- 7 -

Enlarge image

|

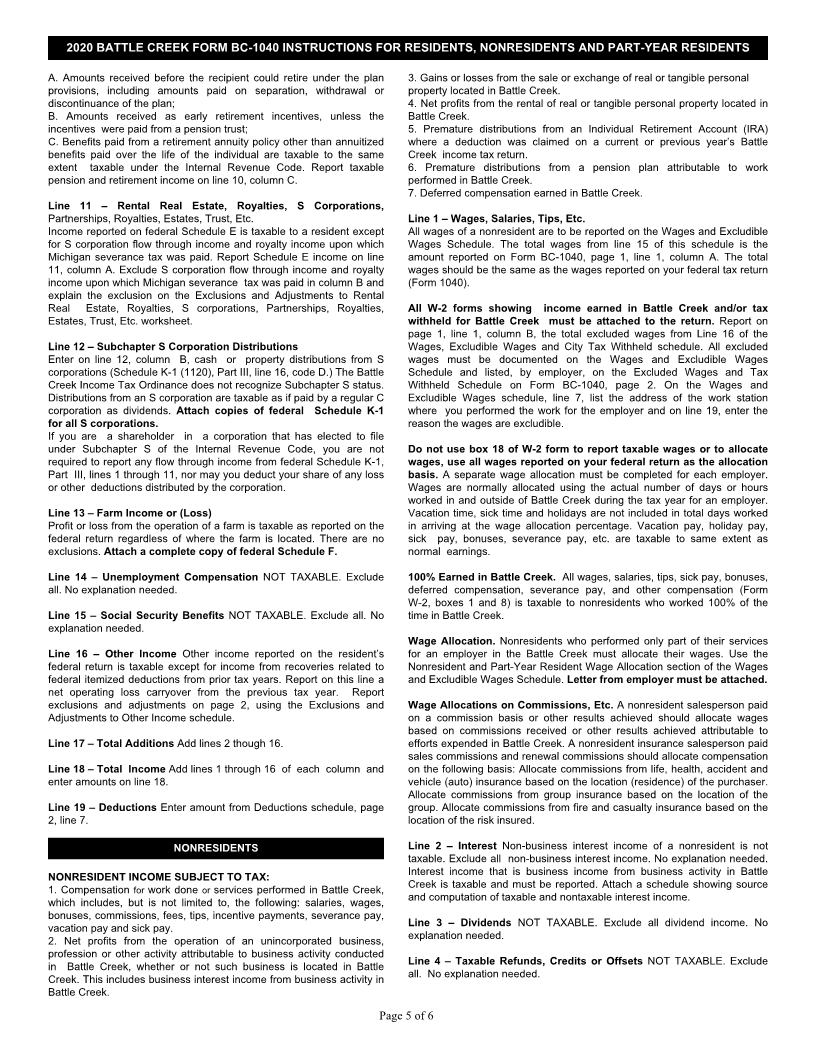

2020 BATTLE CREEK FORM BC-1040 INSTRUCTIONS FOR RESIDENTS, NONRESIDENTS AND PART-YEAR RESIDENTS

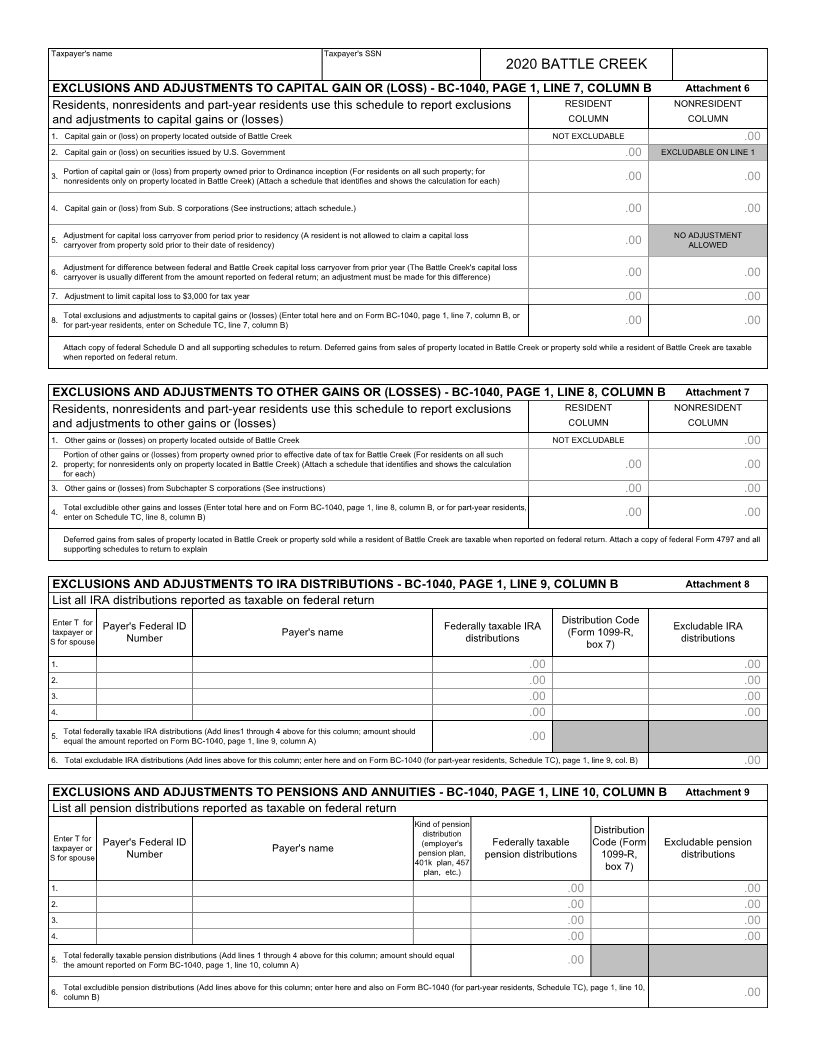

A. Amounts received before the recipient could retire under the plan 3. Gains or losses from the sale or exchange of real or tangible personal

provisions, including amounts paid on separation, withdrawal or property located in Battle Creek.

discontinuance of the plan; 4. Net profits from the rental of real or tangible personal property located in

B. Amounts received as early retirement incentives, unless the Battle Creek.

incentives were paid from a pension trust; 5. Premature distributions from an Individual Retirement Account (IRA)

C. Benefits paid from a retirement annuity policy other than annuitized where a deduction was claimed on a current or previous year’s Battle

benefits paid over the life of the individual are taxable to the same Creek income tax return.

extent taxable under the Internal Revenue Code. Report taxable 6. Premature distributions from a pension plan attributable to work

pension and retirement income on line 10, column C. performed in Battle Creek.

7. Deferred compensation earned in Battle Creek.

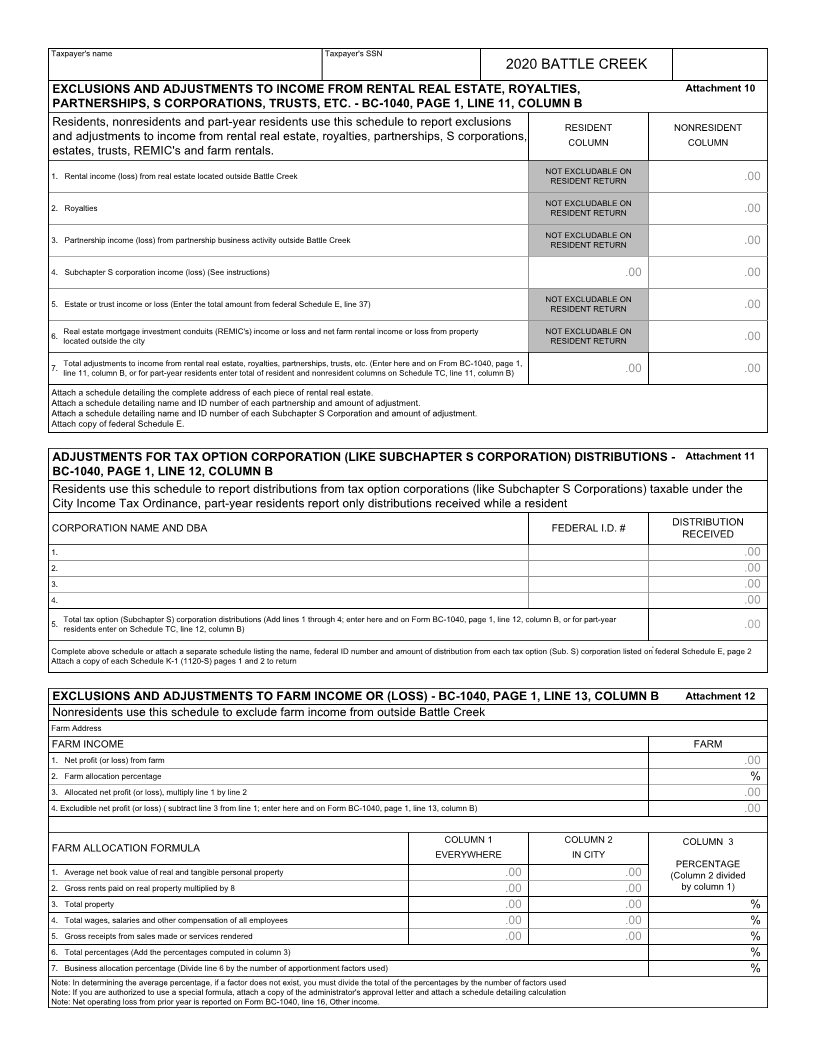

Line 11 – Rental Real Estate, Royalties, S Corporations,

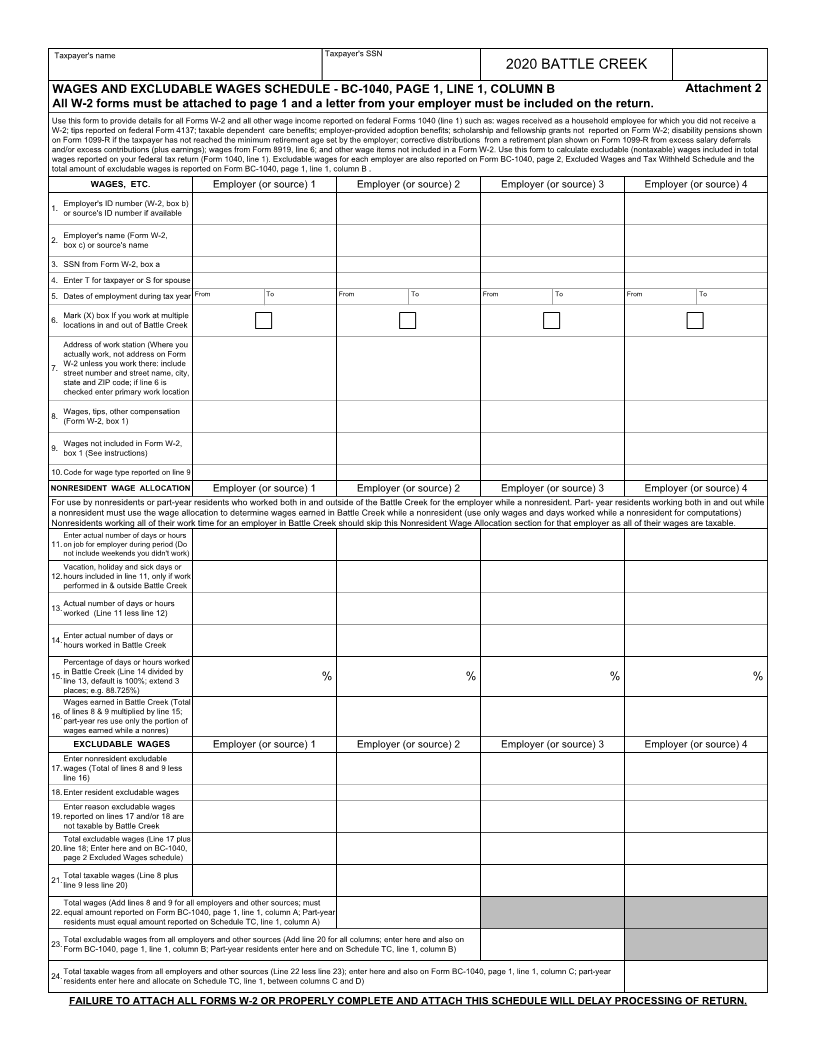

Partnerships, Royalties, Estates, Trust, Etc. Line 1 – Wages, Salaries, Tips, Etc.

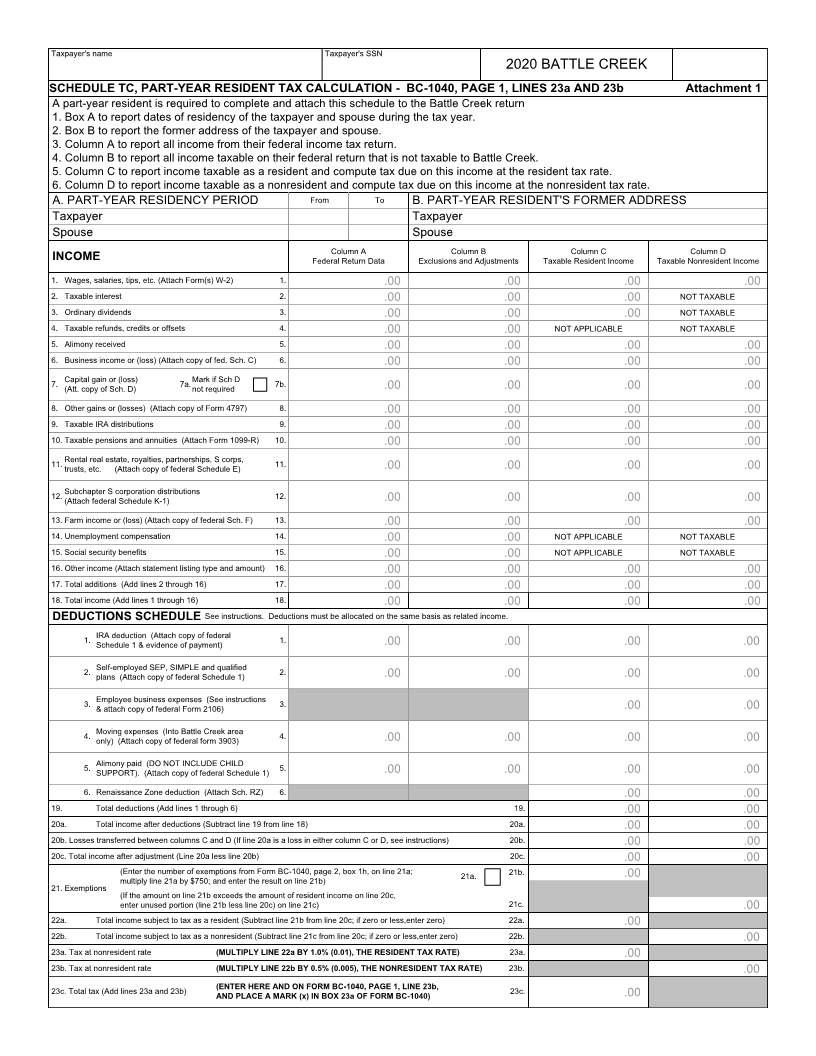

Income reported on federal Schedule E is taxable to a resident except All wages of a nonresident are to be reported on the Wages and Excludible

for S corporation flow through income and royalty income upon which Wages Schedule. The total wages from line 15 of this schedule is the

Michigan severance tax was paid. Report Schedule E income on line amount reported on Form BC-1040, page 1, line 1, column A. The total

11, column A. Exclude S corporation flow through income and royalty wages should be the same as the wages reported on your federal tax return

income upon which Michigan severance tax was paid in column B and (Form 1040).

explain the exclusion on the Exclusions and Adjustments to Rental

Real Estate, Royalties, S corporations, Partnerships, Royalties, All W-2 forms showing income earned in Battle Creek and/or tax

Estates, Trust, Etc. worksheet. withheld for Battle Creek must be attached to the return. Report on

page 1, line 1, column B, the total excluded wages from Line 16 of the

Line 12 – Subchapter S Corporation Distributions Wages, Excludible Wages and City Tax Withheld schedule. All excluded

Enter on line 12, column B, cash or property distributions from S wages must be documented on the Wages and Excludible Wages

corporations (Schedule K-1 (1120), Part III, line 16, code D.) The Battle Schedule and listed, by employer, on the Excluded Wages and Tax

Creek Income Tax Ordinance does not recognize Subchapter S status. Withheld Schedule on Form BC-1040, page 2. On the Wages and

Distributions from an S corporation are taxable as if paid by a regular C Excludible Wages schedule, line 7, list the address of the work station

corporation as dividends. Attach copies of federal Schedule K-1 where you performed the work for the employer and on line 19, enter the

for all S corporations. reason the wages are excludible.

If you are a shareholder in a corporation that has elected to file

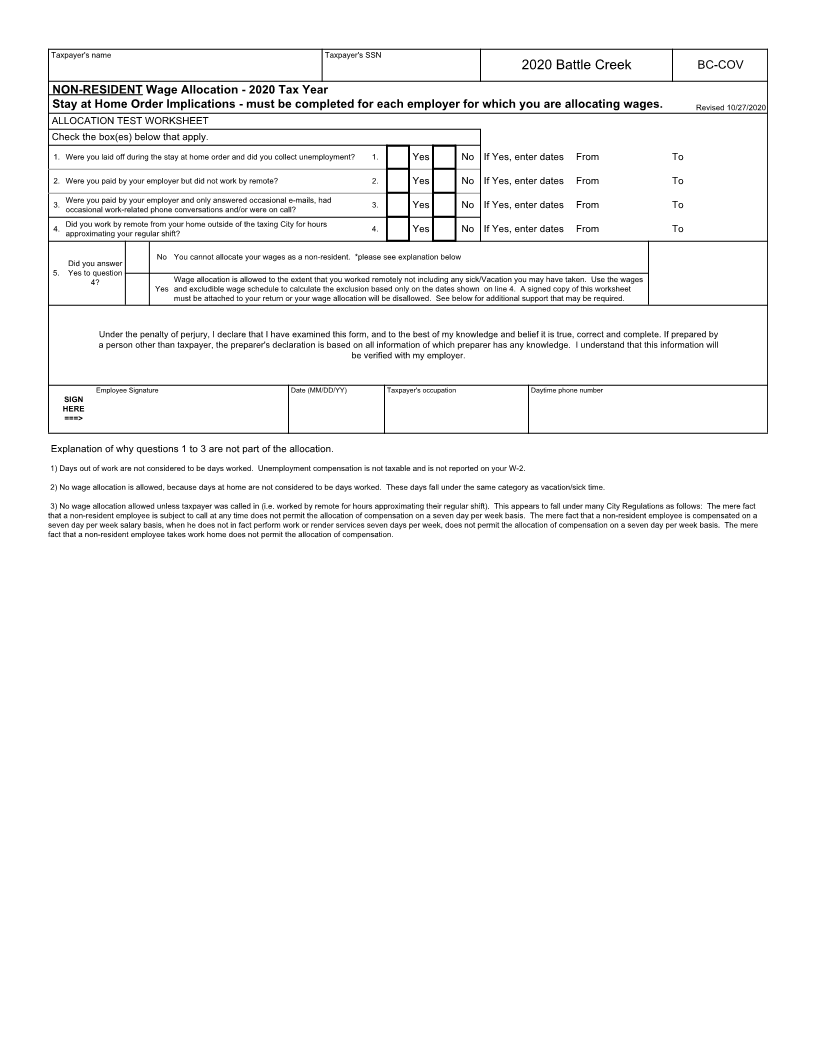

under Subchapter S of the Internal Revenue Code, you are not Do not use box 18 of W-2 form to report taxable wages or to allocate

required to report any flow through income from federal Schedule K-1, wages, use all wages reported on your federal return as the allocation

Part III, lines 1 through 11, nor may you deduct your share of any loss basis. A separate wage allocation must be completed for each employer.

or other deductions distributed by the corporation. Wages are normally allocated using the actual number of days or hours

worked in and outside of Battle Creek during the tax year for an employer.

Line 13 – Farm Income or (Loss) Vacation time, sick time and holidays are not included in total days worked

Profit or loss from the operation of a farm is taxable as reported on the in arriving at the wage allocation percentage. Vacation pay, holiday pay,

federal return regardless of where the farm is located. There are no sick pay, bonuses, severance pay, etc. are taxable to same extent as

exclusions. Attach a complete copy of federal Schedule F. normal earnings.

Line 14 – Unemployment Compensation NOT TAXABLE. Exclude 100% Earned in Battle Creek. All wages, salaries, tips, sick pay, bonuses,

all. No explanation needed. deferred compensation, severance pay, and other compensation (Form

W-2, boxes 1 and 8) is taxable to nonresidents who worked 100% of the

Line 15 – Social Security Benefits NOT TAXABLE. Exclude all. No time in Battle Creek.

explanation needed.

Wage Allocation. Nonresidents who performed only part of their services

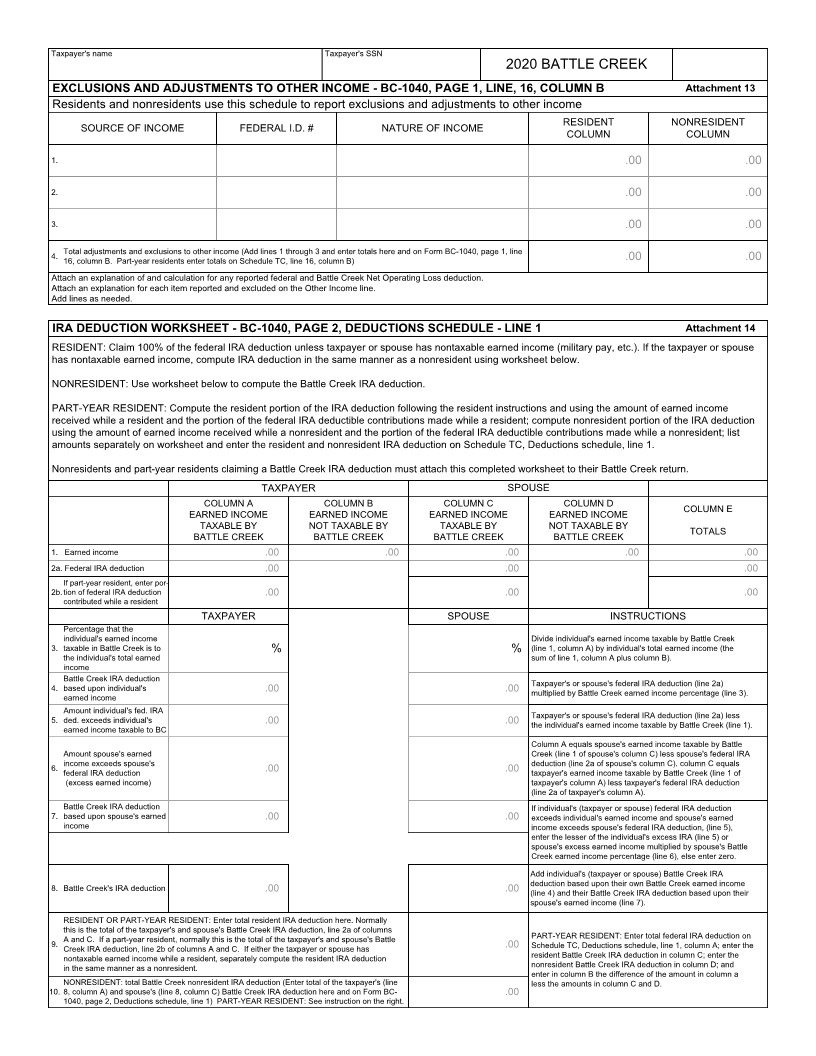

Line 16 – Other Income Other income reported on the resident’s for an employer in the Battle Creek must allocate their wages. Use the

federal return is taxable except for income from recoveries related to Nonresident and Part-Year Resident Wage Allocation section of the Wages

federal itemized deductions from prior tax years. Report on this line a and Excludible Wages Schedule. Letter from employer must be attached.

net operating loss carryover from the previous tax year. Report

exclusions and adjustments on page 2, using the Exclusions and Wage Allocations on Commissions, Etc. A nonresident salesperson paid

Adjustments to Other Income schedule. on a commission basis or other results achieved should allocate wages

based on commissions received or other results achieved attributable to

Line 17 – Total Additions Add lines 2 though 16. efforts expended in Battle Creek. A nonresident insurance salesperson paid

sales commissions and renewal commissions should allocate compensation

Line 18 – Total Income Add lines 1 through 16 of each column and on the following basis: Allocate commissions from life, health, accident and

enter amounts on line 18. vehicle (auto) insurance based on the location (residence) of the purchaser.

Allocate commissions from group insurance based on the location of the

Line 19 – Deductions Enter amount from Deductions schedule, page group. Allocate commissions from fire and casualty insurance based on the

2, line 7. location of the risk insured.

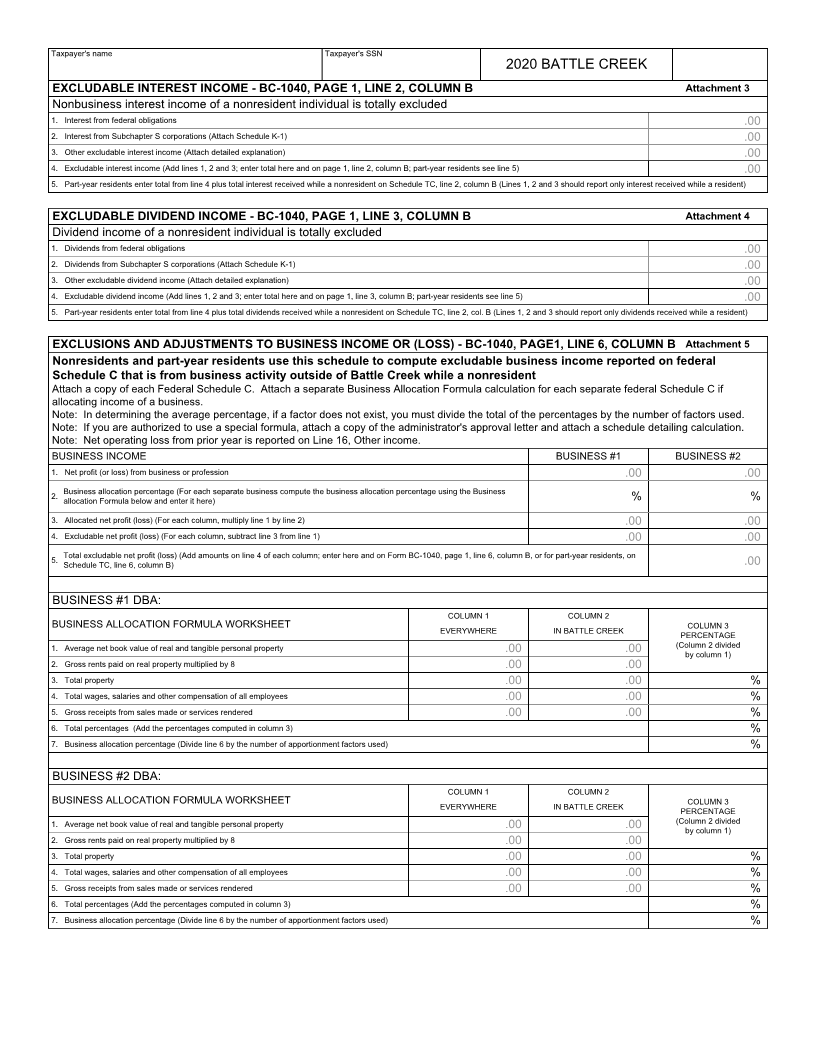

NONRESIDENTS Line 2 – Interest Non-business interest income of a nonresident is not

taxable. Exclude all non-business interest income. No explanation needed.

NONRESIDENT INCOME SUBJECT TO TAX: Interest income that is business income from business activity in Battle

1. Compensation for work done or services performed in Battle Creek, Creek is taxable and must be reported. Attach a schedule showing source

which includes, but is not limited to, the following: salaries, wages, and computation of taxable and nontaxable interest income.

bonuses, commissions, fees, tips, incentive payments, severance pay,

vacation pay and sick pay. Line 3 – Dividends NOT TAXABLE. Exclude all dividend income. No

2. Net profits from the operation of an unincorporated business, explanation needed.

profession or other activity attributable to business activity conducted

in Battle Creek, whether or not such business is located in Battle Line 4 – Taxable Refunds, Credits or Offsets NOT TAXABLE. Exclude

Creek. This includes business interest income from business activity in all. No explanation needed.

Battle Creek.

Page 5 of 6

|