Enlarge image

IA 2848 Iowa Department of Revenue Power of Attorney

tax.iowa.gov

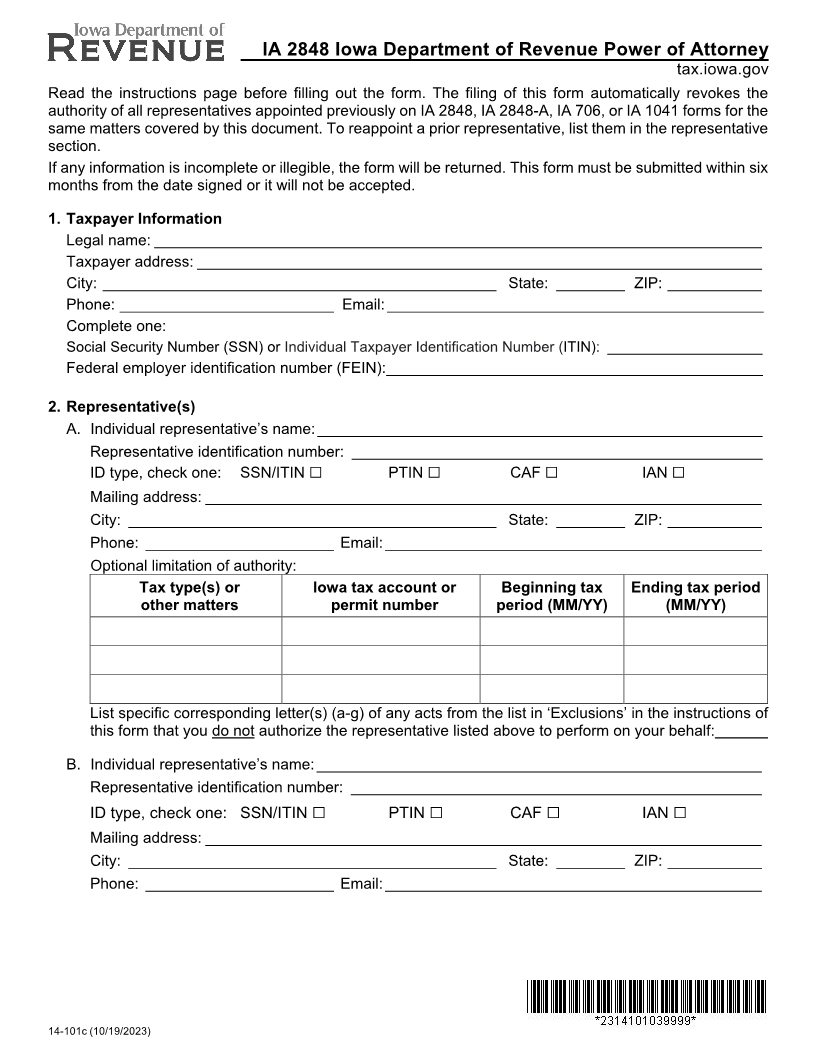

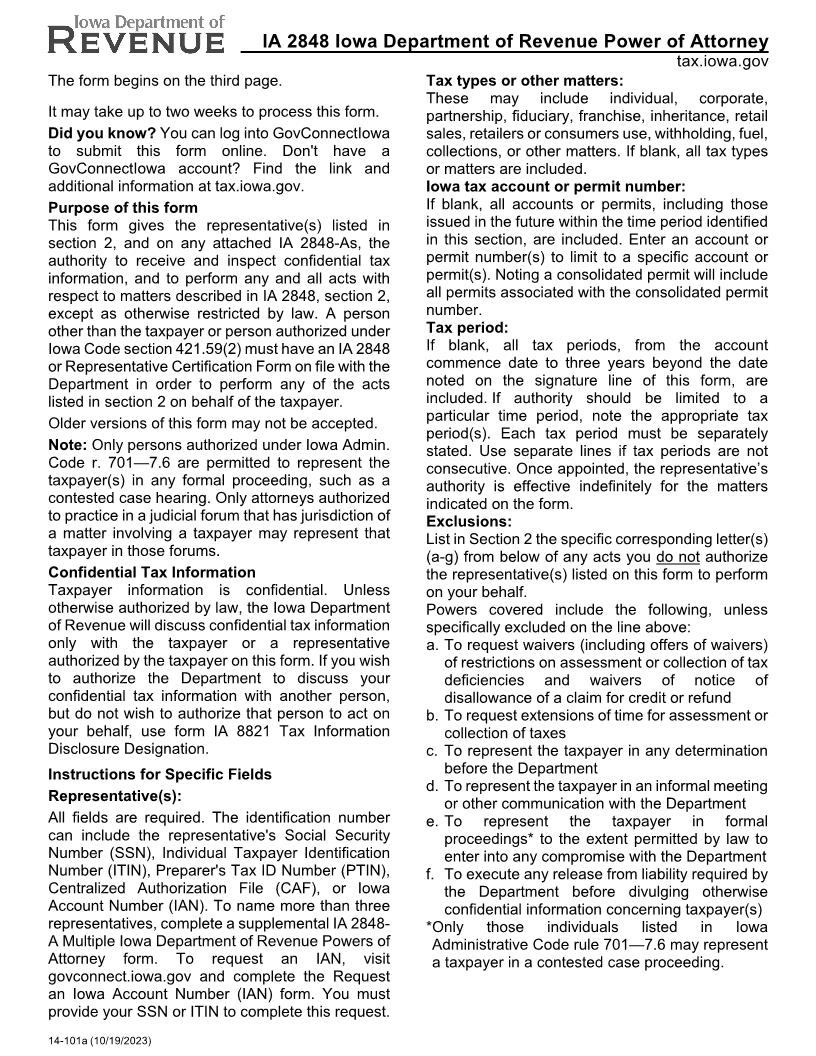

The form begins on the third page. Tax types or other matters:

These may include individual, corporate,

It may take up to two weeks to process this form. partnership, fiduciary, franchise, inheritance, retail

Did you know? You can log into GovConnectIowa sales, retailers or consumers use, withholding, fuel,

to submit this form online. Don't have a collections, or other matters. If blank, all tax types

GovConnectIowa account? Find the link and or matters are included.

additional information at tax.iowa.gov. Iowa tax account or permit number:

Purpose of this form If blank, all accounts or permits, including those

This form gives the representative(s) listed in issued in the future within the time period identified

section 2, and on any attached IA 2848-As, the in this section, are included. Enter an account or

authority to receive and inspect confidential tax permit number(s) to limit to a specific account or

information, and to perform any and all acts with permit(s). Noting a consolidated permit will include

respect to matters described in IA 2848, section 2, all permits associated with the consolidated permit

except as otherwise restricted by law. A person number.

other than the taxpayer or person authorized under Tax period:

Iowa Code section 421.59(2) must have an IA 2848 If blank, all tax periods, from the account

or Representative Certification Form on file with the commence date to three years beyond the date

Department in order to perform any of the acts noted on the signature line of this form, are

listed in section 2 on behalf of the taxpayer. included. If authority should be limited to a

particular time period, note the appropriate tax

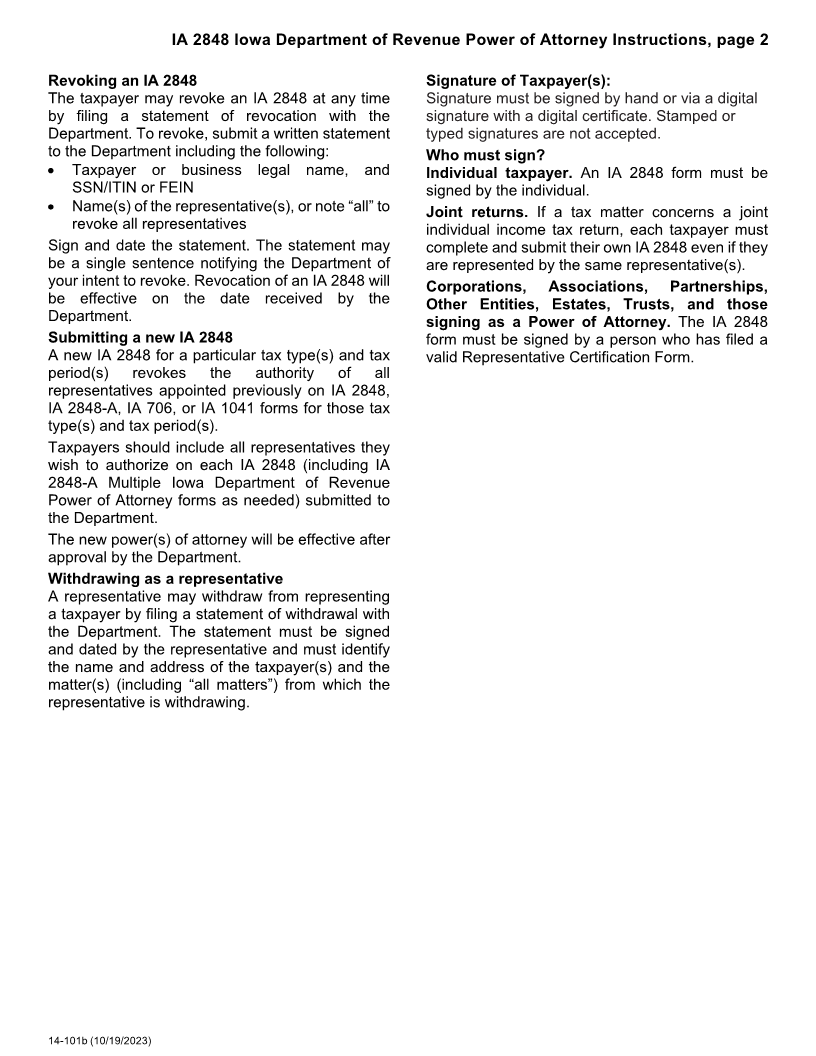

Older versions of this form may not be accepted.

period(s). Each tax period must be separately

Note: Only persons authorized under Iowa Admin. stated. Use separate lines if tax periods are not

Code r. 701—7.6 are permitted to represent the consecutive. Once appointed, the representative’s

taxpayer(s) in any formal proceeding, such as a authority is effective indefinitely for the matters

contested case hearing. Only attorneys authorized indicated on the form.

to practice in a judicial forum that has jurisdiction of

Exclusions:

a matter involving a taxpayer may represent that List in Section 2 the specific corresponding letter(s)

taxpayer in those forums. (a-g) from below of any acts you do not authorize

Confidential Tax Information the representative(s) listed on this form to perform

Taxpayer information is confidential. Unless on your behalf.

otherwise authorized by law, the Iowa Department Powers covered include the following, unless

of Revenue will discuss confidential tax information specifically excluded on the line above:

only with the taxpayer or a representative a. To request waivers (including offers of waivers)

authorized by the taxpayer on this form. If you wish of restrictions on assessment or collection of tax

to authorize the Department to discuss your deficiencies and waivers of notice of

confidential tax information with another person, disallowance of a claim for credit or refund

but do not wish to authorize that person to act on b. To request extensions of time for assessment or

your behalf, use form IA 8821 Tax Information collection of taxes

Disclosure Designation. c. To represent the taxpayer in any determination

before the Department

Instructions for Specific Fields

d. To represent the taxpayer in an informal meeting

Representative(s):

or other communication with the Department

All fields are required. The identification number e. To represent the taxpayer in formal

can include the representative's Social Security proceedings* to the extent permitted by law to

Number (SSN), Individual Taxpayer Identification enter into any compromise with the Department

Number (ITIN), Preparer's Tax ID Number (PTIN), f. To execute any release from liability required by

Centralized Authorization File (CAF), or Iowa the Department before divulging otherwise

Account Number (IAN). To name more than three confidential information concerning taxpayer(s)

representatives, complete a supplemental IA 2848- *Only those individuals listed in Iowa

A Multiple Iowa Department of Revenue Powers of Administrative Code rule 701—7.6 may represent

Attorney form. To request an IAN, visit a taxpayer in a contested case proceeding.

govconnect.iowa.gov and complete the Request

an Iowa Account Number (IAN) form. You must

provide your SSN or ITIN to complete this request.

14-101a (10/19/2023)