- 5 -

Enlarge image

|

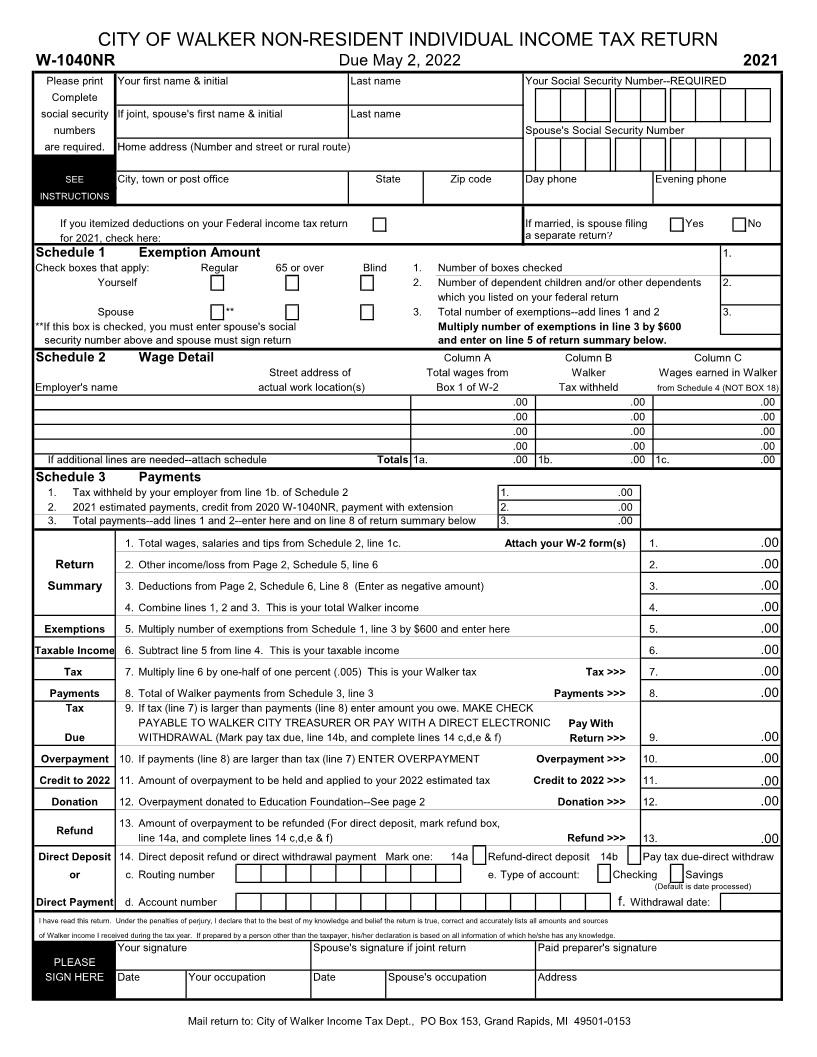

If your Schedule C business is operated entirely within Walker, enter Line 3—Moving expenses

your Schedule C income/loss on line 1a. Enter your SEP deduction, if Moving expenses for certain Armed Forced members only that qualify

applicable, on line 1b. Subtract line 1b. from 1a. and enter the result on line under the Internal Revenue Code as a deduction from federal gross income

1c. If you have deducted a SEP contribution on line 1b. you must attach may be deducted on your Walker return. However, the Walker deduction is

a copy of Schedule 1 of your Federal Form 1040. limited to those expenses that are applicable to income taxable under the

If your Schedule C business is operated partly within Walker and partly Walker Income Tax Ordinance.

within another locality, complete Worksheets 1 and 2 on page 2 to calculate You must attach a copy of Federal Form 3903 or a list of your moving

the amount to be entered on line 1. expenses, including the distance in miles from where you moved.

If your Schedule C business is operated entirely outside of Walker, do Line 7—Alimony deduction (CHILD SUPPORT IS NOT DEDUCTIBLE)

not enter an amount on line 1a. or 1b. Alimony deducted on your 2021 federal return is subject to adjustment

Line 2—Income/loss from rents/royalties (for filers of Federal Schedule before it may be deducted on this return. The alimony adjustment is

E, page one) computed as follows:

If you have rent/royalty income/loss from property located in Walker, Walker Income (Line 4, Page 1)

enter the applicable amount from your Federal Schedule E, page one on line (without alimony deduction) X Alimony Paid

2. Attach a copy of Federal Schedule E. Federal Adjusted Gross Income

Line 3—Income/loss from partnerships (for filers of Federal Schedule E, (without alimony deduction)

page two) You must attach a copy of Schedule 1 of your Federal Form 1040.

Enter your share of the partnership income/loss on line 3 of Schedule 5.

Enter your share of ordinary income only. Your share of qualifying COMPLETING YOUR RETURN

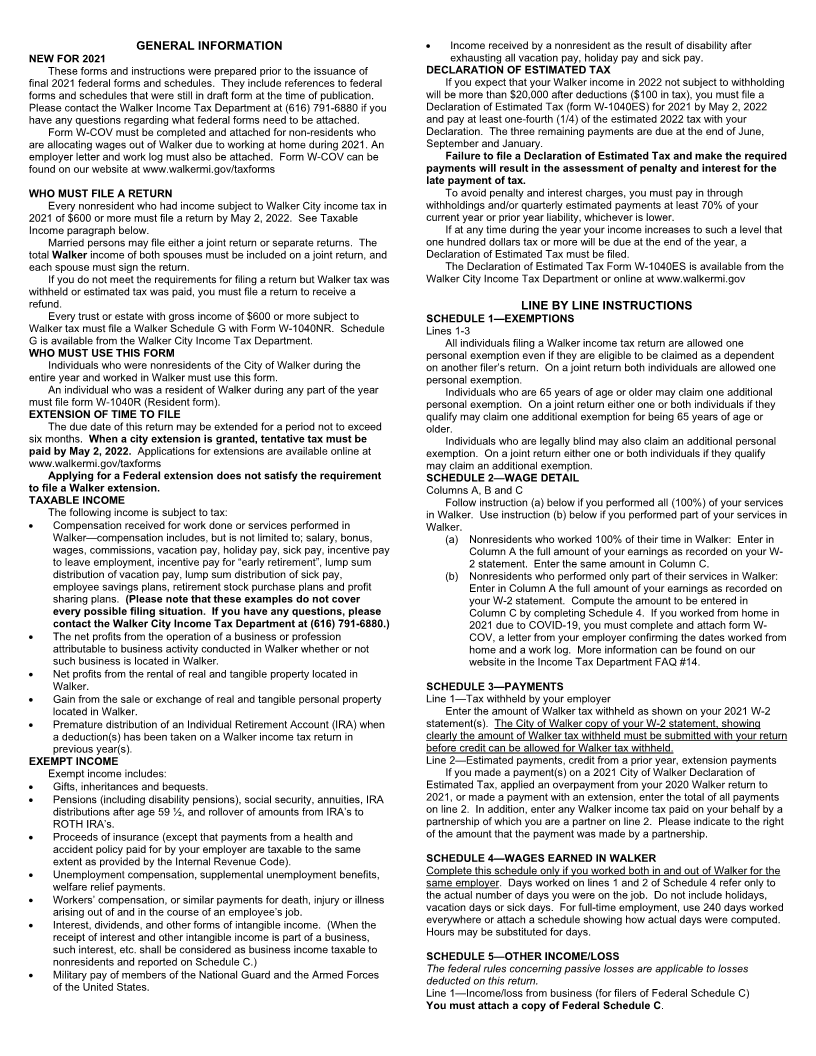

dividends, gains, etc. are treated as belonging to you as an individual. After completing schedules 1 through 6 as applicable, transfer the

A partner is not allowed to apportion income distributed by a results of schedules 1 through 6 to lines 1, 2, 3, 5 and 8 on the front of the

partnership. All apportionment of distributed income must be made on the form.

Walker Partnership Return, form W-1065. Follow the instructions on the front of the form for lines 4, 6 and 7.

If you are a shareholder in a corporation that has elected to file under Line 9—Tax due

Subchapter S of the Internal Revenue Code, you are not required to report If after computing your Walker Income tax and deducting your payments

any distributed income nor may you deduct your share of any loss or other and credits, the balance due is one dollar ($1.00) or more, it must be

deductions distributed by the corporation. entered on Line 9.

Line 4—Income/loss from sale or exchange of property (for filers of Federal Make check or money order payable to CITY TREASURER and mail

Schedule D or Form 4797) with this return to: WALKER CITY INCOME TAX DEPARTMENT, P.O. BOX

Enter on line 4 the gain/loss from the sale or exchange of real or 153, GRAND RAPIDS, MI 49501-0153. For direct electronic withdrawal,

tangible personal property located in Walker. The Walker Income Tax mark pay tax due, line 14b, and complete lines 14c, de, e and f. Withdrawal

Ordinance follows the Internal Revenue Code in its treatment of capital date (line 14f) must be no later than the due date of the return. If no date is

gains. All capital gains received from the sale or exchange of real or entered, the default withdrawal date will be the date processed.

tangible personal property located within the City of Walker are fully taxable Line 10—Overpayment

on this return. If your total payments and credits on line 9 are more than Walker Tax on

Attach Federal Schedule D and Form 8949. Also attach Form 4797 line 7, you have overpaid your tax for 2021.

and Form 6252 if applicable. 1. If you want your overpayment to be HELD and applied to your 2022

Line 5—Premature Pension/IRA distribution(s) estimated tax, enter the overpayment on line 11.

Enter on line 5 premature distributions (before age 59 ½) from an IRA 2. If you want your overpayment to be DONATED to the Education

when a deduction has been taken on a current or previous year’s Walker Foundation of your choice, enter the overpayment on line 12. Select

Income Tax return and/or premature distributions from a pension plan. If the Education Foundation on page 2.

you have completed Schedule 4, apply the percentage on Schedule 4, Line 3. If you want your overpayment MAILED to you, enter the overpayment

3 to your total distribution and enter the taxable portion of the distribution on on line 13.

line 5. 4. If you want your overpayment REFUNDED VIA DIRECT DEPOSIT,

enter the overpayment on line 13 and complete the routing number,

SCHEDULE 6—DEDUCTIONS--All deductions are limited to the extent they type of account and account number boxes provided in line 14.

apply to income earned in Walker. The only deductions allowed by the Refunds or credits of less than one dollar ($1.00) cannot be made.

Income Tax Ordinance are:

Line 1—IRA deduction THIRD PARTY DESIGNEE

The rules governing IRA deductions on this return are the same as If you want to allow a friend, family member or any other person you

under the Internal Revenue Code. Contributions to ROTH IRA’s are not choose to discuss your 2021 tax return with the Income Tax Department,

deductible. If your earned income on which the federal IRA deduction is give the Department any information missing from your return, receive

based is earned both in and out of Walker, you must apportion your IRA copies of notices and/or respond to notices about math errors, offsets and

deduction regardless of whether the income is from a single employer or return preparation, check the “Yes” box in the designated area. Enter the

multiple employers. See the worksheet under the FAQ section of the designee’s name and phone number. To designate the preparer who

Walker website at www.walkermi.gov/incometaxFAQs signed your return, enter “Preparer” in the space for designee’s name.

Attach Schedule 1 of Federal Form 1040.

A SEP retirement plan deduction must be entered on line 1b. of ASSISTANCE

Schedule 5. If you have questions not answered in these instructions or if you need

Line 2—Employee business expenses assistance in preparing your return, call (616) 791-6880.

The employee business expenses listed below are not subject to the We would be happy to prepare your Walker Income Tax Return free of

same reductions and limitations required under the Internal Revenue Code. charge. Please contact the Walker Income Tax Department at 791-6880 for

These expenses are, however, allowed only to the extent not paid or an appointment.

reimbursed by your employer and only when incurred in the performance of Questions by mail should be directed to: Walker City Income Tax

service for your employer. Department, P.O. Box 153, Grand Rapids, MI 49501-0153.

The only deductions allowed by the City of Walker Income Tax

Ordinance are as follows: NOTICE

• Expenses of travel, meals and lodging while away from home These instructions are an interpretation of the Walker City Income Tax

• Expenses as an outside salesperson who works away from his Ordinance. If any discrepancy exists between the instructions and the

employer’s place of business (does not include driver/salesperson Ordinance, the Ordinance prevails.

whose primary duty is service and delivery).

• Expenses of transportation (but not transportation to and from

work).

• Expenses reimbursed under an expense account or other

arrangement with your employer, if the reimbursement has been

included in reported gross earnings.

You must attach a detailed list of your employee business expenses.

|