- 24 -

Enlarge image

|

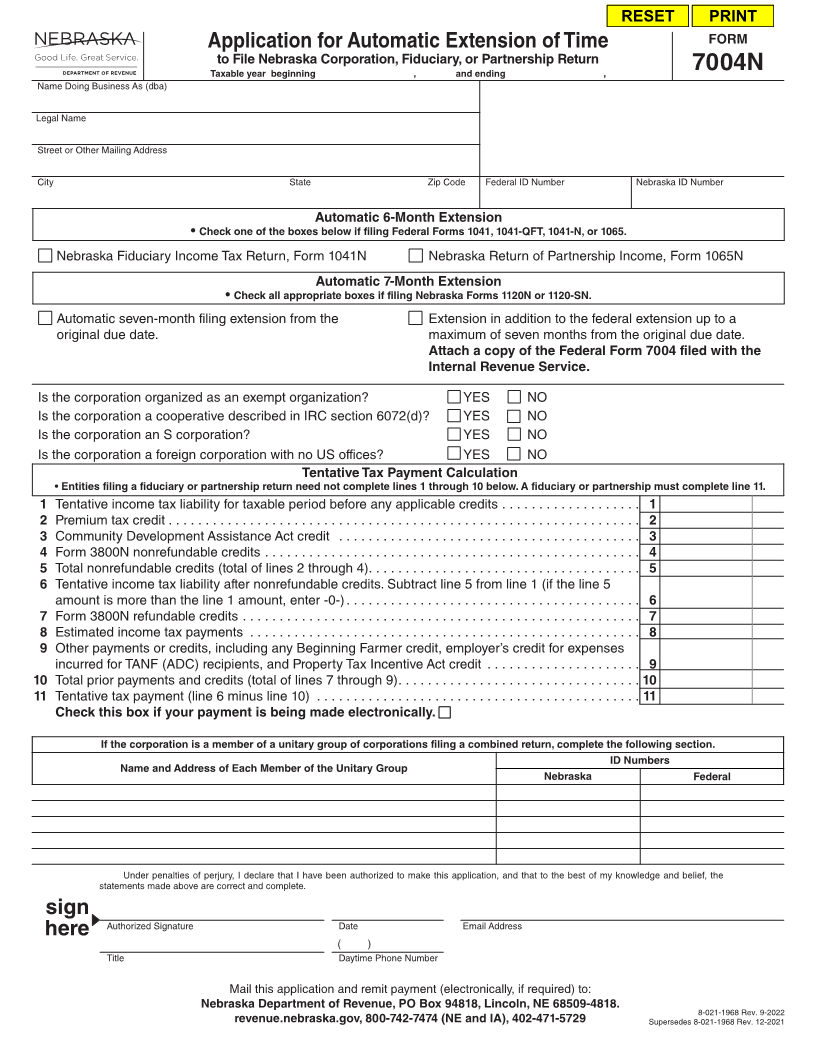

Instructions

Who May File. A corporation (C corporation and S corporation), fiduciary, partnership, or limited liability company

making a tentative tax payment, and/or wanting more time to file a Nebraska tax return, must file a Nebraska

Application for Extension of Time, Form 7004N. The Form 7004N must be filed even if a tentative income tax

payment is made electronically.

If you have filed for a federal extension and are not making a tentative income tax payment to Nebraska, you do

not need to complete this application. When your Nebraska income tax return is filed, you must attach a copy of the

Federal Form 7004 filed with the IRS, or a copy of the approved federal extension. If a federal extension of time has

been granted, the filing date for Forms 1120N, 1120-SN, and 1065N is automatically extended for the same period.

If a federal extension of time has been granted to an estate or trust, the filing date for Form 1041N is automatically

extended for six months.

Corporations. When a federal extension of time has been granted and additional time is necessary to file a Nebraska

corporation income tax return, file Form 7004N on or before the date the federal extension expires. Attach a copy of

the Federal Form 7004 filed with the IRS, or a copy of the approved federal extension. A maximum of a seven-month

extension beyond the original due date of the corporation income tax return is allowed for Nebraska.

Partnerships, Estates, and Trusts. Nebraska will only allow partnerships an extension of time up to the maximum

number of months provided by the IRS. Nebraska will allow estates and trusts an extension of up to six months. No

additional Nebraska extension will be granted.

When to File. Form 7004N must be filed on or before the due date of the original return. Corporations may also file

Form 7004N on or before the date that a federal extension expires.

Where to File. Mail Form 7004N to the Nebraska Department of Revenue, PO Box 94818, Lincoln, Nebraska

68509-4818.

Line 9. Other payments or credits. Enter the total other credits. The property tax incentive act credit includes the

credits for school district property taxes and community college taxes paid.

Amount of Payment. Payment of the amount shown on line 11 must be remitted either with this form or electronically

using one of the electronic payment options identified below.

Mandates of Electronic Payment. Some entities are required to make their payments (tax, penalty, and interest)

electronically. For mandate purposes, all of the electronic payment options listed below satisfy the mandate

requirement. All entities are encouraged to make their payments electronically.

Electronic Payment Options

Nebraska e-pay. Nebraska e-pay is the Nebraska Department of Revenue's (DOR's) web-based electronic

payment system. You enter your payment and bank account information, and choose a date (up to a year in

advance) to have your account debited. You will receive an email confirmation for each payment scheduled.

ACH Credit. You (or your bank) create an electronic file in the appropriate ACH file format. It is submitted to

the Federal Reserve and instructs your bank to “credit” the state’s bank account.

Nebraska Tele-pay. Nebraska Tele-pay is the DOR's phone-based electronic payment system.

Call 800-232-0057, enter your payment and bank account information, and choose a date (up to a year in

advance) to have your account debited. You will receive a confirmation number at the end of your call.

Credit Card (Corporations only). Secure credit card payments can be initiated through ACI Payments, Inc.

at acipayonline.com or via phone at 800-272-9829. Eligible credit cards include American Express, Discover,

MasterCard, and VISA. A convenience fee is charged to the card you use. This fee is paid to the credit card

vendor, not the state, and will appear on your credit card statement separately from the payment made to

the DOR. At the end of your transaction, you will be given a confirmation number. Keep this number for

your records. [If you are making your credit card payment by phone, you will need to provide the Nebraska

Jurisdiction Code, which is 3700.]

Check or Money Order. If you are not using one of the electronic payment options described above, include a check

or money order payable to the “Nebraska Department of Revenue.” Checks written to the DOR may be presented

for payment electronically.

Corporate Unitary Group. Members of a unitary group filing a single return using the combined income approach

should only request one extension for the entire group. The name, address, Federal ID number, and Nebraska ID

number of each corporation included in the combined return must be listed on Form 7004N.

Terminating the Extension. The DOR may, at any time, terminate a C corporation’s extension of time by mailing

the taxpayer a notice of termination and allowing ten days from the date of the termination notice to file the Nebraska

corporate return.

Taxpayer Notification. The DOR will notify the applicant if this request for extension is denied. The notice will be

sent to the address entered on Form 7004N. No notice will be sent with respect to approved applications for an extension

of time to file a return.

Signatures. This application must be signed by a corporate officer, fiduciary, partner, member, a person currently

enrolled to practice before the IRS, or an attorney or certified public accountant qualified to practice before the IRS.

If the taxpayer authorizes any other person to sign this application, there must be a power of attorney on file with the

DOR.

|