Enlarge image

REGISTRATION FOR ALBION CITY INCOME TAX

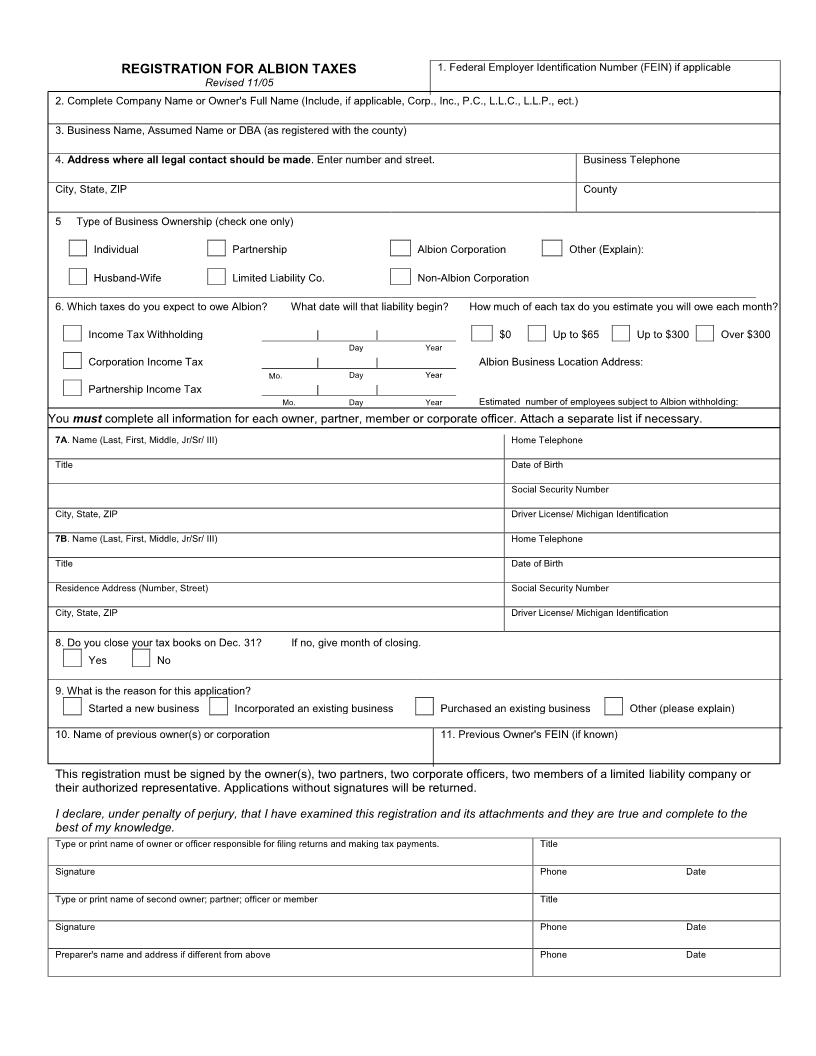

It is important that you complete all items on this registration form. Incomplete information will delay

processing. Read all instructions carefully before you begin.

Complete this registration form if you:

Are starting a new business or reinstating an old business.

Purchased an existing business.

Need to register for any of the Albion taxes listed below.

Changed the type of business (example: from sole proprietorship to partnership, or

incorporating a sole proprietorship or partnership).

►Register for Albion withholding tax if you:

Are an employer located in Albion

Are located outside Albion and have employees who work in Albion

Employ an Albion resident, regardless of where the employee’s work is performed.

Individual owners and partners cannot remit withholding on their wages. Contact the City of Albion for

information and forms for reporting and paying quarterly estimates.

►Register for Albion corporate income tax if the corporation is doing business in the city, whether or not it has

an office or place of business in the city and whether or not it has net profits. The corporation must file an

annual City of Albion Corporate Income Tax Return (AL-1120).

►Register for Albion partnership income tax if the partnership is doing business in the city, whether or not it

has an office or place of business in the city and whether or not it has net profits. The partnership must file an

annual Albion Income Tax Partnership Return (AL-1065).

Partnerships have the option to file either an information return or pay the tax which is due with respect to each

partner’s share of the net profits of the business. The partnership may pay the tax for partners only if it pays for

ALL partners subject to tax.

Taxes may be paid by check or ACH payments. Mail completed registration to:

City of Albion

Income Tax Department

112 W Cass St

Albion, MI 49224

Tax forms may be downloaded by going to the city website www.cityofalbionmi.gov then clicking on the link to

City Income Tax Forms.

The income tax department may also be reached by phone: 517-629-7865.

Revised 11/05