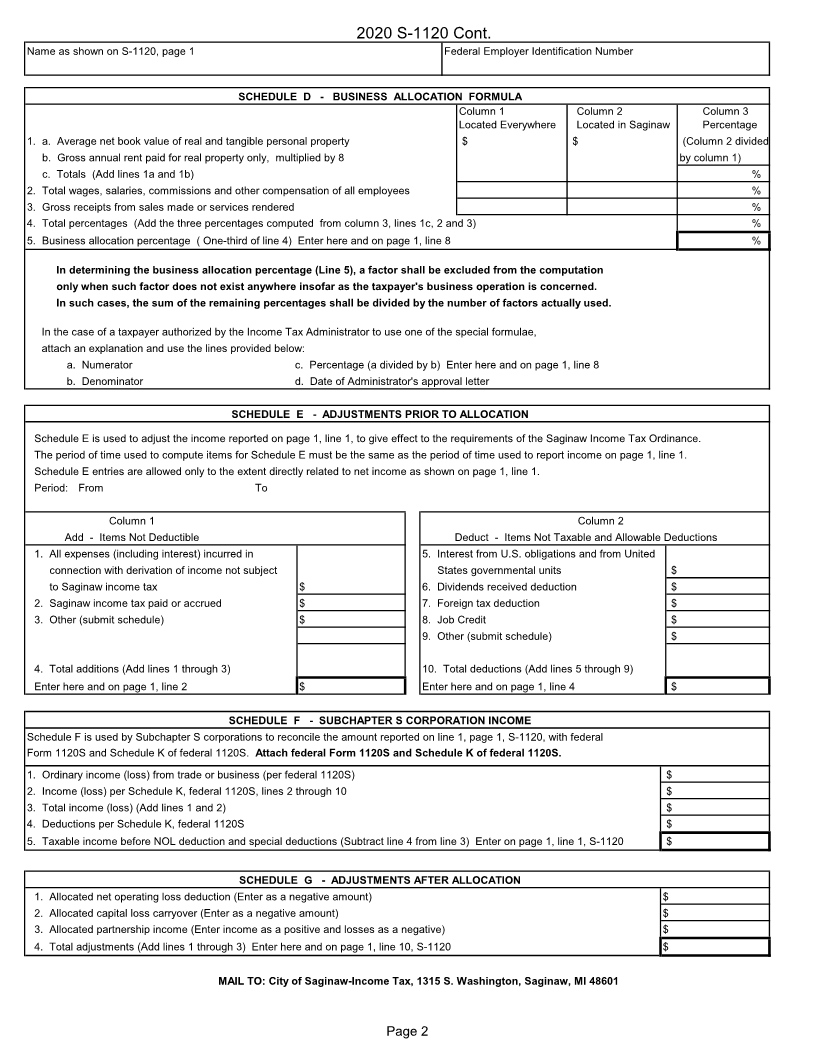

Enlarge image

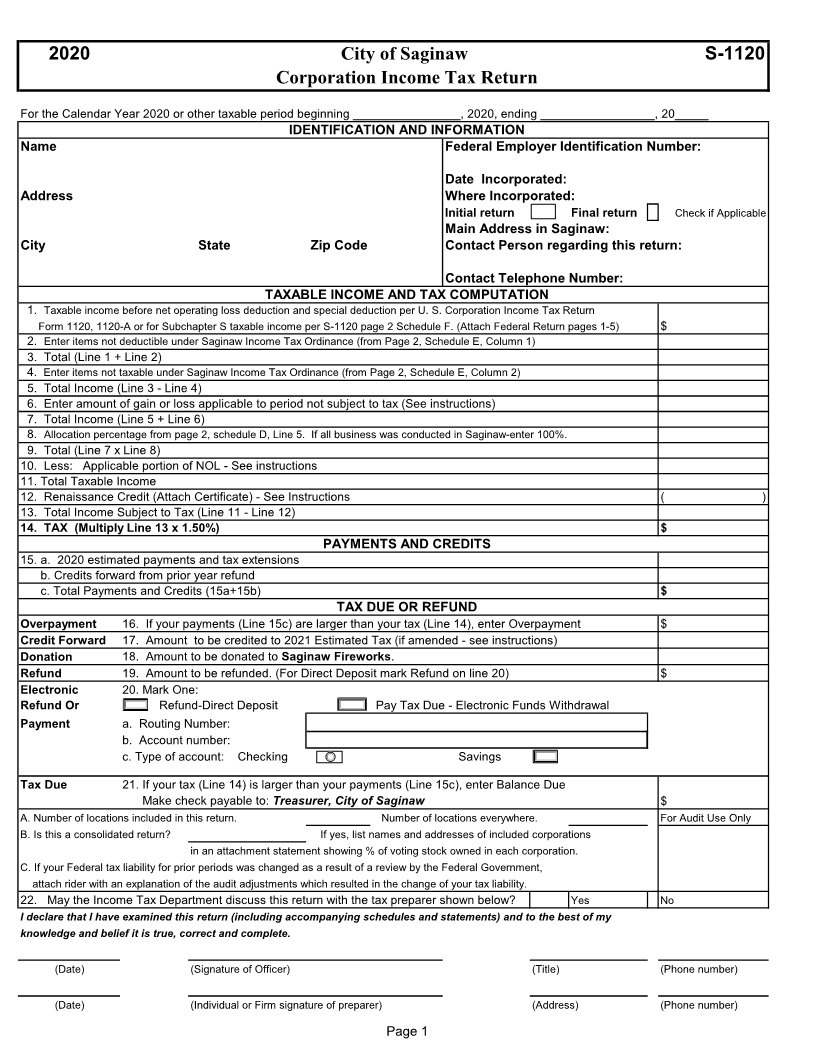

2020 City of Saginaw S-1120

Corporation Income Tax Return

For the Calendar Year 2020 or other taxable period beginning ________________, 2020, ending _________________, 20_____

IDENTIFICATION AND INFORMATION

Name Federal Employer Identification Number:

Date Incorporated:

Address Where Incorporated:

Initial return D Final return Check if Applicable

Main Address in Saginaw: □

City State Zip Code Contact Person regarding this return:

Contact Telephone Number:

TAXABLE INCOME AND TAX COMPUTATION

1. Taxable income before net operating loss deduction and special deduction per U. S. Corporation Income Tax Return

Form 1120, 1120-A or for Subchapter S taxable income per S-1120 page 2 Schedule F. (Attach Federal Return pages 1-5) $

2. Enter items not deductible under Saginaw Income Tax Ordinance (from Page 2, Schedule E, Column 1)

3. Total (Line 1 + Line 2)

4. Enter items not taxable under Saginaw Income Tax Ordinance (from Page 2, Schedule E, Column 2)

5. Total Income (Line 3 - Line 4)

6. Enter amount of gain or loss applicable to period not subject to tax (See instructions)

7. Total Income (Line 5 + Line 6)

8. Allocation percentage from page 2, schedule D, Line 5. If all business was conducted in Saginaw-enter 100%.

9. Total (Line 7 x Line 8)

10. Less: Applicable portion of NOL - See instructions

11. Total Taxable Income

12. Renaissance Credit (Attach Certificate) - See Instructions ( )

13. Total Income Subject to Tax (Line 11 - Line 12)

14. TAX (Multiply Line 13 x 1.50%) $

PAYMENTS AND CREDITS

15. a. 2020 estimated payments and tax extensions

b. Credits forward from prior year refund

c. Total Payments and Credits (15a+15b) $

TAX DUE OR REFUND

Overpayment 16. If your payments (Line 15c) are larger than your tax (Line 14), enter Overpayment $

Credit Forward 17. Amount to be credited to 2021 Estimated Tax (if amended - see instructions)

Donation 18. Amount to be donated to Saginaw Fireworks.

Refund 19. Amount to be refunded. (For Direct Deposit mark Refund on line 20) $

Electronic 20. Mark One:

Refund Or D Refund-Direct Deposit CJ Pay Tax Due - Electronic Funds Withdrawal

Payment a. Routing Number: I I

b. Account number: I I

c. Type of account: Checking D Savings D

Tax Due 21. If your tax (Line 14) is larger than your payments (Line 15c), enter Balance Due

Make check payable to: Treasurer, City of Saginaw $

A. Number of locations included in this return. Number of locations everywhere. For Audit Use Only

B. Is this a consolidated return? If yes, list names and addresses of included corporations

in an attachment statement showing % of voting stock owned in each corporation.

C. If your Federal tax liability for prior periods was changed as a result of a review by the Federal Government,

attach rider with an explanation of the audit adjustments which resulted in the change of your tax liability.

22. May the Income Tax Department discuss this return with the tax preparer shown below? I I Yes I No

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my

knowledge and belief it is true, correct and complete.

(Date) (Signature of Officer) (Title) (Phone number)

(Date) (Individual or Firm signature of preparer) (Address) (Phone number)

Page 1