Enlarge image

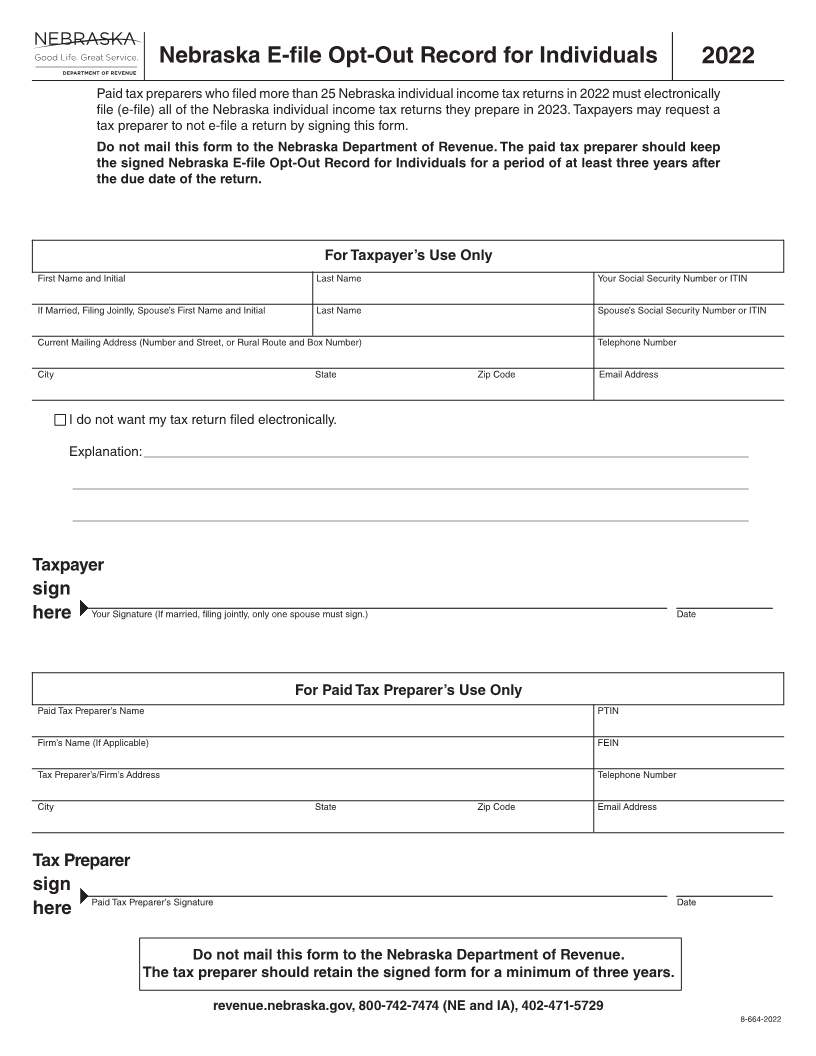

Nebraska E-file Opt-Out Record for Individuals 2022

Paid tax preparers who filed more than 25 Nebraska individual income tax returns in 2022 must electronically

file (e-file) all of the Nebraska individual income tax returns they prepare in 2023. Taxpayers may request a

tax preparer to not e-file a return by signing this form.

Do not mail this form to the Nebraska Department of Revenue. The paid tax preparer should keep

the signed Nebraska E-file Opt-Out Record for Individuals for a period of at least three years after

the due date of the return.

For Taxpayer’s Use Only

First Name and Initial Last Name Your Social Security Number or ITIN

If Married, Filing Jointly, Spouse’s First Name and Initial Last Name Spouse’s Social Security Number or ITIN

Current Mailing Address (Number and Street, or Rural Route and Box Number) Telephone Number

City State Zip Code Email Address

I do not want my tax return filed electronically.

Explanation: ______________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

Taxpayer

sign

here Your Signature (If married, filing jointly, only one spouse must sign.) Date

For Paid Tax Preparer’s Use Only

Paid Tax Preparer’s Name PTIN

Firm’s Name (If Applicable) FEIN

Tax Preparer’s/Firm’s Address Telephone Number

City State Zip Code Email Address

Tax Preparer

sign

Paid Tax Preparer’s Signature Date

here

Do not mail this form to the Nebraska Department of Revenue.

The tax preparer should retain the signed form for a minimum of three years.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

8-664-2022