

1,975 1,990 58 44 29

1,990 2,005 59 45 30

2,005 2,020 60 45 31

2,020 2,035 61 46 31

2,035 2,050 61 47 32

2,050 2,065 62 47 33

2,065 2,080 63 48 34

2,080 2,095 64 49 34

2,095 2,110 64 50 35

2,110 2,125 65 50 36

2,125 2,140 66 51 36

2,140 2,155 66 52 37

2,155 2,170 67 53 38

2,170 2,185 68 53 39

2,185 2,200 69 54 39

2,200 2,215 69 55 40

2,215 2,230 70 55 41

2,230 2,245 71 56 42

2,245 2,260 71 57 42

2,260 2,275 72 58 43

2,275 2,290 73 58 44

2,290 2,305 74 59 44

2,305 2,320 74 60 45

2,320 2,335 75 60 46

2,335 2,350 76 61 47

2,350 2,365 76 62 47

2,365 2,380 77 63 48

2,380 2,395 78 63 49

2,395 2,410 79 64 49

2,410 2,425 79 65 50

2,425 2,440 80 65 51

2,440 2,455 81 66 52

2,455 2,470 82 67 52

2,470 2,485 82 68 53

2,485 2,500 83 68 54

2,500 2,515 84 69 54

4.80 PERCENT OF THE EXCESS OVER 2,515 PLUS

2,515 AND OVER 84 69 55

|