Enlarge image

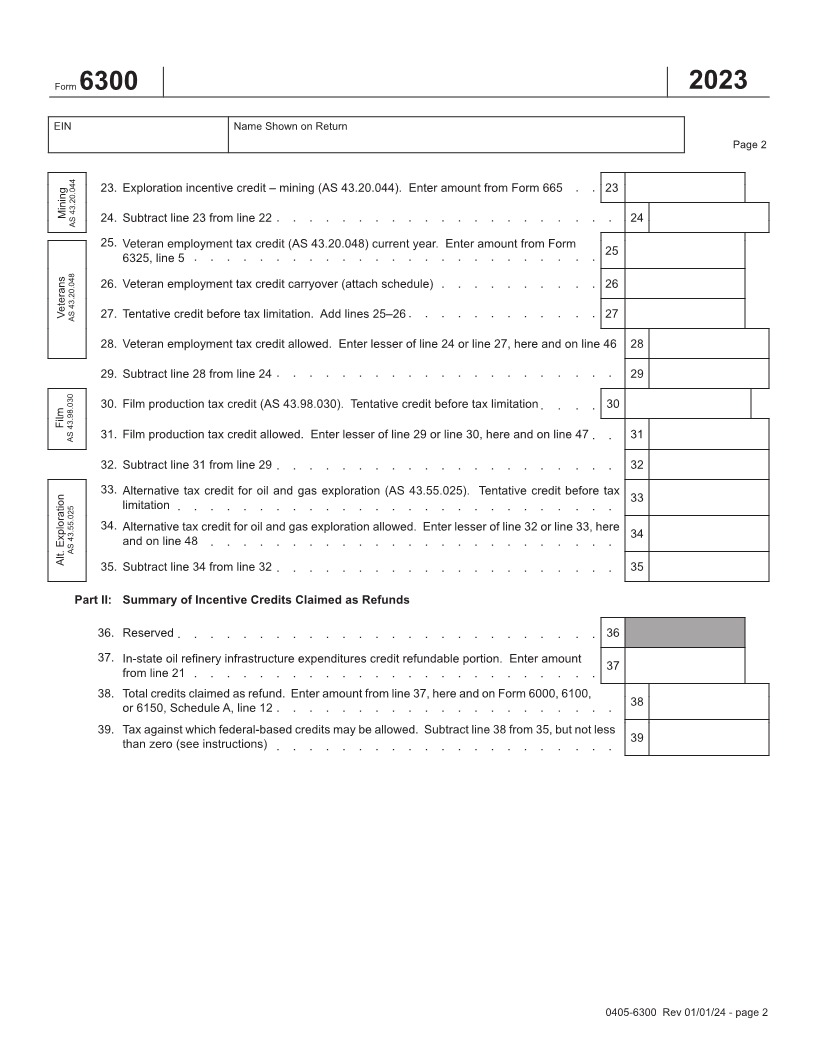

Alaska Incentive Credits Summary

Form

6300 2023

EIN Name Shown on Return

Part I: Order of Application

1. Alaska income tax before credits. Enter amount from line 4 of Form 6000, 6100, or 6150. . 1

2a. Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

2b. Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

2c. Reserved . . . . . . . . . . . . . . . . . . . . . . . . . .

2c

2d. Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . 2d

3. Alaska other taxes. Enter amount from Schedule E, line 7. . . . . . . . . . . . 3

4. Add lines 1 and 3 . . . . . . . . . . . . . . . . . . . . . . . . 4

5. In-state manufacture of urea, ammonia or gas-to-liquids products (attach schedule) . . . 5

Manufacture AS 43.20.052 6. Credit allowed. Enter lesser of line 4 or line 5, here and on line 41 . . . . . . . . . 6

7. Subtract line 6 from line 4 . . . . . . . . . . . . . . . . . . . . . . 7

8. Income tax education credit (AS 43.20.014). Tentative credit before tax limitation. Enter

8

amount from Form 6310, line 4 . . . . . . . . . . . . . . . . . . .

Education AS 43.20.014 9. Income tax education credit allowed. Enter lesser of line 7 or line 8, here and on line 42 . . 9

10. Subtract line 9 from line 7 . . . . . . . . . . . . . . . . . . . . . . 10

11. Oil and gas service industry expenditure credit (AS 43.20.049) current year. Enter 11

amount from Form 6327, line 3 . . . . . . . . . . . . . . . . . . . .

12. Oil and gas service industry expenditure credit carryover (attach schedule) . . . . . . 12

AS 43.20.049 13. Tentative credit before tax limitation. Add lines 11–12 . . . . . . . . . . . . . 13

O & G Service Industry 14. Oil and gas service industry expenditure credit allowed. Enter lesser of line 10 or line 13, here

14

and on line 43 . . . . . . . . . . . . . . . . . . . . . . . . .

15. Subtract line 14 from line 10 . . . . . . . . . . . . . . . . . . . . . 15

16. Reserved . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17. In-state oil refinery infrastructure expenditures credit carryover (attach schedule) . . . 17

18. Tentative credit before tax limitation. Enter amount from line 17. . . . . . . . . 18

19. Applied to tax. Enter the lesser of line 15 or line 18 here and on line 44 . . . . . . . 19

Refinery AS 43.20.053 20. In-state oil refinery infrastructure expenditures credit available for refund. Subtract line

20

19 from line 18 . . . . . . . . . . . . . . . . . . . . . . . .

21. In-state oil refinery infrastructure expenditures credit requested as a refund. Enter here

21

and on line 37 . . . . . . . . . . . . . . . . . . . . . . . .

22. Subtract line 19 from line 15 . . . . . . . . . . . . . . . . . . . . . 22

0405-6300 Rev 01/01/24 - page 1