- 24 -

Enlarge image

|

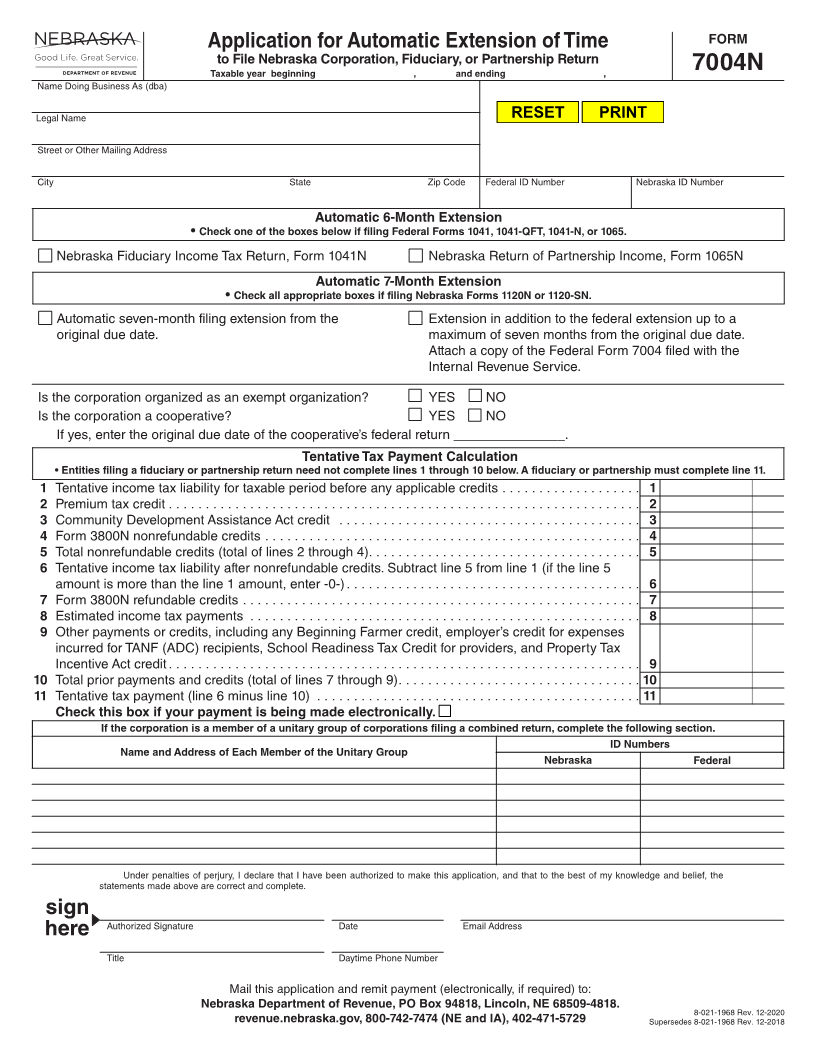

Instructions

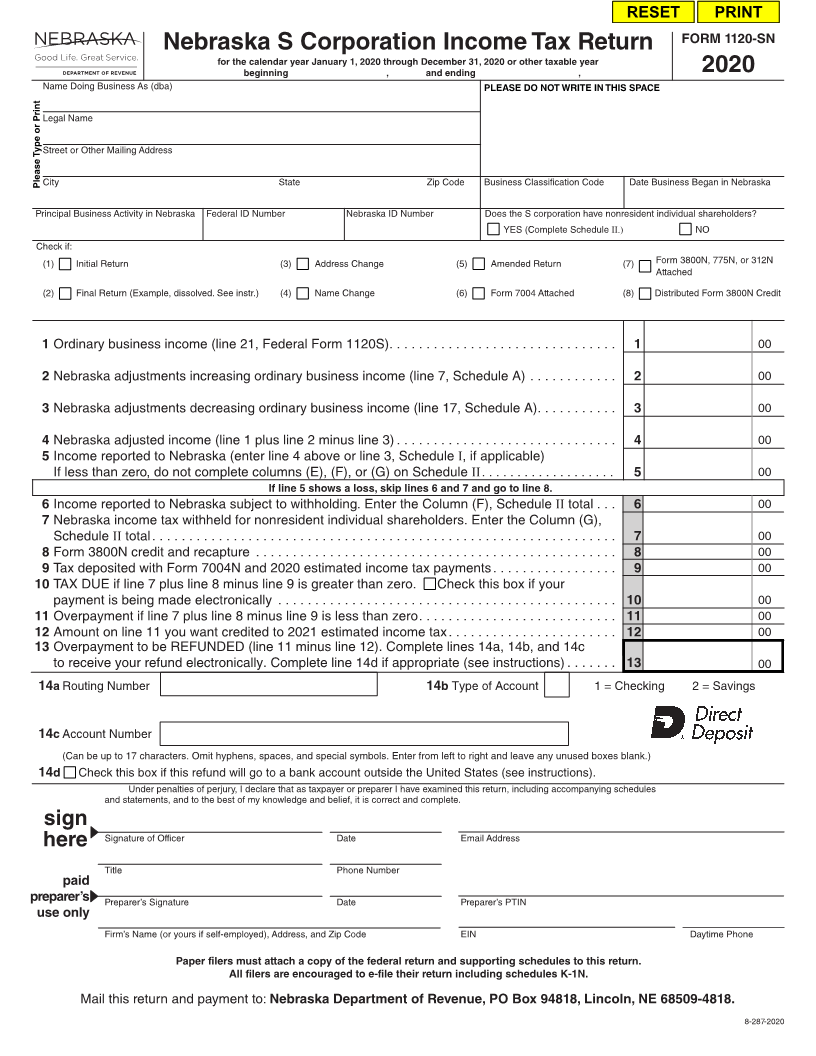

Who May File. A corporation (C corporation and S corporation), fiduciary, partnership, or limited liability company

making a tentative tax payment, and/or wanting more time to file a Nebraska tax return, must file a Nebraska Application for

Extension of Time, Form 7004N. The Form 7004N must be filed even if a tentative income tax payment is made electronically.

If you have filed for a federal extension and are not making a tentative income tax payment to Nebraska, you do not need to

complete this application. When your Nebraska income tax return is filed, you must attach a copy of the Federal Form 7004

filed with the IRS, or a copy of the approved federal extension. If a federal extension of time has been granted, the filing date

for Forms 1120N, 1120-SN, and 1065N is automatically extended for the same period. If a federal extension of time has been

granted to an estate or trust, the filing date for Form 1041N is automatically extended for six months.

Corporations. When a federal extension of time has been granted and additional time is necessary to file a Nebraska

corporation income tax return, file Form 7004N on or before the date the federal extension expires. Attach a copy of the

Federal Form 7004 filed with the IRS, or a copy of the approved federal extension. A maximum of a seven-month extension

beyond the original due date of the corporation income tax return is allowed for Nebraska.

Partnerships, Estates, and Trusts. Nebraska will only allow partnerships an extension of time up to the maximum

number of months provided by the IRS. Nebraska will allow estates and trusts an extension of up to six months. No additional

Nebraska extension will be granted.

When to File. Form 7004N must be filed on or before the due date of the original return. Corporations may also file

Form 7004N on or before the date that a federal extension expires.

Where to File. Mail Form 7004N to the Nebraska Department of Revenue, PO Box 94818, Lincoln, Nebraska 68509-4818.

Amount of Payment. Payment of the amount shown on line 11 must be remitted either with this form or electronically

using one of the electronic payment options identified below.

Mandates of Electronic Payment. Some entities are required to make their payments (tax, penalty, and interest)

electronically. For mandate purposes, all oF the electronic payment options listed below satisFy the mandate

requirement. all entities are encouraged to make their payments electronically.

Electronic Payment Options

Nebraska e-pay. Nebraska e-pay is the Nebraska Department of Revenue's (DOR's) web-based electronic payment

system. You enter your payment and bank account information, and choose a date (up to a year in advance) to have

your account debited. You will receive an email confirmation for each payment scheduled.

ACH Credit. You (or your bank) create an electronic file in the appropriate ACH file format. It is submitted to the

Federal Reserve and instructs your bank to “credit” the state’s bank account.

Nebraska Tele-pay. Nebraska Tele-pay is DOR's phone-based electronic payment system. Call 800-232-0057, enter

your payment and bank account information, and choose a date (up to a year in advance) to have your account debited.

You will receive a confirmation number at the end of your call.

Credit Card (Corporations only). Secure credit card payments can be initiated through Official Payments at

officialpayments.com; via phone at 800-272-9829; or by downloading the OPAY app from your smart phone’s app

store. Eligible credit cards include American Express, Discover, MasterCard, and VISA. A convenience fee (2.35% of

the payment, $1 minimum) is charged to the card you use. This fee is paid to the credit card vendor, not the state, and

will appear on your credit card statement separately from the payment made to DOR. At the end of your transaction,

you will be given a confirmation number. Keep this number for your records. [If you are making your credit card

payment by phone, you will need to provide the Nebraska Jurisdiction Code, which is 3700.]

Check or Money Order. If you are not using one of the electronic payment options described above, include a check

or money order payable to the “Nebraska Department of Revenue.” Checks written to DOR may be presented for

payment electronically.

Corporate Unitary Group. Members of a unitary group filing a single return using the combined income approach should

only request one extension for the entire group. The name, address, Federal ID number, and Nebraska ID number of each

corporation included in the combined return must be listed on Form 7004N.

Termination of Extension. DORmay, at any time, terminate a C corporation’s extension of time by mailing the taxpayer

a notice of this termination, allowing ten days from the date of the termination notice to file the Nebraska corporate return.

Taxpayer Notification. DORwill notify the applicant if this request for extension is denied.The notice will be sent to the

address entered on Form 7004N. No notice will be sent with respect to approved applications for an extension of time

to file a return.

Signatures. This application must be signed by a corporate officer, fiduciary, partner, member, a person currently enrolled

to practice before the IRS, or an attorney or certified public accountant qualified to practice before the IRS. If the taxpayer

authorizes any other person to sign this application, there must be a power of attorney on file with DOR.

Email. By entering an email address, the taxpayer acknowledges that DOR may contact the taxpayer by email. The taxpayer

accepts any risk to confidentiality associated with this method of communication. DOR will send all confidential information

by secure email or the State of Nebraska’s file share system. If you do not wish to be contacted by email, write “Opt Out”

on the line labeled “email address.”

|