- 2 -

Enlarge image

|

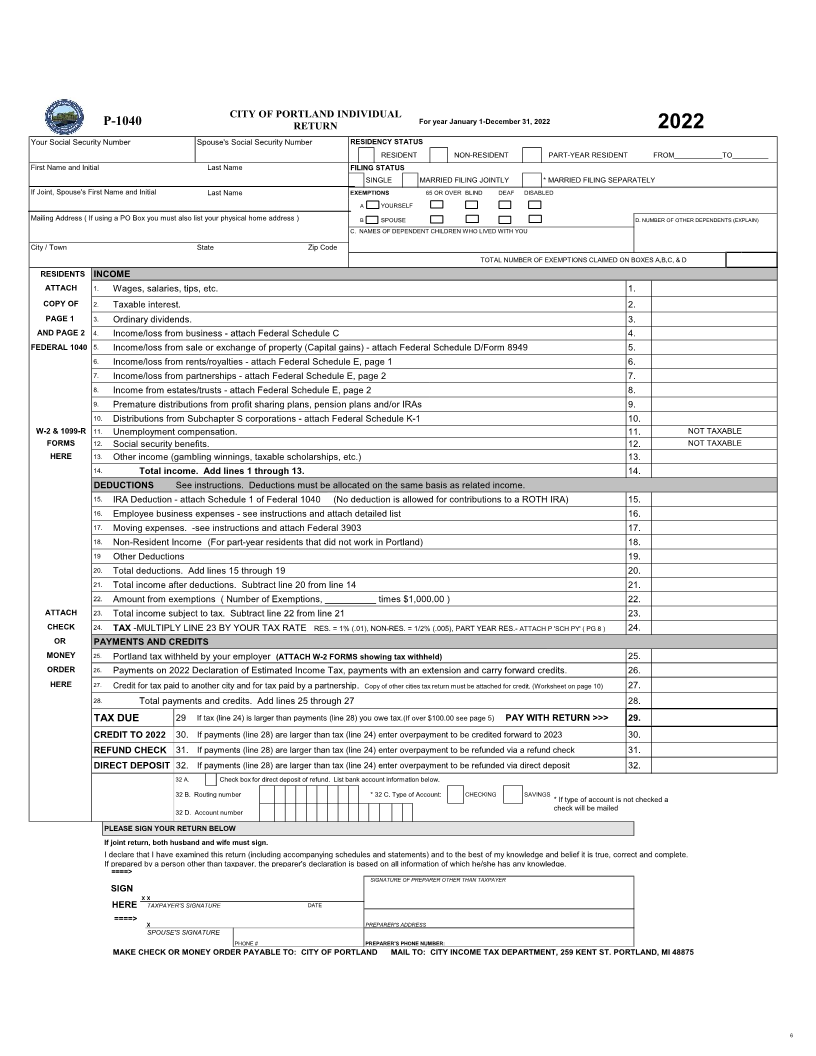

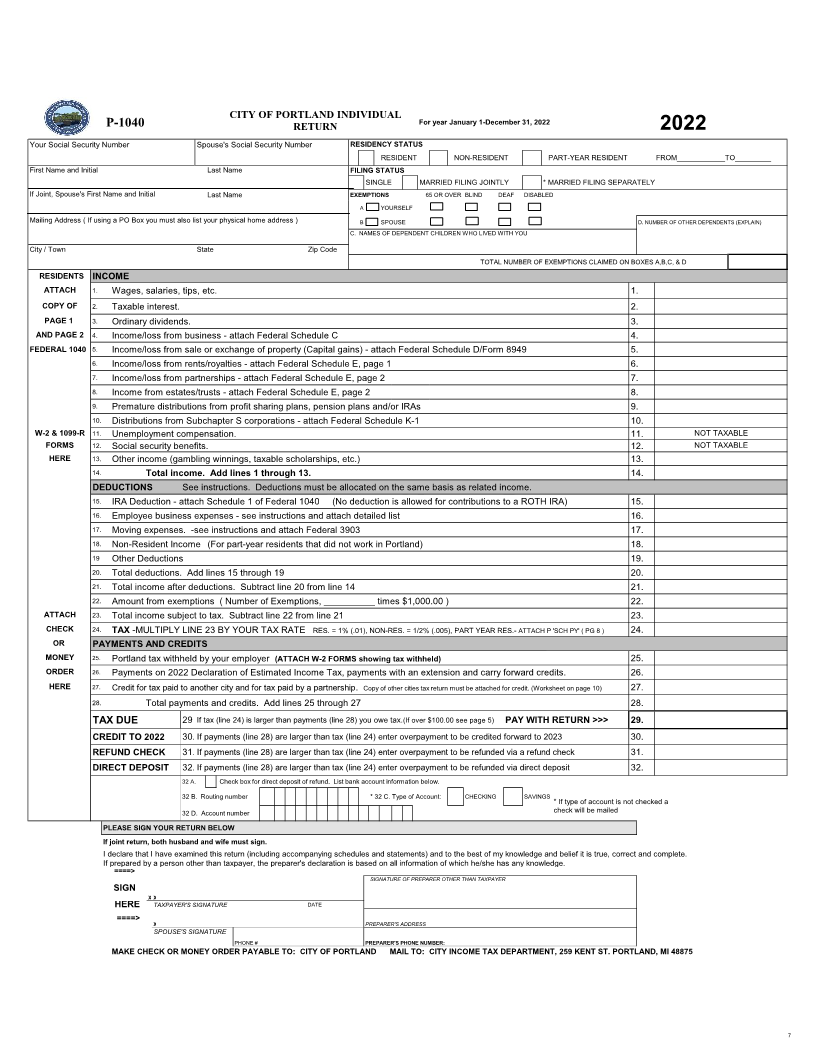

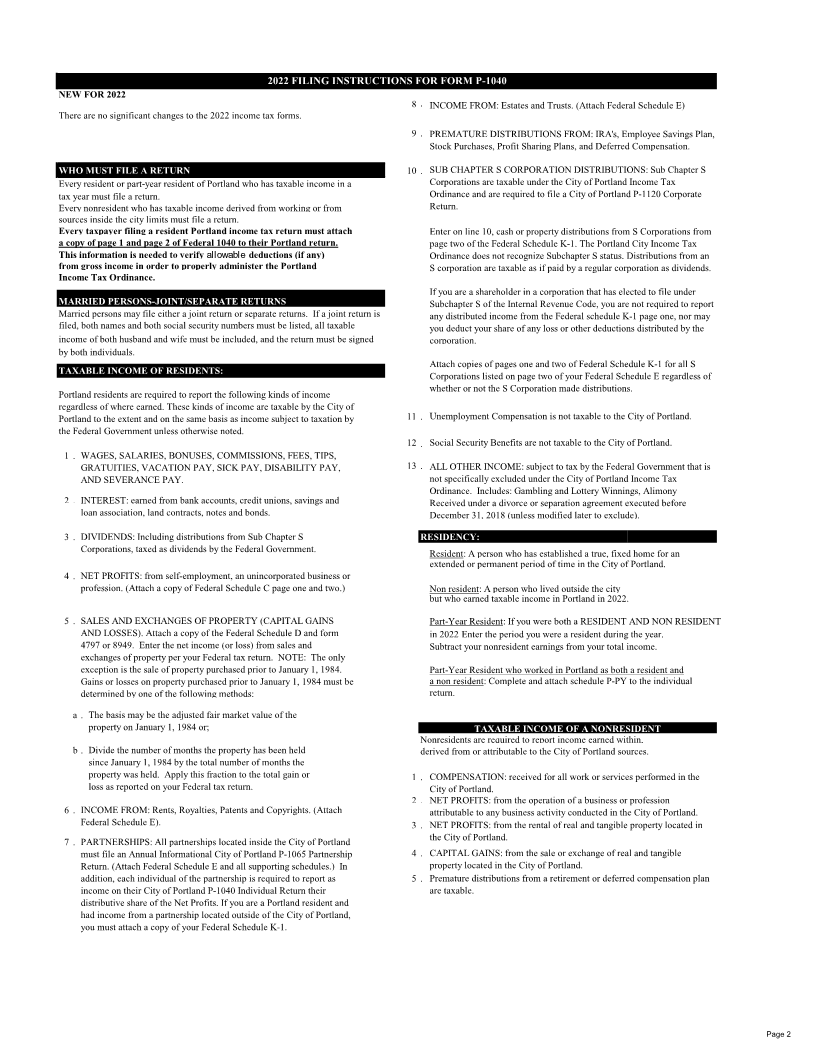

2022 FILING INSTRUCTIONS FOR FORM P-1040

NEW FOR 2022

8 . INCOME FROM: Estates and Trusts. (Attach Federal Schedule E)

There are no significant changes to the 2022 income tax forms.

9 . PREMATURE DISTRIBUTIONS FROM: IRA's, Employee Savings Plan,

Stock Purchases, Profit Sharing Plans, and Deferred Compensation.

WHO MUST FILE A RETURN 10 . SUB CHAPTER S CORPORATION DISTRIBUTIONS: Sub Chapter S

Every resident or part-year resident of Portland who has taxable income in a Corporations are taxable under the City of Portland Income Tax

tax year must file a return. Ordinance and are required to file a City of Portland P-1120 Corporate

Every nonresident who has taxable income derived from working or from Return.

sources inside the city limits must file a return.

Every taxpayer filing a resident Portland income tax return must attach Enter on line 10, cash or property distributions from S Corporations from

a copy of page 1 and page 2 of Federal 1040 to their Portland return. page two of the Federal Schedule K-1. The Portland City Income Tax

This information is needed to verify allowable deductions (if any) Ordinance does not recognize Subchapter S status. Distributions from an

from gross income in order to properly administer the Portland S corporation are taxable as if paid by a regular corporation as dividends.

Income Tax Ordinance.

If you are a shareholder in a corporation that has elected to file under

MARRIED PERSONS-JOINT/SEPARATE RETURNS Subchapter S of the Internal Revenue Code, you are not required to report

Married persons may file either a joint return or separate returns. If a joint return is any distributed income from the Federal schedule K-1 page one, nor may

filed, both names and both social security numbers must be listed, all taxable you deduct your share of any loss or other deductions distributed by the

income of both husband and wife must be included, and the return must be signed corporation.

by both individuals.

Attach copies of pages one and two of Federal Schedule K-1 for all S

TAXABLE INCOME OF RESIDENTS: Corporations listed on page two of your Federal Schedule E regardless of

Portland residents are required to report the following kinds of income whether or not the S Corporation made distributions.

regardless of where earned. These kinds of income are taxable by the City of

Portland to the extent and on the same basis as income subject to taxation by 11 . Unemployment Compensation is not taxable to the City of Portland.

the Federal Government unless otherwise noted.

12 . Social Security Benefits are not taxable to the City of Portland.

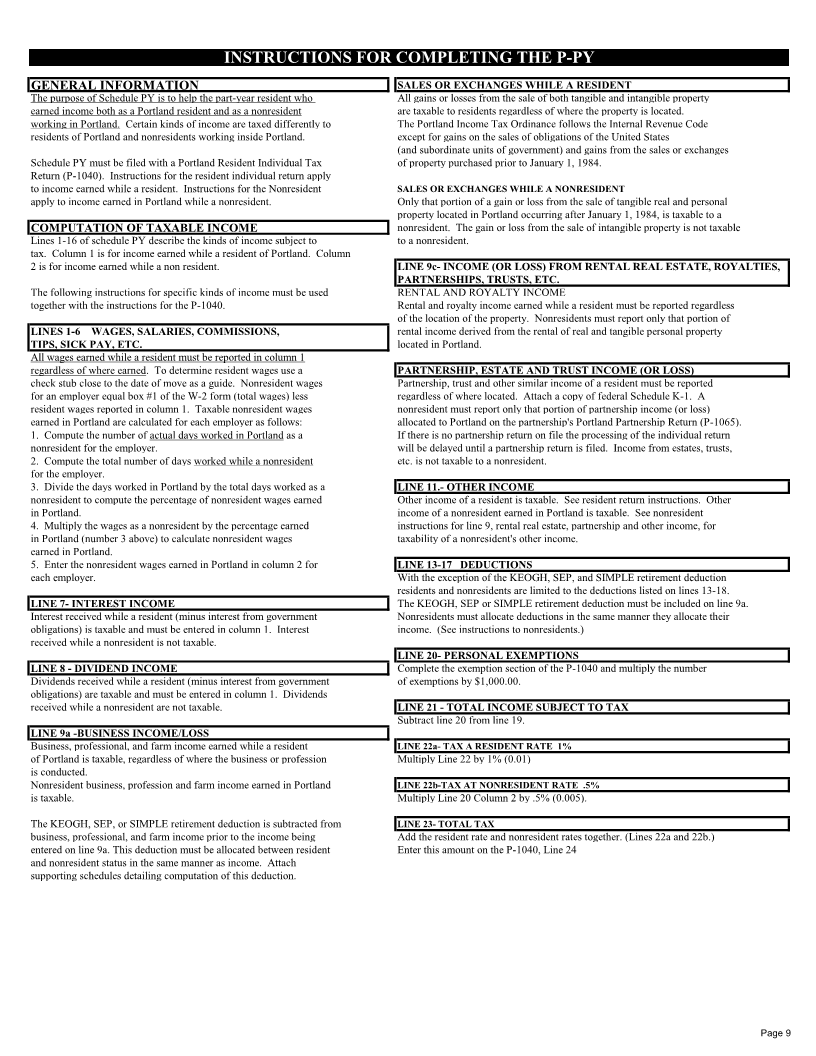

1 . WAGES, SALARIES, BONUSES, COMMISSIONS, FEES, TIPS,

GRATUITIES, VACATION PAY, SICK PAY, DISABILITY PAY, 13 . ALL OTHER INCOME: subject to tax by the Federal Government that is

AND SEVERANCE PAY. not specifically excluded under the City of Portland Income Tax

Ordinance. Includes: Gambling and Lottery Winnings, Alimony

2 . INTEREST: earned from bank accounts, credit unions, savings and Received under a divorce or separation agreement executed before

loan association, land contracts, notes and bonds. December 31, 2018 (unless modified later to exclude).

3 . DIVIDENDS: Including distributions from Sub Chapter S RESIDENCY:

Corporations, taxed as dividends by the Federal Government. Resident: A person who has established a true, fixed home for an

extended or permanent period of time in the City of Portland.

4 . NET PROFITS: from self-employment, an unincorporated business or

profession. (Attach a copy of Federal Schedule C page one and two.) Non resident: A person who lived outside the city

but who earned taxable income in Portland in 2022.

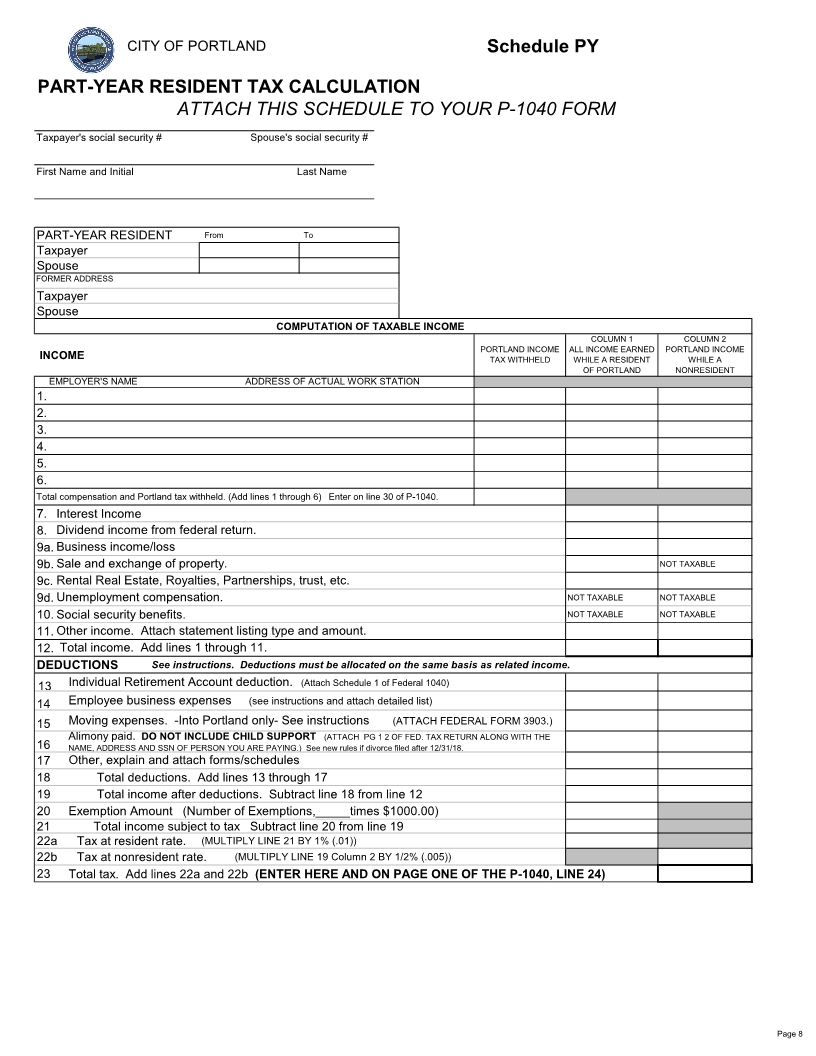

5 . SALES AND EXCHANGES OF PROPERTY (CAPITAL GAINS Part-Year Resident: If you were both a RESIDENT AND NON RESIDENT

AND LOSSES). Attach a copy of the Federal Schedule D and form in 2022. Enter the period you were a resident during the year.

4797 or 8949. Enter the net income (or loss) from sales and Subtract your nonresident earnings from your total income.

exchanges of property per your Federal tax return. NOTE: The only

exception is the sale of property purchased prior to January 1, 1984. Part-Year Resident who worked in Portland as both a resident and

Gains or losses on property purchased prior to January 1, 1984 must be a non resident: Complete and attach schedule P-PY to the individual

determined by one of the following methods: return.

a . The basis may be the adjusted fair market value of the

property on January 1, 1984 or; TAXABLE INCOME OF A NONRESIDENT

Nonresidents are required to report income earned within,

b . Divide the number of months the property has been held derived from or attributable to the City of Portland sources.

since January 1, 1984 by the total number of months the

property was held. Apply this fraction to the total gain or 1 . COMPENSATION: received for all work or services performed in the

loss as reported on your Federal tax return. City of Portland.

2 . NET PROFITS: from the operation of a business or profession

6 . INCOME FROM: Rents, Royalties, Patents and Copyrights. (Attach attributable to any business activity conducted in the City of Portland.

Federal Schedule E). 3 . NET PROFITS: from the rental of real and tangible property located in

7 . PARTNERSHIPS: All partnerships located inside the City of Portland the City of Portland.

must file an Annual Informational City of Portland P-1065 Partnership 4 . CAPITAL GAINS: from the sale or exchange of real and tangible

Return. (Attach Federal Schedule E and all supporting schedules.) In property located in the City of Portland.

addition, each individual of the partnership is required to report as 5 . Premature distributions from a retirement or deferred compensation plan

income on their City of Portland P-1040 Individual Return their are taxable.

distributive share of the Net Profits. If you are a Portland resident and

had income from a partnership located outside of the City of Portland,

you must attach a copy of your Federal Schedule K-1.

Page 2

|