Enlarge image

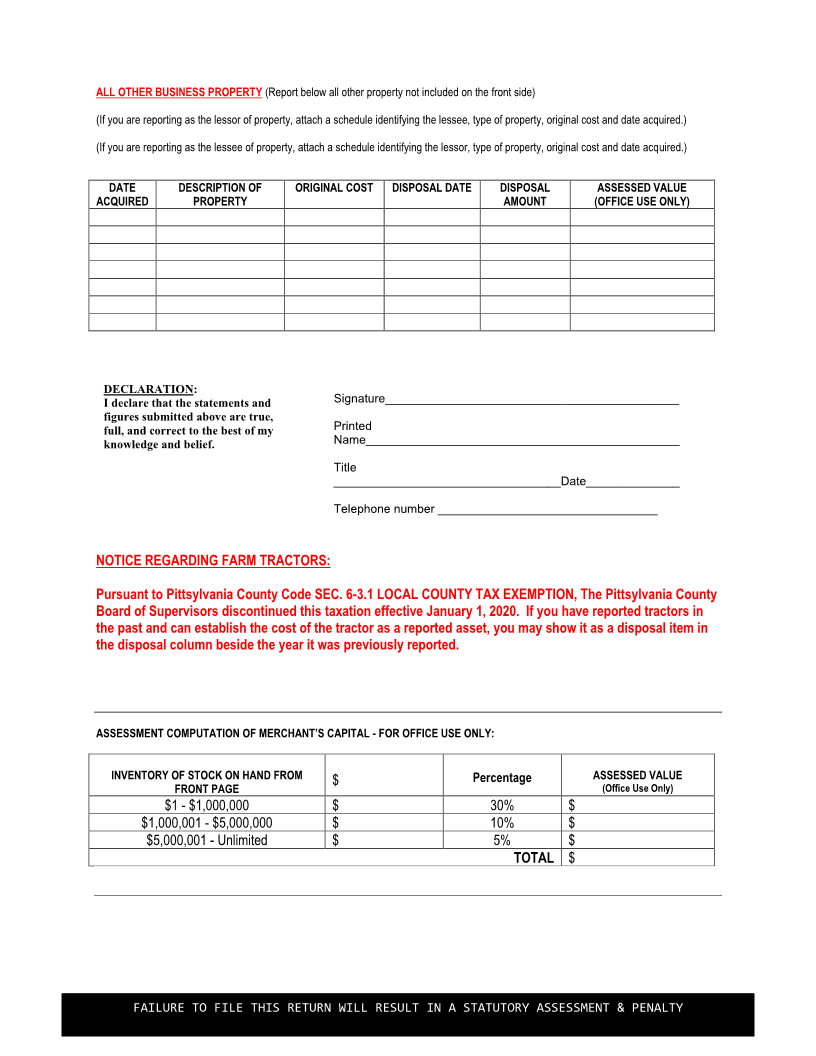

2023 BUSINESS & PROFESSIONAL REPORTING

FOR TANGIBLE PERSONAL PROPERTY TELEPHONE NUMBERS

(434) 432-7940

Robin Coles-Goard (434) 656-6211 TE MAY 1,

Commissioner of the Revenue DUE DATE FEBRUARY 15TH 20042004 FAX (434) 432-7957

Pittsylvania County

PO Box 272 Account Number: __________

Chatham, VA 24531

(SSN or Fed ID): _____________

Failure to file by deadline will result in

penalty 10% or $10.00 whichever is greater.

LEGAL BUSINESS NAME: (If different from above) _______________________________________________________________________(SSN or Fed ID)

LOCATION ADDRESS: (If different from mailing address) ___________________________________________________________

HEAVY CONSTRUCTION MACHINERY

SEE NOTICE ON REVERSE SIDE REGARDING FARM TRACTORS. (List all property with purchase date, description & cost. If any of this

property has been sold, show the date sold and disposal amount; then attach sheet giving the new owners name & address.) If you use any

heavy construction equipment which is located in another city or county, please indicate which on an attached sheet. Note: Farm Tractors

used in other businesses are no longer required to be reported as business tangible property.

Date DISPOSAL ASSESSED VALUE (OFFICE

MODEL & DESCRIPTION ORIGINAL COST DISPOSAL DATE

Acquired AMOUNT USE ONLY)

BUSINESS FURNITURE OFFICE EQUIPMENT TOOLS

SEE NOTICE ON REVERSE SIDE REGARDING FARM TRACTORS (Show total cost below of all furniture, office equipment and tools

purchased in each year; then attach a detailed listing [such as a depreciation schedule] of all such property along with the date and cost of

purchase.) If any of this property has been disposed of, show the original cost of such equipment in the disposal column beside the purchase

year; then attach sheet explaining the disposal and give the new owners name & address if it was sold.)

Purchase Year Cost Percentage DISPOSALS ASSESSED VALUE

(before any disposals) (list in year of purchase) (Office Use Only)

2022 27.5%

2021 25.0%

2020 23.5%

2019 20.0%

2018 17.5%

2017 15.0%

2016 13.5%

2015 10.0%

2014 7.5%

2013 & Prior 5.0%

MERCHANTS CAPITAL (To be reported if the taxpayer is a merchant)

Merchants should enter the cost figure of their “Inventory of Stock on Hand” for January 1st of this year. Generally, this should equal the ending

inventory shown in the “Cost of Goods Sold” section of their prior year’s Federal income tax return. The Commissioner shall compute the

assessment amount on the back of this form.

INVENTORY OF STOCK ON HAND ________________

ALL OTHER BUSINESS PROPERTY (Leased Property and any other property not defined on this side – SEE REVERSE SIDE)

FAILURE TO FILE THIS RETURN WILL RESULT IN A STATUTORY ASSESSMENT & PENALTY