Enlarge image

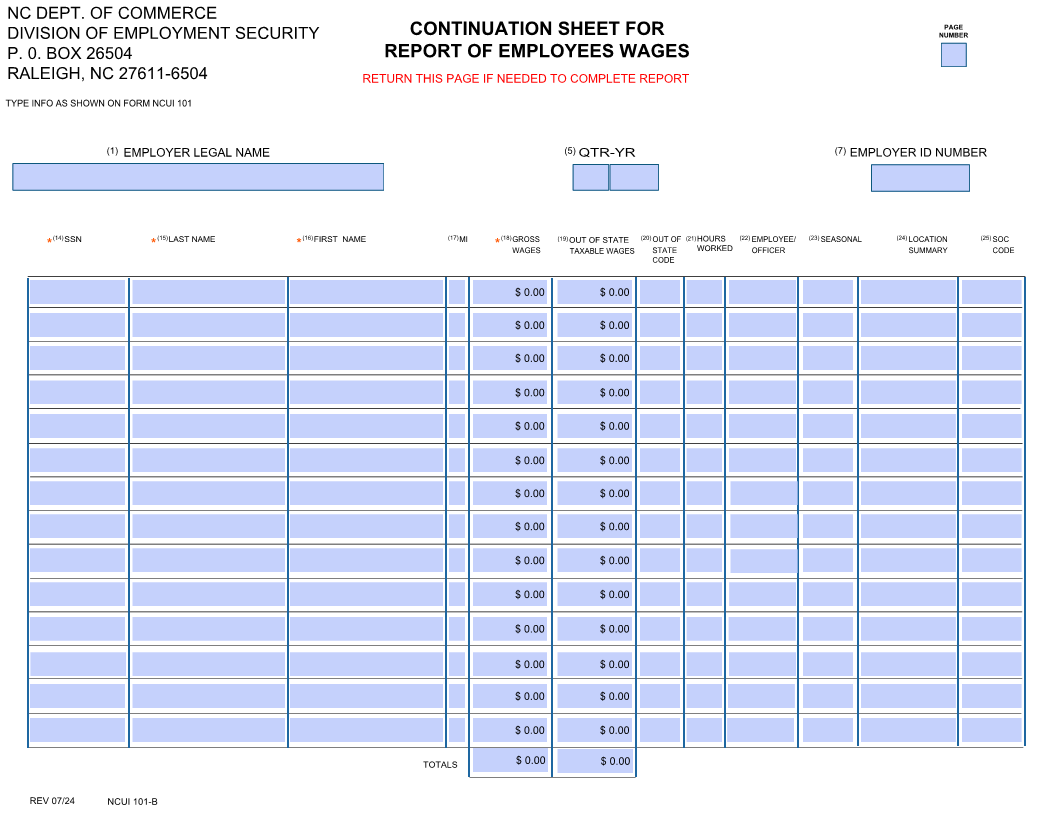

SOC CODE

(25)

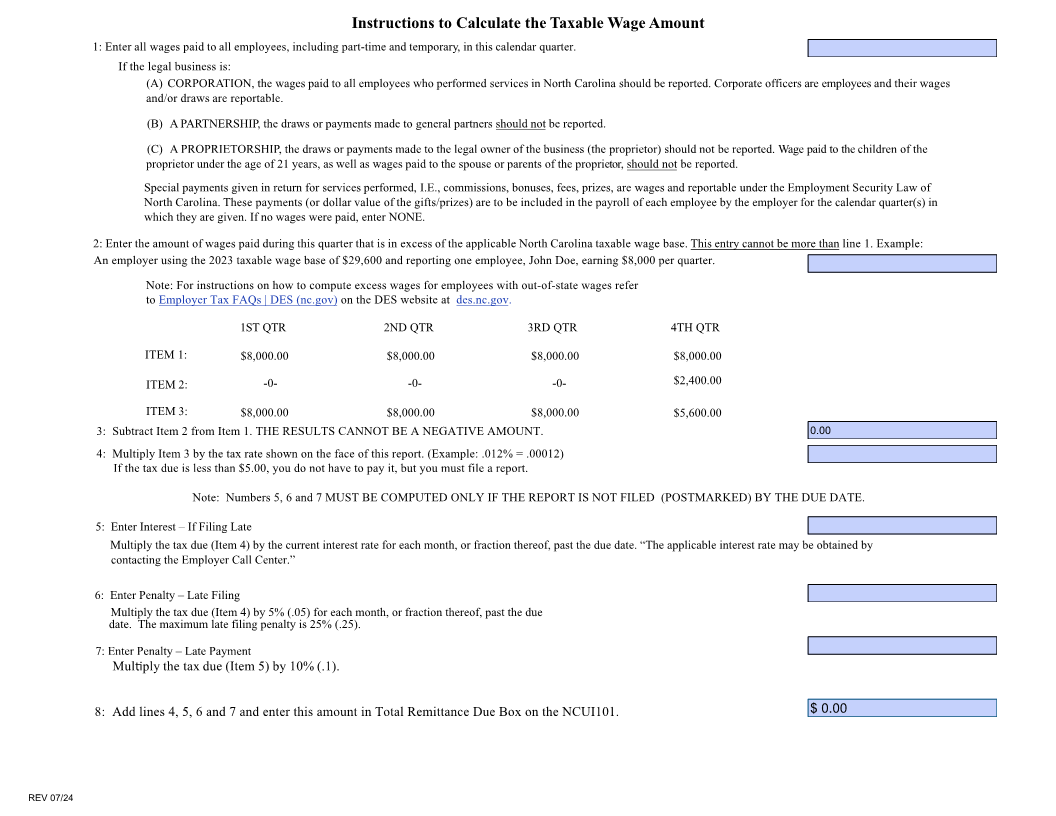

$ 0.00

) 3RD MONTH

(13

TOTAL REMITTANCE DUE

(10) 24) LOCATION SUMMARY

(

YOUONLINECAN0.FILEBOXAT26504THISDES.NC.GOVREPORT )2 2ND MONTH

NC DEPT. OF COMMERCE DIVISION OF EMPLOYMENT SECURITY P. RALEIGH, NC 27611-6504 (1

SEASONAL

(23)

1ST MONTH DATE Date format: mm/dd/yyyy

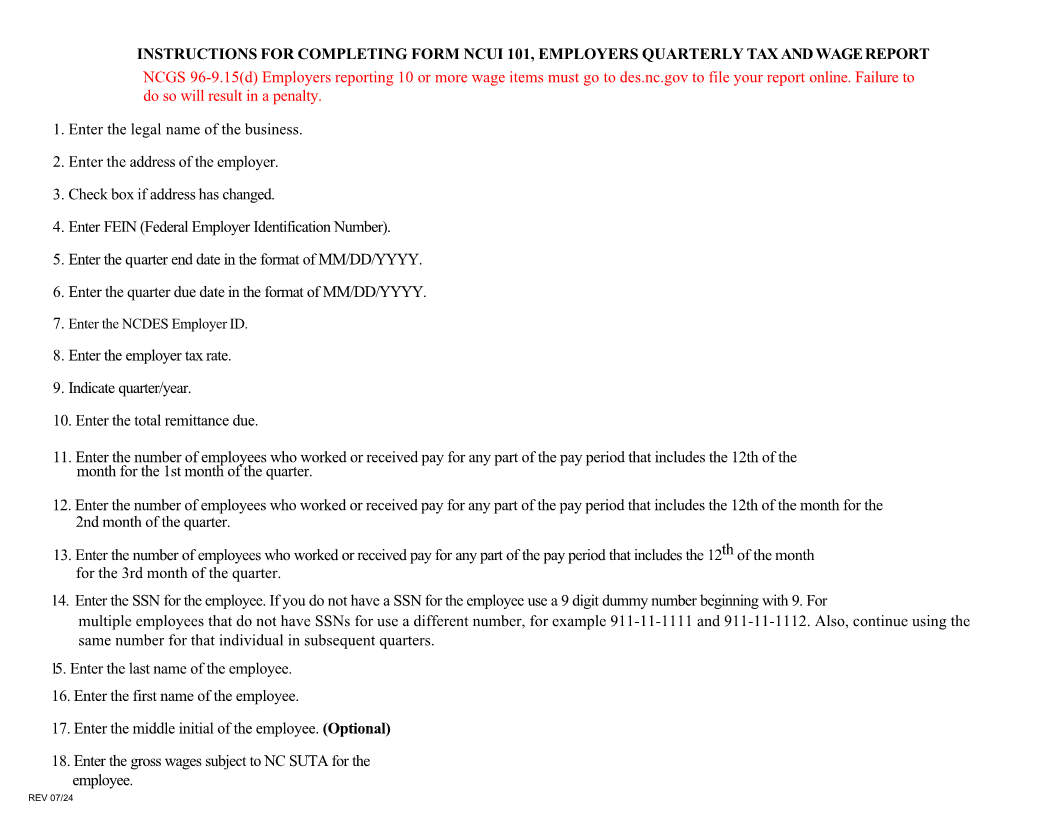

QTR-YR NUMBER OF COVERED WORKERS WHO WORKED DURING OR RECEIVED PAY FOR THE PAYROLL PERIOD WHICH INCLUDES THE 12TH OF THE MONTH (11) (30)

(9) *

EMPLOYEE/ OFFICER

(22)

EMPLOYER ID NUMBER

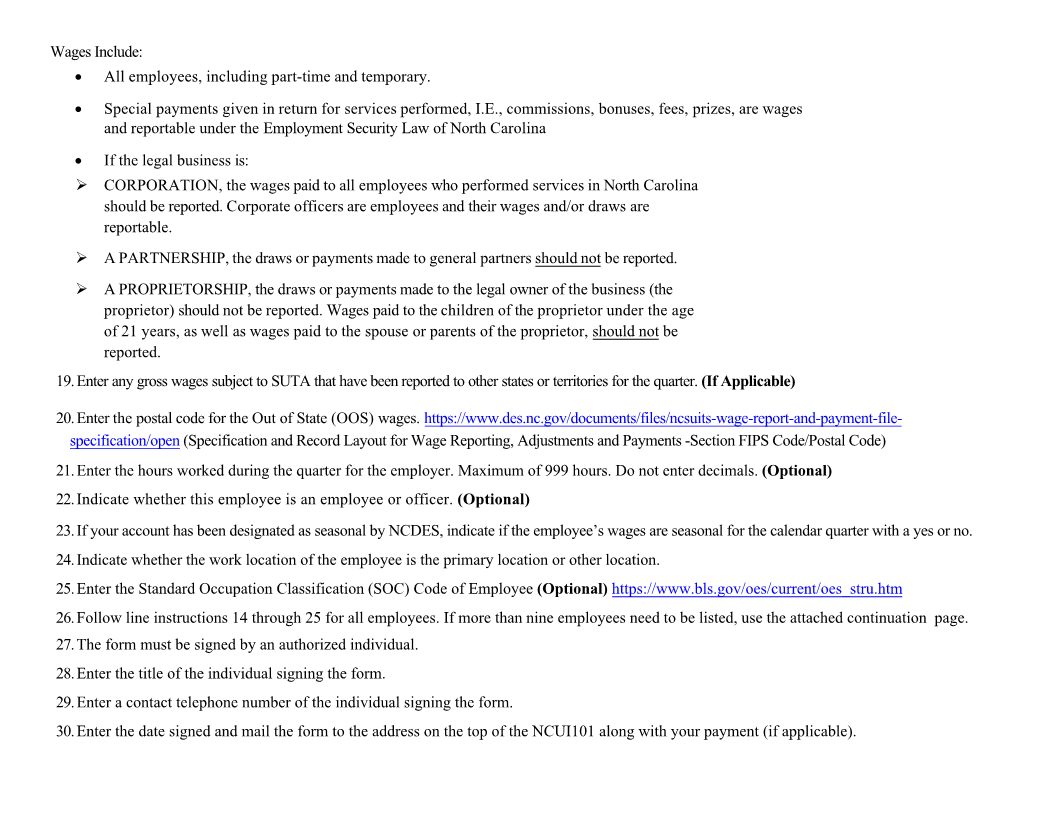

(7) HOURS WORKED

(21)

INITIAL LPP.W

OUT OF STATE CODE

(20)

TELEPHONE NUMBER

DUE DATE WAGES $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 ACCOUNT NUMBER $ 0.00 $ 0.00 $ 0.00 (29)

(6) Date format: mm/dd/yyyy COLL LFP.W

AGENCY USE

TAXABLE

9)(1 OUT OF STATE

DATE R/CK

$ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00

GROSS WAGES

DO NOT USE THIS FORM IF REPORTING 10 OR MORE WAGE ITEMS (18)

*

DES.NC.GOV

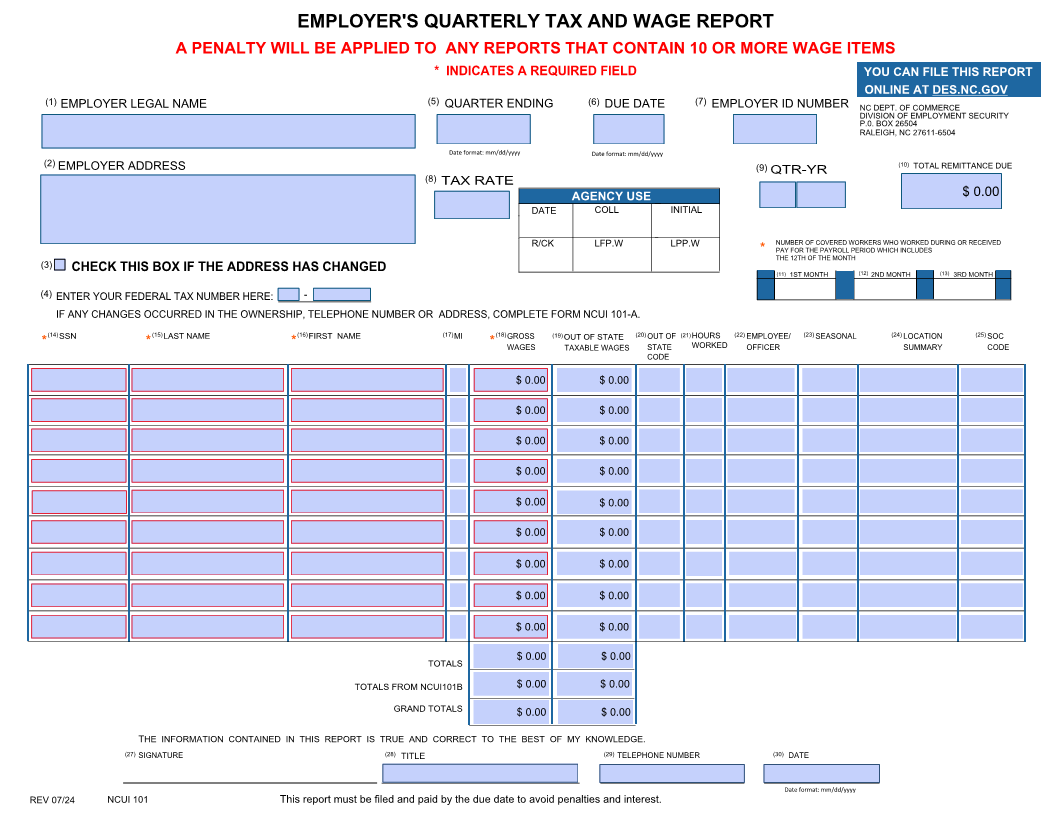

WAGEQUARTERLYEMPLOYER'S REPORT TAXDate format:ANDmm/dd/yyyy )MI

INDICATES A REQUIRED FIELD QUARTER ENDING TAX RATE (17

* (5) (8) TOTALS

ONLINE AT TITLE

GRAND TOTALS (28)

DUE DATE

YOU CAN FILE THIS REPORT TOTALS FROM NCUI101B

NAME

- FIRST

EMPLOYER'S QUARTERLY TAX AND(16) * WAGE REPORT

This report must be filed and paid by the due date to avoid penalties and interest.

HERE:

NUMBER

NAME

A PENALTY WILL BE APPLIED TO ANY REPORTS THAT CONTAIN 10 OR MORE WAGE ITEMS

LAST

(15) * QUARTER ENDING HE INFORMATION CONTAINED IN THIS REPORT IS TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE.T SIGNATURE

(27)

NCUI 101

CHECK THIS BOX IF THE ADDRESS HAS CHANGED

EMPLOYER LEGAL NAME EMPLOYER ADDRESS ENTER YOUR FEDERAL TAX IF ANY CHANGES OCCURRED IN THE OWNERSHIP, TELEPHONE NUMBER OR ADDRESS, COMPLETE FORM NCUI 101-A. SSN 70/24

(14)

(1) (2) (3) (4) *

REV