Enlarge image

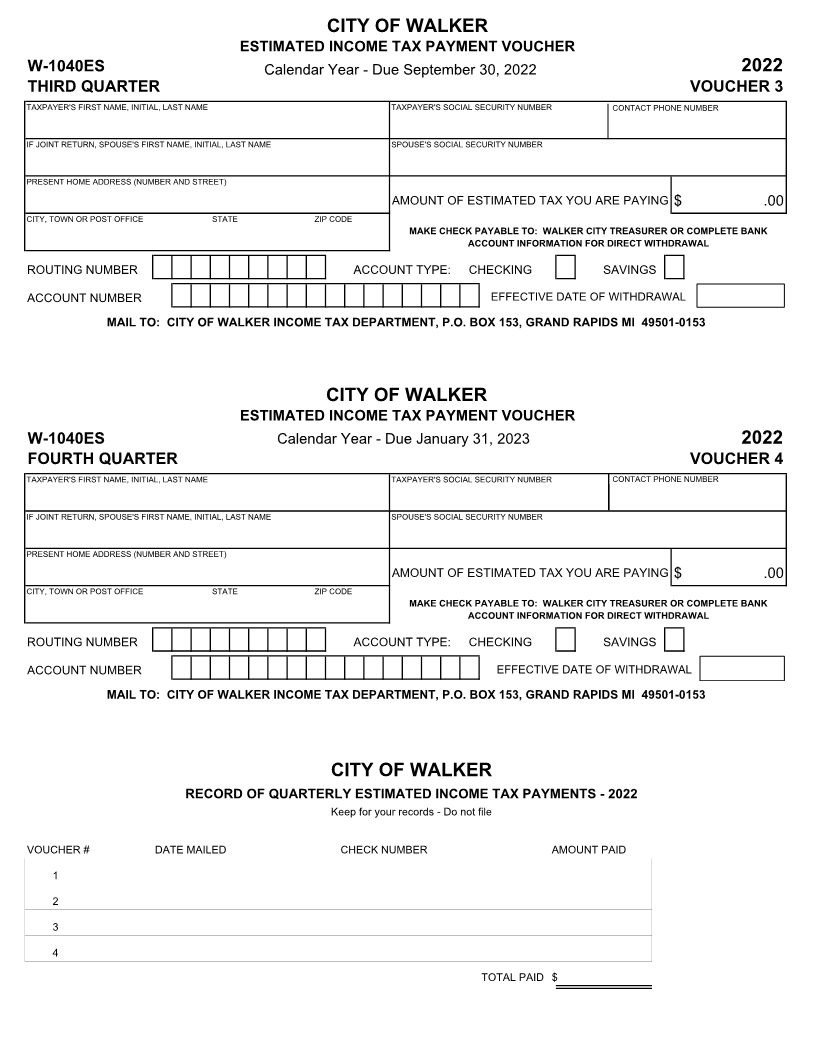

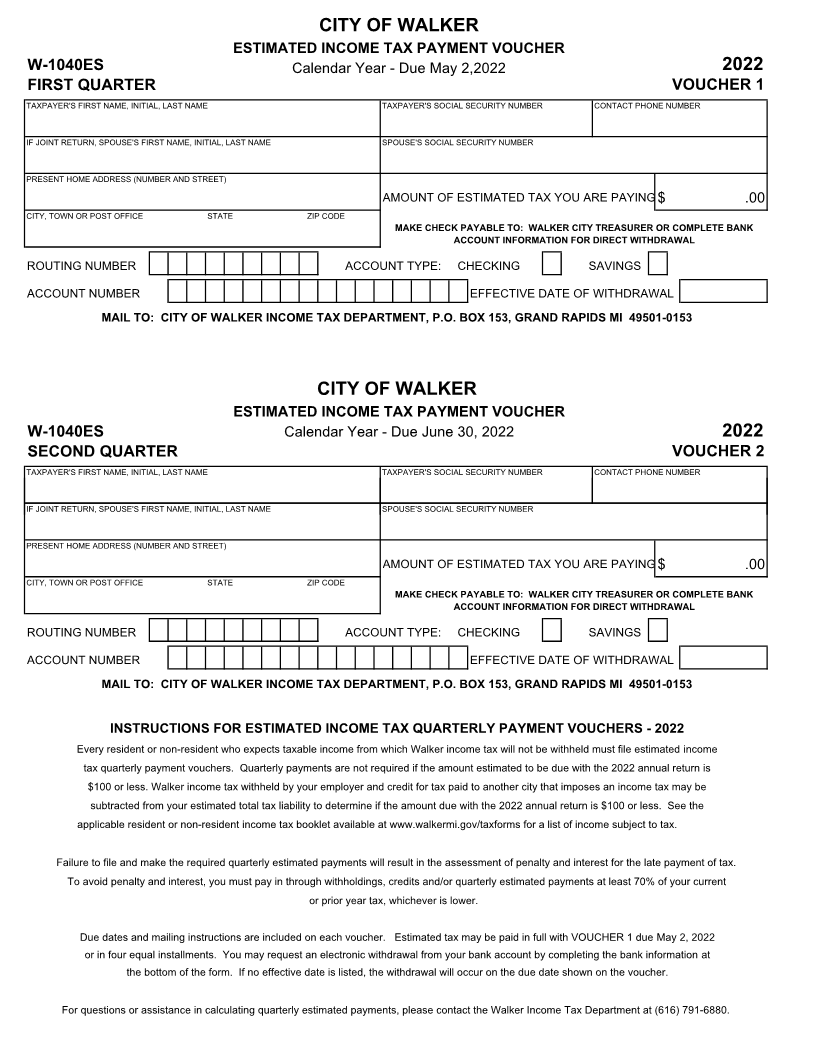

CITY OF WALKER

ESTIMATED INCOME TAX PAYMENT VOUCHER

W-1040ES Calendar Year - Due May 2,2022 2022

FIRST QUARTER VOUCHER 1

TAXPAYER'S FIRST NAME, INITIAL, LAST NAME TAXPAYER'S SOCIAL SECURITY NUMBER CONTACT PHONE NUMBER

IF JOINT RETURN, SPOUSE'S FIRST NAME, INITIAL, LAST NAME SPOUSE'S SOCIAL SECURITY NUMBER

PRESENT HOME ADDRESS (NUMBER AND STREET)

AMOUNT OF ESTIMATED TAX YOU ARE PAYING $ .00

CITY, TOWN OR POST OFFICE STATE ZIP CODE

MAKE CHECK PAYABLE TO: WALKER CITY TREASURER OR COMPLETE BANK

ACCOUNT INFORMATION FOR DIRECT WITHDRAWAL

ROUTING NUMBER ACCOUNT TYPE: CHECKING SAVINGS

ACCOUNT NUMBER EFFECTIVE DATE OF WITHDRAWAL

MAIL TO: CITY OF WALKER INCOME TAX DEPARTMENT, P.O. BOX 153, GRAND RAPIDS MI 49501-0153

CITY OF WALKER

ESTIMATED INCOME TAX PAYMENT VOUCHER

W-1040ES Calendar Year - Due June 30, 20 22 2022

SECOND QUARTER VOUCHER 2

TAXPAYER'S FIRST NAME, INITIAL, LAST NAME TAXPAYER'S SOCIAL SECURITY NUMBER CONTACT PHONE NUMBER

IF JOINT RETURN, SPOUSE'S FIRST NAME, INITIAL, LAST NAME SPOUSE'S SOCIAL SECURITY NUMBER

PRESENT HOME ADDRESS (NUMBER AND STREET)

AMOUNT OF ESTIMATED TAX YOU ARE PAYING $ .00

CITY, TOWN OR POST OFFICE STATE ZIP CODE

MAKE CHECK PAYABLE TO: WALKER CITY TREASURER OR COMPLETE BANK

ACCOUNT INFORMATION FOR DIRECT WITHDRAWAL

ROUTING NUMBER ACCOUNT TYPE: CHECKING SAVINGS

ACCOUNT NUMBER EFFECTIVE DATE OF WITHDRAWAL

MAIL TO: CITY OF WALKER INCOME TAX DEPARTMENT, P.O. BOX 153, GRAND RAPIDS MI 49501-0153

INSTRUCTIONS FOR ESTIMATED INCOME TAX QUARTERLY PAYMENT VOUCHERS - 2022

Every resident or non-resident who expects taxable income from which Walker income tax will not be withheld must file estimated income

tax quarterly payment vouchers. Quarterly payments are not required if the amount estimated to be due with the 2022 annual return is

$100 or less. Walker income tax withheld by your employer and credit for tax paid to another city that imposes an income tax may be

subtracted from your estimated total tax liability to determine if the amount due with the 2022 annual return is $100 or less. See the

applicable resident or non-resident income tax booklet available at www.walkermi.gov/taxforms for a list of income subject to tax.

Failure to file and make the required quarterly estimated payments will result in the assessment of penalty and interest for the late payment of tax.

To avoid penalty and interest, you must pay in through withholdings, credits and/or quarterly estimated payments at least 70% of your current

or prior year tax, whichever is lower.

Due dates and mailing instructions are included on each voucher. Estimated tax may be paid in full with VOUCHER 1 due May 2, 2022

or in four equal installments. You may request an electronic withdrawal from your bank account by completing the bank information at

the bottom of the form. If no effective date is listed, the withdrawal will occur on the due date shown on the voucher.

For questions or assistance in calculating quarterly estimated payments, please contact the Walker Income Tax Department at (616) 791-6880.