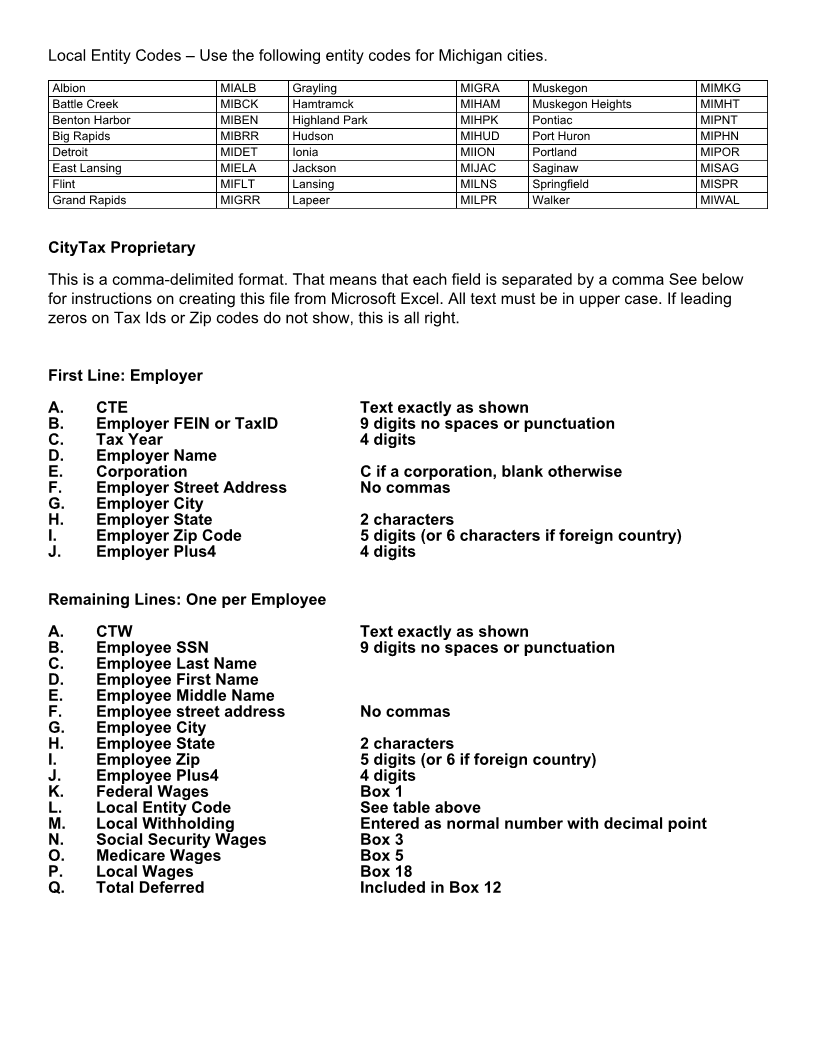

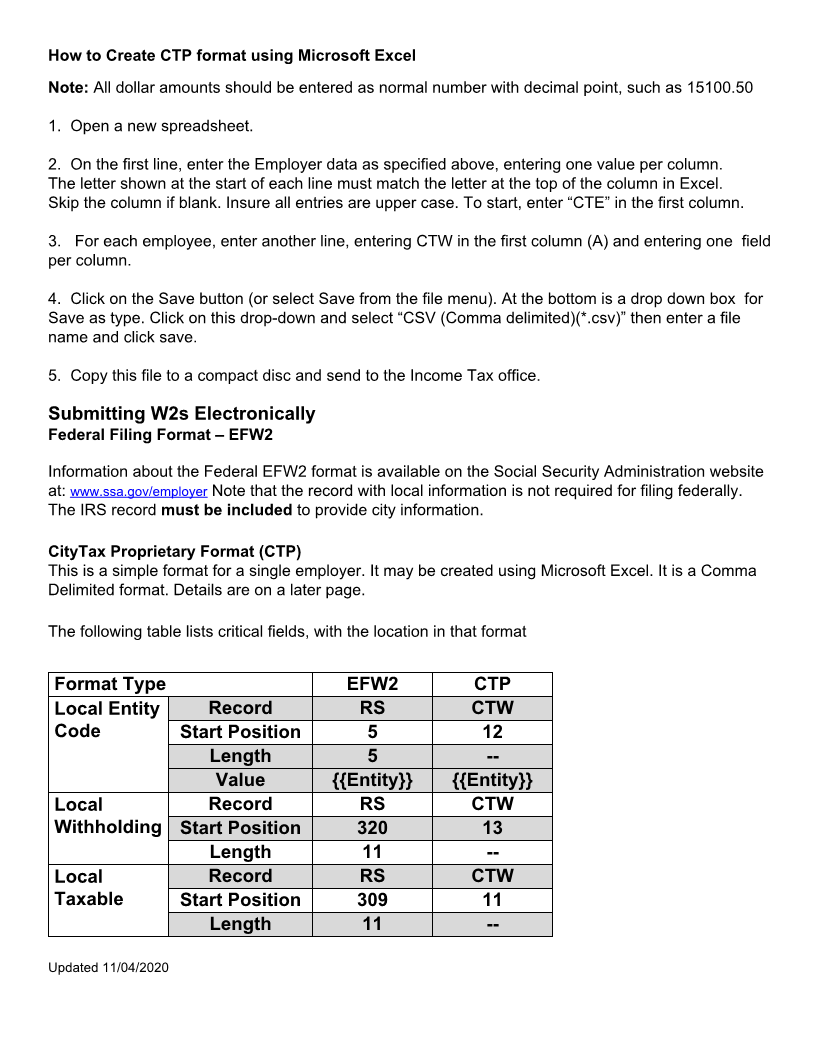

Enlarge image

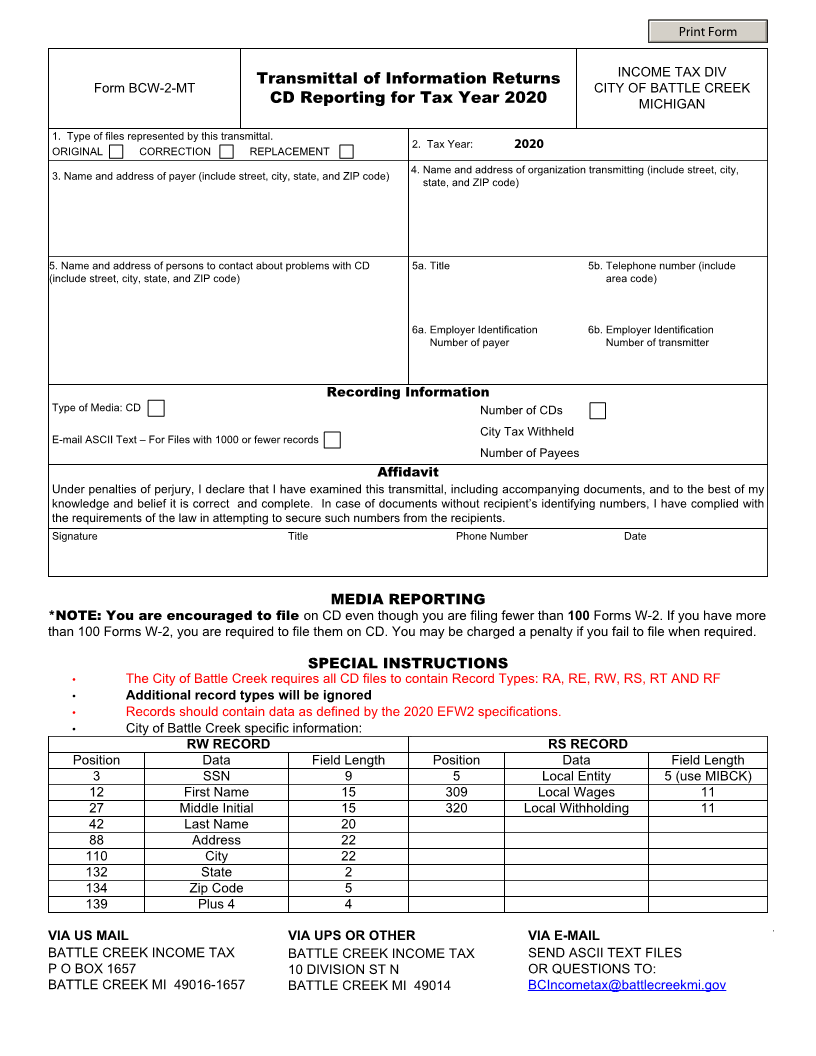

Print Form

INCOME TAX DIV

Transmittal of Information Returns

Form BCW-2-MT CITY OF BATTLE CREEK

CD Reporting for Tax Year 2020 MICHIGAN

1. Type of files represented by this transmittal.

2. Tax Year: 2020

ORIGINAL CORRECTION REPLACEMENT

3. Name and address of payer (include street, city, state, and ZIP code) 4. Name and address of organization transmitting (include street, city,

state, and ZIP code)

5. Name and address of persons to contact about problems with CD 5a. Title 5b. Telephone number (include

(include street, city, state, and ZIP code) area code)

6a. Employer Identification 6b. Employer Identification

Number of payer Number of transmitter

Recording Information

Type of Media: CD Number of CDs

City Tax Withheld

E-mail ASCII Text – For Files with 1000 or fewer records

Number of Payees

Affidavit

Under penalties of perjury, I declare that I have examined this transmittal, including accompanying documents, and to the best of my

knowledge and belief it is correct and complete. In case of documents without recipient’s identifying numbers, I have complied with

the requirements of the law in attempting to secure such numbers from the recipients.

Signature Title Phone Number Date

MEDIA REPORTING

*NOTE: You are encouraged to file on CD even though you are filing fewer than 100 Forms W-2. If you have more

than 100 Forms W-2, you are required to file them on CD. You may be charged a penalty if you fail to file when required.

SPECIAL INSTRUCTIONS

• The City of Battle Creek requires all CD files to contain Record Types: RA, RE, RW, RS, RT AND RF

• Additional record types will be ignored

• Records should contain data as defined by the 2020 EFW2 specifications.

• City of Battle Creek specific information:

RW RECORD RS RECORD

Position Data Field Length Position Data Field Length

3 SSN 9 5 Local Entity 5 (use MIBCK)

12 First Name 15 309 Local Wages 11

27 Middle Initial 15 320 Local Withholding 11

42 Last Name 20

88 Address 22

110 City 22

132 State 2

134 Zip Code 5

139 Plus 4 4

VIA US MAIL VIA UPS OR OTHER VIA E-MAIL

BATTLE CREEK INCOME TAX BATTLE CREEK INCOME TAX SEND ASCII TEXT FILES

P O BOX 1657 10 DIVISION ST N OR QUESTIONS TO:

BATTLE CREEK MI 49016-1657 BATTLE CREEK MI 49014 BCIncometax@battlecreekmi.gov