- 2 -

Enlarge image

|

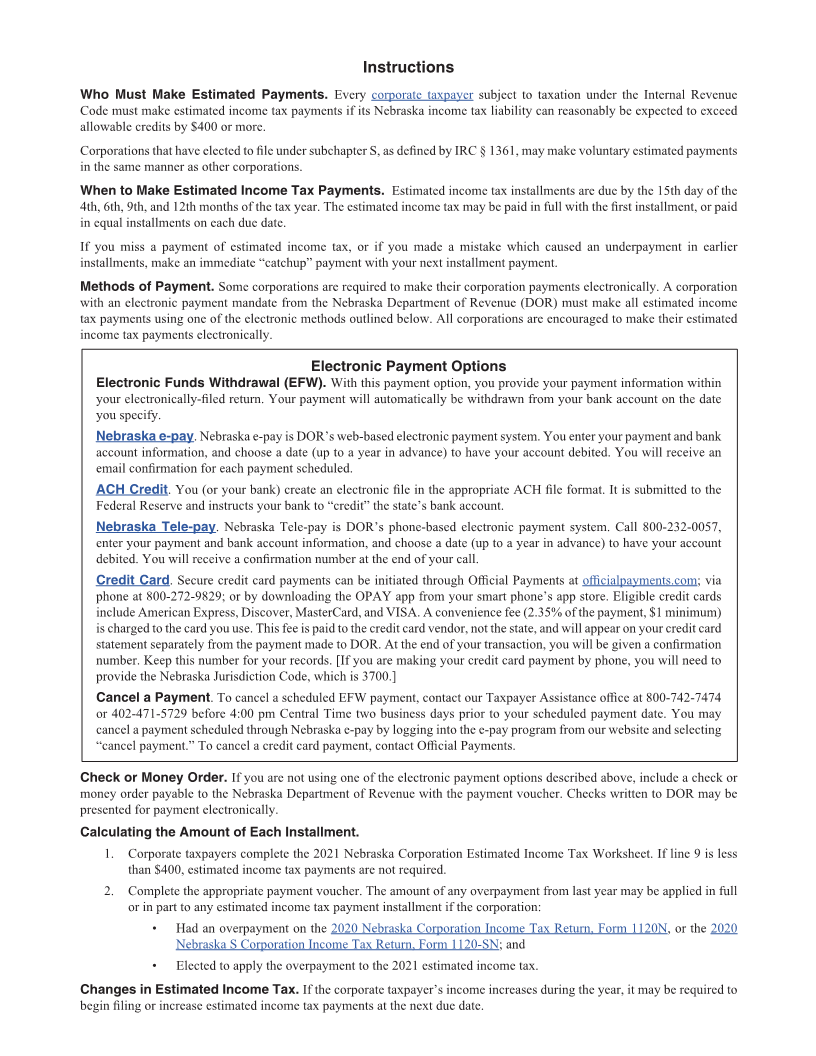

Instructions

Who Must Make Estimated Payments. Every corporate taxpayer subject to taxation under the Internal Revenue

Code must make estimated income tax payments if its Nebraska income tax liability can reasonably be expected to exceed

allowable credits by $400 or more.

Corporations that have elected to file under subchapter S, as defined by IRC § 1361, may make voluntary estimated payments

in the same manner as other corporations.

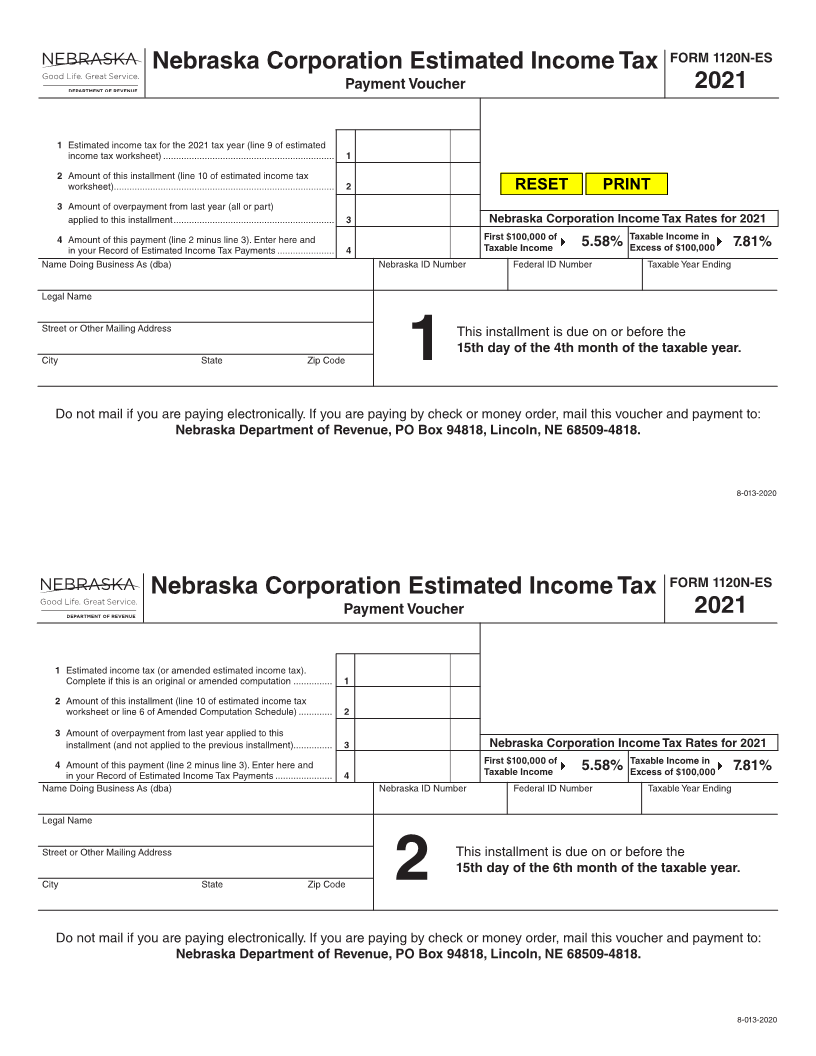

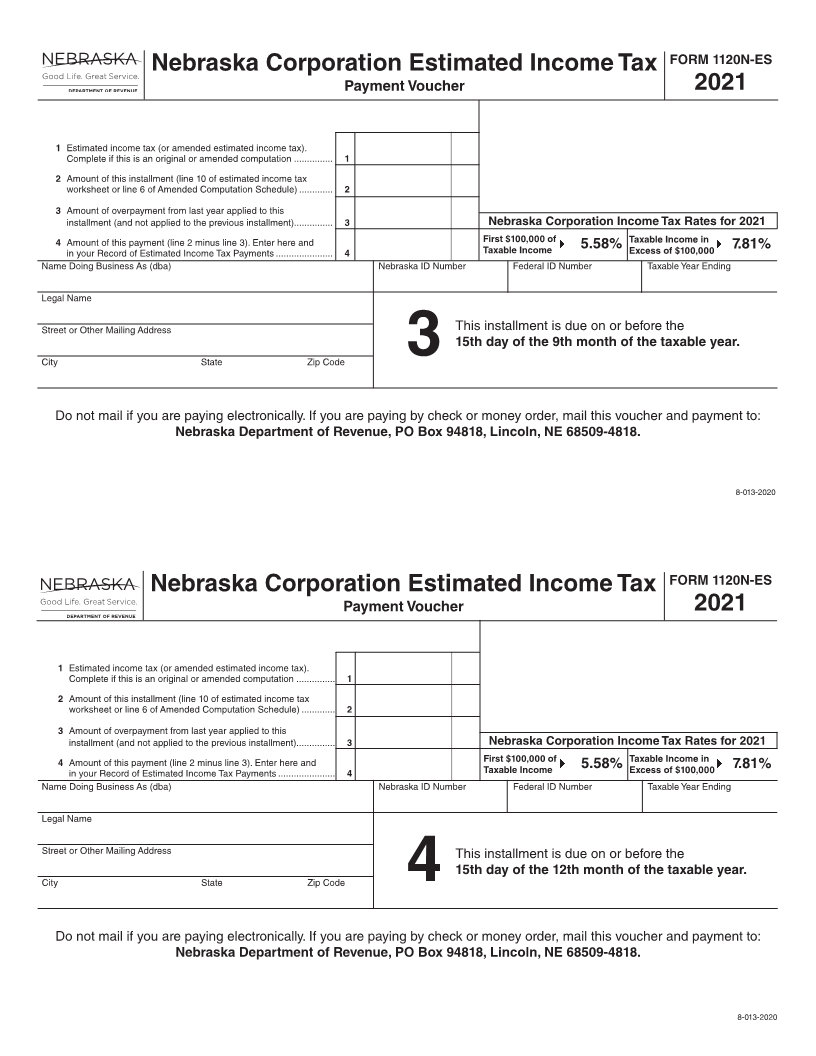

When to Make Estimated Income Tax Payments. Estimated income tax installments are due by the 15th day of the

4th, 6th, 9th, and 12th months of the tax year. The estimated income tax may be paid in full with the first installment, or paid

in equal installments on each due date.

If you miss a payment of estimated income tax, or if you made a mistake which caused an underpayment in earlier

installments, make an immediate “catchup” payment with your next installment payment.

Methods of Payment. Some corporations are required to make their corporation payments electronically. A corporation

with an electronic payment mandate from the Nebraska Department of Revenue (DOR) must make all estimated income

tax payments using one of the electronic methods outlined below. All corporations are encouraged to make their estimated

income tax payments electronically.

Electronic Payment Options

Electronic Funds Withdrawal (EFW). With this payment option, you provide your payment information within

your electronically-filed return. Your payment will automatically be withdrawn from your bank account on the date

you specify.

Nebraska e-pay. Nebraska e-pay is DOR’s web-based electronic payment system. You enter your payment and bank

account information, and choose a date (up to a year in advance) to have your account debited. You will receive an

email confirmation for each payment scheduled.

ACH Credit. You (or your bank) create an electronic file in the appropriate ACH file format. It is submitted to the

Federal Reserve and instructs your bank to “credit” the state’s bank account.

Nebraska Tele-pay. Nebraska Tele-pay is DOR’s phone-based electronic payment system. Call 800-232-0057,

enter your payment and bank account information, and choose a date (up to a year in advance) to have your account

debited. You will receive a confirmation number at the end of your call.

Credit Card. Secure credit card payments can be initiated through Official Payments at officialpayments.com; via

phone at 800-272-9829; or by downloading the OPAY app from your smart phone’s app store. Eligible credit cards

include American Express, Discover, MasterCard, and VISA. A convenience fee (2.35% of the payment, $1 minimum)

is charged to the card you use. This fee is paid to the credit card vendor, not the state, and will appear on your credit card

statement separately from the payment made to DOR. At the end of your transaction, you will be given a confirmation

number. Keep this number for your records. [If you are making your credit card payment by phone, you will need to

provide the Nebraska Jurisdiction Code, which is 3700.]

Cancel a Payment. To cancel a scheduled EFW payment, contact our Taxpayer Assistance office at 800-742-7474

or 402-471-5729 before 4:00 pm Central Time two business days prior to your scheduled payment date. You may

cancel a payment scheduled through Nebraska e-pay by logging into the e-pay program from our website and selecting

“cancel payment.” To cancel a credit card payment, contact Official Payments.

Check or Money Order. If you are not using one of the electronic payment options described above, include a check or

money order payable to the Nebraska Department of Revenue with the payment voucher. Checks written to DOR may be

presented for payment electronically.

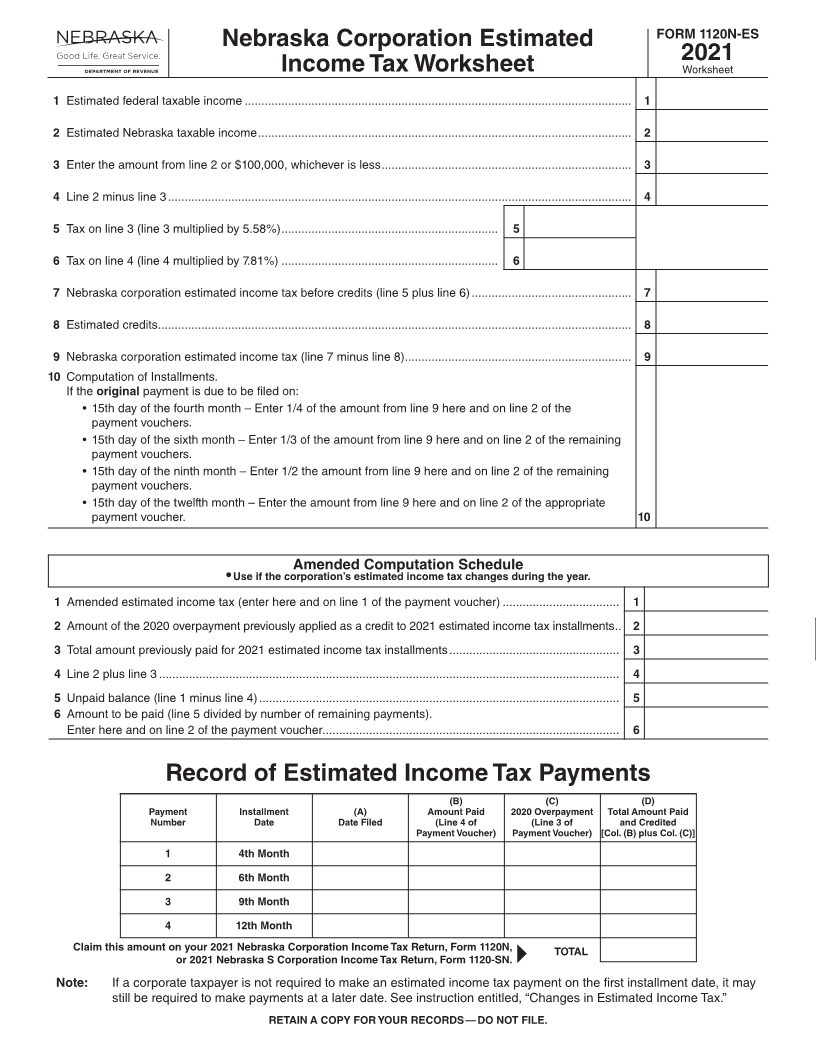

Calculating the Amount of Each Installment.

1. Corporate taxpayers complete the 2021 Nebraska Corporation Estimated Income Tax Worksheet. If line 9 is less

than $400, estimated income tax payments are not required.

2. Complete the appropriate payment voucher. The amount of any overpayment from last year may be applied in full

or in part to any estimated income tax payment installment if the corporation:

• Had an overpayment on the 2020 Nebraska Corporation Income Tax Return, Form 1120N, or the 2020

Nebraska S Corporation Income Tax Return, Form 1120-SN; and

• Elected to apply the overpayment to the 2021 estimated income tax.

Changes in Estimated Income Tax. If the corporate taxpayer’s income increases during the year, it may be required to

begin filing or increase estimated income tax payments at the next due date.

|