Enlarge image

PRINT FORM RESET FORM

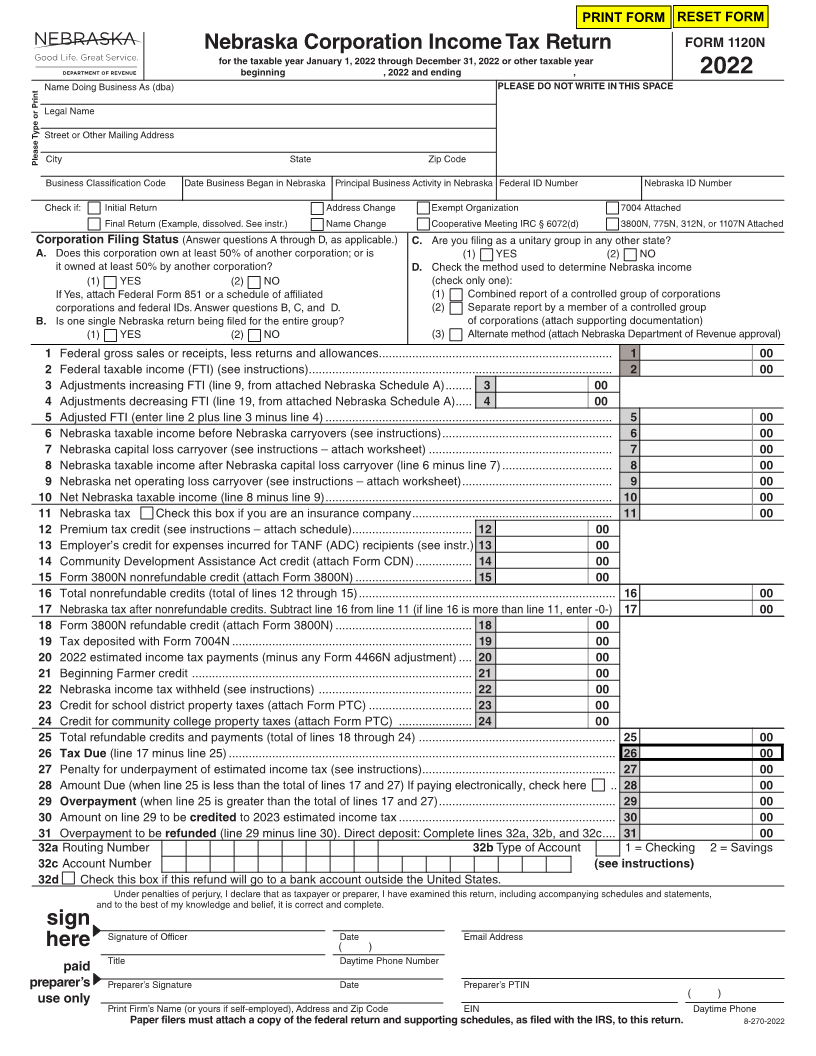

Nebraska Corporation Income Tax Return FORM 1120N

for the taxable year January 1, 2022 through December 31, 2022 or other taxable year

beginning , 2022 and ending , 2022

Name Doing Business As (dba) PLEASE DO NOT WRITE IN THIS SPACE

Legal Name

Street or Other Mailing Address

CityPlease Type or Print State Zip Code

Business Classification Code Date Business Began in Nebraska Principal Business Activity in Nebraska Federal ID Number Nebraska ID Number

Check if: Initial Return Address Change Exempt Organization 7004 Attached

Final Return (Example, dissolved. See instr.) Name Change Cooperative Meeting IRC § 6072(d) 3800N, 775N, 312N, or 1107N Attached

Corporation Filing Status (Answer questions A through D, as applicable.) C. Are you filing as a unitary group in any other state?

A. Does this corporation own at least 50% of another corporation; or is (1) YES (2) NO

it owned at least 50% by another corporation? D. Check the method used to determine Nebraska income

(1) YES (2) NO (check only one):

If Yes, attach Federal Form 851 or a schedule of affiliated (1) Combined report of a controlled group of corporations

corporations and federal IDs. Answer questions B, C, and D. (2) Separate report by a member of a controlled group

B. Is one single Nebraska return being filed for the entire group? of corporations (attach supporting documentation)

(1) YES (2) NO (3) Alternate method (attach Nebraska Department of Revenue approval)

1 Federal gross sales or receipts, less returns and allowances ...................................................................... 1 00

2 Federal taxable income (FTI) (see instructions) ........................................................................................... 2 00

3 Adjustments increasing FTI (line 9, from attached Nebraska Schedule A) ........ 3 00

4 Adjustments decreasing FTI (line 19, from attached Nebraska Schedule A) ..... 4 00

5 Adjusted FTI (enter line 2 plus line 3 minus line 4) ...................................................................................... 5 00

6 Nebraska taxable income before Nebraska carryovers (see instructions) ................................................... 6 00

7 Nebraska capital loss carryover (see instructions – attach worksheet) ....................................................... 7 00

8 Nebraska taxable income after Nebraska capital loss carryover (line 6 minus line 7) ................................. 8 00

9 Nebraska net operating loss carryover (see instructions – attach worksheet) ............................................. 9 00

10 Net Nebraska taxable income (line 8 minus line 9) ...................................................................................... 10 00

11 Nebraska tax Check this box if you are an insurance company ............................................................ 11 00

12 Premium tax credit (see instructions – attach schedule) .................................... 12 00

13 Employer’s credit for expenses incurred for TANF (ADC) recipients (see instr.) 13 00

14 Community Development Assistance Act credit (attach Form CDN) ................. 14 00

15 Form 3800N nonrefundable credit (attach Form 3800N) ................................... 15 00

16 Total nonrefundable credits (total of lines 12 through 15) ............................................................................. 16 00

17 Nebraska tax after nonrefundable credits. Subtract line 16 from line 11 (if line 16 is more than line 11, enter -0-) 17 00

18 Form 3800N refundable credit (attach Form 3800N) ......................................... 18 00

19 Tax deposited with Form 7004N ........................................................................ 19 00

20 2022 estimated income tax payments (minus any Form 4466N adjustment) .... 20 00

21 Beginning Farmer credit .................................................................................... 21 00

22 Nebraska income tax withheld (see instructions) .............................................. 22 00

23 Credit for school district property taxes (attach Form PTC) ............................... 23 00

24 Credit for community college property taxes (attach Form PTC) ...................... 24 00

25 Total refundable credits and payments (total of lines 18 through 24) ........................................................... 25 00

26 Tax Due (line 17 minus line 25) .................................................................................................................... 26 00

27 Penalty for underpayment of estimated income tax (see instructions) .......................................................... 27 00

28 Amount Due (when line 25 is less than the total of lines 17 and 27) If paying electronically, check here .. 28 00

29 Overpayment (when line 25 is greater than the total of lines 17 and 27) ..................................................... 29 00

30 Amount on line 29 to be credited to 2023 estimated income tax ................................................................. 30 00

31 Overpayment to be refunded (line 29 minus line 30). Direct deposit: Complete lines 32a, 32b, and 32c .... 31 00

32a Routing Number 32b Type of Account 1 = Checking 2 = Savings

32c Account Number (see instructions)

32d Check this box if this refund will go to a bank account outside the United States.

Under penalties of perjury, I declare that as taxpayer or preparer, I have examined this return, including accompanying schedules and statements,

and to the best of my knowledge and belief, it is correct and complete.

sign

Signature of Officer Date Email Address

here ( )

Title Daytime Phone Number

paid

preparer’s Preparer’s Signature Date Preparer’s PTIN

use only ( )

Print Firm’s Name (or yours if self-employed), Address and Zip Code EIN Daytime Phone

Paper filers must attach a copy of the federal return and supporting schedules, as filed with the IRS, to this return. 8-270-2022