Enlarge image

RESET PRINT

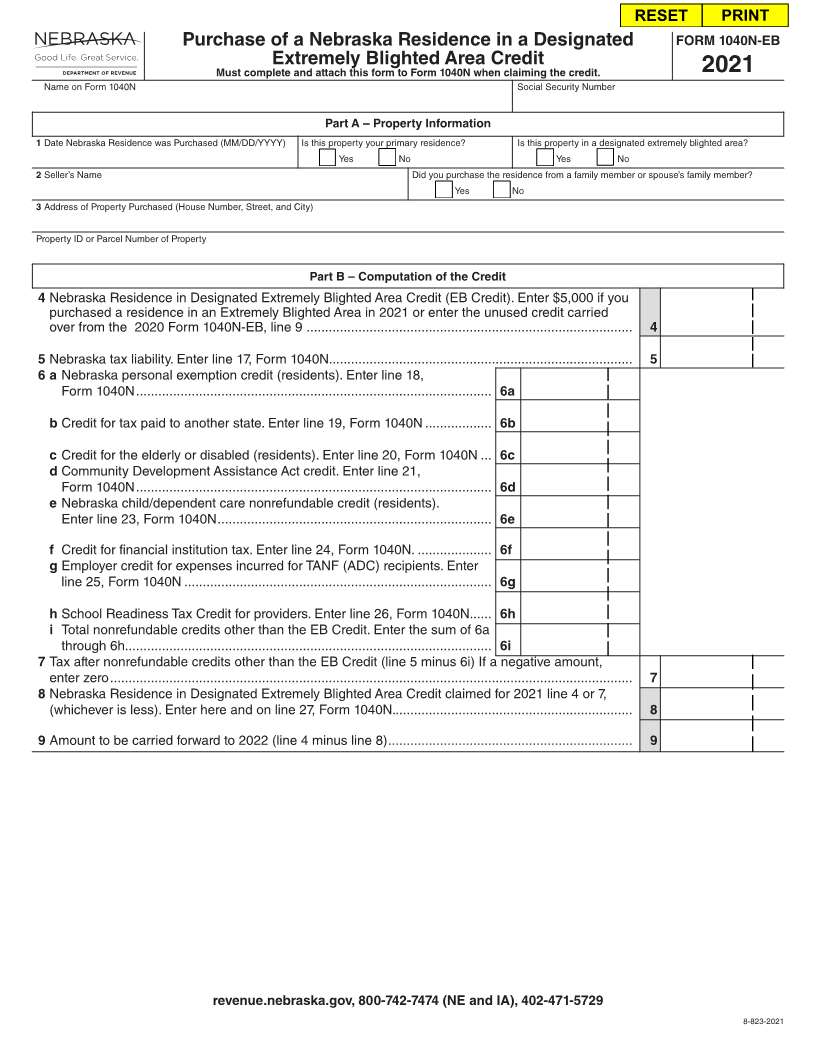

Purchase of a Nebraska Residence in a Designated FORM 1040N-EB

Extremely Blighted Area Credit

Must complete and attach this form to Form 1040N when claiming the credit. 2021

Name on Form 1040N Social Security Number

Part A – Property Information

1Date Nebraska Residence was Purchased (MM/DD/YYYY) Is this property your primary residence? Is this property in a designated extremely blighted area?

c Yes c No c Yes c No

2Seller’s Name Did you purchase the residence from a family member or spouse’s family member?

c Yes c No

3Address of Property Purchased (House Number, Street, and City)

Property ID or Parcel Number of Property

Part B – Computation of the Credit

4 Nebraska Residence in Designated Extremely Blighted Area Credit (EB Credit). Enter $5,000 if you

purchased a residence in an Extremely Blighted Area in 2021 or enter the unused credit carried

over from the 2020 Form 1040N-EB, line 9 ........................................................................................ 4

5Nebraska tax liability. Enter line 17, Form 1040N. ................................................................................. 5

6 a Nebraska personal exemption credit (residents). Enter line 18,

Form 1040N ................................................................................................ 6a

b Credit for tax paid to another state. Enter line 19, Form 1040N .................. 6b

cCredit for the elderly or disabled (residents). Enter line 20, Form 1040N ... 6c

dCommunity Development Assistance Act credit. Enter line 21,

Form 1040N ................................................................................................ 6d

eNebraska child/dependent care nonrefundable credit (residents).

Enter line 23, Form 1040N .......................................................................... 6e

f Credit for financial institution tax. Enter line 24, Form 1040N. .................... 6f

gEmployer credit for expenses incurred for TANF (ADC) recipients. Enter

line 25, Form 1040N ................................................................................... 6g

hSchool Readiness Tax Credit for providers. Enter line 26, Form 1040N. .....6h

i Total nonrefundable credits other than the EB Credit. Enter the sum of 6a

through 6h. .................................................................................................. 6i

7Tax after nonrefundable credits other than the EB Credit (line 5 minus 6i) If a negative amount,

enter zero ............................................................................................................................................. 7

8Nebraska Residence in Designated Extremely Blighted Area Credit claimed for 2021 line 4 or 7,

(whichever is less). Enter here and on line 27, Form 1040N. ................................................................ 8

9Amount to be carried forward to 2022 (line 4 minus line 8) .................................................................. 9

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

8-823-2021