Enlarge image

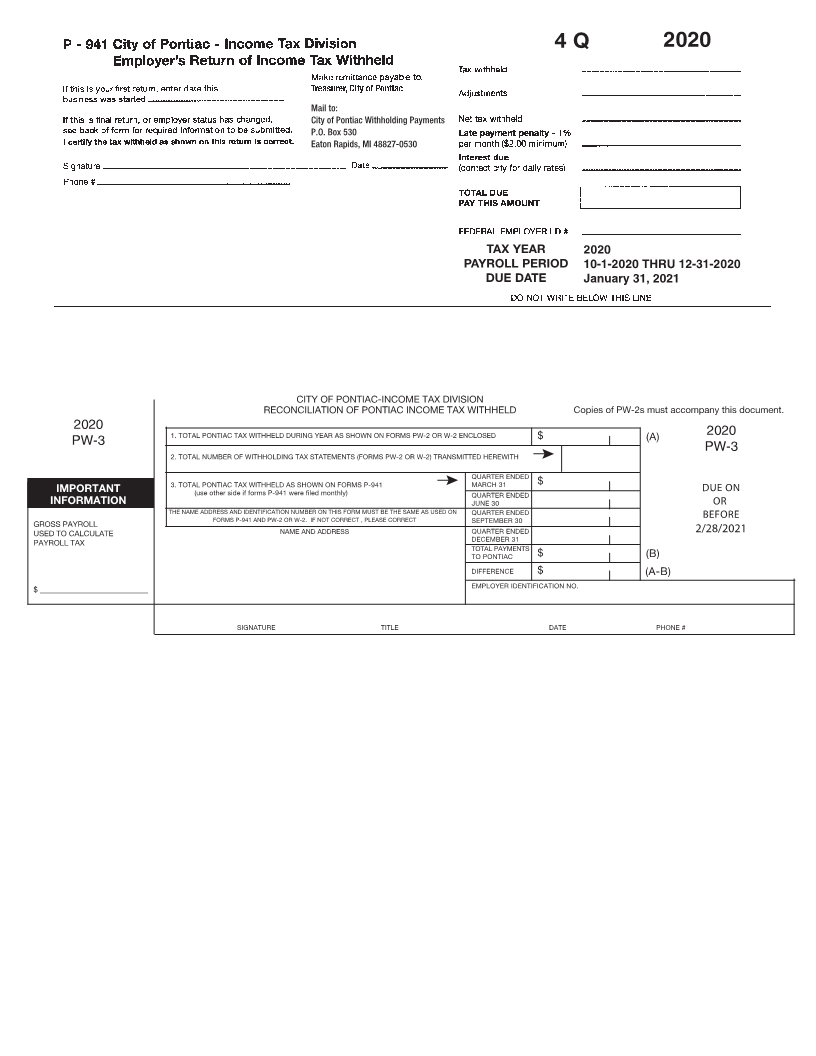

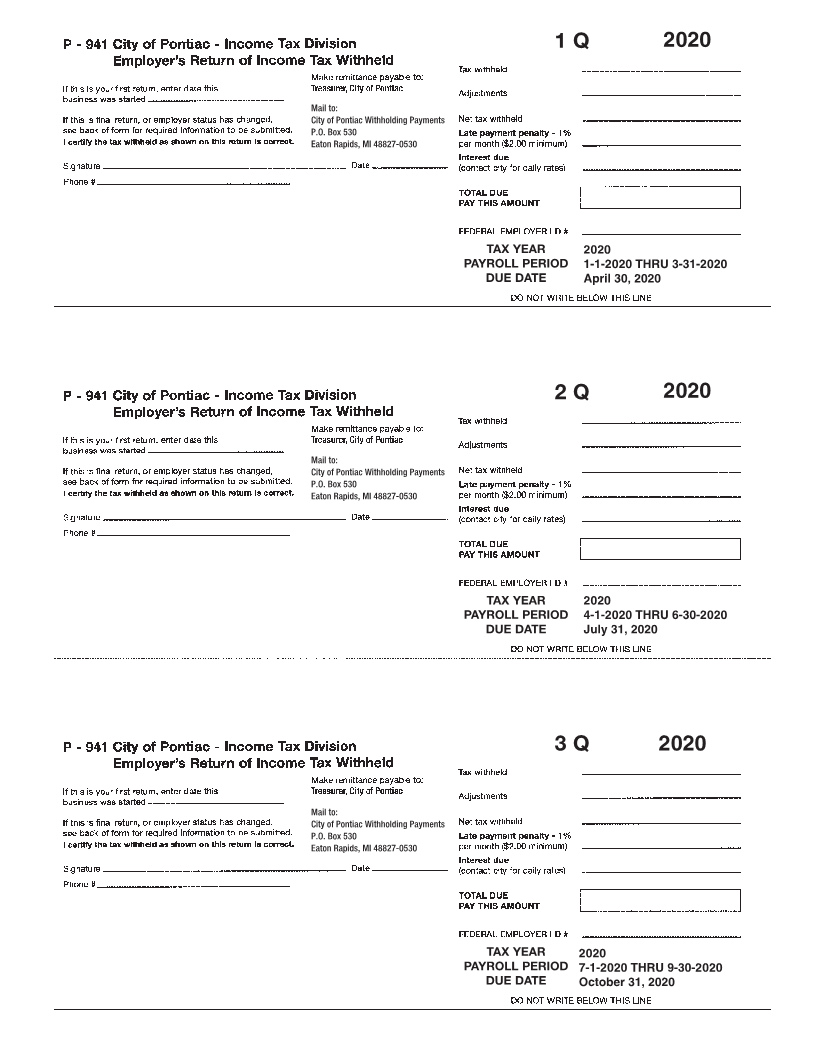

1 Q 2020

Mail to:

City of Pontiac Withholding Payments

P.O. Box 530

Eaton Rapids, MI 48827-0530

TAX YEAR 2020

PAYROLL PERIOD 1-1-2020 THRU 3-31-2020

DUE DATE April 30, 2020

2 Q 2020

Mail to:

City of Pontiac Withholding Payments

P.O. Box 530

Eaton Rapids, MI 48827-0530

TAX YEAR 2020

PAYROLL PERIOD 4-1-2020 THRU 6-30-2020

DUE DATE July 31, 2020

3 Q 2020

Mail to:

City of Pontiac Withholding Payments

P.O. Box 530

Eaton Rapids, MI 48827-0530

TAX YEAR 2020

PAYROLL PERIOD 7-1-2020 THRU 9-30-2020

DUE DATE October 31, 2020