Enlarge image

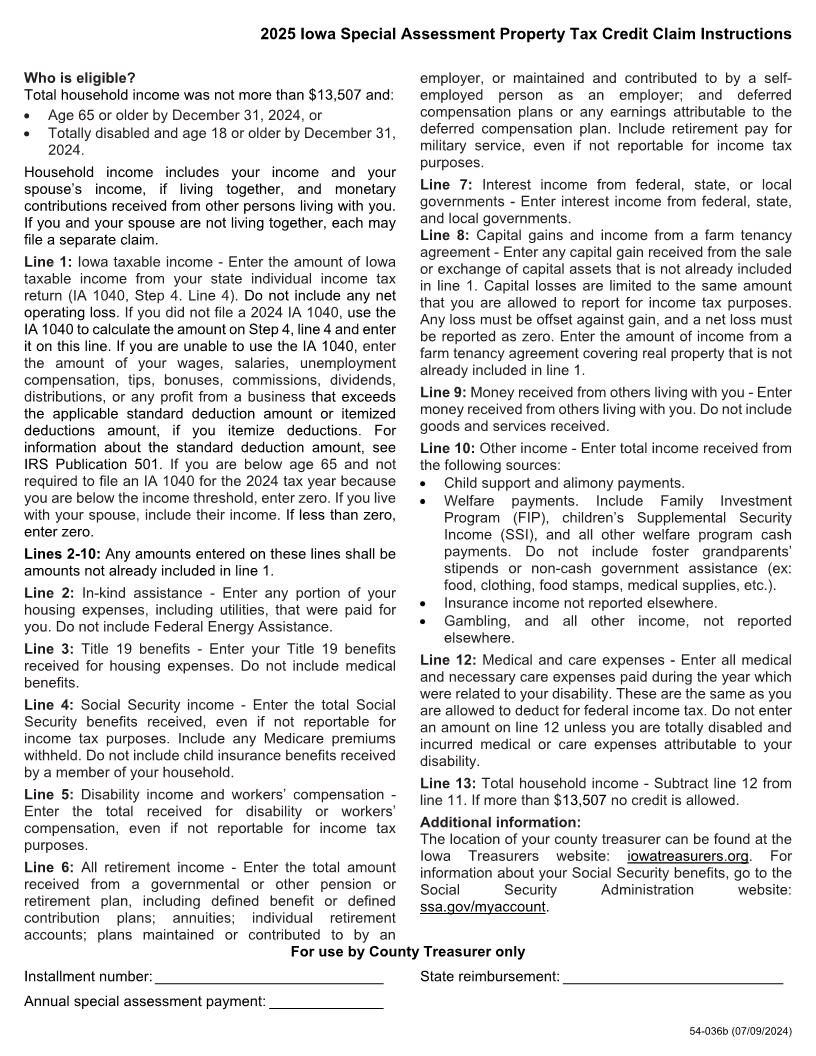

2025 Iowa Special Assessment Property Tax Credit Claim

Iowa Code section 425.23(3) and Iowa Administrative Code rule 701—104.27

Complete the following personal information:

Your name: ______________________________ Spouse name: ______________________________

Your Social Security Number: ________________ Spouse Social Security Number: _______________

Your birth date (MM/DD/YYYY): ______________ Spouse birth date (MM/DD/YYYY): ______________

Address: _________________________________ City: ______________________________________

State: ________________ ZIP: _______________ Phone: ____________________________________

Were you age 65 or older, or totally disabled and age 18 or older, as of

December 31, 2024? .................................................................................................................. Yes ☐ No ☐

If “No,” stop. No credit is allowed.

If you are under age 65 and totally disabled, you must include proof of disability. Provide proof of disability

such as a current statement from Social Security Administration, Veterans Administration, your doctor, or

Form SSA-1099.

2024 Total household income for the entire year

Use whole dollars only

Read instructions before completing

1. Iowa taxable income (see instructions) If less than zero, enter 0 ......................... , .00

2. In-kind assistance for housing expenses ............................................................. , .00

3. Title 19 benefits (excluding medical benefits) ...................................................... , .00

4. Social Security income ......................................................................................... , .00

5. Disability income and workers’ compensation ...................................................... , .00

6. All retirement income ........................................................................................... , .00

7. Interest income from federal, state, or local government .....................................

, .00

8. Capital gains and income from a farm tenancy agreement

If less than zero, enter 0 ...................................................................................... , .00

9. Money received from others living with you ......................................................... , .00

10. Other income ....................................................................................................... , .00

11. Add amounts from lines 1 through 10 .................................................................. , .00

12. Medical and care expenses (totally disabled individuals only) ............................. , .00

13. Total household income (Subtract line 12 from line 11) ....................................... , .00

(If line 13 is more than $13,507 stop. No credit is allowed.)

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this claim, and,

to the best of my knowledge and belief, it is true, correct, and complete.

Your signature: _______________________________________________ Date: _____________________

This claim must be filed or mailed to your county treasurer on or before September 30, 2025.

54-036a (07/09/2024)