Enlarge image

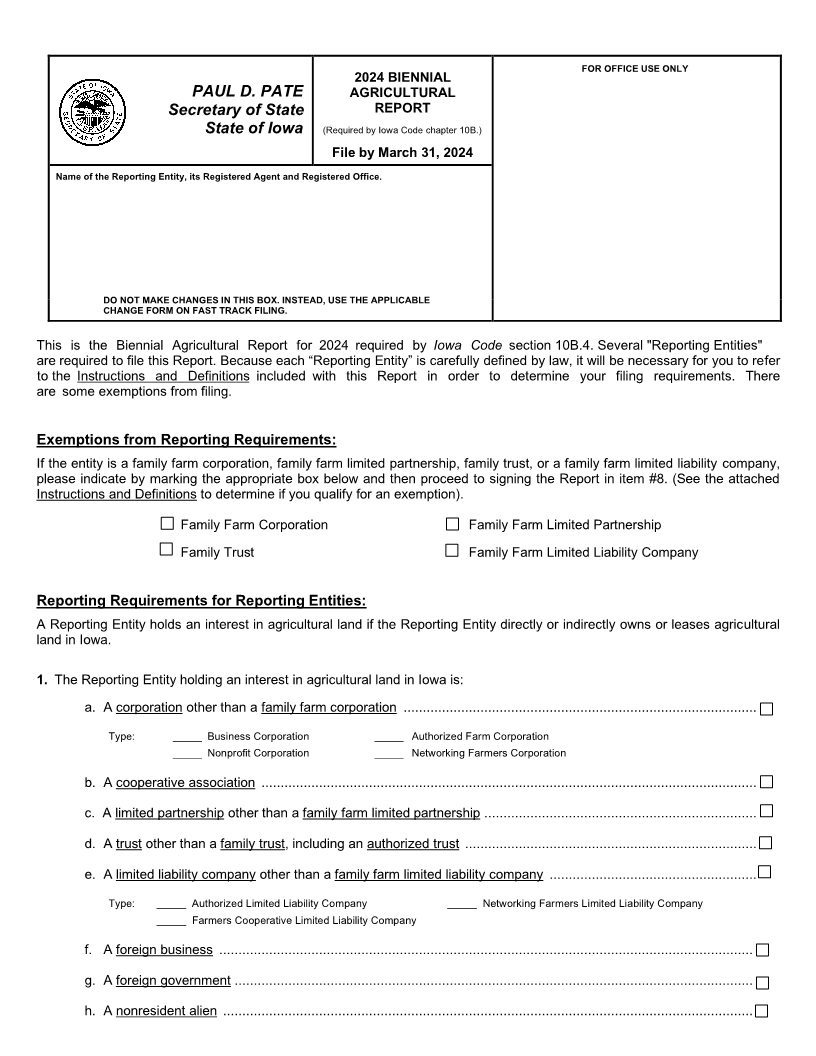

FOR OFFICE USE ONLY

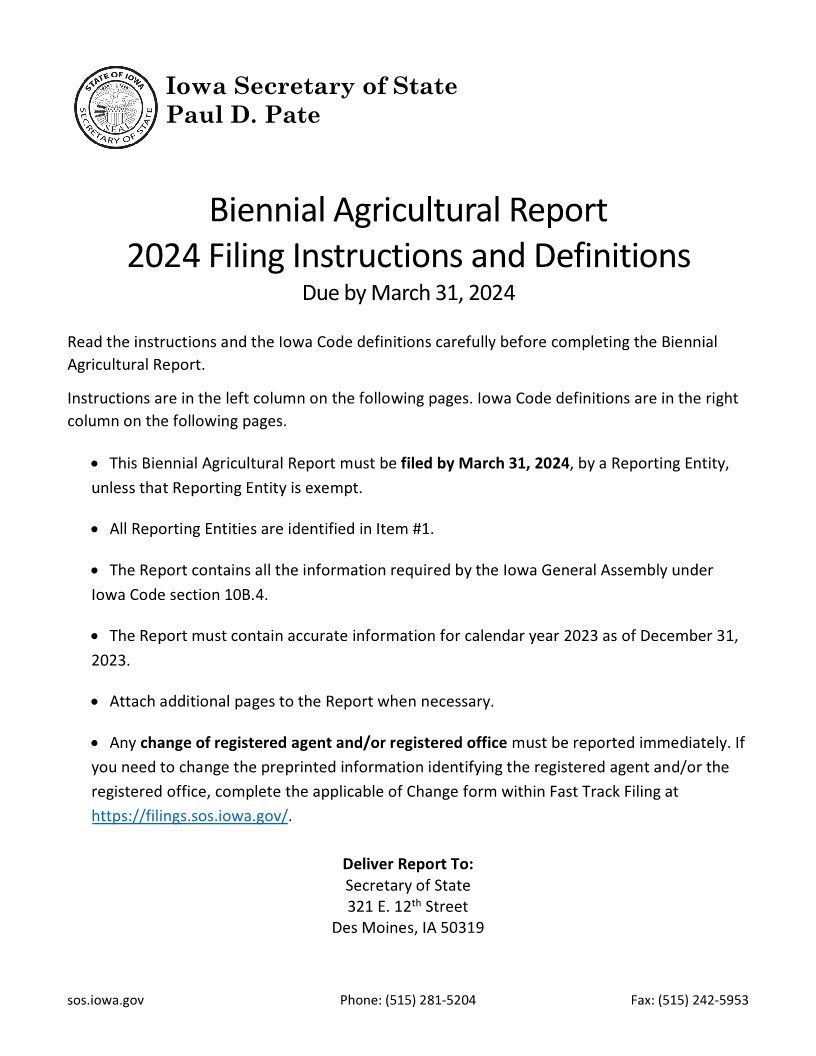

2024 BIENNIAL

PAUL D. PATE AGRICULTURAL

Secretary of State REPORT

State of Iowa (Required by Iowa Code chapter 10B.)

File by March 31, 2024

Name of the Reporting Entity, its Registered Agent and Registered Office.

DO NOT MAKE CHANGES IN THIS BOX. INSTEAD, USE THE APPLICABLE

CHANGE FORM ON FAST TRACK FILING.

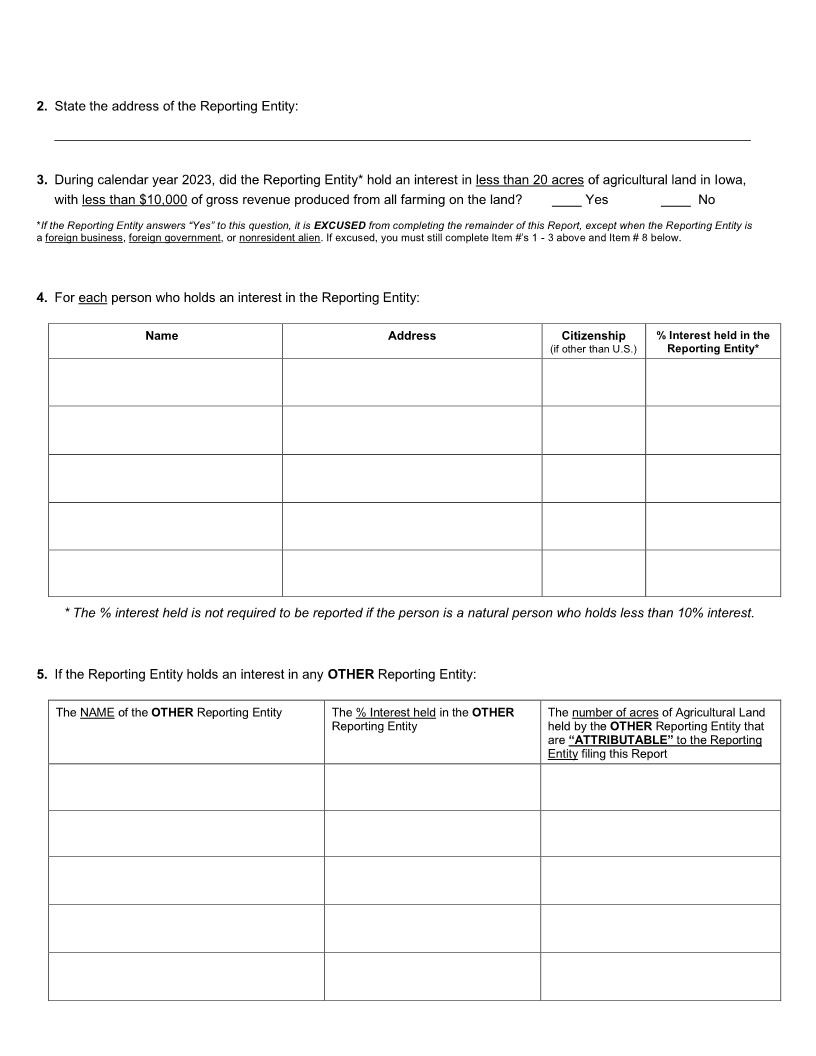

This is the Biennial Agricultural Report for 2024 required byIowa Code section 10B.4. Several"Reporting Entities"

are required to file this Report. Because each “Reporting Entity” is carefully defined by law, it will be necessary for you to refer

to the Instructions and Definitions included with this Report in order to determine your filing requirements. There

are some exemptions from filing.

Exemptions from Reporting Requirements:

If the entity is a family farm corporation, family farm limited partnership, family trust, or a family farm limited liability company,

please indicate by marking the appropriate box below and then proceed to signing the Report in item #8. (See the attached

Instructions and Definitions to determine if you qualify for an exemption).

Family Farm Corporation Family Farm Limited Partnership

Family Trust Family Farm Limited Liability Company

Reporting Requirements for Reporting Entities:

A Reporting Entity holds an interest in agricultural land if the Reporting Entity directly or indirectly owns or leases agricultural

land in Iowa.

1. The Reporting Entity holding an interest in agricultural land in Iowa is:

a. A corporation other than a family farm corporation ............................................................................................

Type: _____ Business Corporation _____ Authorized Farm Corporation

_____ Nonprofit Corporation _____ Networking Farmers Corporation

b. A cooperative association .................................................................................................................................

c. A limited partnership other than a family farm limited partnership .......................................................................

d. A trust other than a family trust, including an authorized trust ............................................................................

e. A limited liability company other than a family farm limited liability company ......................................................

Type: _____ Authorized Limited Liability Company _____ Networking Farmers Limited Liability Company

_____ Farmers Cooperative Limited Liability Company

f. A foreign business ...........................................................................................................................................

g. A foreign government .......................................................................................................................................

h. A nonresident alien ..........................................................................................................................................