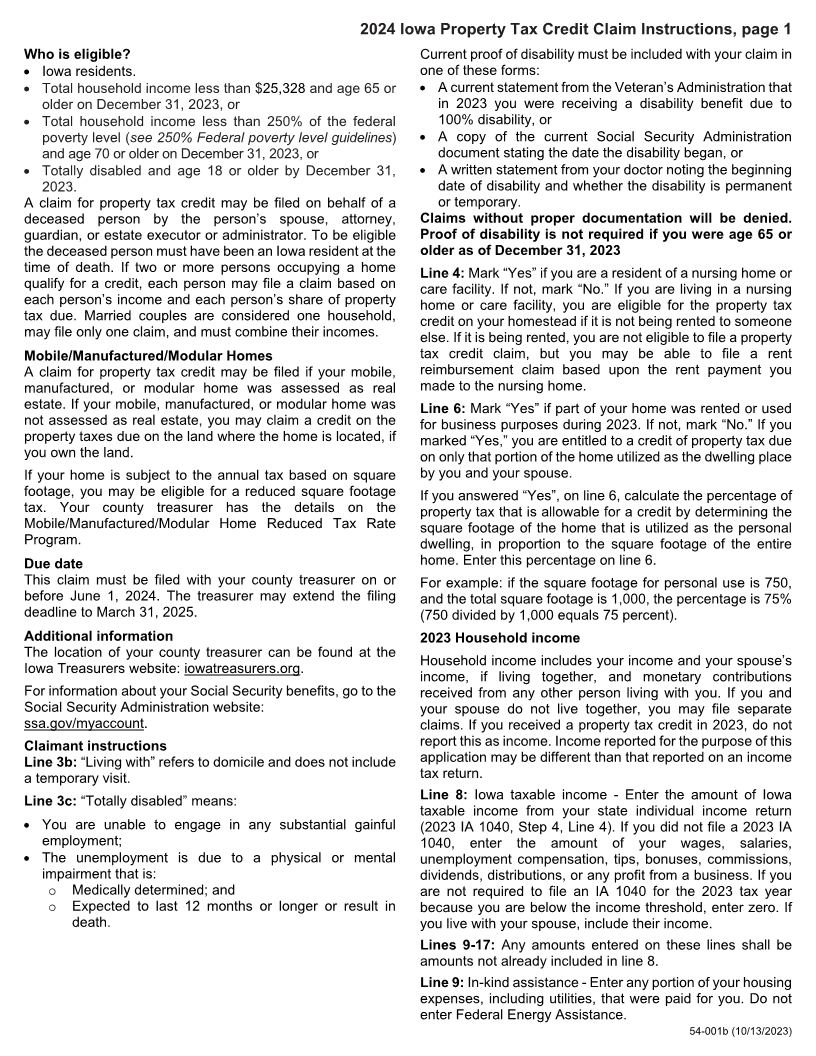

Enlarge image

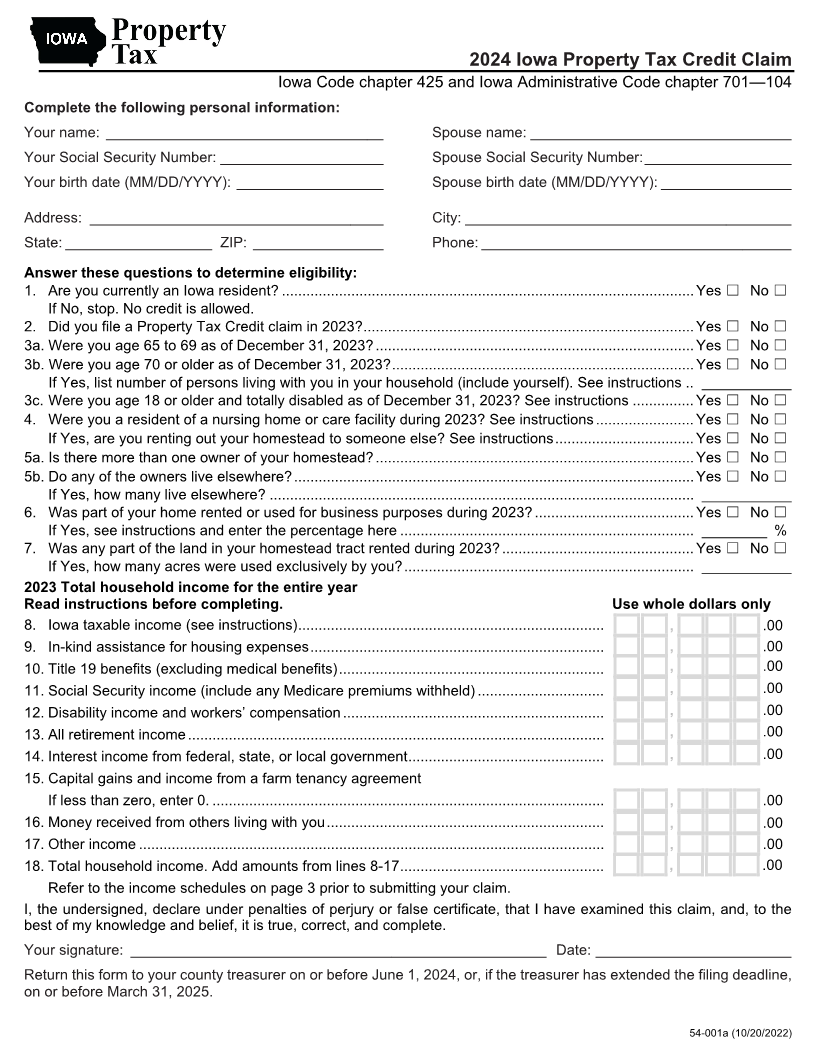

2024 Iowa Property Tax Credit Claim

Iowa Code chapter 425 and Iowa Administrative Code chapter 701—104

Complete the following personal information:

Your name: __________________________________ Spouse name: ________________________________

Your Social Security Number: ____________________ Spouse Social Security Number: __________________

Your birth date (MM/DD/YYYY): __________________ Spouse birth date (MM/DD/YYYY): ________________

Address: ____________________________________ City: ________________________________________

State: __________________ ZIP: ________________ Phone: ______________________________________

Answer these questions to determine eligibility:

1. Are you currently an Iowa resident? ..................................................................................................... Yes ☐ No ☐

If No, stop. No credit is allowed.

2. Did you file a Property Tax Credit claim in 2023? ................................................................................. Yes ☐ No ☐

3a. Were you age 65 to 69 as of December 31, 2023? .............................................................................. Yes ☐ No ☐

3b. Were you age 70 or older as of December 31, 2023? .......................................................................... Yes ☐ No ☐

If Yes, list number of persons living with you in your household (include yourself). See instructions .. ___________

3c. Were you age 18 or older and totally disabled as of December 31, 2023? See instructions ............... Yes ☐ No ☐

4. Were you a resident of a nursing home or care facility during 2023? See instructions ........................ Yes ☐ No ☐

If Yes, are you renting out your homestead to someone else? See instructions .................................. Yes ☐ No ☐

5a. Is there more than one owner of your homestead? .............................................................................. Yes ☐ No ☐

5b. Do any of the owners live elsewhere? .................................................................................................. Yes ☐ No ☐

If Yes, how many live elsewhere? ........................................................................................................ ___________

6. Was part of your home rented or used for business purposes during 2023? ....................................... Yes ☐ No ☐

If Yes, see instructions and enter the percentage here ........................................................................ ________ %

7. Was any part of the land in your homestead tract rented during 2023? ............................................... Yes ☐ No ☐

If Yes, how many acres were used exclusively by you? ....................................................................... ___________

2023 Total household income for the entire year

Read instructions before completing. Use whole dollars only

8. Iowa taxable income (see instructions) ........................................................................... , .00

9. In-kind assistance for housing expenses ........................................................................ , .00

10. Title 19 benefits (excluding medical benefits) ................................................................. , .00

11. Social Security income (include any Medicare premiums withheld) ............................... , .00

12. Disability income and workers’ compensation ................................................................ , .00

13. All retirement income ...................................................................................................... , .00

14. Interest income from federal, state, or local government ................................................ , .00

15. Capital gains and income from a farm tenancy agreement

If less than zero, enter 0. ................................................................................................ , .00

16. Money received from others living with you .................................................................... , .00

17. Other income .................................................................................................................. , .00

18. Total household income. Add amounts from lines 8-17 .................................................. , .00

Refer to the income schedules on page 3 prior to submitting your claim.

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this claim, and, to the

best of my knowledge and belief, it is true, correct, and complete.

Your signature: ___________________________________________________ Date: ________________________

Return this form to your county treasurer on or before June 1, 2024, or, if the treasurer has extended the filing deadline,

on or before March 31, 2025.

54-001a (10/20/2022)