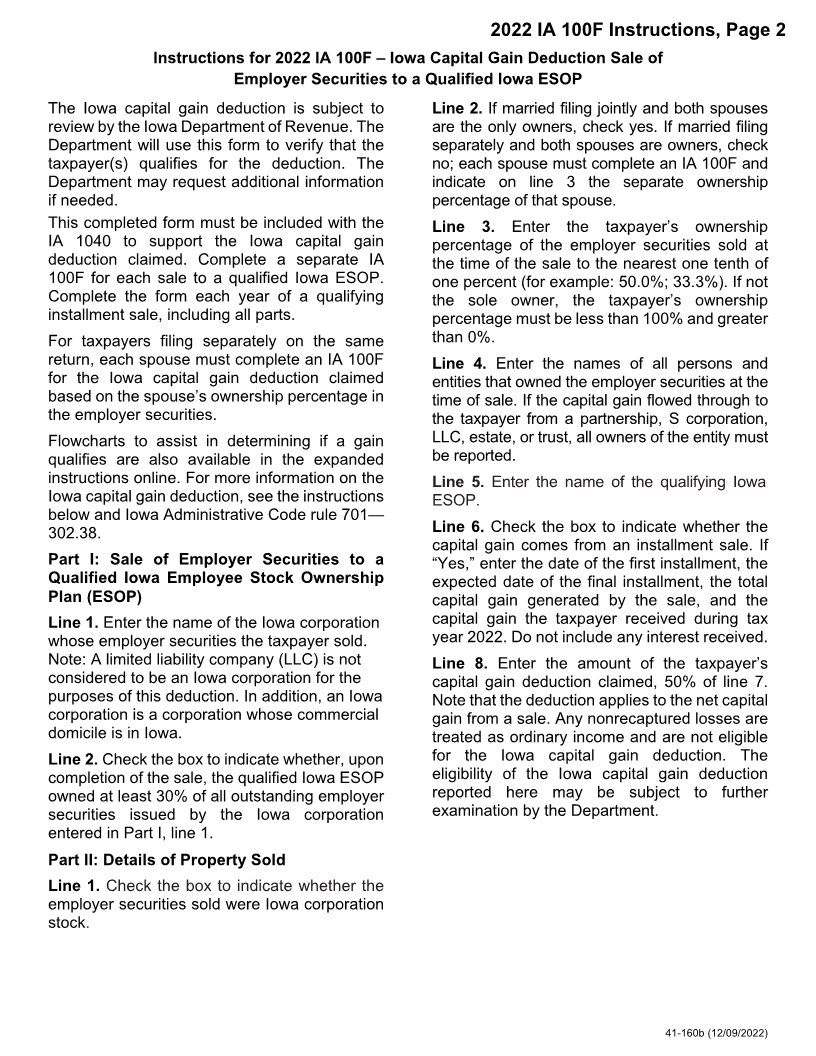

Enlarge image

2022 IA 100F

Iowa Capital Gain Deduction – ESOP

tax.iowa.gov

Name(s): _____________________________________ Social Security Number: __________________

Part I: Sale of Employer Securities to a Qualified Iowa Employee Stock Ownership Plan (ESOP)

1. Name of Iowa corporation: _______________________________________________________

Note: A limited liability company (LLC) is not considered to be an Iowa corporation for the

purposes of this deduction.

2. Does the qualified Iowa ESOP own at least 30% of all outstanding employer securities issued by

the Iowa corporation?

No ☐ ... Sale is not eligible for Iowa capital gain deduction. Stop.

Yes ☐... Continue to Part II, line 1.

Part II: Details of Property Sold

1. Were the employer securities sold Iowa corporation stock?

No ☐ ... Sale is not eligible for Iowa capital gain deduction under sale of employer securities

to a qualified Iowa ESOP. Stop.

Yes ☐... Continue to Part II, line 2.

2. Are you the sole owner of the employer securities? Married filers, see instructions.

No ☐ ... Continue to Part II, line 3.

Yes ☐... Enter 100% on Part II, line 3.

3. Enter taxpayer’s ownership percentage of the total employer securities

sold to the nearest one tenth of one percent (for example 65.2%) .............. 3. _____________ %

4. Provide all other owner name(s): ____________________________________________________

______________________________________________________________________________

5. Provide the name of the qualifying Iowa ESOP: ________________________________________

______________________________________________________________________________

6. Is the capital gain from an installment sale?

No ☐ ... Continue to Part II, line 7.

Yes ☐... Enter the property installment sale information:

a. Start date ........................................................ 6a. _____________

b. End date ......................................................... 6b. _____________

c. Total capital gain to be received by taxpayer

over the life of the installment sale ................. 6c. $ ____________

d. Capital gain received by the taxpayer in tax year 2022 .................. 6d. $ _____________

7. Enter the amount of taxpayer’s capital gain received from this sale in

tax year 2022 ............................................................................................... 7. $ ______________

8. Iowa capital gain deduction. Multiply Part II, line 7 by 50% (.5).

Enter here and include on IA 1040 line 23 ................................................... 8. $ ______________

41-160a (06/07/2022)