Enlarge image

1 1

1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form With grid With grid & data2 84 85

3 4 82 83

3 3

4 4

5 Office use only 5

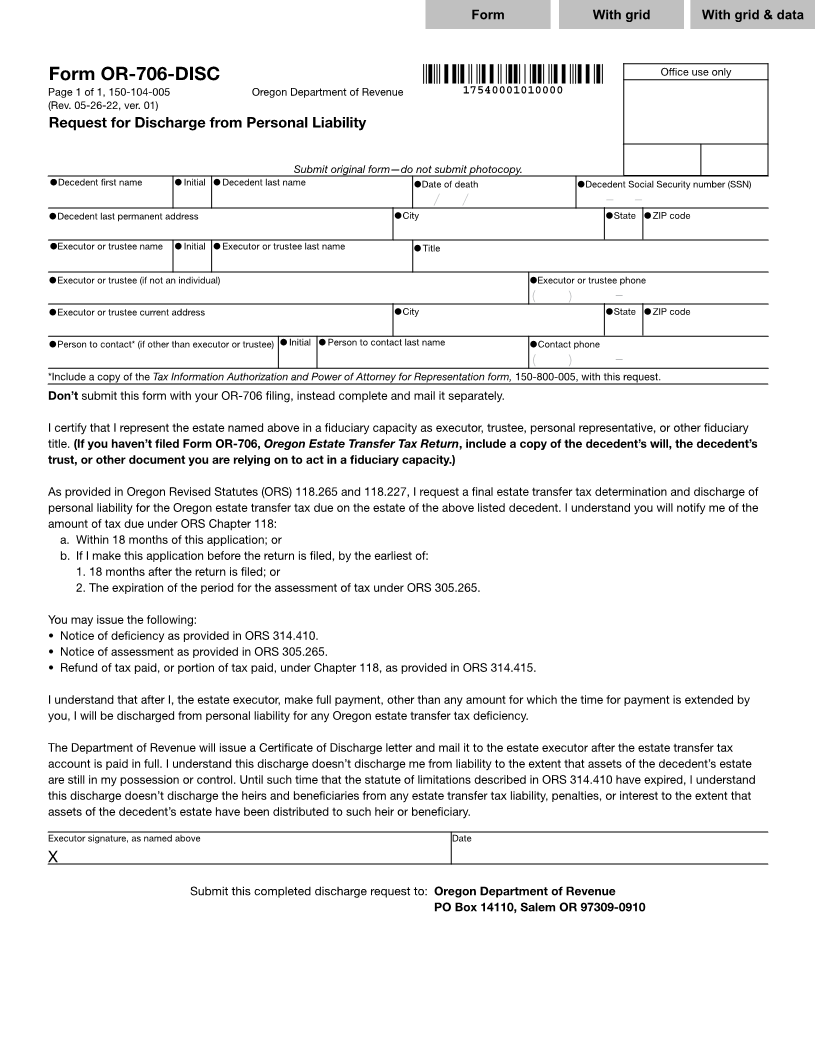

Form OR-706-DISC

6 Page 1 of 1, 150-104-005 Oregon Department of Revenue 17540001010000 6

7 (Rev. 05-26-22, ver. 01) 7

8 Request for Discharge from Personal Liability 8

9 9

10 10

11 Submit original form—do not submit photocopy. 11

Decedent first name Decedent last name

12 • •Initial • •Date of death •Decedent Social Security number (SSN) 12

13 13

XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX99/99/9999/ / 999-99-9999– –

14 •Decedent last permanent address •City •State •ZIP code 14

15 15

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX

Executor or trustee last name

16 •Executor or trustee name •Initial • •Title 16

17 17

XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

18 •Executor or trustee (if not an individual) •Executor or trustee phone 18

19 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX (999)() 999-9999– 19

20 •Executor or trustee current address •City •State •ZIP code 20

21 21

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX

Person to contact last name

22 •Person to contact* (if other than executor or trustee) •Initial • •Contact phone 22

23 XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX (999)( ) 999-9999– 23

24 *Include a copy of the Tax Information Authorization and Power of Attorney for Representation form, 150-800-005, with this request. 24

25 Don’t submit this form with your OR-706 filing, instead complete and mail it separately. 25

26 26

27 I certify that I represent the estate named above in a fiduciary capacity as executor, trustee, personal representative, or other fiduciary 27

28 title. (If you haven’t filed Form OR-706, Oregon Estate Transfer Tax Return, include a copy of the decedent’s will, the decedent’s 28

29 trust, or other document you are relying on to act in a fiduciary capacity.) 29

30 30

31 As provided in Oregon Revised Statutes (ORS) 118.265 and 118.227, I request a final estate transfer tax determination and discharge of 31

32 personal liability for the Oregon estate transfer tax due on the estate of the above listed decedent. I understand you will notify me of the 32

33 amount of tax due under ORS Chapter 118: 33

34 a. Within 18 months of this application; or 34

35 b. If I make this application before the return is filed, by the earliest of: 35

36 1. 18 months after the return is filed; or 36

37 2. The expiration of the period for the assessment of tax under ORS 305.265. 37

38 38

39 You may issue the following: 39

40 • Notice of deficiency as provided in ORS 314.410. 40

41 • Notice of assessment as provided in ORS 305.265. 41

42 • Refund of tax paid, or portion of tax paid, under Chapter 118, as provided in ORS 314.415. 42

43 43

44 I understand that after I, the estate executor, make full payment, other than any amount for which the time for payment is extended by 44

45 you, I will be discharged from personal liability for any Oregon estate transfer tax deficiency. 45

46 46

47 The Department of Revenue will issue a Certificate of Discharge letter and mail it to the estate executor after the estate transfer tax 47

48 account is paid in full. I understand this discharge doesn’t discharge me from liability to the extent that assets of the decedent’s estate 48

49 are still in my possession or control. Until such time that the statute of limitations described in ORS 314.410 have expired, I understand 49

50 this discharge doesn’t discharge the heirs and beneficiaries from any estate transfer tax liability, penalties, or interest to the extent that 50

51 assets of the decedent’s estate have been distributed to such heir or beneficiary. 51

52 52

53 Executor signature, as named above Date 53

54 X 54

55 55

56 Submit this completed discharge request to: Oregon Department of Revenue 56

57 PO Box 14110, Salem OR 97309-0910 57

58 58

59 59

60 60

61 61

62 62

63 63

64 64

1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85

3 4 82 83

66 66