Enlarge image

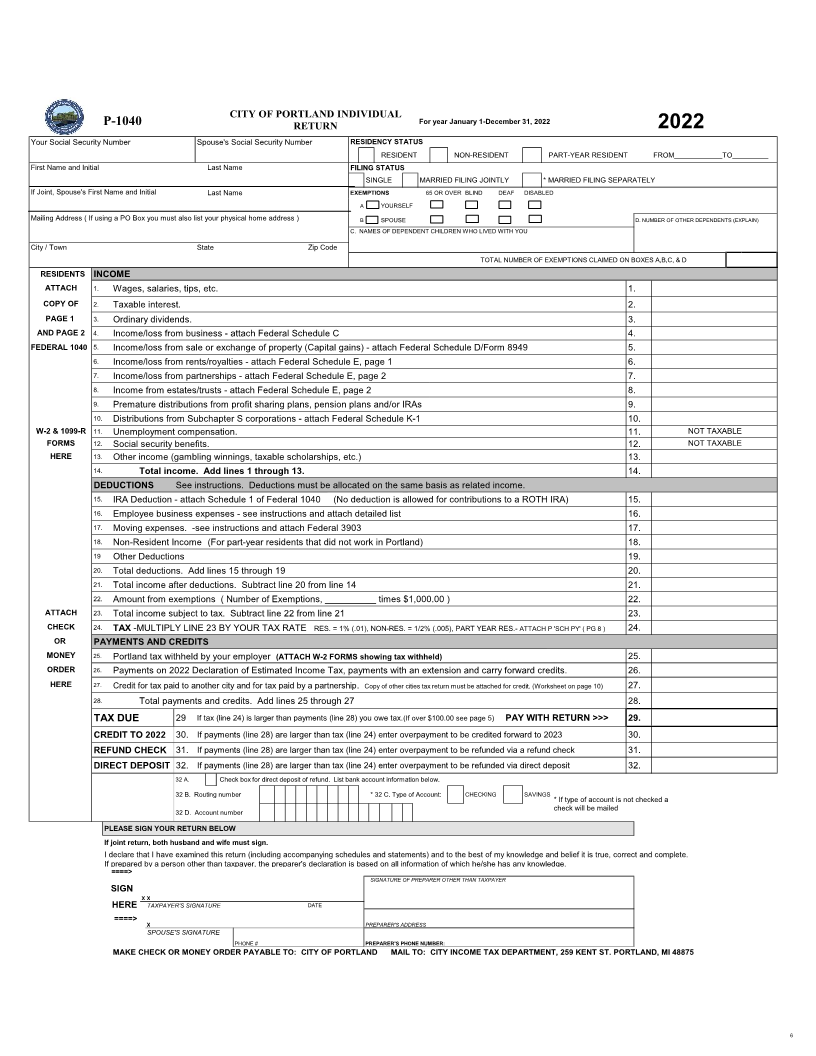

CITY OF PORTLAND INDIVIDUAL

CITY OF PORTLANDP-1040 RETURN For year January 1-December 31, 2022 2022

Your Social Security Number Spouse's Social Security Number RESIDENCY STATUS

RESIDENT NON-RESIDENT PART-YEAR RESIDENT FROM____________TO_________

First Name and Initial Last Name FILING STATUS

SINGLE MARRIED FILING JOINTLY * MARRIED FILING SEPARATELY

If Joint, Spouse's First Name and Initial Last Name EXEMPTIONS 65 OR OVER BLIND DEAF DISABLED

A □ YOURSELF □ □ □ □

Mailing Address ( If using a PO Box you must also list your physical home address ) B □ SPOUSE □ □ □ □ D. NUMBER OF OTHER DEPENDENTS (EXPLAIN)

C. NAMES OF DEPENDENT CHILDREN WHO LIVED WITH YOU

City / Town State Zip Code

TOTAL NUMBER OF EXEMPTIONS CLAIMED ON BOXES A,B,C, & D

RESIDENTS INCOME

ATTACH 1. Wages, salaries, tips, etc. 1.

COPY OF 2. Taxable interest. 2.

PAGE 1 3. Ordinary dividends. 3.

AND PAGE 2 4. Income/loss from business - attach Federal Schedule C 4.

FEDERAL 1040 5. Income/loss from sale or exchange of property (Capital gains) - attach Federal Schedule D/Form 8949 5.

6. Income/loss from rents/royalties - attach Federal Schedule E, page 1 6.

7. Income/loss from partnerships - attach Federal Schedule E, page 2 7.

8. Income from estates/trusts - attach Federal Schedule E, page 2 8.

9. Premature distributions from profit sharing plans, pension plans and/or IRAs 9.

10. Distributions from Subchapter S corporations - attach Federal Schedule K-1 10.

W-2 & 1099-R 11. Unemployment compensation. 11. NOT TAXABLE

FORMS 12. Social security benefits. 12. NOT TAXABLE

HERE 13. Other income (gambling winnings, taxable scholarships, etc.) 13.

14. Total income. Add lines 1 through 13. 14.

DEDUCTIONS See instructions. Deductions must be allocated on the same basis as related income.

15. IRA Deduction - attach Schedule 1 of Federal 1040 (No deduction is allowed for contributions to a ROTH IRA) 15.

16. Employee business expenses - see instructions and attach detailed list 16.

17. Moving expenses. -see instructions and attach Federal 3903 17.

18. Non-Resident Income (For part-year residents that did not work in Portland) 18.

19 Other Deductions 19.

20. Total deductions. Add lines 15 through 19 20.

21. Total income after deductions. Subtract line 20 from line 14 21.

22. Amount from exemptions ( Number of Exemptions, __________ times $1,000.00 ) 22.

ATTACH 23. Total income subject to tax. Subtract line 22 from line 21 23.

CHECK 24. TAX -MULTIPLY LINE 23 BY YOUR TAX RATE RES. = 1% (.01), NON-RES. = 1/2% (.005), PART YEAR RES.- ATTACH P 'SCH PY' ( PG 8 ) 24.

OR PAYMENTS AND CREDITS

MONEY 25. Portland tax withheld by your employer (ATTACH W-2 FORMS showing tax withheld) 25.

ORDER 26. Payments on 2022 Declaration of Estimated Income Tax, payments with an extension and carry forward credits. 26.

HERE 27. Credit for tax paid to another city and for tax paid by a partnership. Copy of other cities tax return must be attached for credit. (Worksheet on page 10) 27.

28. Total payments and credits. Add lines 25 through 27 28.

TAX DUE 29 If tax (line 24) is larger than payments (line 28) you owe tax.(If over $100.00 see page 5) PAY WITH RETURN >>> 29.

CREDIT TO 2022 30. If payments (line 28) are larger than tax (line 24) enter overpayment to be credited forward to 2023 30.

REFUND CHECK 31. If payments (line 28) are larger than tax (line 24) enter overpayment to be refunded via a refund check 31.

DIRECT DEPOSIT 32. If payments (line 28) are larger than tax (line 24) enter overpayment to be refunded via direct deposit 32.

32 A. Check box for direct deposit of refund. List bank account information below.

32 B. Routing number * 32 C. Type of Account: CHECKING SAVINGS * If type of account is not checked a

32 D. Account number check will be mailed

PLEASE SIGN YOUR RETURN BELOW

If joint return, both husband and wife must sign.

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct and complete.

If prepared by a person other than taxpayer, the preparer's declaration is based on all information of which he/she has any knowledge.

====>

SIGNATURE OF PREPARER OTHER THAN TAXPAYER

SIGN

X X

HERE TAXPAYER'S SIGNATURE DATE

====> X PREPARER'S ADDRESS

SPOUSE'S SIGNATURE

PHONE # PREPARER'S PHONE NUMBER:

MAKE CHECK OR MONEY ORDER PAYABLE TO: CITY OF PORTLAND MAIL TO: CITY INCOME TAX DEPARTMENT, 259 KENT ST. PORTLAND, MI 48875

6