Enlarge image

PRINT FORM RESET FORM

FORM 1120N

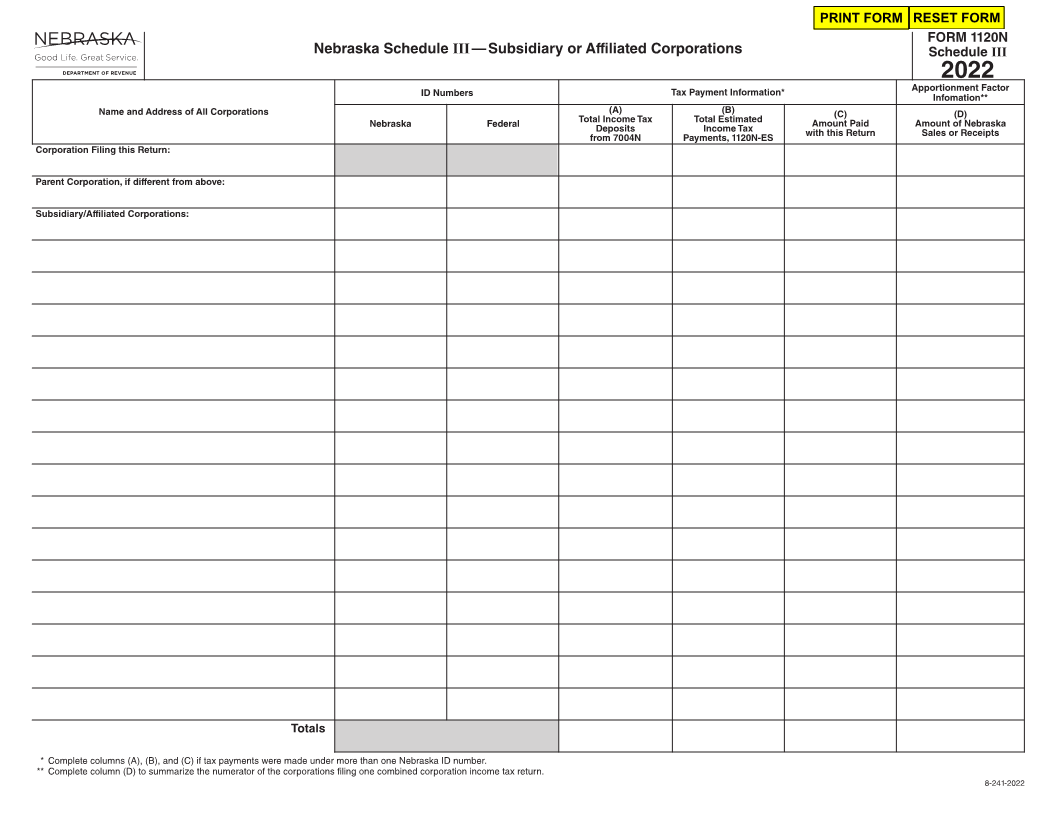

Nebraska Schedule III — Subsidiary or Affiliated Corporations Schedule III

2022

ID Numbers Tax Payment Information* Apportionment Factor

Infomation**

Name and Address of All Corporations (B)

Nebraska Federal (A) Total Estimated (C) (D)

Total Income Tax Income Tax Amount Paid Amount of Nebraska

Deposits Payments, 1120N-ES with this Return Sales or Receipts

from 7004N

Corporation Filing this Return:

Parent Corporation, if different from above:

Subsidiary/Affiliated Corporations:

Totals

* Complete columns (A), (B), and (C) if tax payments were made under more than one Nebraska ID number.

** Complete column (D) to summarize the numerator of the corporations filing one combined corporation income tax return.

8-241-2022