Enlarge image

Unemployment Insurance Tax Bureau

1000 E Grand Avenue

Des Moines, Iowa 50319

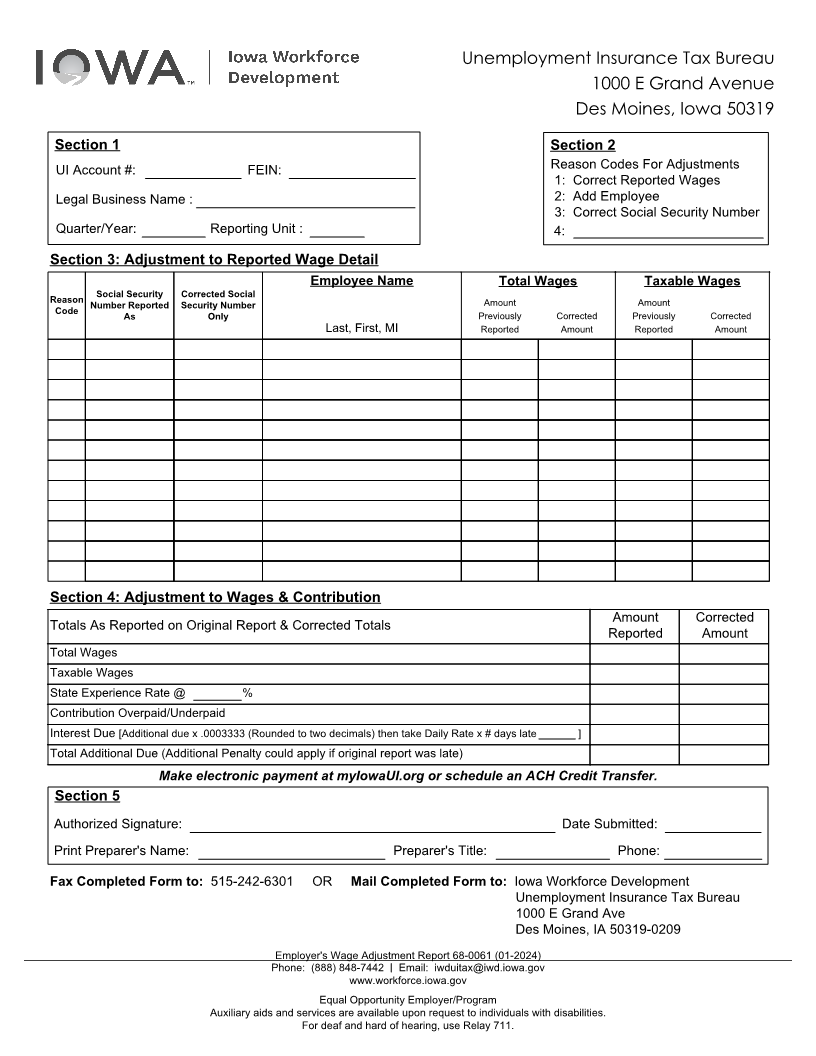

Section 1 Section 2

UI Account #: FEIN: Reason Codes For Adjustments

1: Correct Reported Wages

Legal Business Name : 2: Add Employee

3: Correct Social Security Number

Quarter/Year: Reporting Unit : 4:

Section 3: Adjustment to Reported Wage Detail

Employee Name Total Wages Taxable Wages

Reason Social Security Corrected Social Amount Amount

Code Number Reported Security Number

As Only Previously Corrected Previously Corrected

Last, First, MI Reported Amount Reported Amount

Section 4: Adjustment to Wages & Contribution

Amount Corrected

Totals As Reported on Original Report & Corrected Totals

Reported Amount

Total Wages

Taxable Wages

State Experience Rate @ %

Contribution Overpaid/Underpaid

Interest Due [Additional due x .0003333 (Rounded to two decimals) then take Daily Rate x # days late ]

Total Additional Due (Additional Penalty could apply if original report was late)

Make electronic payment at myIowaUI.org or schedule an ACH Credit Transfer.

Section 5

Authorized Signature: Date Submitted:

Print Preparer's Name: Preparer's Title: Phone:

Fax Completed Form to: 515-242-6301 OR Mail Completed Form to: Iowa Workforce Development

Unemployment Insurance Tax Bureau

1000 E Grand Ave

Des Moines, IA 50319-0209

Employer's Wage Adjustment Report 68-0061 (01-2024)

Phone: (888) 848-7442 Email: iwduitax@iwd.iowa.gov

www.workforce.iowa.gov

Equal Opportunity Employer/Program

Auxiliary aids and services are available upon request to individuals with disabilities.

For deaf and hard of hearing, use Relay 711.