Enlarge image

Income Tax Department

601 Avenue A, Springfield, MI 49037-7774

Phone 269-965-8324 Fax 269-965-8211 www.springfieldmich.com E-Mail: incometax@springfieldmich.com

ARE YOU REQUIRED TO PAY WHO MUST PAY ESTIMATED TAX QUARTERLY:

ESTIMATED TAX FOR 2023? INDIVIDUALS AND UNINCORPORATED BUSINESS:

If you are a resident or non-resident and expect taxable income from which City

Do you expect to owe of Springfield income tax will not be withheld by an employer, you must file and

$100.00 ($250.00 for pay estimated tax. If you estimate your tax to be $100.00 or less, you do not

Corporations) or more for have to pay estimated tax. A husband and wife may file and pay joint estimated

2022 after subtracting tax.

income tax withholdings and

credits from your total tax? CORPORATIONS:

Every corporation subject to the City of Springfield income tax must file and pay

(Do not subtract any

estimated tax on all or part of its net income if the estimated tax is $250.00 or

estimated tax payments). If more.

you answered yes, go to

the next question. PARTNERSHIPS:

A partnership whose partners are subject to the City of Springfield income tax

Do you expect your income on all or part of the distributive share of net profits, may file and pay estimated

tax withholdings and credits tax with the City as a partnership. The partners will not be required to file as

to be at least 70% of the tax individuals unless they have other income in which the Springfield income tax is

expected to exceed $100.00.

shown on your 2022 tax

return? PENALTY AND INTEREST:

If you answered yes, you If the total amount of tax paid by January 31 stis less than 70% of last year’s tax

are not required to make return or this year’s total tax, penalty and interest will be assessed.

estimated tax payments

NOTE: The payment of estimated tax does not excuse the taxpayer from

for 2023.

filing an annual tax return.

If you answered

No, you are required to FILING AND PAYMENTS

make estimated tax Vouchers may be obtained from the Income Tax Department or on our web

page (address above). The estimated tax may be paid in full with the first

payments for 2023.

voucher or paid in four (4) equal installments.

See work sheet on reverse Penalty and interest will be assessed if payment is not received on time.

side.

First Quarter Due by April 30, 2023

Second Quarter Due by June 30, 2023

Third Quarter Due by September30,2023

Fourth Quarter Due by January 31, 2024

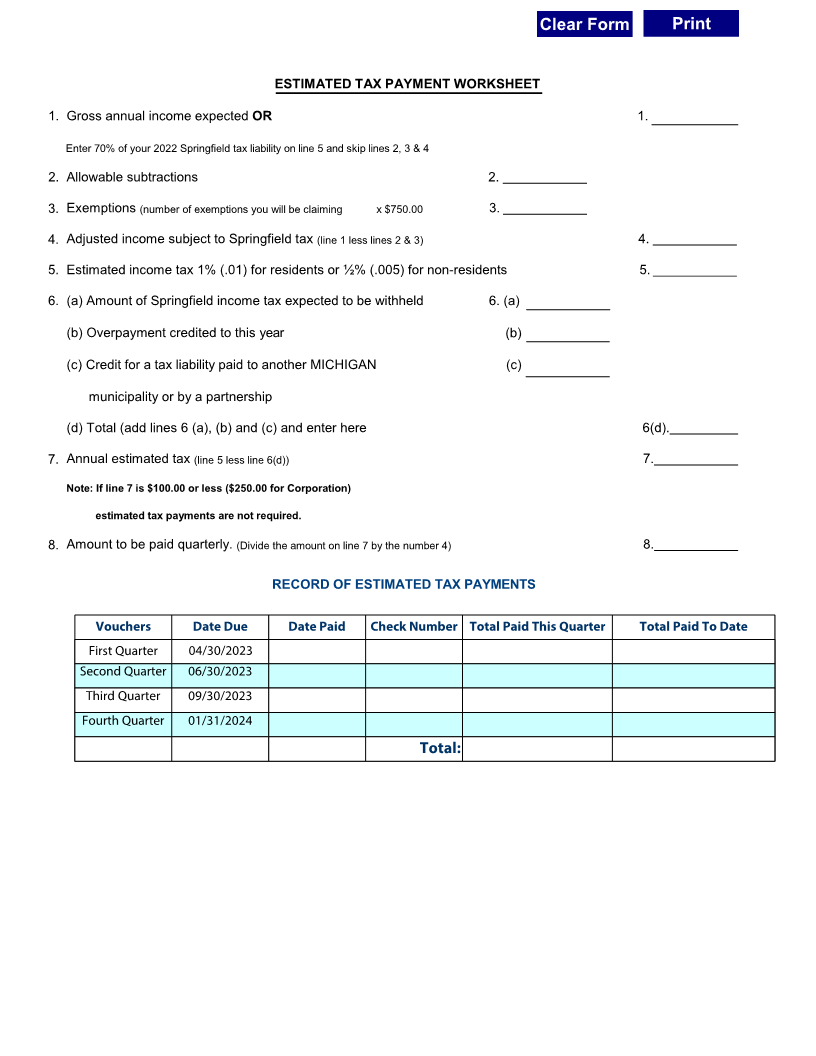

HOW TO CALCULATE YOUR ESTIMATED INCOME TAX:

INDIVIDUAL OR UNINCORPORATED BUSINESS:

Estimate the total amount of your expected gross income. Subtract allowed

exemptions & deductions. Multiply the remainder by 1% (.01) for residents and

½% (.005) for non–residents.

CORPORATIONS:

Net allocated income times 1% (.01).

PARTNERSHIPS:

The liability for a RESIDENT PARTNER is 1% (.01) of their entire distributive

share of net profits regardless of where the activity of the partnership is

conducted. NON-RESIDENT PARTNER tax rate is ½% (.005) based on the

distributive share of City of Springfield income.