Enlarge image

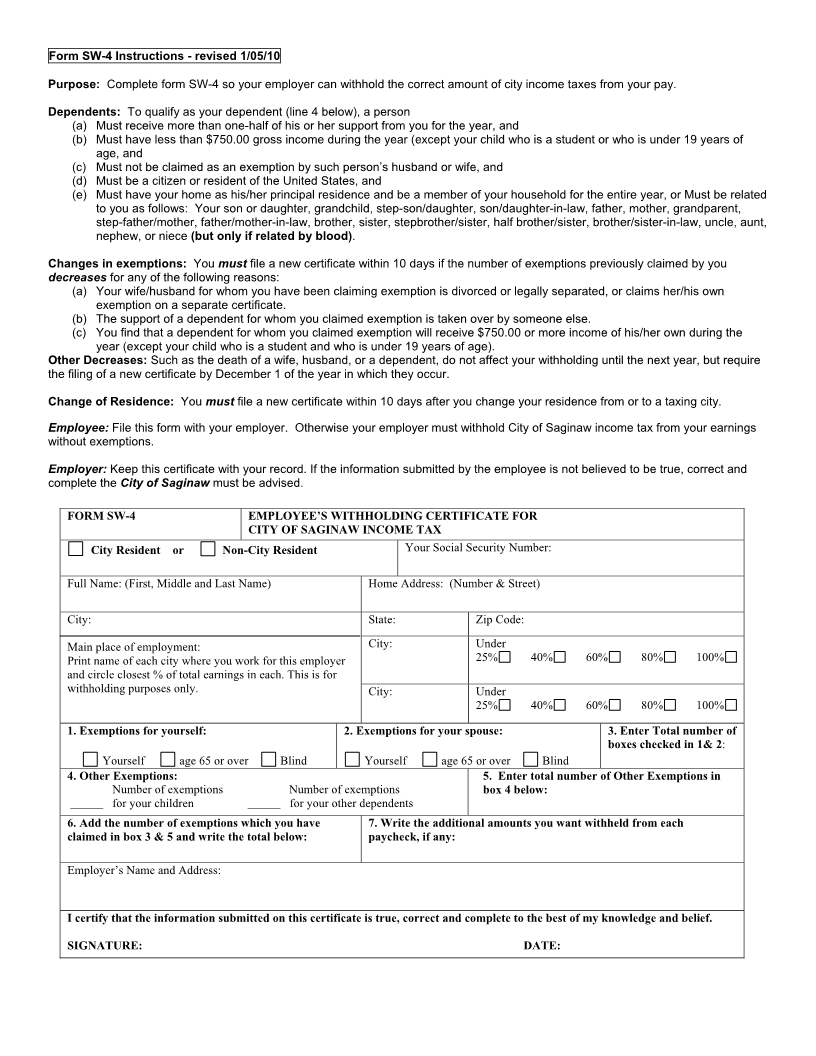

Form SW-4 Instructions - revised 1/05/10

Purpose: Complete form SW-4 so your employer can withhold the correct amount of city income taxes from your pay.

Dependents: To qualify as your dependent (line 4 below), a person

(a) Must receive more than one-half of his or her support from you for the year, and

(b) Must have less than $750.00 gross income during the year (except your child who is a student or who is under 19 years of

age, and

(c) Must not be claimed as an exemption by such person’s husband or wife, and

(d) Must be a citizen or resident of the United States, and

(e) Must have your home as his/her principal residence and be a member of your household for the entire year, or Must be related

to you as follows: Your son or daughter, grandchild, step-son/daughter, son/daughter-in-law, father, mother, grandparent,

step-father/mother, father/mother-in-law, brother, sister, stepbrother/sister, half brother/sister, brother/sister-in-law, uncle, aunt,

nephew, or niece (but only if related by blood).

Changes in exemptions: You must file a new certificate within 10 days if the number of exemptions previously claimed by you

decreases for any of the following reasons:

(a) Your wife/husband for whom you have been claiming exemption is divorced or legally separated, or claims her/his own

exemption on a separate certificate.

(b) The support of a dependent for whom you claimed exemption is taken over by someone else.

(c) You find that a dependent for whom you claimed exemption will receive $750.00 or more income of his/her own during the

year (except your child who is a student and who is under 19 years of age).

Other Decreases: Such as the death of a wife, husband, or a dependent, do not affect your withholding until the next year, but require

the filing of a new certificate by December 1 of the year in which they occur.

Change of Residence: You must file a new certificate within 10 days after you change your residence from or to a taxing city.

Employee: File this form with your employer. Otherwise your employer must withhold City of Saginaw income tax from your earnings

without exemptions.

Employer: Keep this certificate with your record. If the information submitted by the employee is not believed to be true, correct and

complete the City of Saginaw must be advised.

FORM SW-4 EMPLOYEE’S WITHHOLDING CERTIFICATE FOR

CITY OF SAGINAW INCOME TAX

City Resident or Non-City Resident Your Social Security Number:

Full Name: (First, Middle and Last Name) Home Address: (Number & Street)

City: State: Zip Code:

Main place of employment: City: Under

Print name of each city where you work for this employer 25% 40% 60% 80% 100%

and circle closest % of total earnings in each. This is for

withholding purposes only. City: Under

25% 40% 60% 80% 100%

1. Exemptions for yourself: 2. Exemptions for your spouse: 3. Enter Total number of

boxes checked in 1& 2:

Yourself age 65 or over Blind Yourself age 65 or over Blind

4. Other Exemptions: 5. Enter total number of Other Exemptions in

Number of exemptions Number of exemptions box 4 below:

for your children for your other dependents

6. Add the number of exemptions which you have 7. Write the additional amounts you want withheld from each

claimed in box 3 & 5 and write the total below: paycheck, if any:

Employer’s Name and Address:

I certify that the information submitted on this certificate is true, correct and complete to the best of my knowledge and belief.

SIGNATURE: DATE: